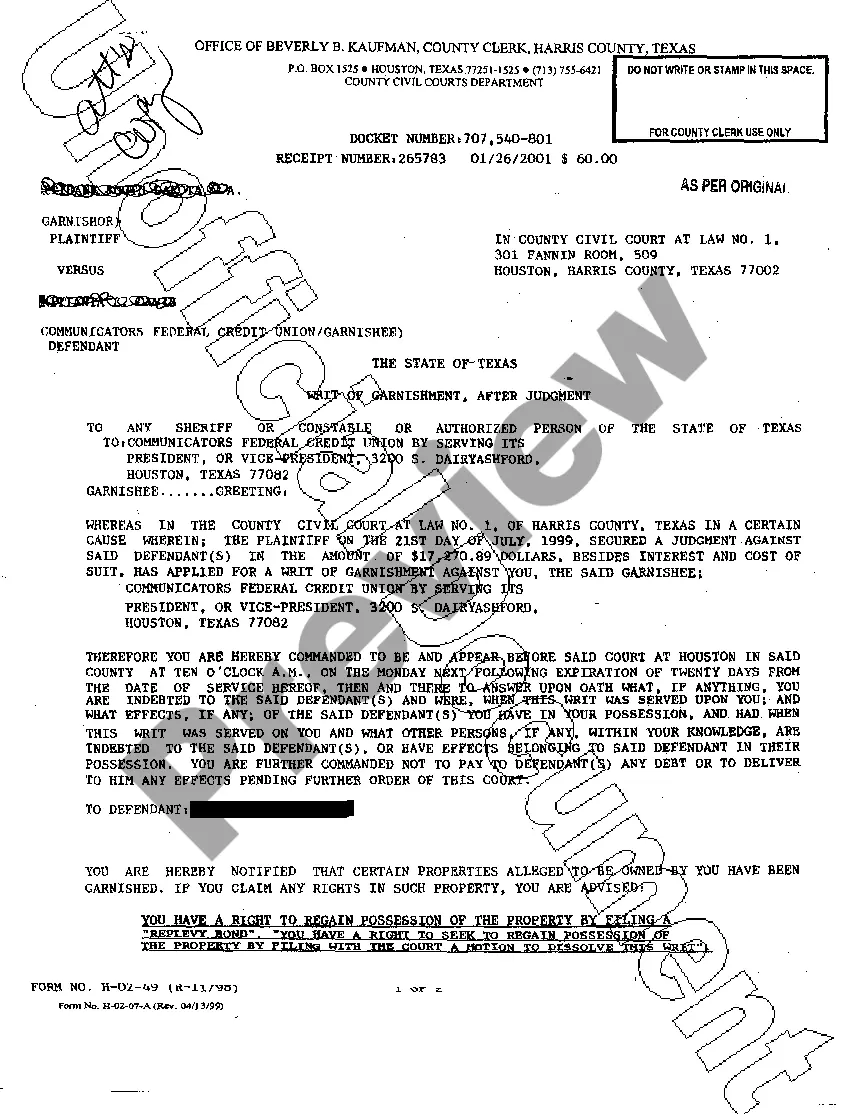

Mesquite, Texas Writ of Garnishment: Understanding the Legal Process and Types In Mesquite, Texas, a Writ of Garnishment is a legal procedure used to collect unpaid debts or satisfy judgments. It allows a creditor to seize a portion of the debtor's wages, bank accounts, or other assets to satisfy the outstanding debt. Understanding the intricacies of this process is crucial for both creditors and debtors. Types of Mesquite, Texas Writ of Garnishment: 1. Writ of Garnishment for Consumer Debt: This type of garnishment is commonly used in Mesquite to collect outstanding consumer debts, such as credit card bills, medical bills, personal loans, or unpaid utility bills. Creditors can seek a Writ of Garnishment against debtors who have failed to make payments despite multiple reminders. 2. Writ of Garnishment for Child Support: If a parent fails to fulfill their court-ordered child support obligations, the custodial parent or the state's child support agency can file a Writ of Garnishment to collect the owed amount. This ensures that the child's financial needs are met and encourages parents to fulfill their responsibilities. 3. Writ of Garnishment for Taxes: The government can seek a Writ of Garnishment to collect unpaid taxes from individuals or businesses in Mesquite, Texas. This can include income taxes, property taxes, or sales taxes not remitted to the appropriate authorities. 4. Writ of Garnishment for Judgments: After successfully obtaining a judgment against a debtor in a civil lawsuit, the creditor can utilize a Writ of Garnishment to recover the awarded amount. This type of garnishment allows creditors to seize funds from the debtor's bank accounts, wages, or any other non-exempt assets. Process of Obtaining a Writ of Garnishment in Mesquite, Texas: 1. Creditor files a lawsuit: The creditor initiates a legal action against the debtor to obtain a judgment for the outstanding debt. 2. Judgment is obtained: If the creditor prevails in the lawsuit, a judgment is issued by the court specifying the amount the debtor owes. 3. Filing for Writ of Garnishment: The creditor files a writ of garnishment application with the court, requesting authorization to seize the debtor's assets. 4. Issuance of Writ: Once the court approves the application, a Writ of Garnishment is issued, authorizing the creditor to collect the debt from specified assets. 5. Service of Writ: The writ is then served to the debtor, informing them of the garnishment and providing details on how to respond. 6. Compliance and Response: Debtors have a specific timeframe to comply with or respond to the garnishment notice. They may choose to pay the debt in full, negotiate a settlement, claim exemptions, or contest the garnishment. It is essential for debtors to understand their rights and consult legal counsel when facing a Writ of Garnishment in Mesquite, Texas. Similarly, creditors must ensure they follow legal procedures accurately to maximize their chances of recovering the outstanding debts owed to them.

Mesquite Texas Writ of Garnishment

State:

Texas

City:

Mesquite

Control #:

TX-G0310

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Writ of Garnishment

Mesquite, Texas Writ of Garnishment: Understanding the Legal Process and Types In Mesquite, Texas, a Writ of Garnishment is a legal procedure used to collect unpaid debts or satisfy judgments. It allows a creditor to seize a portion of the debtor's wages, bank accounts, or other assets to satisfy the outstanding debt. Understanding the intricacies of this process is crucial for both creditors and debtors. Types of Mesquite, Texas Writ of Garnishment: 1. Writ of Garnishment for Consumer Debt: This type of garnishment is commonly used in Mesquite to collect outstanding consumer debts, such as credit card bills, medical bills, personal loans, or unpaid utility bills. Creditors can seek a Writ of Garnishment against debtors who have failed to make payments despite multiple reminders. 2. Writ of Garnishment for Child Support: If a parent fails to fulfill their court-ordered child support obligations, the custodial parent or the state's child support agency can file a Writ of Garnishment to collect the owed amount. This ensures that the child's financial needs are met and encourages parents to fulfill their responsibilities. 3. Writ of Garnishment for Taxes: The government can seek a Writ of Garnishment to collect unpaid taxes from individuals or businesses in Mesquite, Texas. This can include income taxes, property taxes, or sales taxes not remitted to the appropriate authorities. 4. Writ of Garnishment for Judgments: After successfully obtaining a judgment against a debtor in a civil lawsuit, the creditor can utilize a Writ of Garnishment to recover the awarded amount. This type of garnishment allows creditors to seize funds from the debtor's bank accounts, wages, or any other non-exempt assets. Process of Obtaining a Writ of Garnishment in Mesquite, Texas: 1. Creditor files a lawsuit: The creditor initiates a legal action against the debtor to obtain a judgment for the outstanding debt. 2. Judgment is obtained: If the creditor prevails in the lawsuit, a judgment is issued by the court specifying the amount the debtor owes. 3. Filing for Writ of Garnishment: The creditor files a writ of garnishment application with the court, requesting authorization to seize the debtor's assets. 4. Issuance of Writ: Once the court approves the application, a Writ of Garnishment is issued, authorizing the creditor to collect the debt from specified assets. 5. Service of Writ: The writ is then served to the debtor, informing them of the garnishment and providing details on how to respond. 6. Compliance and Response: Debtors have a specific timeframe to comply with or respond to the garnishment notice. They may choose to pay the debt in full, negotiate a settlement, claim exemptions, or contest the garnishment. It is essential for debtors to understand their rights and consult legal counsel when facing a Writ of Garnishment in Mesquite, Texas. Similarly, creditors must ensure they follow legal procedures accurately to maximize their chances of recovering the outstanding debts owed to them.

Free preview

How to fill out Mesquite Texas Writ Of Garnishment?

If you’ve already used our service before, log in to your account and save the Mesquite Texas Writ of Garnishment on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Mesquite Texas Writ of Garnishment. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!