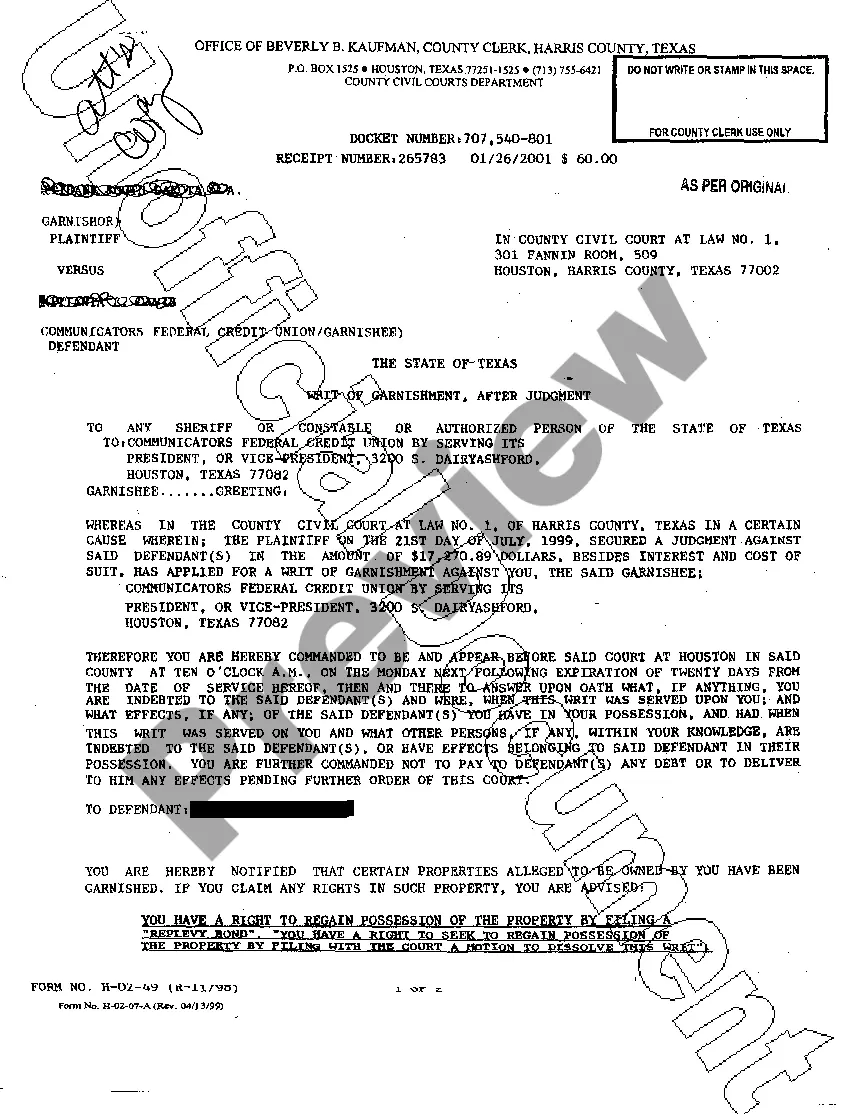

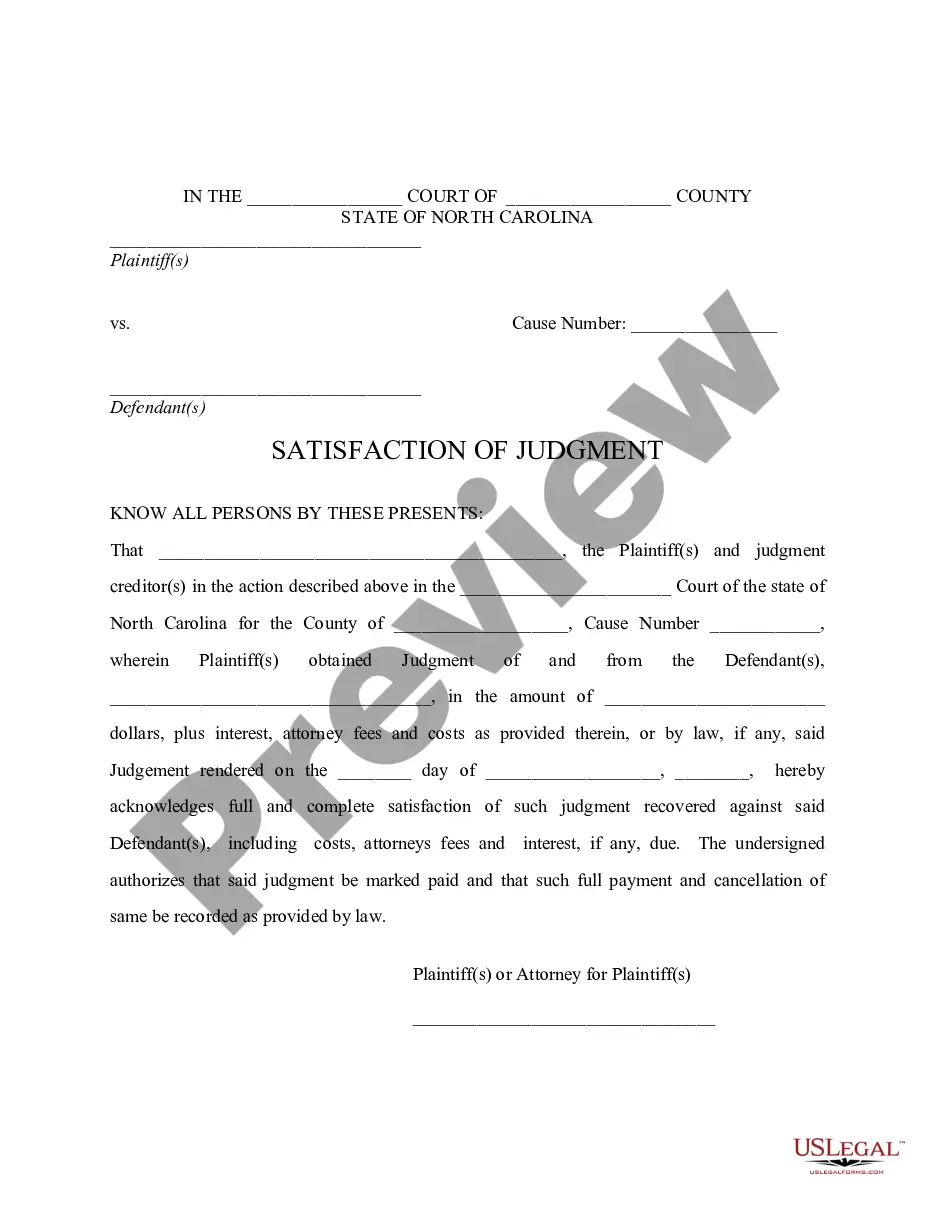

The Pearland Texas Writ of Garnishment is a legal mechanism used to enforce the collection of a debt owed by an individual or entity residing in Pearland, Texas. This writ is typically issued by a court and allows a creditor to collect money directly from a debtor's wages, bank accounts, or other financial assets. The process involves a court order instructing a third party, such as an employer or financial institution, to withhold a specific amount of money from the debtor's income or accounts and transfer it to the creditor. There are different types of Pearland Texas Writ of Garnishment, depending on the nature of the debt and the specific circumstances of the case. Here are a few common variations: 1. Wage Garnishment: This type of writ allows a creditor to collect a portion of the debtor's income directly from their employer. Under Texas law, creditors can garnish up to 25% of the debtor's disposable income or the amount by which the debtor's weekly earnings exceed 30 times the federal minimum wage, whichever is less. 2. Bank Account Garnishment: With a bank account garnishment, a creditor can seize funds directly from the debtor's bank account(s). However, certain exempt funds, such as Social Security benefits or child support payments, are typically protected from garnishment. 3. Property or Asset Garnishment: In some cases, the Pearland Texas Writ of Garnishment can extend to seizing and selling the debtor's property or assets to satisfy the debt owed. This can include real estate, vehicles, or other valuable possessions. It's important to note that the process of obtaining a Writ of Garnishment requires following specific legal procedures and obtaining proper court approval. Debtors also have certain rights and protections under Texas law, such as the right to receive notice and an opportunity to contest the garnishment. If you find yourself facing a Pearland Texas Writ of Garnishment, it is advisable to seek legal counsel to understand your options and ensure your rights are protected.

Pearland Texas Writ of Garnishment

Description

How to fill out Pearland Texas Writ Of Garnishment?

We always strive to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for legal solutions that, as a rule, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Pearland Texas Writ of Garnishment or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Pearland Texas Writ of Garnishment complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Pearland Texas Writ of Garnishment is proper for you, you can pick the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

A motion to dismiss garnishment is a legal request to terminate a writ of garnishment. In Pearland, Texas, this motion can be filed if you believe that the garnishment is unjust or if you are exempt under state laws. The motion should detail your reasons and any supporting evidence. Engaging with legal resources can provide you with essential guidance to navigate this process.

A judgement proof letter conveys that you do not have the financial means to fulfill a garnishment order. Start by clearly stating your financial situation and include details about your income and expenses. It’s crucial to communicate this information effectively and maintain a professional tone. This letter can potentially help avoid or delay further legal action.

Writing a letter to stop garnishment involves clear communication of your situation. Begin by addressing the letter to the creditor and include your account details. State your request clearly, provide supporting reasons, and outline your proposed alternatives. A well-structured letter can help prompt a favorable response from the creditor.

To effectively stop wage garnishment in Pearland, Texas, you can take several steps. Start by filing a motion with the court if you believe you have a valid defense against the garnishment. Alternatively, negotiating a payment plan with the creditor may also halt the garnishment process. Understanding your rights can empower you to address the situation more effectively.

When you receive a Pearland Texas writ of garnishment, it is important to first review the document carefully to understand the details. Next, consider contacting the court or the creditor to clarify any uncertainties. If you believe the garnishment is incorrect or unfair, you can file a response to contest it. Additionally, you may want to consult with an attorney to explore your options.

Judgments awarded in Texas to a non-government creditor are generally valid for ten years but they can be renewed for longer. If a judgment is not renewed, it will become dormant. You can attempt to revive a dormant judgment in order to continue to try and collect the debt.

A judgment is valid for 10 years and can be enforced at any time during those that time. It is not uncommon for a creditor to seek to enforce a judgment that is close to ten years old. There are also ways to renew the judgment, so that it can be enforced for even longer than ten years.

Once issued, the writ of execution directs the sheriff to seize the non-exempt property and sell it. The proceeds of the sale are given to the creditor to satisfy all or part of the judgment.

In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor. It is the third party, the bank or financial institution, which receives the Writ of Garnishment.

How Long Is a Writ of Execution Good for? According to Texas Rule of Civil Procedure 34.001, a Writ of Execution for a money judgment can be applied for within 10 years of the entry of a judgment and is good for just as long. Within the 10 year period, the writ can be renewed at any time for an additional 10 years.