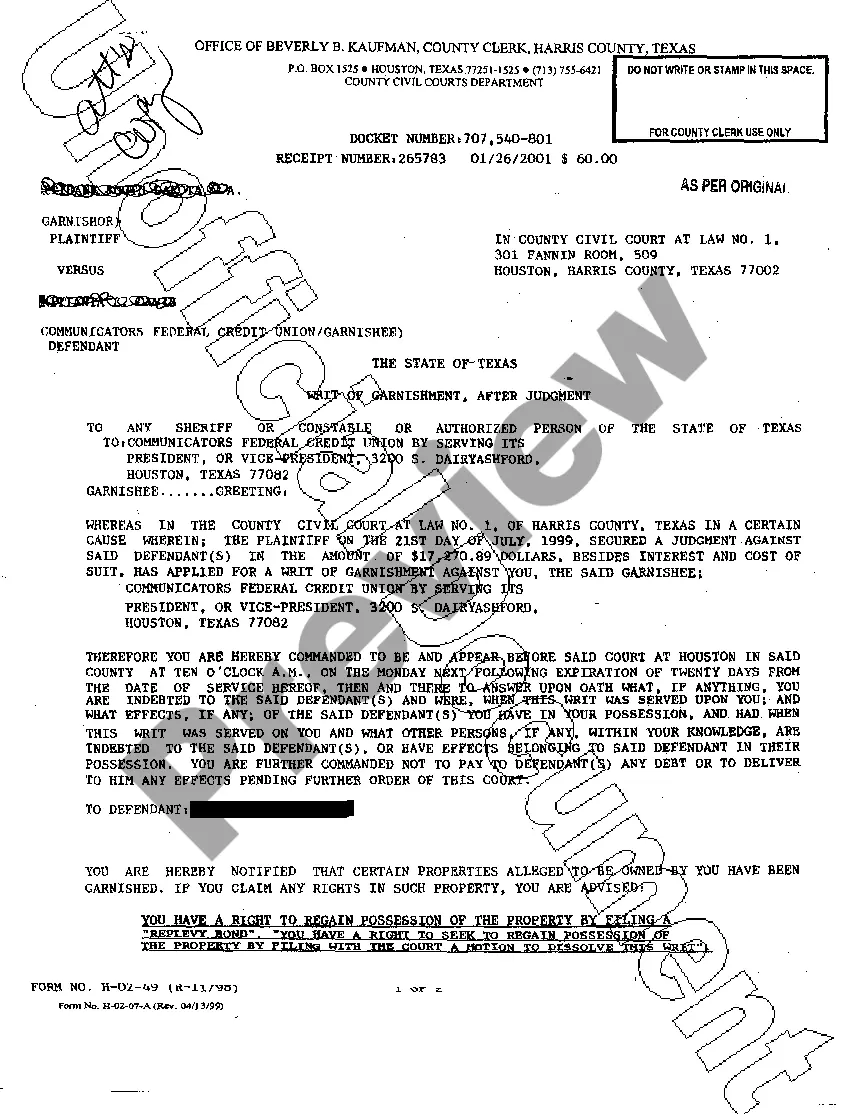

Plano, Texas Writ of Garnishment: A Comprehensive Overview with Key Types Explained The Plano, Texas Writ of Garnishment is a legal procedure used to collect outstanding debts owed by an individual or entity within the city of Plano in Texas, United States. It allows creditors to seize a portion of the debtor's wages or assets, thereby satisfying the outstanding debt. This detailed description sheds light on the process, requirement, and types of Writ of Garnishment in Plano, Texas. Key Aspects of the Plano, Texas Writ of Garnishment: 1. Definition: The Plano, Texas Writ of Garnishment is a court order issued by a judge that directs an employer or financial institution to withhold a portion of the debtor's income or assets to repay the creditor. 2. Purpose: The primary purpose of a Writ of Garnishment is to enforce debt collection. It acts as a mechanism to ensure that individuals or companies who owe money fulfill their obligations to their creditors. 3. Process: To initiate a Plano, Texas Writ of Garnishment, the creditor must file a legal action against the debtor. Once approved by the court, the writ is issued and delivered to the employer or financial institution responsible for withholding the specified amount from the debtor's wages or assets. 4. Types of Plano, Texas Writ of Garnishment: a. Wage Garnishment: A common type, wage garnishment allows a creditor to deduct a portion of the debtor's earnings directly from their salary. The employer is required to withhold the specified amount until the debt is satisfied. b. Bank Account Garnishment: With this type of Writ of Garnishment, funds are taken directly from the debtor's bank account(s). Once the writ is received by the financial institution, they freeze the demanded amount until the debt is repaid. c. Property or Asset Garnishment: In some cases, Plano, Texas Writ of Garnishment can target specific assets or property owned by the debtor. These assets may include real estate, vehicles, or other valuable possessions that can be sold to satisfy the debt owed. d. Federal Benefits Garnishment: This type refers to the garnishment of federal benefits received by the debtor, such as Social Security or veterans' benefits. However, certain federal benefits have legal protections and limitations on garnishment. It is essential to note that the Plano, Texas Writ of Garnishment must adhere to the relevant state laws and regulations governing debt collection practices. These laws aim to protect debtors from excessive or unfair garnishments, ensuring a fair and balanced approach in resolving outstanding debts. In conclusion, the Plano, Texas Writ of Garnishment is a legal tool utilized by creditors to collect outstanding debts in the Plano area. The process involves obtaining court approval, followed by the garnishment of wages, bank accounts, or assets to satisfy the debt owed. Understanding the different types of Plano, Texas Writ of Garnishment, including wage garnishment, bank account garnishment, property or asset garnishment, and federal benefits' garnishment, helps both creditors and debtors navigate the intricacies of debt collection in the city effectively.

Plano Texas Writ of Garnishment

Description

How to fill out Plano Texas Writ Of Garnishment?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person without any law background to create such paperwork cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes in handy. Our service provides a massive library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Plano Texas Writ of Garnishment or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Plano Texas Writ of Garnishment in minutes employing our trustworthy service. If you are presently a subscriber, you can go on and log in to your account to download the needed form.

Nevertheless, if you are a novice to our library, ensure that you follow these steps before downloading the Plano Texas Writ of Garnishment:

- Be sure the template you have found is specific to your area considering that the regulations of one state or county do not work for another state or county.

- Review the form and go through a short description (if available) of cases the paper can be used for.

- In case the form you chosen doesn’t suit your needs, you can start over and look for the needed form.

- Click Buy now and choose the subscription plan you prefer the best.

- Access an account {using your login information or create one from scratch.

- Pick the payment gateway and proceed to download the Plano Texas Writ of Garnishment as soon as the payment is completed.

You’re good to go! Now you can go on and print out the form or complete it online. In case you have any issues getting your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.