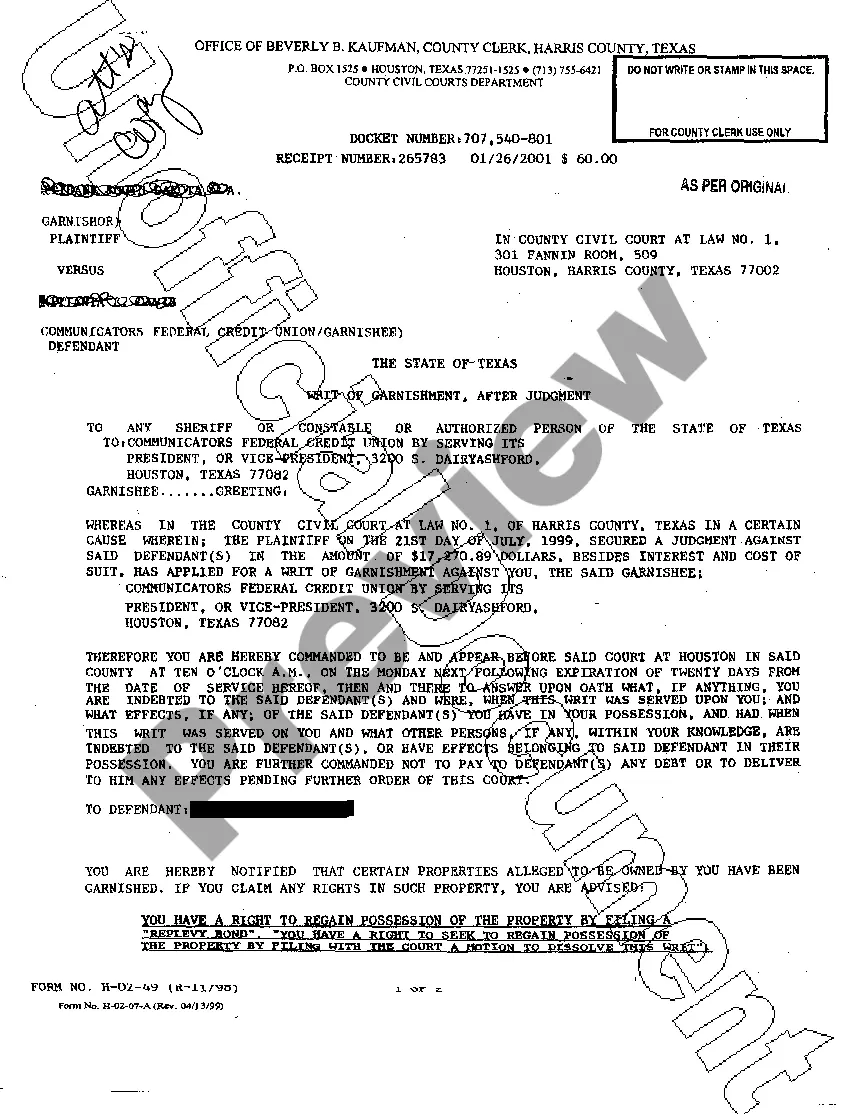

If you reside in Round Rock, Texas, and are facing a financial dispute, you may come across the term "Writ of Garnishment." This legal process plays a significant role in debt collection and can have implications for both debtors and creditors. In this article, we will delve into the details of what a Round Rock Texas Writ of Garnishment entails, its purpose, and the different types that exist. A Writ of Garnishment is a court-ordered mechanism used to collect a debt from a debtor by seizing their assets. When a creditor sues a debtor for non-payment or breach of contract and ultimately obtains a judgment, they may proceed with a Writ of Garnishment to satisfy the debt. The primary purpose of a Writ of Garnishment is to enforce the judgment by compelling the garnishee (the party who owes a debt to the debtor) to turn over funds or assets to the creditor. The garnishee could be an individual, a business, or a financial institution that holds the debtor's assets, such as wages, bank accounts, or rental income. In Round Rock, Texas, there are various types of Writs of Garnishment that creditors may utilize, depending on the nature of the debt and the assets involved. These types include: 1. Writ of Wage Garnishment: This type of garnishment allows the creditor to collect a portion of the debtor's wages directly from their employer. The garnishee, typically the employer, deducts the specified amount from the debtor's salary until the debt is cleared. 2. Writ of Bank Account Garnishment: This type of garnishment permits the creditor to freeze and potentially seize funds from the debtor's bank accounts to satisfy the debt. The garnishee, in this case, is the financial institution where the debtor holds accounts. 3. Writ of Rental Income Garnishment: If the debtor derives income from rental properties, a creditor may seek a Writ of Rental Income Garnishment to collect the debt. This allows the creditor to receive rental payments directly from the tenant(s) or property management company. It is important to note that Round Rock, Texas, adheres to state and federal laws regarding garnishment procedures. The creditor must follow proper legal channels, adhere to specific timelines, and obtain the necessary court orders to execute a Writ of Garnishment. In conclusion, a Round Rock Texas Writ of Garnishment is a court-ordered process used to collect debts from debtors by seizing their assets. It allows creditors to recover their owed funds through various forms of garnishment, including wage garnishment, bank account garnishment, and rental income garnishment. If you find yourself facing a Writ of Garnishment, it is crucial to seek legal advice to understand your rights and potential options for resolving the debt.

Round Rock Texas Writ of Garnishment

State:

Texas

City:

Round Rock

Control #:

TX-G0310

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Writ of Garnishment

If you reside in Round Rock, Texas, and are facing a financial dispute, you may come across the term "Writ of Garnishment." This legal process plays a significant role in debt collection and can have implications for both debtors and creditors. In this article, we will delve into the details of what a Round Rock Texas Writ of Garnishment entails, its purpose, and the different types that exist. A Writ of Garnishment is a court-ordered mechanism used to collect a debt from a debtor by seizing their assets. When a creditor sues a debtor for non-payment or breach of contract and ultimately obtains a judgment, they may proceed with a Writ of Garnishment to satisfy the debt. The primary purpose of a Writ of Garnishment is to enforce the judgment by compelling the garnishee (the party who owes a debt to the debtor) to turn over funds or assets to the creditor. The garnishee could be an individual, a business, or a financial institution that holds the debtor's assets, such as wages, bank accounts, or rental income. In Round Rock, Texas, there are various types of Writs of Garnishment that creditors may utilize, depending on the nature of the debt and the assets involved. These types include: 1. Writ of Wage Garnishment: This type of garnishment allows the creditor to collect a portion of the debtor's wages directly from their employer. The garnishee, typically the employer, deducts the specified amount from the debtor's salary until the debt is cleared. 2. Writ of Bank Account Garnishment: This type of garnishment permits the creditor to freeze and potentially seize funds from the debtor's bank accounts to satisfy the debt. The garnishee, in this case, is the financial institution where the debtor holds accounts. 3. Writ of Rental Income Garnishment: If the debtor derives income from rental properties, a creditor may seek a Writ of Rental Income Garnishment to collect the debt. This allows the creditor to receive rental payments directly from the tenant(s) or property management company. It is important to note that Round Rock, Texas, adheres to state and federal laws regarding garnishment procedures. The creditor must follow proper legal channels, adhere to specific timelines, and obtain the necessary court orders to execute a Writ of Garnishment. In conclusion, a Round Rock Texas Writ of Garnishment is a court-ordered process used to collect debts from debtors by seizing their assets. It allows creditors to recover their owed funds through various forms of garnishment, including wage garnishment, bank account garnishment, and rental income garnishment. If you find yourself facing a Writ of Garnishment, it is crucial to seek legal advice to understand your rights and potential options for resolving the debt.

Free preview

How to fill out Round Rock Texas Writ Of Garnishment?

If you’ve already utilized our service before, log in to your account and save the Round Rock Texas Writ of Garnishment on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Round Rock Texas Writ of Garnishment. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!