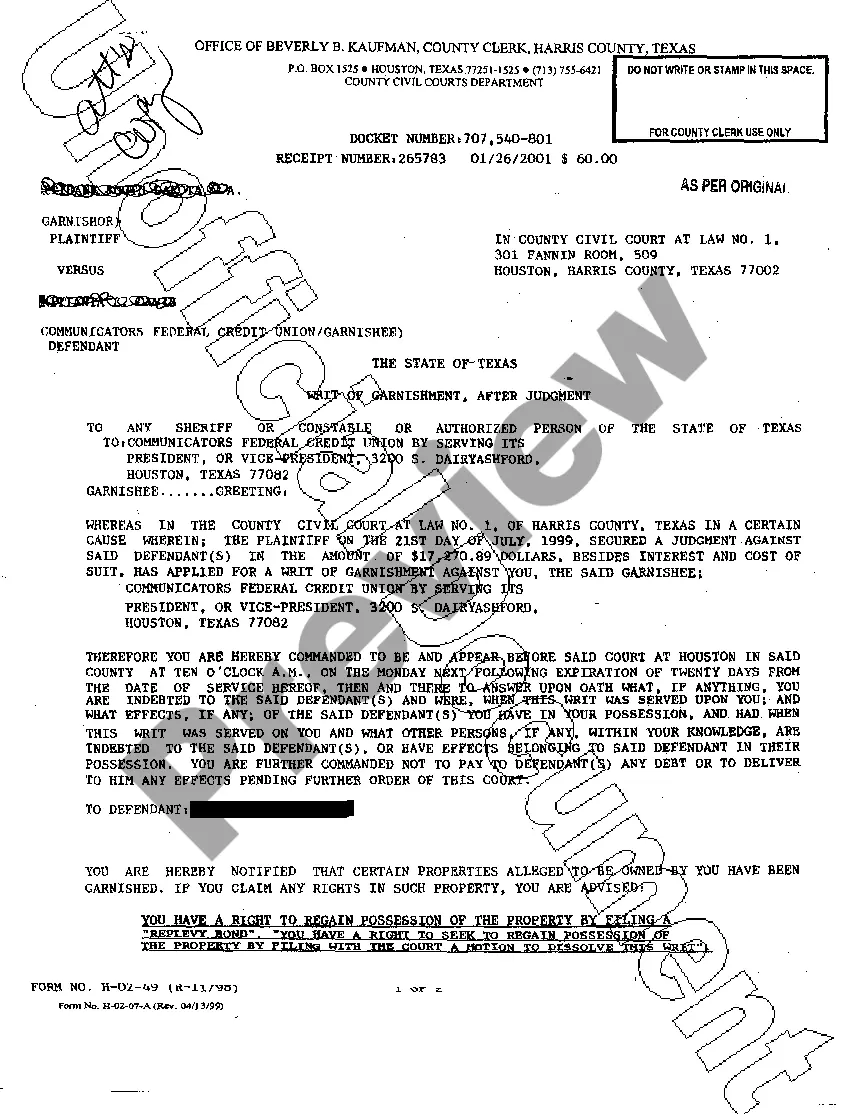

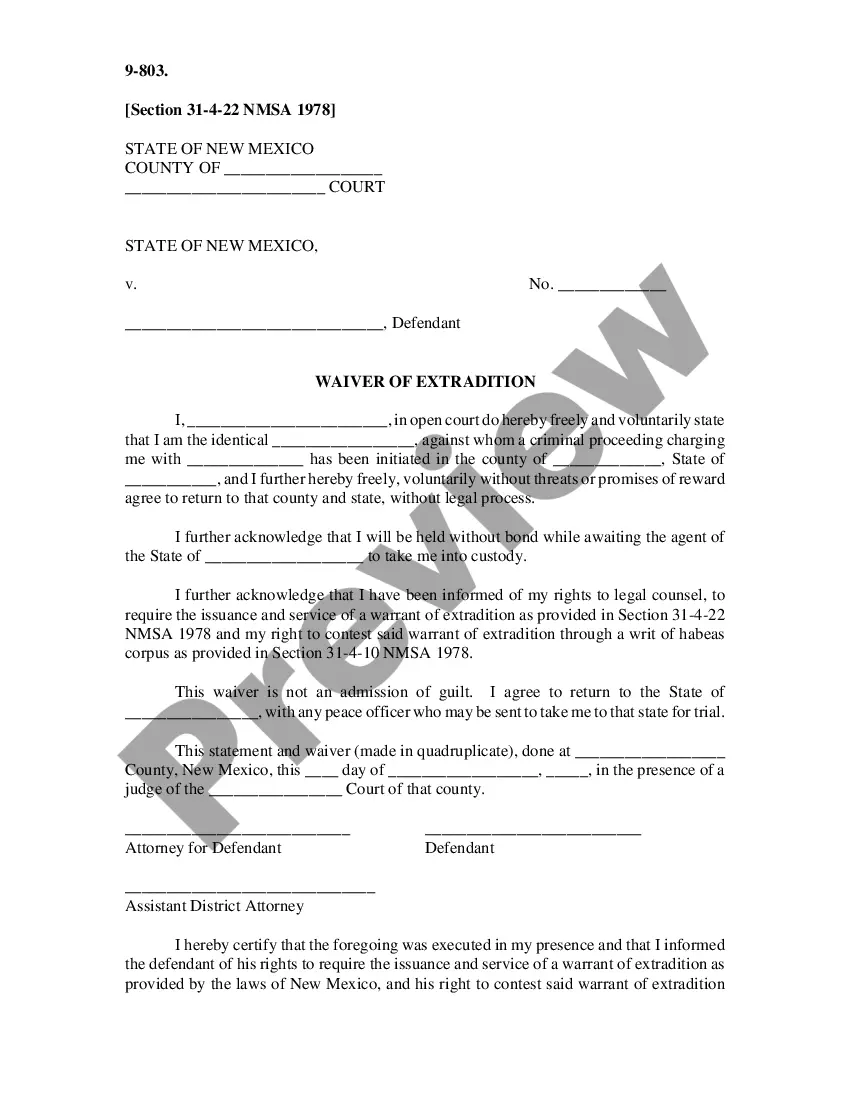

The San Antonio Texas Writ of Garnishment is a legal document filed by a creditor to collect a debt owed by a debtor residing in San Antonio, Texas. This writ allows the creditor to obtain funds from the debtor's bank accounts or wages to satisfy the debt. It is an effective legal tool commonly used in debt collection procedures. There are different types of San Antonio Texas Writs of Garnishment, depending on the source from which the creditor seeks to collect funds. The two main types are: 1. Writ of Garnishment for Bank Account: This type of writ allows a creditor to seize funds present in the debtor's bank account. Once the writ has been issued, it is served to the debtor's bank, which is then required to freeze the debtor's account. The creditor is then able to withdraw funds to satisfy the debt. 2. Writ of Garnishment for Wages: This type of writ enables a creditor to garnish a portion of the debtor's wages until the debt is fully paid. The writ is served to the debtor's employer, who must deduct the specified amount from the debtor's paycheck and send it directly to the creditor. The deductions continue until the debt is satisfied or the court orders a different arrangement. The San Antonio Texas Writ of Garnishment is a legal process regulated by state laws, which provide guidelines on the maximum amount that can be garnished, exemptions for certain types of income, and the proper procedures for initiating and serving a writ. It is essential for both creditors and debtors to be familiar with these laws to ensure their rights are protected during the garnishment process. In summary, the San Antonio Texas Writ of Garnishment is a legal instrument used by creditors to collect debts owed by debtors residing in San Antonio, Texas. It can be issued for bank accounts or wages, allowing the creditor to freeze the debtor's account or deduct a portion of their wages until the debt is fully satisfied. Understanding the different types of writs and the laws surrounding garnishment is vital for both parties involved in the debt collection process.

San Antonio Texas Writ of Garnishment

Description

How to fill out San Antonio Texas Writ Of Garnishment?

If you’ve previously used our service, Log In to your account and download the San Antonio Texas Writ of Garnishment onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it per your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You maintain continuous access to all documents you have purchased: you can retrieve them in your profile within the My documents menu whenever you wish to access them again. Take advantage of the US Legal Forms service to quickly find and store any template for your personal or professional needs!

- Ensure you’ve found the correct document. Review the description and utilize the Preview option, if available, to verify if it suits your requirements. If it doesn’t meet your needs, use the Search tab above to locate the appropriate one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and complete a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your San Antonio Texas Writ of Garnishment. Choose the file format for your document and store it on your device.

- Complete your document. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

The writ of garnishment orders the third party to surrender the defendant's assets to the court in order to satisfy a judgment against the defendant. With a writ of garnishment in place, creditors such as banks and credit cards can pull directly from defendants' bank accounts under Texas garnishment laws.

The Writ of Execution is a proactive approach to post-judgment enforcement. 30 days after obtaining a final judgment, a creditor can request a Writ of Execution from the clerk of the court. The creditor or the creditor's attorney will fill out a Writ of Execution form available at any county courthouse.

A creditor can stop a writ of garnishment by essentially asking the court to dismiss it.

WHO MAY ISSUE. The clerk of a district or county court or a justice of the peace may issue a writ of garnishment returnable to his court. Acts 1985, 69th Leg., ch. 959, Sec.

A judgment is valid for 10 years and can be enforced at any time during those that time. It is not uncommon for a creditor to seek to enforce a judgment that is close to ten years old. There are also ways to renew the judgment, so that it can be enforced for even longer than ten years.

A judgment can remain on your credit report as long as it is ?valid? or ?active.? In Texas, judgments are valid (?active?) for at least 10 years and they can be renewed for another 10 years after that, and then another 10 year after that, and so on, indefinitely.

Do Judgments Expire in Texas? Judgments awarded in Texas to a non-government creditor are generally valid for ten years but they can be renewed for longer. If a judgment is not renewed, it will become dormant. You can attempt to revive a dormant judgment in order to continue to try and collect the debt.

Texas and Federal Law The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.