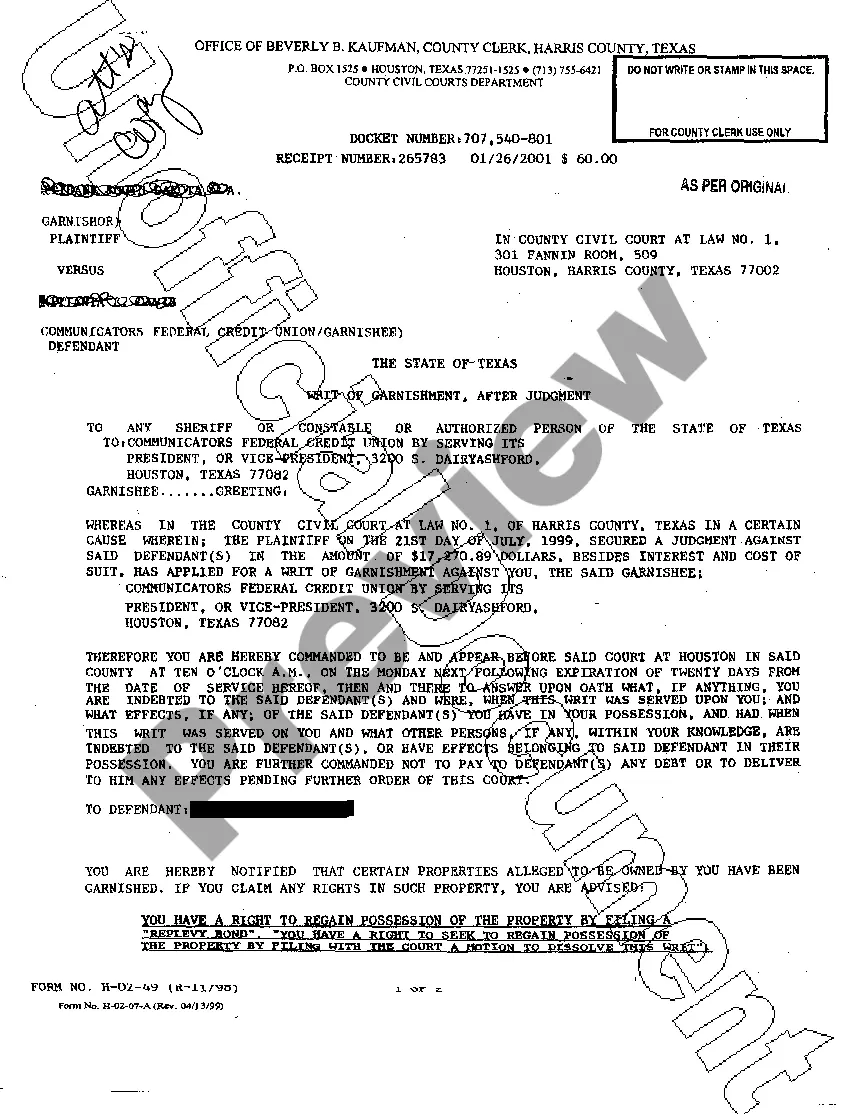

Travis Texas Writ of Garnishment: A Detailed Description and Its Types The Travis Texas Writ of Garnishment is a legal proceeding that allows a creditor to collect debts owed to them by an individual or entity through a court-ordered seizure of the debtor's property or funds held by a third party. This writ is governed by Texas law and is commonly used to enforce judgment and recover unpaid debts. Keywords: Travis Texas, Writ of Garnishment, legal proceeding, creditor, collect debts, court-ordered seizure, debtor, property, funds, third party, Texas law, judgment, unpaid debts. Types of Travis Texas Writ of Garnishment: 1. Regular Garnishment: This type involves the garnishment of a debtor's wages or salary. When a creditor obtains a judgment against the debtor, they may file a writ of garnishment with the court, providing an opportunity to collect a portion of the debtor's income until the debt is satisfied. The employer of the debtor then becomes responsible for withholding the specified amount from the debtor's paycheck and remitting it to the creditor. Keywords: Regular Garnishment, debtor's wages, salary, judgment, court, writ of garnishment, collect, debtor's income, debt, satisfied, employer, withholding. 2. Bank Garnishment: In this type of writ, the creditor seeks to collect the debt owed to them by freezing the debtor's bank accounts. Once the writ is granted by the court, the financial institution in which the debtor holds an account must freeze the funds up to the amount owed. The frozen funds are then turned over to the creditor, satisfying their debt. Keywords: Bank Garnishment, creditor, debt, freezing, debtor's bank accounts, writ, court, financial institution, freeze, funds, turned over, satisfying debt. 3. Third-Party Garnishment: This writ allows a creditor to seize the debtor's property held by a third party. The third party can be an individual or an organization that owes money to the debtor. The creditor can legally require the third party to surrender the debtor's property, including bank accounts, real estate, vehicles, or any other valuable assets, to satisfy the outstanding debt. Keywords: Third-Party Garnishment, seize, debtor's property, third party, individual, organization, money, surrender, bank accounts, real estate, vehicles, valuable assets, outstanding debt. It is essential for both creditors and debtors to familiarize themselves with the Travis Texas Writ of Garnishment and its various types. Creditors can utilize this legal process to recover their debts, while debtors should be aware of their rights and potential consequences associated with a writ of garnishment. Seeking legal advice from an attorney is highly recommended for accurate guidance through the garnishment process.

Travis Texas Writ of Garnishment

Description

How to fill out Travis Texas Writ Of Garnishment?

We always want to reduce or prevent legal issues when dealing with nuanced legal or financial matters. To do so, we sign up for attorney services that, usually, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Travis Texas Writ of Garnishment or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Travis Texas Writ of Garnishment complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Travis Texas Writ of Garnishment is proper for your case, you can pick the subscription option and make a payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!