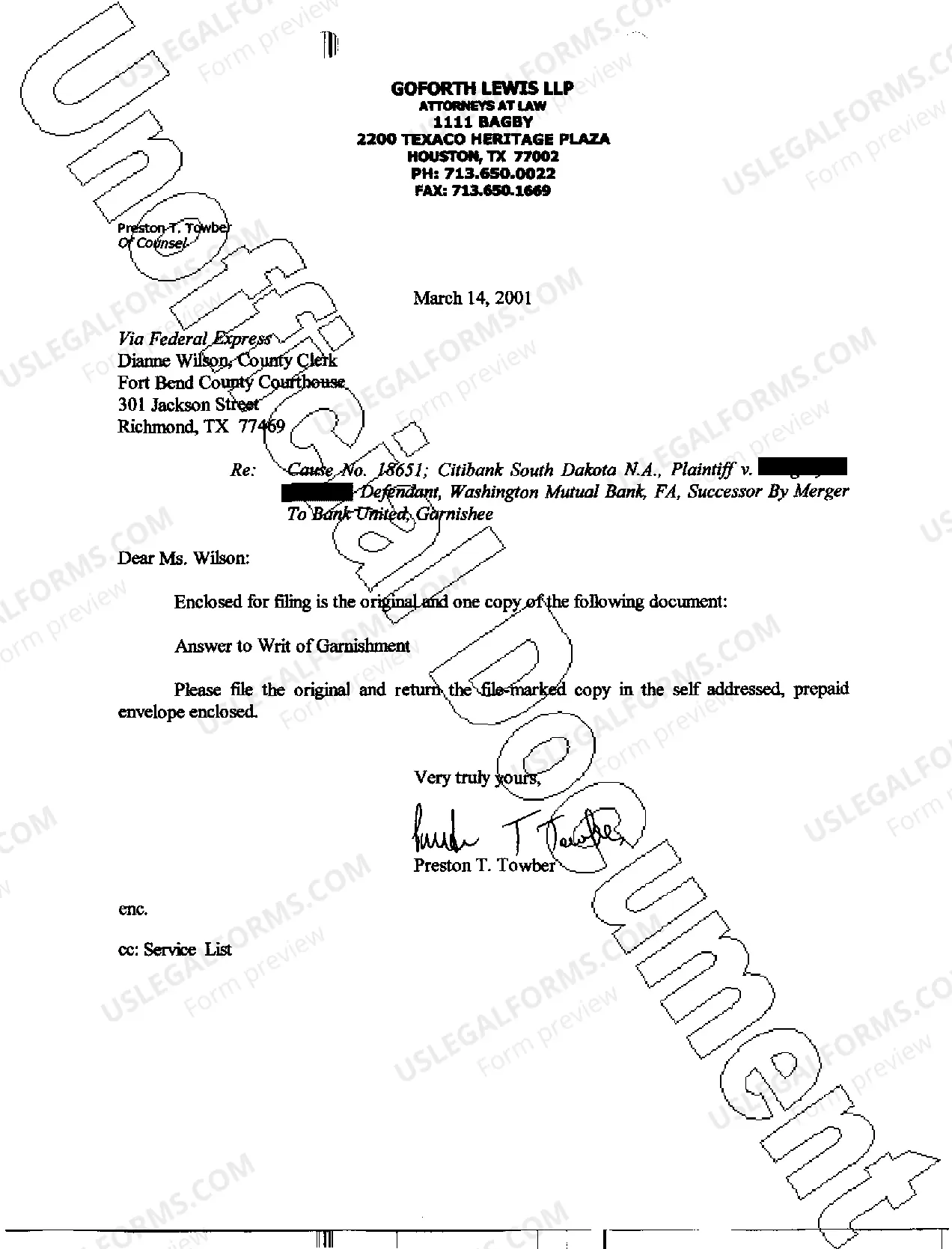

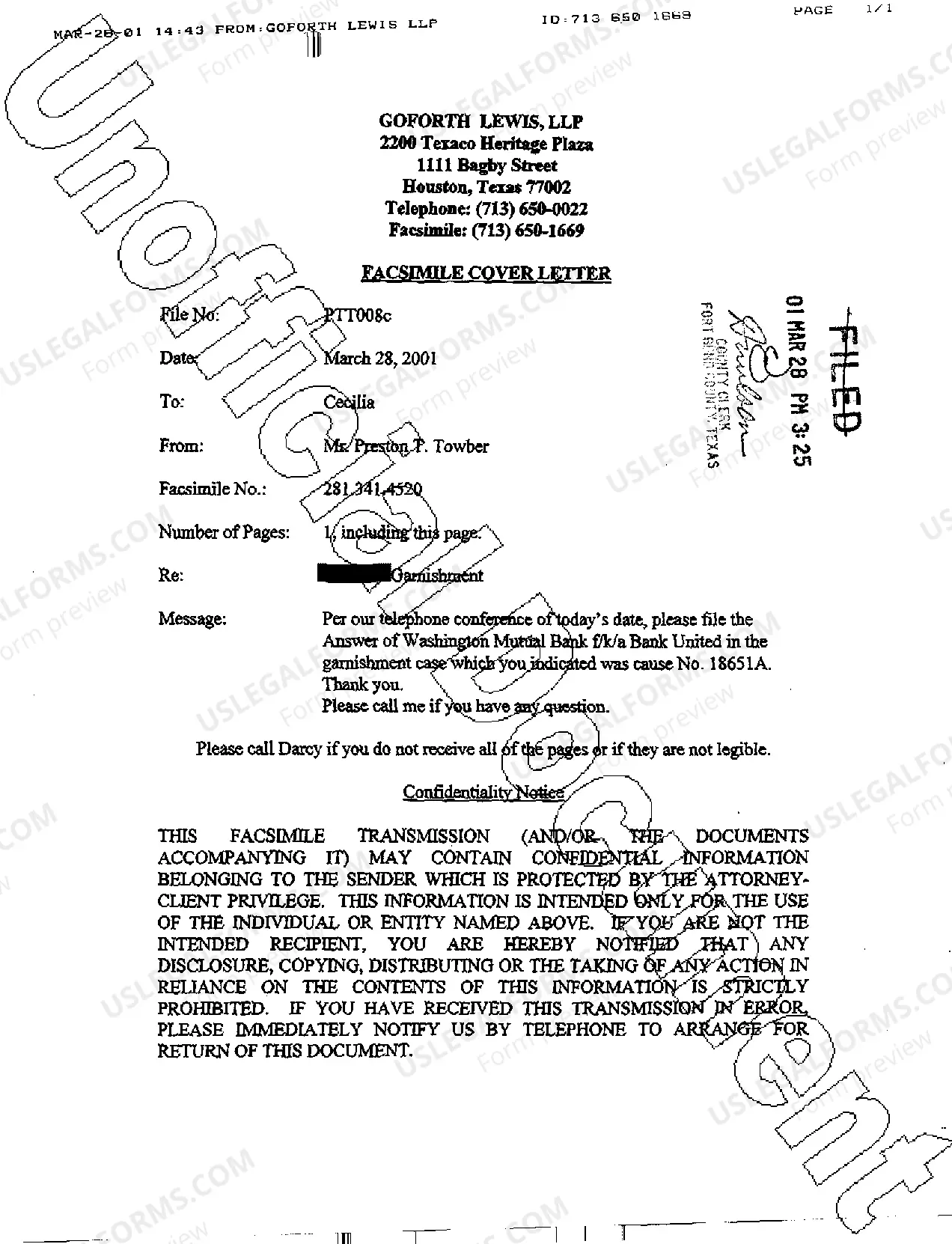

Abilene, Texas Answer to Write of Garnishment is a legal document filed by a debtor in response to a writ of garnishment initiated by a creditor. This document serves as the debtor's formal reply to the court, underlining their objections or defenses against the garnishment. Keywords: Abilene, Texas, answer, writ of garnishment, legal document, debtor, creditor, objections, defenses, court. There are two main types of Abilene, Texas Answers to Write of Garnishment: 1. General Answers to Write of Garnishment: In this type of response, the debtor provides a comprehensive statement that addresses the issues stated in the writ of garnishment. The debtor may argue against the reasons behind the garnishment or present defenses such as exemptions, statute of limitations, or procedural errors. The general answer allows the debtor to present their case fully and seek potential relief from the garnishment. Keywords: General answer, comprehensive statement, issues, reasons, garnishment, arguments, exemptions, statute of limitations, procedural errors, relief. 2. Verified Answer to Write of Garnishment: A verified answer is similar to a general answer; however, it requires the debtor to affirm the truthfulness of the statement made under oath or penalty of perjury. This type of answer holds the debtor legally responsible for the accuracy of their response. By filing a verified answer, the debtor ensures that their objections or defenses are backed by factual evidence, adding credibility to their position. Keywords: Verified answer, truthfulness, statement, oath, penalty of perjury, legally responsible, accuracy, objections, defenses, factual evidence, credibility. In both types of Abilene, Texas Answers to Write of Garnishment, debtors should consult with a legal professional to understand their rights, obligations, and potential consequences. Each case is unique, and legal advice can greatly assist debtors in navigating the complexities and finding the optimal course of action.

Abilene Texas Answer To Writ of Garnishment

Description

How to fill out Abilene Texas Answer To Writ Of Garnishment?

If you are looking for a pertinent form, it’s impossible to select a more suitable service than the US Legal Forms website – likely the most extensive online repositories.

With this library, you can discover a vast number of document samples for business and individual purposes by categories and locations, or keywords.

With our superior search feature, obtaining the latest Abilene Texas Answer To Writ of Garnishment is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the format and save it to your device.

- Moreover, the relevance of each record is confirmed by a team of skilled attorneys who regularly assess the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to receive the Abilene Texas Answer To Writ of Garnishment is to Log In to your user profile and click the Download option.

- If you utilize US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have located the sample you need. Review its details and use the Preview feature to examine its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to locate the necessary document.

- Validate your choice. Click on the Buy now option. Afterwards, select your preferred pricing plan and provide the necessary details to register an account.

Form popularity

FAQ

Filing a Writ of Execution 30 days after obtaining a final judgment, a creditor can request a Writ of Execution from the clerk of the court. The creditor or the creditor's attorney will fill out a Writ of Execution form available at any county courthouse.

A sheriff or constable. A person over 18 years of age authorized by written order of the court. A person certified under order of the Supreme Court. The clerk of the court in which the case is pending (by certified mail, return receipt requested)

Specifically, Texas Rule of Civil Procedure 658, Application for Writ of Garnishment and Order, states that a plaintiff may file an application for a writ of garnishment of a bank account in Texas ?either at the commencement of a lawsuit or at any time during its progress.? Tex.

In Texas, wage garnishment is prohibited by the Texas Constitution except for a few kinds of debt: child support, spousal support, student loans, or unpaid taxes. A debt collector cannot garnish your wages for ordinary debts. However, Texas does allow for a bank account to be frozen.

In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor. It is the third party, the bank or financial institution, which receives the Writ of Garnishment.

Description. A writ of garnishment is a process by which the court orders the seizure or attachment of the property of a defendant or judgment debtor in the possession or control of a third party. The garnishee is the person or corporation in possession of the property of the defendant or judgment debtor.

A creditor can stop a writ of garnishment by essentially asking the court to dismiss it.

WHO MAY ISSUE. The clerk of a district or county court or a justice of the peace may issue a writ of garnishment returnable to his court. Acts 1985, 69th Leg., ch. 959, Sec.

§§ 63.001-. 008 (Vernon 1986). In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor.

The writ of garnishment orders the third party to surrender the defendant's assets to the court in order to satisfy a judgment against the defendant. With a writ of garnishment in place, creditors such as banks and credit cards can pull directly from defendants' bank accounts under Texas garnishment laws.