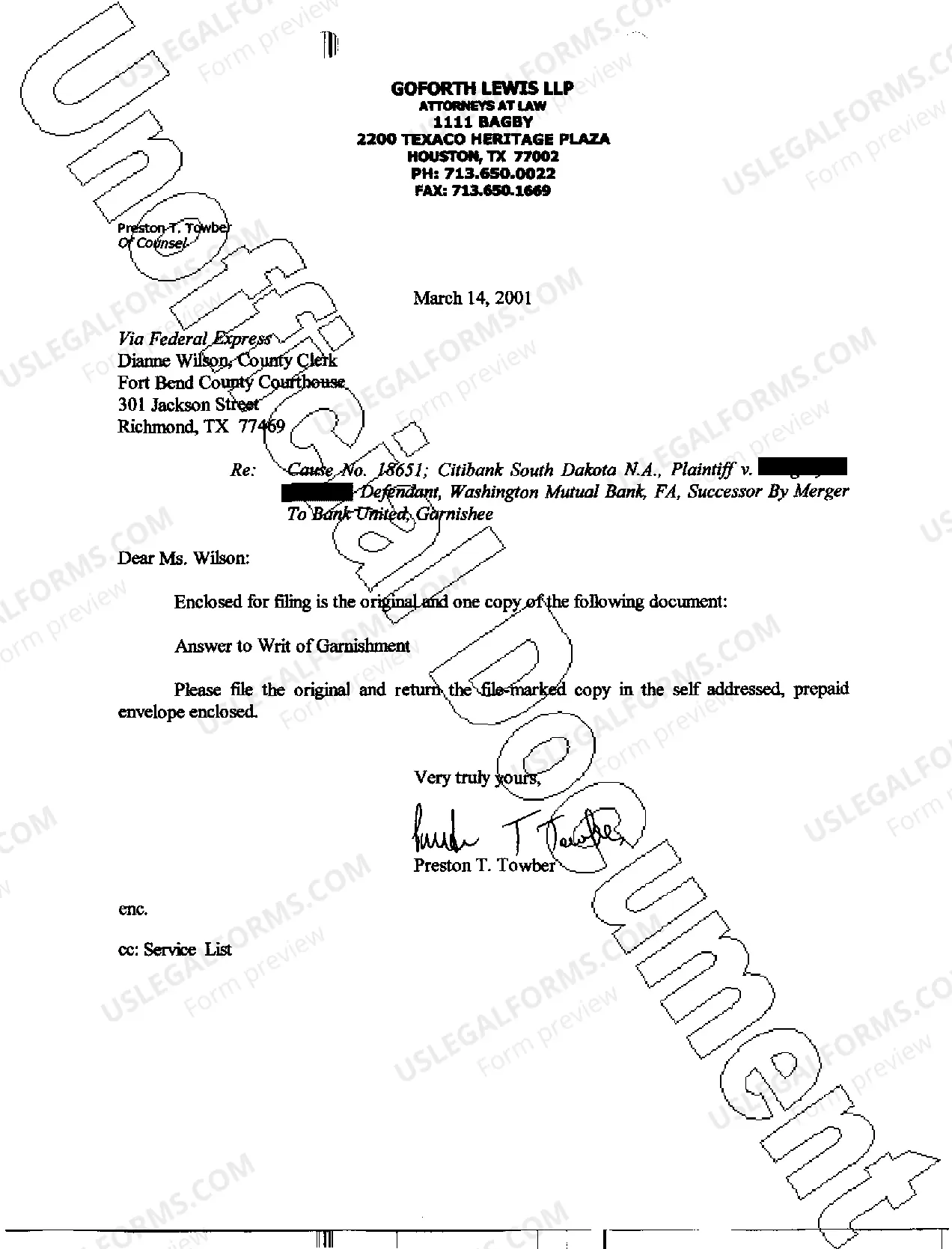

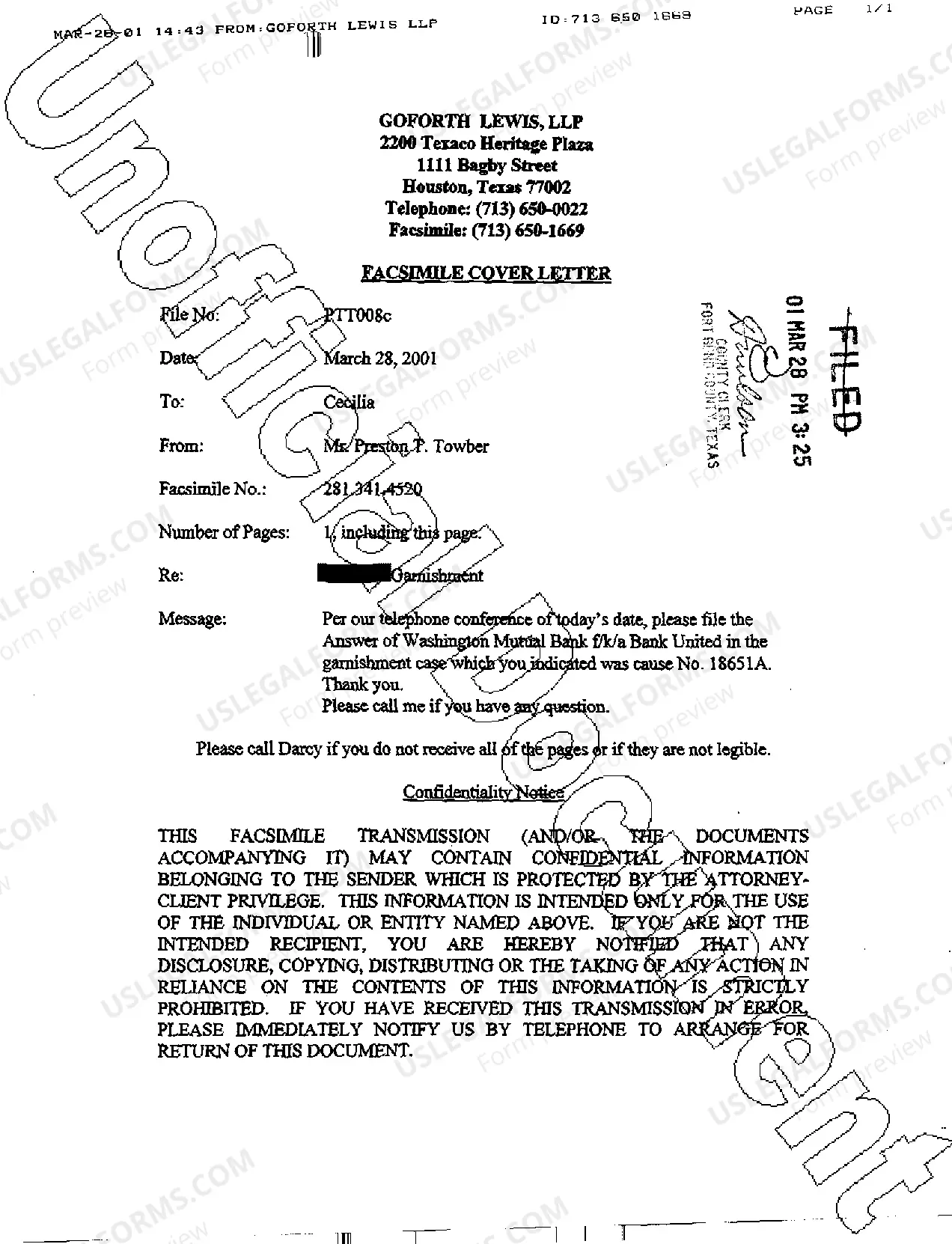

The Austin Texas Answer to Write of Garnishment is a legal document that allows individuals or entities (garnishees) to respond to a writ of garnishment issued by a court. This process typically occurs when a creditor is attempting to collect on a debt owed by a debtor. The answer to the writ of garnishment is a crucial step in the garnishment process. It enables the garnishee to present their response and provide relevant information related to the debt owed by the debtor. The garnishee can either admit or deny the debt, claim exemptions, or assert any other applicable defenses. There are different types of Austin Texas Answer to Write of Garnishment, depending on the specific circumstances of the case. These may include: 1. General denial: The garnishee denies all the allegations made by the creditor and asserts that they do not owe any debt to the debtor. 2. Admission: The garnishee admits to owing a debt to the debtor and provides the necessary details, such as the amount owed and how it should be paid. 3. Exemption claim: The garnishee claims that certain funds or property are exempt from garnishment under Texas law. This may include wages that are protected by federal or state laws, government benefits, or other exempt assets. 4. Counterclaim: The garnishee asserts a counterclaim against the creditor or debtor, claiming that they are owed money or have any other valid legal claims against them. 5. Payment in installments: The garnishee may propose a payment plan or offer to pay the debt in installments rather than the full amount owed. It is important for the garnishee to consult with an attorney familiar with Texas garnishment laws to understand which type of answer is most appropriate for their specific situation. The answer to the writ of garnishment must be filed within a certain timeframe and should comply with all relevant legal requirements to protect the garnishee's rights and interests.

Austin Texas Answer To Writ of Garnishment

Description

How to fill out Austin Texas Answer To Writ Of Garnishment?

Take advantage of the US Legal Forms and gain instant access to any form template you require.

Our user-friendly platform with a vast collection of document templates enables you to locate and acquire nearly any document sample you seek.

You can effortlessly download, complete, and sign the Austin Texas Answer To Writ of Garnishment in just a few minutes instead of spending hours browsing the Internet for the correct template.

Utilizing our catalog is an excellent method to enhance the security of your form submission. Our experienced attorneys frequently review all documents to ensure that the templates are appropriate for a specific state and adhere to new laws and regulations.

US Legal Forms is among the largest and most dependable form repositories online. Our team is always prepared to support you in any legal matter, even if it’s simply downloading the Austin Texas Answer To Writ of Garnishment.

Feel free to utilize our platform and make your document experience as easy as possible!

- How can you access the Austin Texas Answer To Writ of Garnishment.

- If you possess a subscription, simply Log In/">Log In to your account. The Download button will be activated for all the samples you view. Furthermore, you can locate all the previously saved documents in the My documents section.

- If you haven’t created an account yet, follow the instructions outlined below.

- Locate the form you need. Ensure that it is the document you were searching for: verify its title and description, and utilize the Preview feature if it is available. If not, use the Search field to find the required one.

- Initiate the download process. Click Buy Now and select the pricing option that best fits your needs. Then, register for an account and complete your order using a credit card or PayPal.

- Download the document. Choose the format to receive the Austin Texas Answer To Writ of Garnishment and edit and complete it as necessary.