Title: Understanding the Brownsville Texas Answer to Write of Garnishment: Types and Detailed Description Introduction: The Brownsville Texas Answer to Write of Garnishment is a legal process that allows creditors to potentially collect debt directly from a debtor's paycheck or bank account. This comprehensive guide will delve into the various aspects of the Brownsville Texas Answer to Write of Garnishment, including the different types, the purpose, and the necessary steps to respond effectively. Types of Brownsville Texas Answer to Write of Garnishment: 1. Ordinary Garnishment: Ordinary garnishment occurs when a creditor initiates legal action against a debtor to recover outstanding debts. The creditor obtains a court order called a "Writ of Garnishment" which authorizes them to collect funds directly from the debtor's wages or bank account. 2. Federal Debt Garnishment: Federal government entities, such as the Internal Revenue Service (IRS), may utilize garnishment to recover unpaid taxes, student loans, or other federal debts. This type of garnishment has its unique rules and procedures. Detailed Description of the Brownsville Texas Answer to Write of Garnishment: 1. Purpose of an Answer to Write of Garnishment: An Answer to Write of Garnishment is a legal response filed by the debtor to the court, explaining their financial situation, defenses, or objections to the garnishment. Its purpose is to halt or minimize the garnishment by providing valid justifications. 2. Content of an Answer to Write of Garnishment: When responding to a Writ of Garnishment, it is crucial to include the following information: a. Personal Information: The debtor's name, address, and contact information. b. Case Information: The case number, court name, and date of the Writ of Garnishment. c. Financial Details: A detailed breakdown of the debtor's income, expenses, and dependents to demonstrate financial hardship. d. Legal Defenses/Objections: Any applicable legal defenses or objections, such as an incorrect Writ of Garnishment, already satisfied debt, or exempt income sources. e. Supporting Documentation: Any relevant financial records, contracts, or legal forms that support the debtor's claims. 3. Timelines and Filing Requirements: Debtors must respond promptly to a Writ of Garnishment to protect their rights. In Brownsville Texas, the exact timelines and filing requirements may vary. However, debtors usually have a limited window, typically around 14-30 days, to file their Answer to Write of Garnishment after receiving the notice. 4. Seeking Legal Advice: Navigating the complexities of an Answer to Write of Garnishment can be overwhelming. Debtors are encouraged to consult an experienced attorney in Brownsville Texas specializing in debt collection and consumer rights to ensure the best possible outcome. Conclusion: The Brownsville Texas Answer to Write of Garnishment is a crucial legal document that helps debtors assert their rights and protect their financial interests. By understanding the different types of garnishment and diligently responding with a detailed Answer, debtors can mitigate the impact of the garnishment and potentially resolve their financial obligations. Seeking legal advice is highly recommended navigating this legal process effectively.

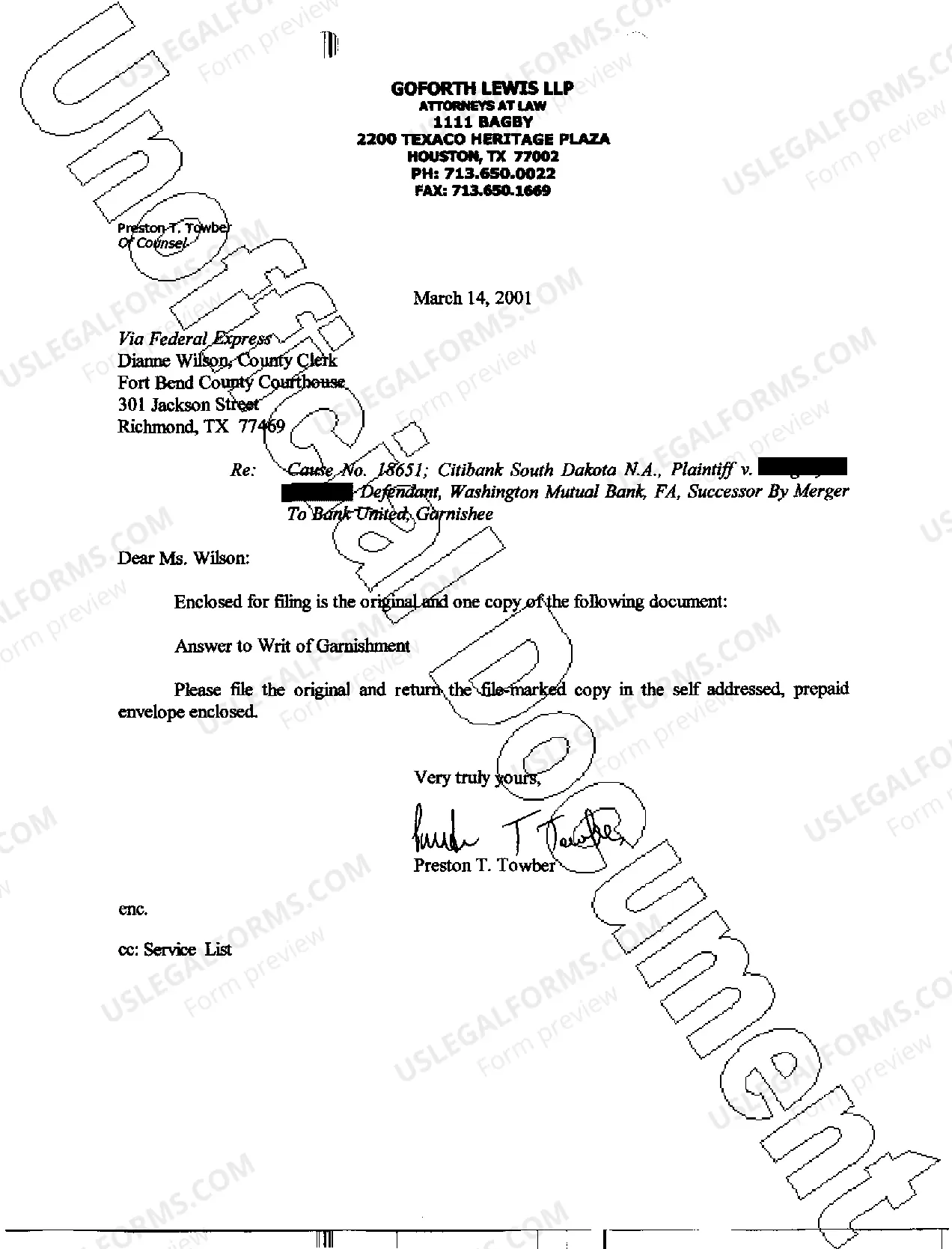

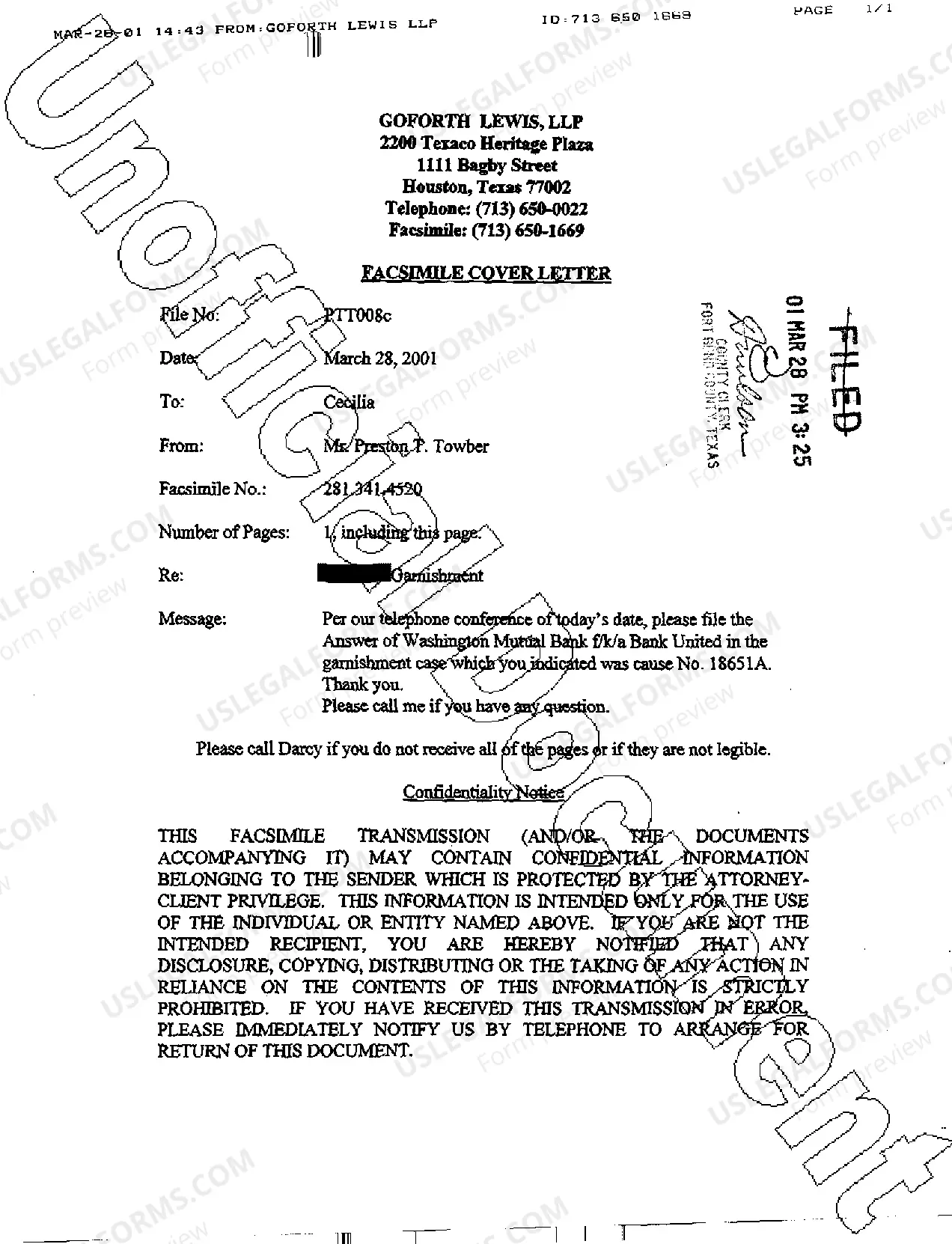

Brownsville Texas Answer To Writ of Garnishment

Description

How to fill out Brownsville Texas Answer To Writ Of Garnishment?

Do you need a reliable and affordable legal forms provider to get the Brownsville Texas Answer To Writ of Garnishment? US Legal Forms is your go-to solution.

Whether you require a basic agreement to set regulations for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked in accordance with the requirements of specific state and county.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Brownsville Texas Answer To Writ of Garnishment conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is good for.

- Restart the search if the form isn’t good for your legal situation.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Brownsville Texas Answer To Writ of Garnishment in any provided format. You can return to the website at any time and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal papers online for good.