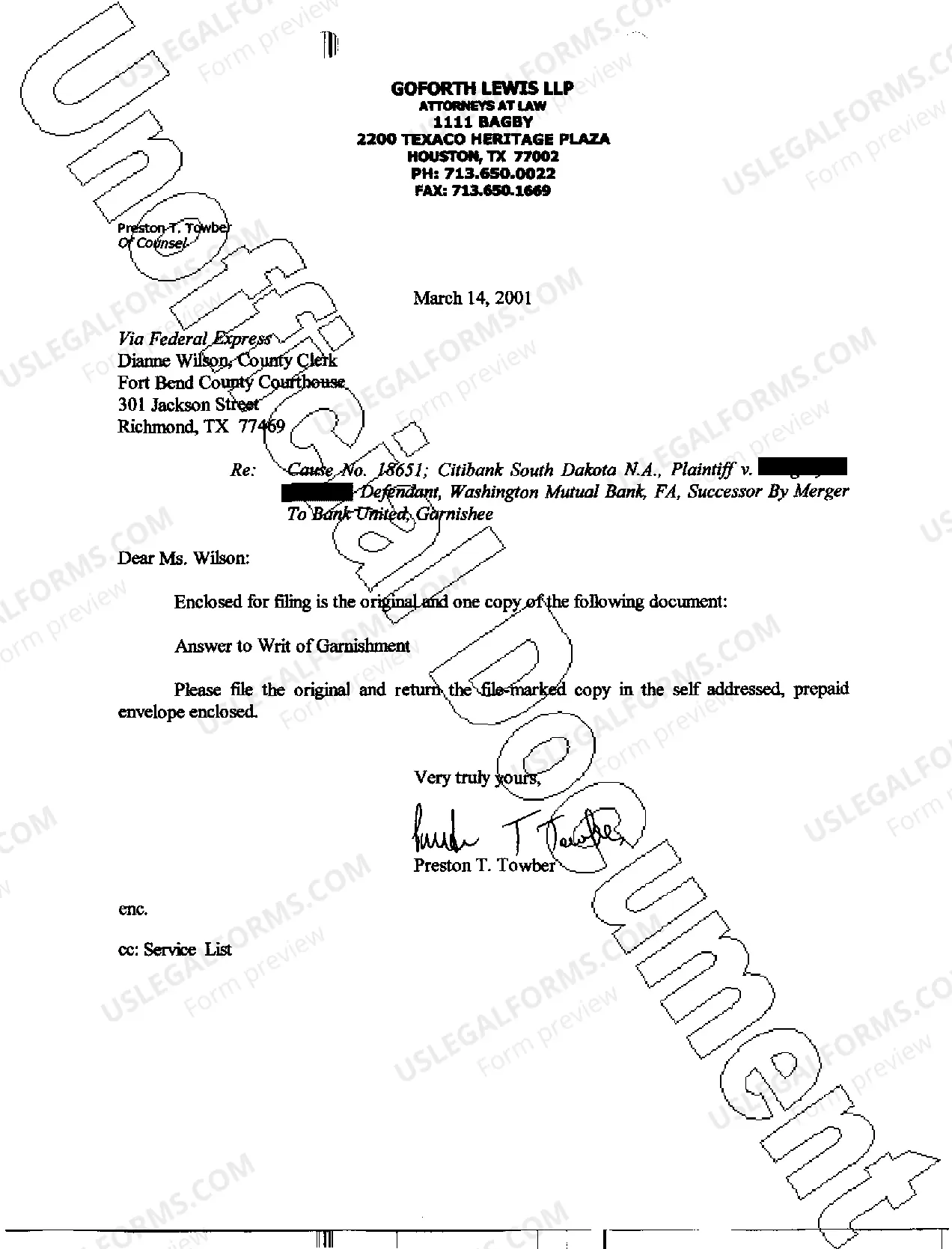

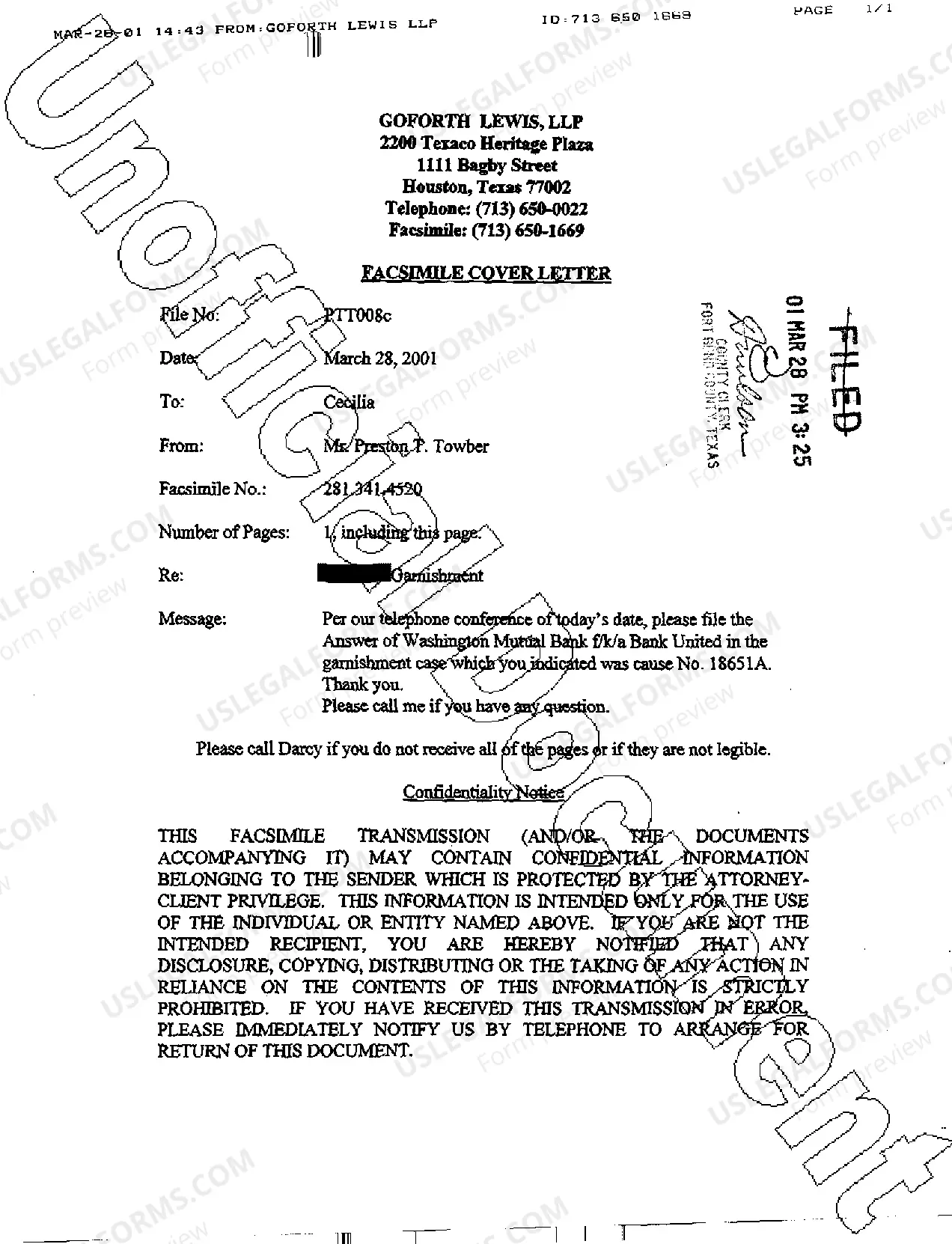

Dallas Texas Answer To Writ of Garnishment

Description

How to fill out Texas Answer To Writ Of Garnishment?

Utilize the US Legal Forms and gain instant access to any document you require. Our advantageous platform featuring a wide array of documents simplifies the process of locating and obtaining nearly any document template you might need.

You can download, complete, and endorse the Dallas Texas Answer To Writ of Garnishment in mere minutes instead of spending hours scanning the internet for a suitable template.

Using our collection is an excellent method to enhance the security of your document submissions. Our skilled attorneys routinely examine all the documents to ensure that the forms are suitable for specific jurisdictions and adhere to current regulations and standards.

How can you acquire the Dallas Texas Answer To Writ of Garnishment? If you possess an account, simply Log In to your profile. The Download button will be activated on all the templates you view. Additionally, you can access all your previously saved files in the My documents section.

US Legal Forms is one of the most extensive and trustworthy form repositories online. Our organization is always prepared to assist you in any legal procedure, even if it is merely downloading the Dallas Texas Answer To Writ of Garnishment.

Feel free to take advantage of our services and make your document experience as streamlined as possible!

- Open the page with the document you need. Confirm that it is the document you were searching for: check its title and description, and use the Preview feature if available. If not, utilize the Search bar to find the appropriate one.

- Initiate the purchasing process. Click Buy Now and select your preferred pricing option. After that, register for an account and finalize your order using a credit card or PayPal.

- Download the document. Specify the format to download the Dallas Texas Answer To Writ of Garnishment and modify and complete, or endorse it as per your requirements.

Form popularity

FAQ

To dissolve a writ of garnishment in Dallas, Texas, you typically need to file a motion with the court that issued the writ. This process often involves outlining the reasons for dissolving the writ, such as incorrect claims or resolution of the underlying debt. It's essential to adhere to the proper court procedures to ensure your request is successful. For comprehensive assistance, consider using US Legal Forms to access the necessary documentation and guidance tailored to the Dallas Texas Answer To Writ of Garnishment.

To file an answer to a debt lawsuit in Texas, you need to prepare a written response that addresses each claim made by the plaintiff. You must submit this response to the court within the specified time frame, usually 14 days. The US Legal Forms platform can provide you with the resources and forms needed for a successful submission. Remember, your Dallas Texas Answer To Writ of Garnishment can significantly impact the outcome of your case, so take the time to do it right.

After receiving a writ of garnishment, the first step is to understand your rights and obligations. You can respond to the garnishment by filing an answer in court, which is essential to protect your interests. Consider using the US Legal Forms platform to help you navigate this process effectively. The Dallas Texas Answer To Writ of Garnishment is crucial to ensure your voice is heard and your financial situation is managed properly.

If an employer ignores a wage garnishment in Texas, they may face legal consequences, including penalties. The court can impose fines or even hold the employer in contempt for non-compliance. It's essential for both employees and employers to understand their obligations to avoid complications. Should you find yourself in this predicament, USLegalForms can assist you in obtaining the Dallas Texas Answer To Writ of Garnishment you need.

Fighting a writ of execution in Texas involves filing a motion to quash or set aside the writ in court. This process requires presenting evidence and argumentation against the legitimacy of the writ, which can be challenging without proper guidance. It is beneficial to consult legal resources or experts to navigate this situation effectively. By turning to USLegalForms, you can gain access to useful information regarding your Dallas Texas Answer To Writ of Garnishment.

Once a writ of garnishment is served, it notifies your employer or bank of the legal action to withhold funds. Your salary or assets may be frozen, and funds will not be released until the matter is resolved. It is crucial to understand your rights and options promptly, as delays can affect your financial situation. Exploring solutions through platforms like USLegalForms can provide you with a comprehensive Dallas Texas Answer To Writ of Garnishment.

To stop a writ of garnishment in Texas, you can file a motion with the court that issued the garnishment. This motion must demonstrate valid reasons to lift the garnishment, such as an exemption or change in circumstances. Often, securing legal assistance can provide clarity on how to proceed. Utilizing resources like USLegalForms can help guide you through the necessary steps, ensuring that you understand the Dallas Texas Answer To Writ of Garnishment.

Filling out a challenge to a garnishment form requires clarity and accuracy. First, gather the necessary information, including your own details and the specifics of the garnishment. Then, provide a clear explanation of why you believe the garnishment should be challenged. Remember, utilizing the US Legal platform can streamline this process, guiding you through the necessary steps for a thorough and effective Dallas Texas Answer to Writ of Garnishment.