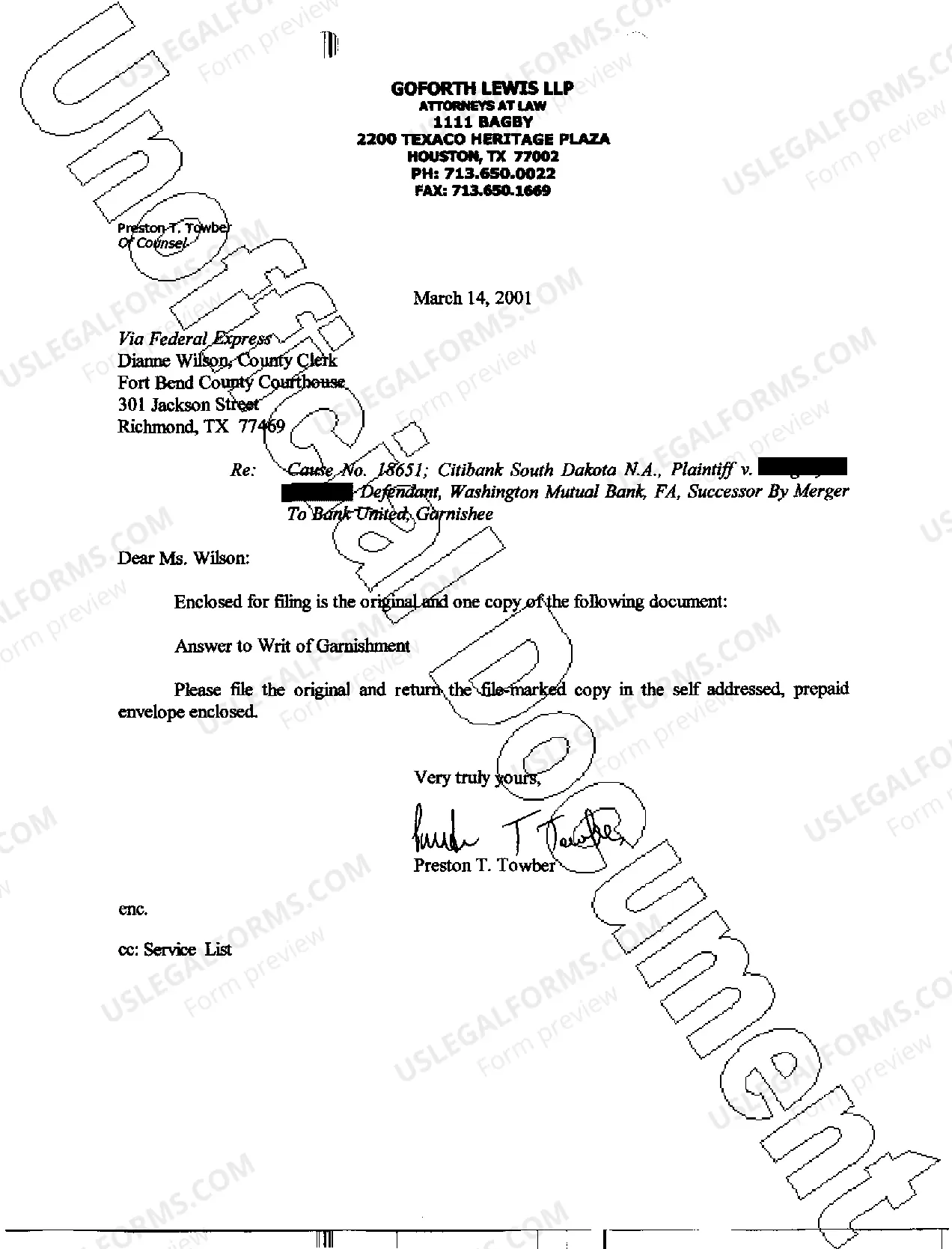

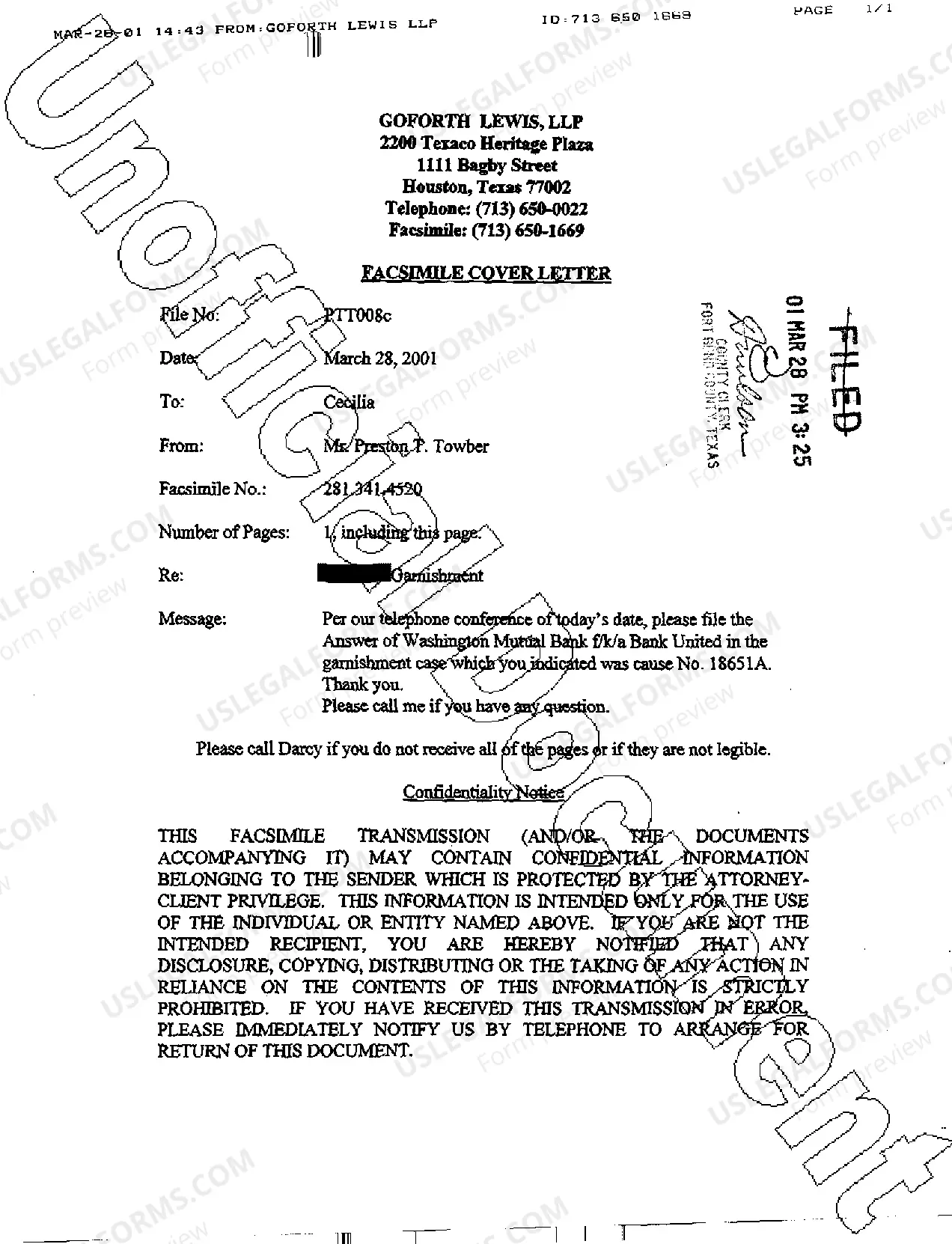

The Grand Prairie Texas Answer to Write of Garnishment is a legal process that occurs when a creditor seeks to collect a debt owed by a debtor. When a creditor successfully obtains a writ of garnishment, they can request that a portion of the debtor's wages or bank account, held by a third party, be used to satisfy the debt. In response to this writ, the debtor is required to file an answer detailing their financial situation and any possible exemptions they may qualify for. There are several types of Grand Prairie Texas Answer to Write of Garnishment, each serving a specific purpose: 1. Answer to Write of Garnishment — Wage: This type of answer is filed by the debtor when their wages are being garnished. It includes information about their employer, income, and any applicable exemptions. 2. Answer to Write of Garnishment — Bank Account: If the creditor seeks to garnish funds from the debtor's bank account, the debtor must file this type of answer. It includes details about their financial institution, account balance, and possible exemptions. 3. Answer to Write of Garnishment — Exemptions: In some cases, debtors may qualify for exemptions that protect certain assets from being garnished. The Answer to Write of Garnishment — Exemptions is filed to provide information about the assets that are exempt and should not be included in the garnishment process. It is important for debtors in Grand Prairie, Texas, to understand their rights and responsibilities when facing a writ of garnishment. Filing a timely and accurate answer is crucial to protect their assets and ensure proper enforcement of garnishment laws. If you are dealing with a Grand Prairie Texas Answer to Write of Garnishment, it is advisable to consult with an experienced attorney who can guide you through the process and help maximize your exemptions. Remember to provide all the necessary information in your answer accurately and promptly to protect your financial interests.

Grand Prairie Texas Answer To Writ of Garnishment

Description

How to fill out Grand Prairie Texas Answer To Writ Of Garnishment?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Grand Prairie Texas Answer To Writ of Garnishment gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Grand Prairie Texas Answer To Writ of Garnishment takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Grand Prairie Texas Answer To Writ of Garnishment. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!