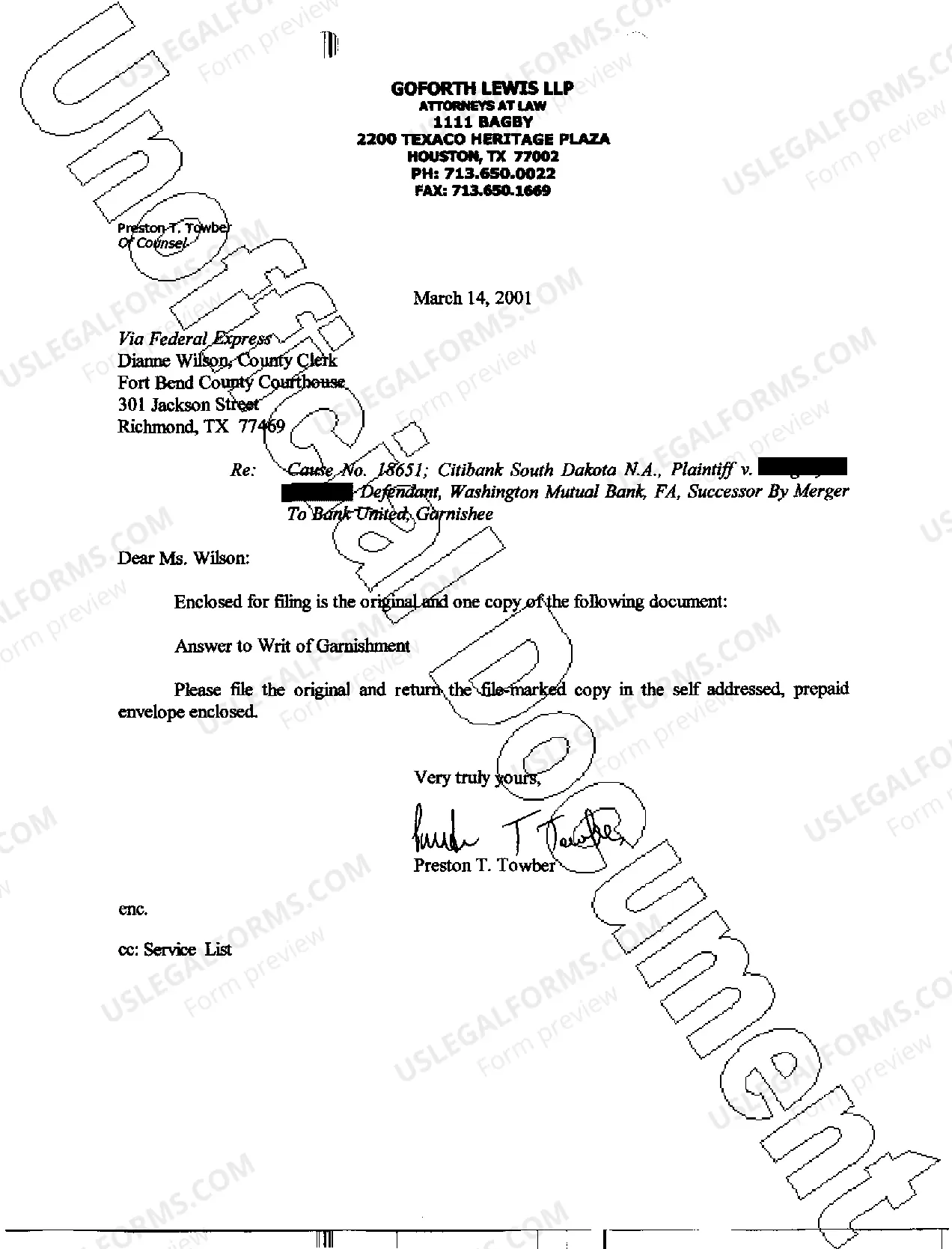

The Harris Texas Answer to Write of Garnishment is a legal document required in response to a writ of garnishment filed by a creditor in Harris County, Texas. This document allows the defendant (the individual whose wages or assets are being garnished) to state their defenses and objections to the garnishment. Keywords: Harris Texas Answer to Write of Garnishment, legal document, writ of garnishment, creditor, defendant, wages, assets, garnished, defenses, objections, Harris County, Texas. There are generally two types of Harris Texas Answer to Write of Garnishment, depending on the type of garnishment involved: 1. Writ of Garnishment for Wages: This type of garnishment allows the creditor to collect a portion of the defendant's wages directly from their employer. The defendant must complete the Harris Texas Answer to Write of Garnishment form to assert any exemptions they may be eligible for, such as head of household exemption or exempt income limits. Keywords: Writ of Garnishment for Wages, garnishment, creditor, wages, employer, exemptions, head of household exemption, exempt income limits. 2. Writ of Garnishment for Assets: In this type of garnishment, the creditor seeks to collect the defendant's assets to satisfy the owed debt. The assets can include bank accounts, property, vehicles, or any other valuable possessions. The Harris Texas Answer to Write of Garnishment form enables the defendant to assert their objections or exemptions regarding the specific assets being targeted for garnishment. Keywords: Writ of Garnishment for Assets, assets, garnishment, creditor, bank accounts, property, vehicles, valuable possessions, objections, exemptions. Regardless of the type of Harris Texas Answer to Write of Garnishment, the defendant must provide accurate and detailed information about their financial situation, income, and any available exemptions or defenses. The purpose of this document is to protect the defendant's rights and ensure fair proceedings in resolving the debt issue. Furthermore, it is essential to consult with an attorney specialized in debt collection or bankruptcy law to understand the specific requirements, exemptions, and legal procedures related to the Harris Texas Answer to Write of Garnishment. This will help the defendant navigate the complex legal process and present their case effectively.

Harris Texas Answer To Writ of Garnishment

Description

How to fill out Harris Texas Answer To Writ Of Garnishment?

Make use of the US Legal Forms and have immediate access to any form you need. Our beneficial website with thousands of documents allows you to find and get virtually any document sample you will need. You are able to download, fill, and certify the Harris Texas Answer To Writ of Garnishment in just a couple of minutes instead of surfing the Net for several hours searching for the right template.

Utilizing our collection is a wonderful way to improve the safety of your record filing. Our experienced legal professionals regularly review all the records to make certain that the forms are appropriate for a particular region and compliant with new acts and polices.

How can you obtain the Harris Texas Answer To Writ of Garnishment? If you have a subscription, just log in to the account. The Download button will appear on all the documents you look at. Moreover, you can find all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the tips listed below:

- Find the template you need. Ensure that it is the template you were hoping to find: verify its headline and description, and make use of the Preview function when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading procedure. Click Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the file. Pick the format to get the Harris Texas Answer To Writ of Garnishment and revise and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy document libraries on the internet. We are always ready to assist you in virtually any legal process, even if it is just downloading the Harris Texas Answer To Writ of Garnishment.

Feel free to take full advantage of our service and make your document experience as convenient as possible!