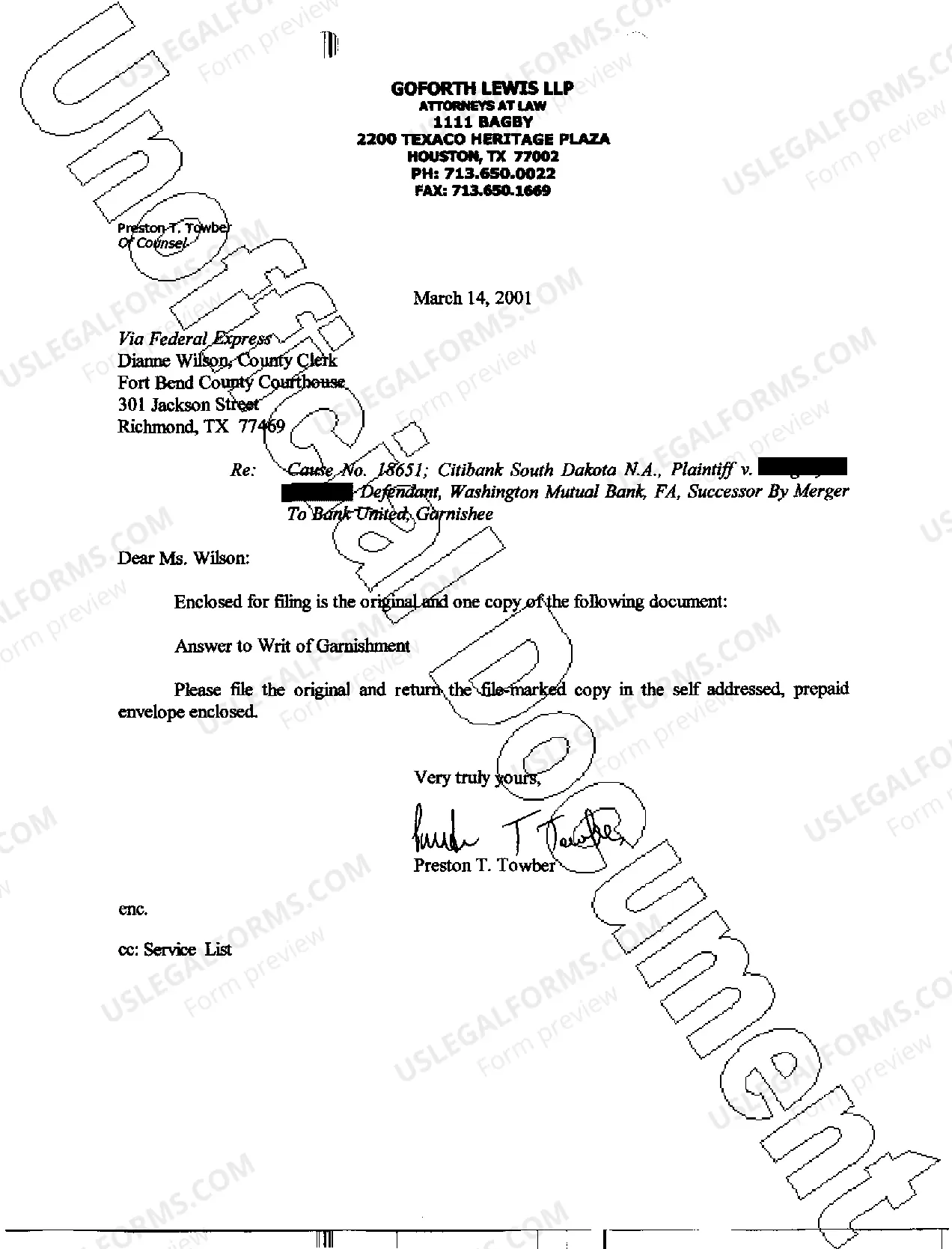

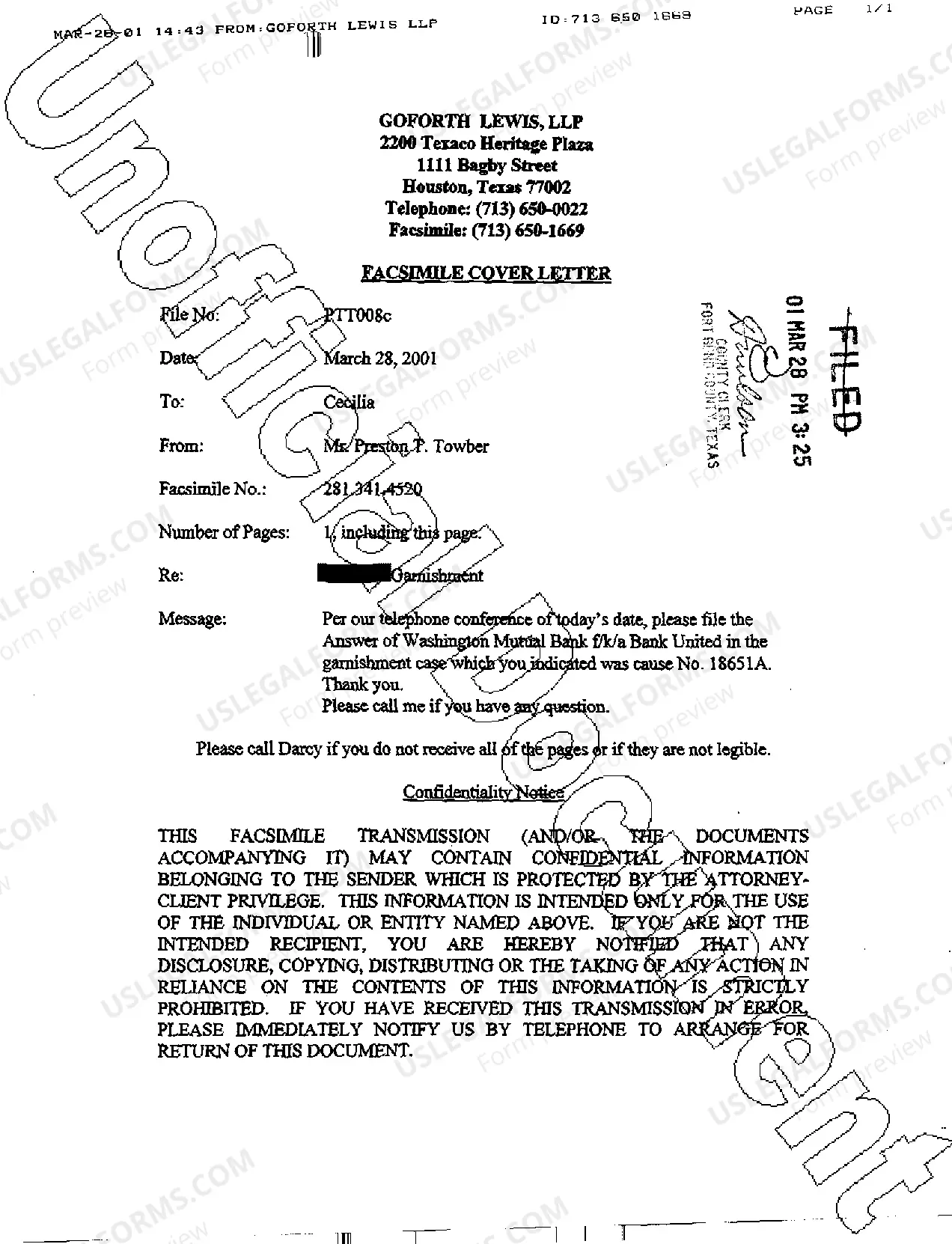

Irving Texas Answer To Writ of Garnishment

Description

How to fill out Texas Answer To Writ Of Garnishment?

Finding approved templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It is an online repository containing over 85,000 legal forms catering to both personal and professional requirements across various real-world situations.

All documents are meticulously categorized by application area and jurisdiction, making the search for the Irving Texas Answer To Writ of Garnishment as simple as pie.

Maintaining paperwork organized and adhering to legal standards is of utmost importance. Benefit from the US Legal Forms library to always have crucial document templates readily available for any purpose!

- Check the Preview mode and document description.

- Ensure you have selected the correct document that satisfies your requirements and fully aligns with your local jurisdiction standards.

- Look for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the accurate document. If it meets your expectations, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

To get a debt lawsuit dismissed in Texas, you will need to file a motion with the court outlining the reasons for your request. Common reasons include improper service or insufficient evidence from the creditor. Ensure that you provide all necessary documentation to support your motion. Utilizing the resources on U.S. Legal Forms can help you prepare a strong motion that effectively argues for dismissal.

When writing an answer to a debt lawsuit, start with your basic information and the case details. Identify each claim made by the creditor, and respond to each one by admitting, denying, or stating that you have insufficient information to respond. This format will help clarify your position. U.S. Legal Forms provides templates that guide you through crafting a comprehensive answer to ensure you cover all your bases.

To file an answer to a debt lawsuit in Texas, gather all necessary information related to your case, including the lawsuit documents. Complete the court-approved forms and submit them to the court clerk by the due date. Include your case number and clearly outline your position or any defenses you might have. Consider using U.S. Legal Forms to streamline the filing process and ensure compliance with court requirements.

Writing a letter to stop garnishment requires a clear statement of your request, along with the reasons for stopping it. Start by addressing the creditor or court, include relevant case information, and express your reasons compassionately yet firmly. Make sure to keep a copy of the letter for your records. If you feel overwhelmed, U.S. Legal Forms can assist in drafting a professional letter tailored to your situation.

To respond to a debt collection lawsuit in Texas, first, review the lawsuit documents carefully to understand the claims against you. Then, file a detailed answer with the court, addressing each point raised in the complaint. You can also consider negotiating with the collector or presenting your case in court if necessary. Leveraging U.S. Legal Forms can help you prepare your response effectively.

Filing an answer to a lawsuit in Texas begins with filling out the appropriate court forms, which can be obtained from the court or online. You must file your answer with the court clerk within the specified time frame, typically 20 days after being served. Be sure to include the case number and your contact information. If you are unsure about the process, consider using the U.S. Legal Forms platform to simplify the paperwork.

In Texas, garnishment rules are designed to protect debtors while allowing creditors to collect what is owed. A writ of garnishment requires a court order and must comply with statutory rules regarding exemptions and limits on garnishment amounts. Understanding these rules is essential for both parties involved. Using resources such as USLegalForms, you can access comprehensive information and forms that help clarify these rules.

Failing to respond to a wage garnishment can expose the employer to legal penalties and enforcement actions from the court. Employees can also seek additional remedies if the employer disregards the garnishment order. It is crucial for employers to act promptly and responsibly to avoid complications. Utilizing USLegalForms can guide employers through understanding their obligations.

To fight a writ of execution in Texas, you must file a motion with the court that issued the writ. You can challenge the validity of the writ, or claim exemptions that may apply to your situation. Properly presenting your case is vital, and gathering all pertinent documents can help. Resources like USLegalForms offer guidance and templates that make this process more manageable.

Yes, employers must comply with wage garnishments in Texas once they receive the appropriate court order. Ignoring this order may lead to legal repercussions for the employer. However, there are limits to how much can be garnished, and there are specific procedures that must be followed. For further clarity on these requirements, consult resources like USLegalForms.