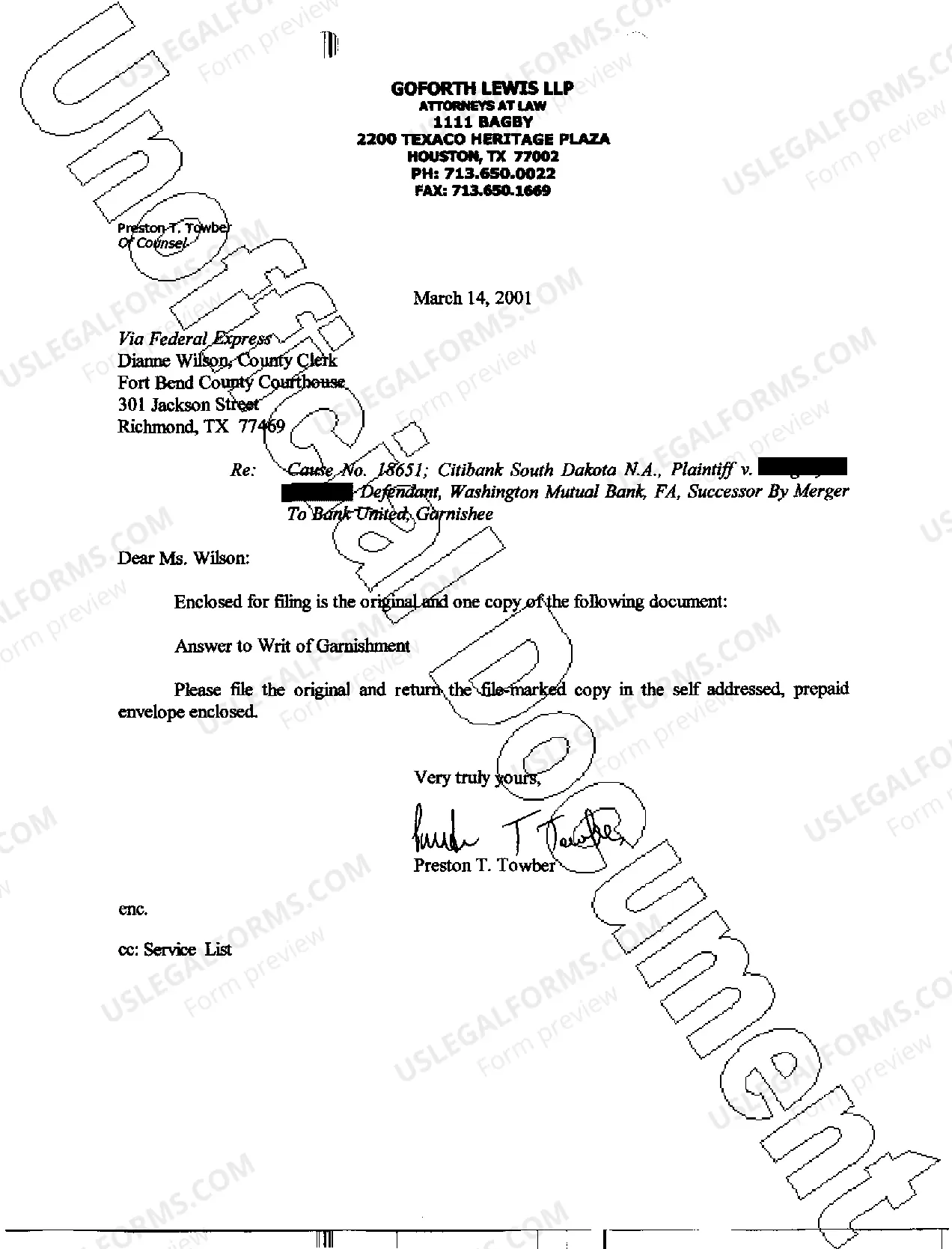

The Killeen Texas Answer to Write of Garnishment is a legal document that allows individuals in Killeen, Texas to respond to a writ of garnishment issued against their wages or bank accounts by a creditor seeking to collect a debt. When a creditor obtains a judgment against a debtor, they may request a writ of garnishment to collect the owed amount directly from the debtor's income or bank accounts. However, debtors have the right to contest the garnishment and protect their finances. There are different types of Killeen Texas Answer to Write of Garnishment, such as: 1. Answer to Write of Garnishment for Wages: This type of answer is used when a creditor seeks to collect the debt directly from the debtor's wages or salary. The debtor must provide detailed information about their employment, income, and any applicable exemptions. 2. Answer to Write of Garnishment for Bank Accounts: If a creditor wishes to collect the debt from the debtor's bank accounts, the debtor must file an answer specific to this type of garnishment. They must disclose information about their bank accounts, including balances, recent transactions, and any exemptions they may claim. 3. Answer to Write of Garnishment for Self-Employed Individuals: Self-employed individuals in Killeen, Texas, may face garnishment of their business income. In this case, they need to submit an answer tailored to their self-employment status, providing details about their business, income, assets, and any applicable exemptions. Regardless of the type of garnishment, the Killeen Texas Answer to Write of Garnishment generally includes the following information: 1. Personal information: The debtor must provide their full name, address, contact information, and any aliases or alternative addresses they may have used. 2. Case information: Debtors need to include the court case number, the name of the creditor, and the date the writ of garnishment was issued. 3. Employment details: In the case of wage garnishment, debtors must provide details about their employer, including the name, address, and contact information. They may also need to disclose their wage rate, hours worked, and any other relevant employment information. 4. Financial information: Debtors are required to disclose their financial circumstances, including assets, liabilities, income, and expenses. This information helps determine whether certain exemptions apply, allowing the debtor to protect a portion of their wages or bank account funds from garnishment. 5. Exemptions: Killeen, Texas law provides certain exemptions that debtors can claim to protect their income or assets from garnishment. These exemptions may include a portion of wages, income from certain sources, and certain personal property. Debtors should clearly state the exemptions they believe are applicable in their answer to the writ of garnishment. Overall, the Killeen Texas Answer to Write of Garnishment is a crucial document that allows debtors to contest the garnishment and protect their financial well-being. It is important for individuals facing garnishment in Killeen, Texas, to consult with an attorney or seek legal advice to ensure they understand their rights and obligations when responding to a writ of garnishment.

Killeen Texas Answer To Writ of Garnishment

Description

How to fill out Killeen Texas Answer To Writ Of Garnishment?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we apply for legal solutions that, usually, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of a lawyer. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Killeen Texas Answer To Writ of Garnishment or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Killeen Texas Answer To Writ of Garnishment complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Killeen Texas Answer To Writ of Garnishment is proper for your case, you can select the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!

Form popularity

FAQ

To dissolve a writ of garnishment, you need to file a motion in the court that issued the writ. This motion should explain your reasons for seeking dissolution, such as errors in the original garnishment order or changes in your financial situation. Additionally, it's important to include supporting documentation that reinforces your position. By following these steps, you can take the first step toward achieving a Killeen Texas Answer To Writ of Garnishment.

To write a letter to stop a garnishment, start by addressing the creditor or collection agency overseeing the garnishment. Clearly state that you wish to contest the garnishment, outlining your reasons in a concise manner. Include any relevant details such as the case number and the specific garnishment order. Finally, send the letter via certified mail for proof of delivery, as you seek a Killeen Texas Answer To Writ of Garnishment.

Fighting a writ of execution in Texas starts with filing a motion to contest it in the appropriate court. In your motion, present valid reasons why the writ should be suspended, such as improper service or errors in the judgment. Make sure to gather all necessary documentation to support your claims. Gaining insights into the Killeen Texas Answer To Writ of Garnishment can be beneficial in crafting a robust defense.

To answer a writ of garnishment, you must file a written response in the court that issued the writ. This answer should detail why the garnishment should not proceed, citing any legal defenses or exemptions that apply to you. Timeliness is key, as failure to respond may lead to automatic deductions from your wages or accounts. Familiarizing yourself with the Killeen Texas Answer To Writ of Garnishment can provide clarity on this process.

To stop a writ of possession, you may file a motion to contest the writ in court. Providing evidence that supports your right to possess the property can strengthen your case. You may also consider negotiating a resolution with the landlord or property owner. Being informed about the Killeen Texas Answer To Writ of Garnishment can equip you with strategies to address related legal issues.

You can stop a writ of execution in Texas by contesting it through a court motion. This involves filing paperwork to request that the court examine the validity of the writ. It's essential to present your arguments clearly and promptly. Consulting resources on Killeen Texas Answer To Writ of Garnishment can guide you in formulating your case effectively.

To stop a writ of garnishment in Texas, you can file a motion with the court that issued the writ. State your reasons for stopping the garnishment, such as claiming exemptions or disputing the debt. Additionally, addressing the issue promptly can lead to a favorable outcome. Understanding the Killeen Texas Answer To Writ of Garnishment can help you navigate this process.

To file an answer to a debt lawsuit in Texas, you need to prepare a written response that addresses the claims made against you. Ensure your answer includes your side of the story and any defenses you may have. Once complete, you must file this answer with the court and provide a copy to the opposing party. This step is crucial to assert your rights and could help set the foundation for addressing a Killeen Texas Answer To Writ of Garnishment.

Filling out a challenge to garnishment form effectively starts with gathering all necessary information about the garnishment and your finances. Make sure to follow the instructions carefully and fill in your details accurately, ensuring you include references to Killeen Texas Answer To Writ of Garnishment. Once completed, submit the form to the court handling your case, keeping a copy for your records. This process can set in motion an effective challenge to the garnishment.

Negotiating a garnishment settlement requires clear communication with your creditor. Start by detailing your financial situation and proposing a more manageable payment option. By including references to the Killeen Texas Answer To Writ of Garnishment, you can strengthen your position in discussions. Utilizing resources like uslegalforms can also provide you with templates and guidance as you navigate these negotiations.