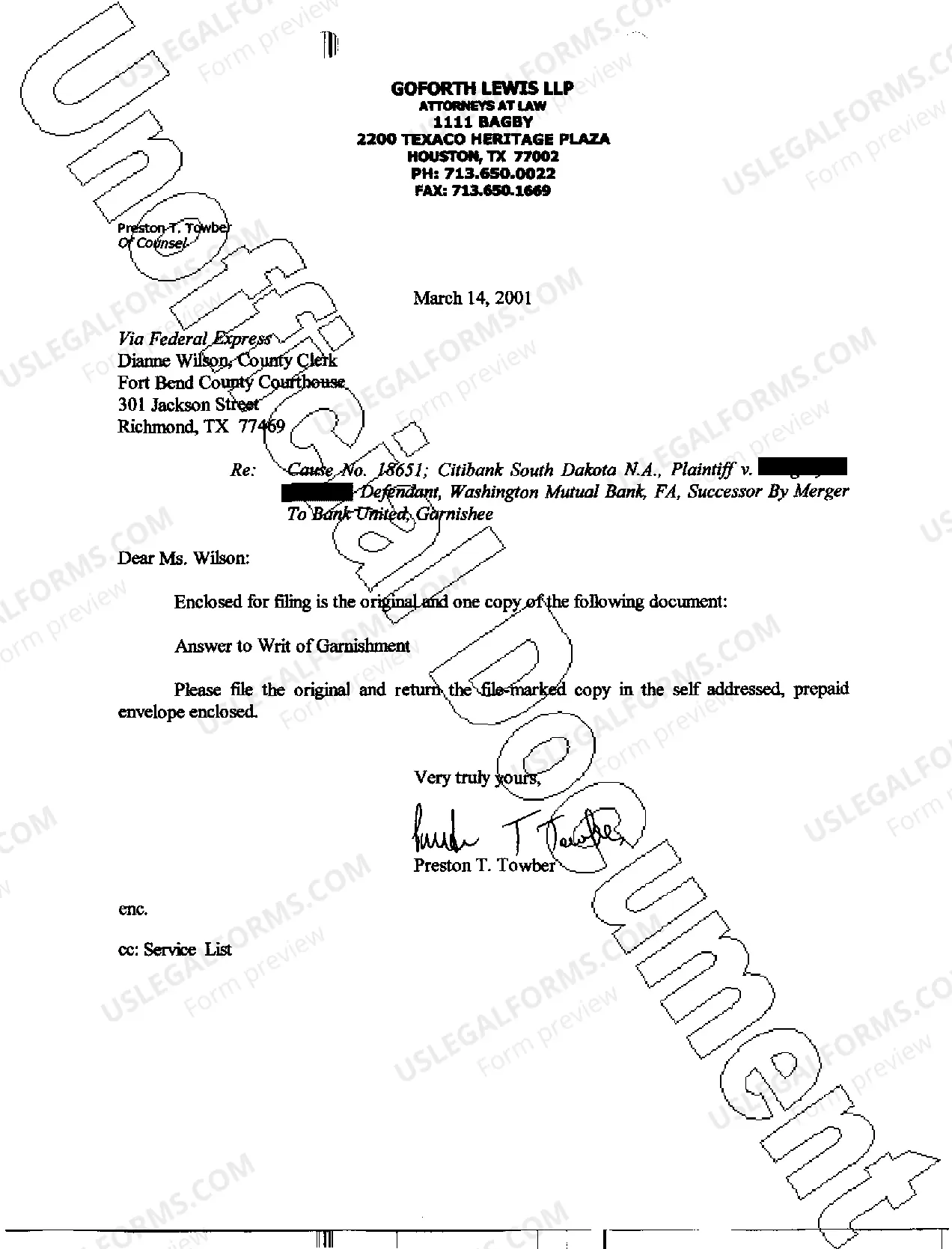

The Round Rock Texas Answer To Write of Garnishment refers to a legal document that allows individuals or entities to respond to a garnishment action initiated by a creditor seeking to collect a debt owed by the debtor. When a debtor fails to meet their financial obligations, a creditor may seek a court-issued writ of garnishment, which enables them to collect funds owed directly from the debtor's wages, bank accounts, or other assets. It is important for residents of Round Rock, Texas, to understand the process and requirements associated with answering a writ of garnishment. By crafting a detailed and accurate response, debtors can protect their rights and potentially mitigate the impact of garnishment actions. Below are essential aspects to consider when preparing a Round Rock Texas Answer To Write of Garnishment: 1. Understanding the Purpose: Debtors who receive a writ of garnishment must comprehend its purpose, which is to legally enforce the collection of a debt. The writ allows creditors to bypass the debtor and collect directly from their income or assets. Debtors need to analyze the specifics of the garnishment to determine which course of action to pursue. 2. Responding Promptly: Swift action is crucial when responding to a writ of garnishment in Round Rock, Texas. Debtors should carefully review the document upon receipt, paying close attention to deadlines for responding. Timely responses ensure proper handling of the garnishment process and minimize potential legal consequences. 3. Seeking Legal Counsel: Given the intricacies of legal procedures, it is prudent for debtors in Round Rock, Texas, to consult with an attorney experienced in debt collection and garnishment cases. An attorney can review the writ, verify its legality, and advise on the appropriate response strategy. Legal professionals can also provide debtors with insights into their rights, potential exemptions, and negotiation opportunities. 4. Completing the Answer Form: Debtors must complete the Round Rock Texas Answer To Write of Garnishment form accurately and thoroughly. This form typically requires providing personal information, details of the debt, and grounds for exemptions or objections. Precise completion of the form is vital to ensure all legally available protections are considered. 5. Asserting Exemptions or Objections: Debtors can contest garnishments by asserting exemptions or objections, which may permit certain funds or assets to be excluded from the garnishment process. Common exemptions might include funds necessary to support the debtor and their family, protected retirement accounts, or public assistance benefits. Debtors must provide supporting documentation and outline their grounds for exemptions or objections clearly. It's worth noting that the Round Rock Texas Answer To Write of Garnishment may not have distinct variations or types; however, the process and requirements might differ based on the specific circumstances, such as the type of debt, the debtor's employment status, or the type of assets being targeted for garnishment. In conclusion, Round Rock, Texas, residents facing a writ of garnishment should act promptly, seek legal counsel, and accurately complete the Answer form, highlighting any eligible exemptions or objections. By doing so, debtors can assert their rights and potentially minimize the impact of garnishment actions on their financial well-being.

Round Rock Texas Answer To Writ of Garnishment

Description

How to fill out Round Rock Texas Answer To Writ Of Garnishment?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone without any law education to create such paperwork cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service provides a huge library with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI tpapers.

Whether you want the Round Rock Texas Answer To Writ of Garnishment or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Round Rock Texas Answer To Writ of Garnishment in minutes using our trusted service. In case you are presently an existing customer, you can go ahead and log in to your account to download the needed form.

However, if you are a novice to our platform, ensure that you follow these steps before obtaining the Round Rock Texas Answer To Writ of Garnishment:

- Ensure the template you have chosen is specific to your location since the rules of one state or county do not work for another state or county.

- Preview the document and read a brief outline (if provided) of cases the paper can be used for.

- In case the form you selected doesn’t suit your needs, you can start again and look for the necessary form.

- Click Buy now and choose the subscription plan you prefer the best.

- with your login information or register for one from scratch.

- Choose the payment method and proceed to download the Round Rock Texas Answer To Writ of Garnishment once the payment is completed.

You’re all set! Now you can go ahead and print the document or complete it online. Should you have any problems getting your purchased documents, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.