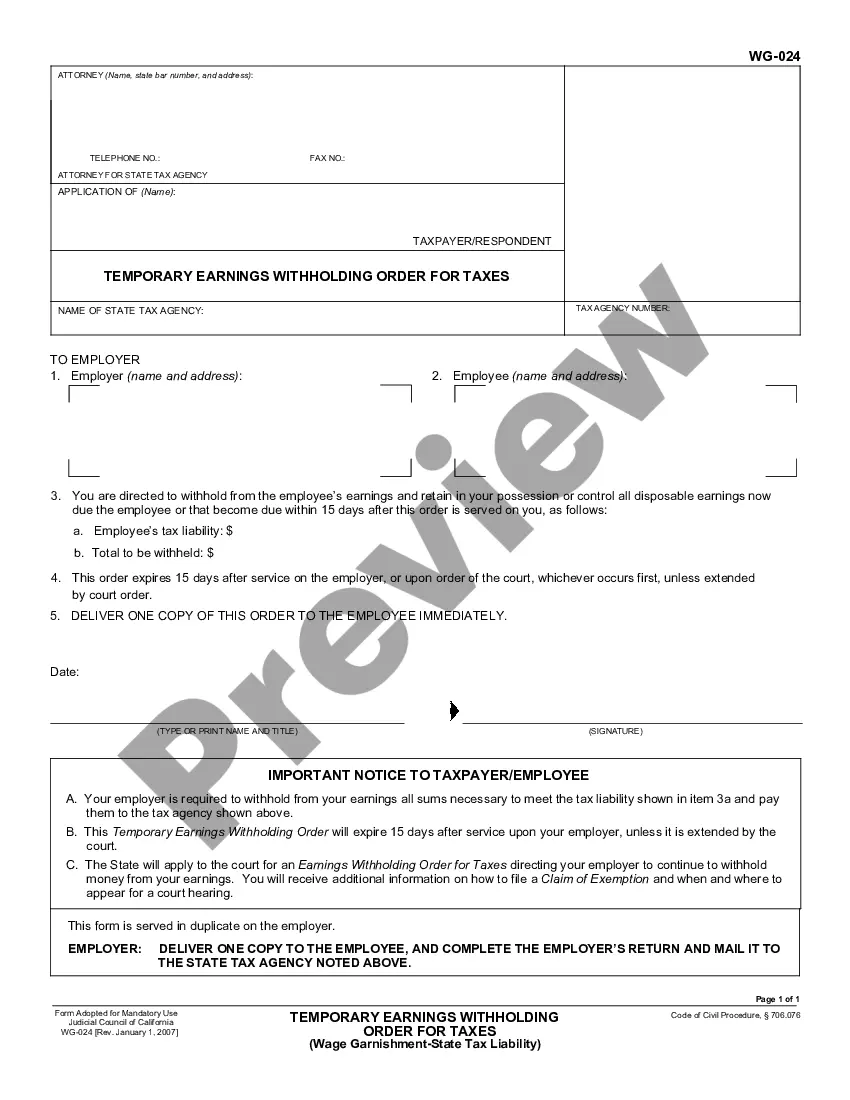

Title: Understanding Waco Texas Answer to Write of Garnishment: Types and Detailed Description Introduction: Waco, Texas is home to a legal process known as "Answer to Write of Garnishment," which involves the garnishment of wages or assets as a means of satisfying a debt or judgment. This article provides a comprehensive overview of the Waco Texas Answer to Write of Garnishment, its purpose, procedures, and the various types of garnishment. Keywords: Waco Texas, Answer to Write of Garnishment, garnishment of wages, garnishment of assets, debt, judgment, types of garnishment 1. What is Waco Texas Answer to Write of Garnishment? The Waco Texas Answer to Write of Garnishment is a judicial order commonly used to enforce the collection of debts or judgments. It allows creditors to seize a portion of wages or assets belonging to the debtor to satisfy their outstanding obligations. 2. Purpose of Waco Texas Answer to Write of Garnishment: The primary objective of the Waco Texas Answer to Write of Garnishment is to facilitate debt repayment by requiring the garnishee (employer, bank, or third-party) to withhold funds owed to the debtor on behalf of the creditor. This process ensures creditors are paid their due while providing an opportunity for debtors to address their financial responsibilities. 3. Procedures Involved in Waco Texas Answer to Write of Garnishment: a) Filing: A creditor initiates the process by filing a legal document, commonly referred to as a Writ of Garnishment, with the appropriate court in Waco, Texas. b) Service: Once filed, the Writ of Garnishment must be served to the garnishee, typically the debtor's employer or financial institution. c) Answer to Write: Upon receiving the Writ, the garnishee is responsible for providing an Answer to Write of Garnishment, detailing the debtor's wages or assets subject to garnishment. d) Notification: The debtor is served a copy of the Answer to Write, informing them of the garnishment process and their rights to challenge or negotiate the debt. 4. Types of Waco Texas Answer To Write of Garnishment: a) Wage Garnishment: This form of garnishment involves the deduction of a portion of the debtor's wages by their employer, directing it towards satisfying the outstanding debt. b) Bank Account Garnishment: In this scenario, funds from the debtor's bank account(s) are frozen or seized by the financial institution, allowing the creditor to collect the owed debt. c) Other Asset Garnishment: In certain cases, other assets such as properties, vehicles, or investments owned by the debtor may be subject to seizure or asset garnishment. Conclusion: The Waco Texas Answer to Write of Garnishment plays a vital role in debt collection and judgment enforcement processes within the jurisdiction. Understanding the purpose, procedures, and the different types of garnishment is crucial for both creditors and debtors to navigate this legal framework effectively. Compliance with the Waco Texas Answer to Write of Garnishment ensures fair treatment and allows for the resolution of financial obligations.

Waco Texas Answer To Writ of Garnishment

Description

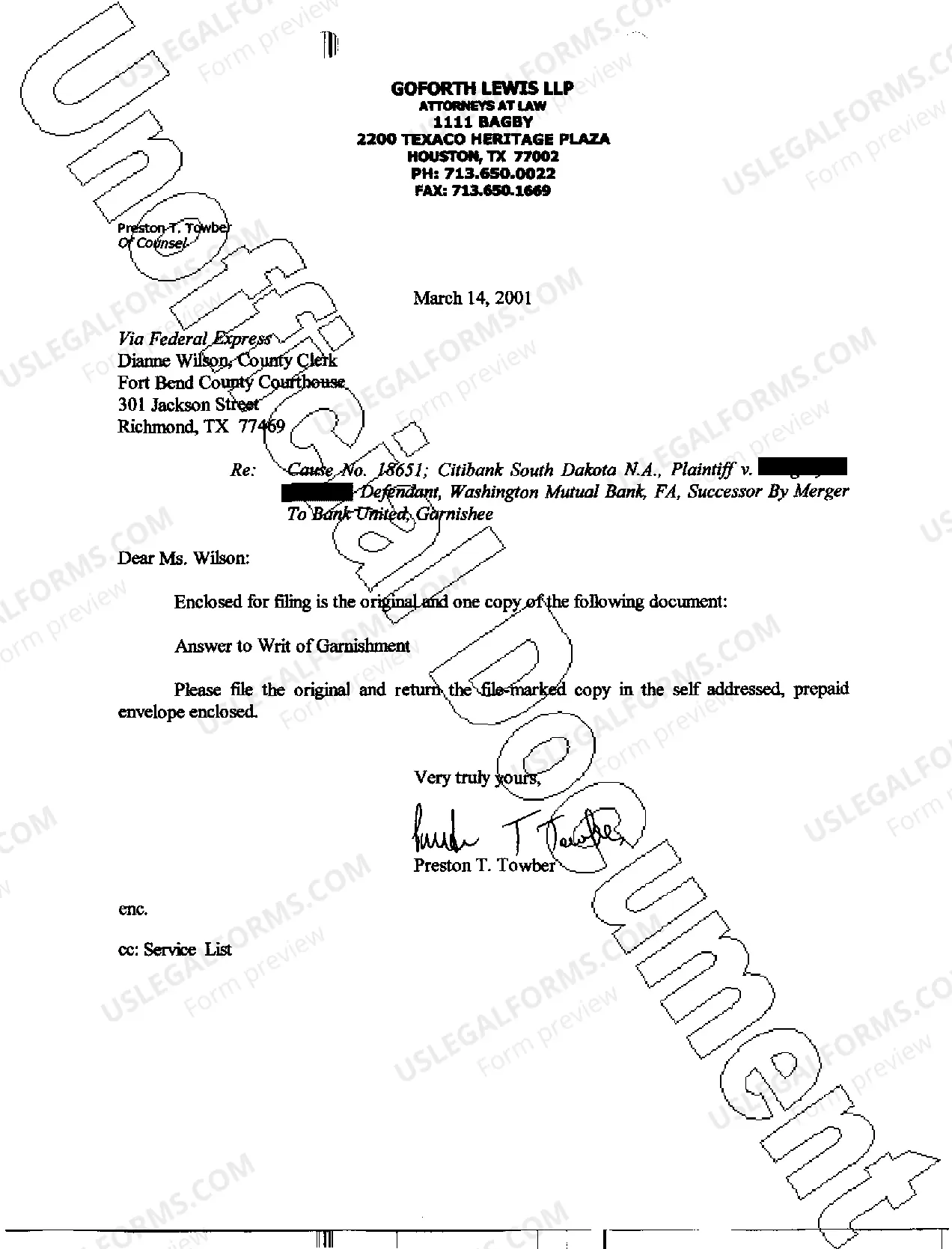

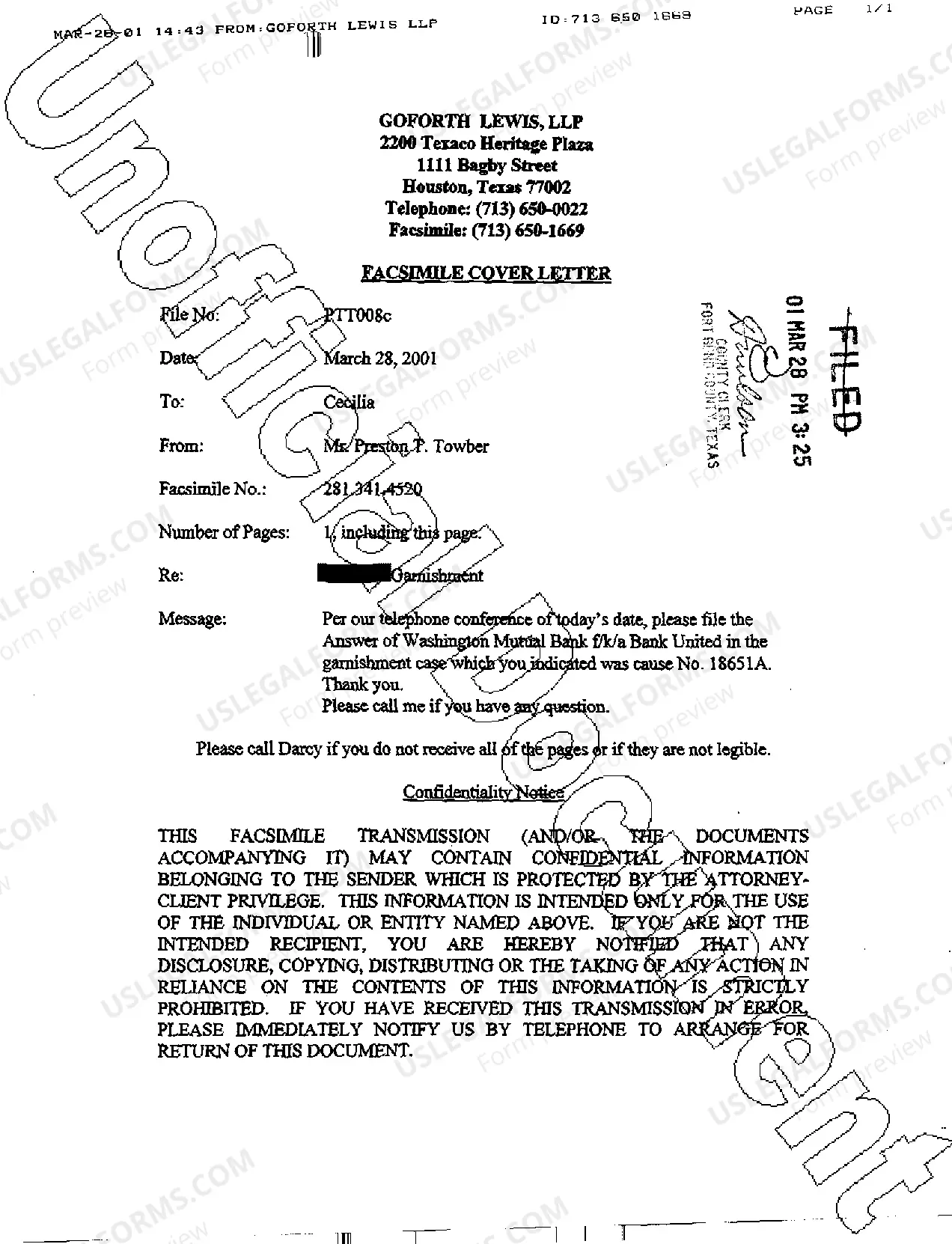

How to fill out Waco Texas Answer To Writ Of Garnishment?

We consistently endeavor to minimize or avert legal harm when addressing subtle legal or financial issues.

To achieve this, we seek legal representation that, as a general rule, can be quite expensive.

However, not all legal situations are of the same complexity; many can be handled by ourselves.

US Legal Forms is an online compilation of current DIY legal templates encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button beside it. If you happen to misplace the form, you can always re-download it in the My documents section.

- Our platform empowers you to manage your issues independently without needing legal advice.

- We provide access to legal form samples that are not always readily available.

- Our templates are tailored to specific states and regions, significantly easing the search process.

- Utilize US Legal Forms whenever you require the Waco Texas Answer To Writ of Garnishment or any other document swiftly and securely.

Form popularity

FAQ

After a writ of execution is served in Texas, the sheriff will typically seize the debtor’s non-exempt property to satisfy the judgment. The debtor usually receives notice of the seizure, providing an opportunity to respond or challenge the actions. At this critical stage, obtaining the correct legal forms and advice is vital, and US Legal Forms can offer an easy way to prepare a Waco Texas Answer to Writ of Garnishment.

A writ of possession in Texas can be stopped by filing a motion to contest the writ or by appealing the underlying judgment. It is also possible to reach an agreement with the party seeking possession, such as settling the debt or dispute. US Legal Forms can assist you in preparing the required documents to fight against the writ, including a Waco Texas Answer to Writ of Garnishment.

To stop a writ of execution in Texas, you should consider filing a motion to set aside the judgment or appealing the decision. You may also be able to negotiate a payment plan with the creditor or request a stay of execution from the court. Utilizing resources like US Legal Forms can provide the necessary templates and guidance for creating legal documents effectively. This can be particularly helpful for obtaining a Waco Texas Answer to Writ of Garnishment.

Dissolving a writ of garnishment involves filing a motion in court to vacate the order. You will need to present compelling evidence or arguments that warrant the dissolution, including any changes in your financial situation. It’s crucial to act promptly and consult legal resources to strengthen your case. Platforms like US Legal Forms offer helpful templates and information about the Waco Texas Answer to Writ of Garnishment to assist you in this process.

To write an effective letter to stop wage garnishment, begin by clearly stating your situation. Include your contact information, a brief explanation of why you are requesting the garnishment to stop, and any relevant supporting documents. Be sure to mention the specifics of your case, such as the original creditor and the court information. For detailed guidance, consider using US Legal Forms to ensure your letter adheres to the proper format and includes the necessary details regarding the Waco Texas Answer to Writ of Garnishment.

Stopping a writ of garnishment in Texas involves taking specific legal steps. You can file a motion to set aside the garnishment, and this often requires presenting valid grounds to the court. It's essential to gather your financial records and any relevant documents to support your case. Utilizing resources like US Legal Forms can guide you through the process, ensuring you understand the Waco Texas Answer to Writ of Garnishment.

To effectively stop a garnishment, you should first review the court documents related to your case. You may consider filing a motion to contest the garnishment or negotiating directly with the creditor. Additionally, exploring exemptions can help protect some of your income from being garnished. Seeking assistance through a legal platform like US Legal Forms can provide valuable insights into the Waco Texas Answer to Writ of Garnishment.

When composing a letter to halt garnishment, start with a clear subject line stating your intent. In the body, provide a concise overview of your situation, mention the garnishment details, and firmly request a pause or dismissal based on valid reasons. Ensure you sign the letter and keep a copy for your records. For a well-structured approach, USLegalForms offers templates that guide you through the Waco Texas Answer To Writ of Garnishment strategy.

To write a letter to stop garnishment, begin by addressing the creditor or their attorney directly, and clearly state your intentions to dispute the garnishment. Include relevant information such as your account number and any supporting documents that justify your request. It's important to communicate your contact information for further correspondence. Consider using templates from USLegalForms, specifically designed to assist with the Waco Texas Answer To Writ of Garnishment process.

When responding to a writ in Waco Texas, you must prepare a formal answer and file it with the court where the writ was issued. Your response should outline your defenses and provide any supporting evidence related to the garnishment. Make sure to comply with your local rules and deadlines to protect your rights. Services like USLegalForms can help streamline your response, ensuring it aligns with the Waco Texas Answer To Writ of Garnishment requirements.