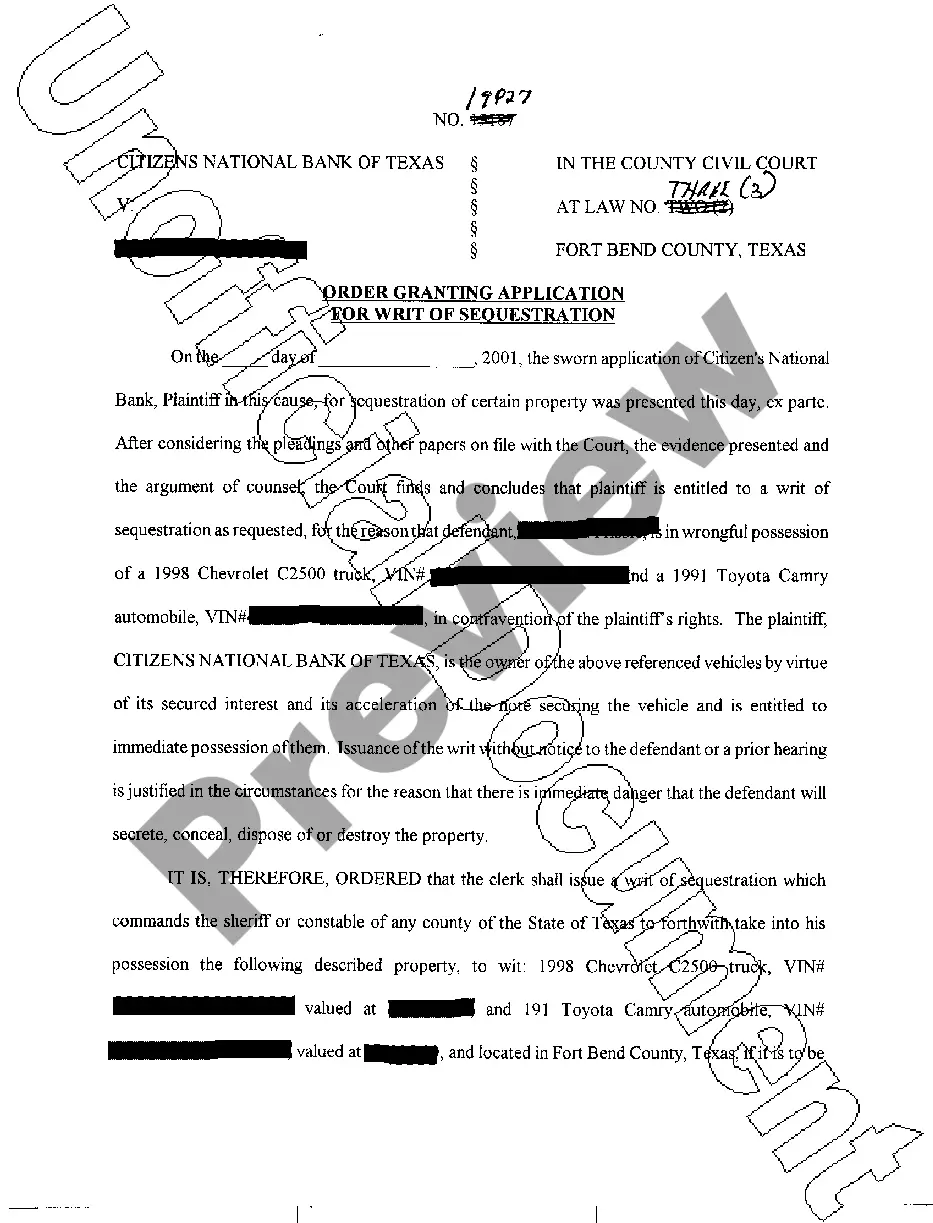

Abilene Texas Order Granting Application For Writ of Sequestration is a legal process that allows a creditor to seize and secure property or assets of a debtor to ensure the payment of a debt. This court order is usually obtained when the creditor has reason to believe that the debtor may try to dispose of or hide assets to avoid paying their debt. In Abilene, Texas, there are two types of orders that can be granted for the application of a writ of sequestration: 1. Prejudgment Sequestration: This type of order is obtained before a judgment is made in a lawsuit. It is pursued when the creditor believes that the debtor may try to dispose of assets before a judgment can be made against them. The purpose of this order is to maintain the status quo by securing the debtor's assets until the court reaches a decision. 2. Post-judgment Sequestration: This type of order is obtained after a judgment has been made in favor of the creditor. It is used when the debtor fails to make payments or does not comply with the court's decision. The purpose of this order is to secure the debtor's assets and ensure that they are not hidden or sold off, allowing the creditor to collect the debt owed. To obtain an Abilene Texas Order Granting Application For Writ of Sequestration, the creditor must file a detailed application with the court, providing sufficient evidence to persuade the judge that the debtor is likely to dispose of or hide assets. The application must include the debtor's name, address, and any available information on their assets. Once the court grants the order, a writ of sequestration will be issued, which authorizes the sheriff or another court-appointed officer to seize and secure the specified assets. The seized assets may include real estate, vehicles, bank accounts, or any other valuable items owned by the debtor. It is important to note that the process of obtaining an Abilene Texas Order Granting Application For Writ of Sequestration can vary depending on the specific circumstances of each case. It is advisable for creditors to seek legal advice or consult with an attorney experienced in debt collection laws to ensure the correct procedure is followed and the application meets all necessary requirements.

Abilene Texas Order Granting Application For Writ of Sequestration is a legal process that allows a creditor to seize and secure property or assets of a debtor to ensure the payment of a debt. This court order is usually obtained when the creditor has reason to believe that the debtor may try to dispose of or hide assets to avoid paying their debt. In Abilene, Texas, there are two types of orders that can be granted for the application of a writ of sequestration: 1. Prejudgment Sequestration: This type of order is obtained before a judgment is made in a lawsuit. It is pursued when the creditor believes that the debtor may try to dispose of assets before a judgment can be made against them. The purpose of this order is to maintain the status quo by securing the debtor's assets until the court reaches a decision. 2. Post-judgment Sequestration: This type of order is obtained after a judgment has been made in favor of the creditor. It is used when the debtor fails to make payments or does not comply with the court's decision. The purpose of this order is to secure the debtor's assets and ensure that they are not hidden or sold off, allowing the creditor to collect the debt owed. To obtain an Abilene Texas Order Granting Application For Writ of Sequestration, the creditor must file a detailed application with the court, providing sufficient evidence to persuade the judge that the debtor is likely to dispose of or hide assets. The application must include the debtor's name, address, and any available information on their assets. Once the court grants the order, a writ of sequestration will be issued, which authorizes the sheriff or another court-appointed officer to seize and secure the specified assets. The seized assets may include real estate, vehicles, bank accounts, or any other valuable items owned by the debtor. It is important to note that the process of obtaining an Abilene Texas Order Granting Application For Writ of Sequestration can vary depending on the specific circumstances of each case. It is advisable for creditors to seek legal advice or consult with an attorney experienced in debt collection laws to ensure the correct procedure is followed and the application meets all necessary requirements.