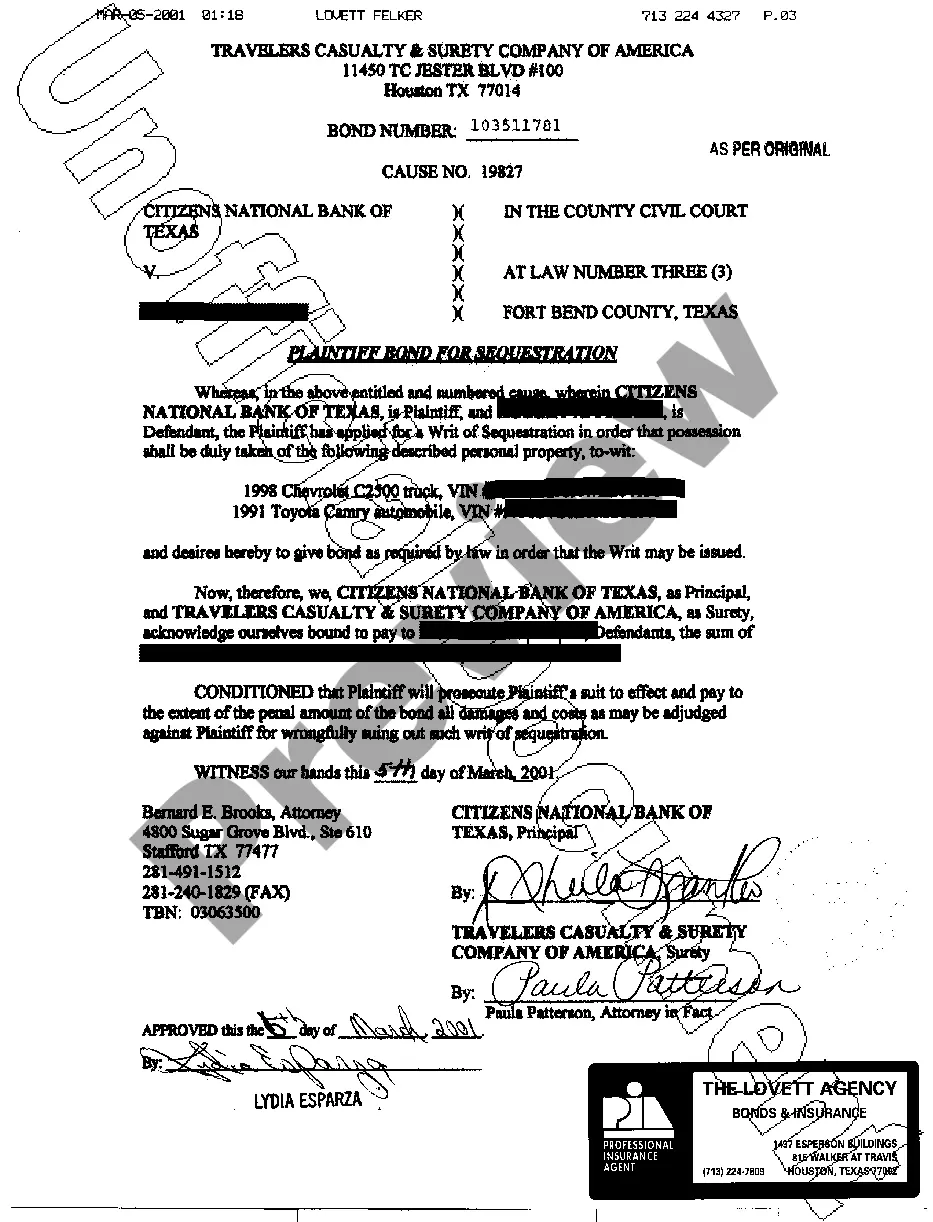

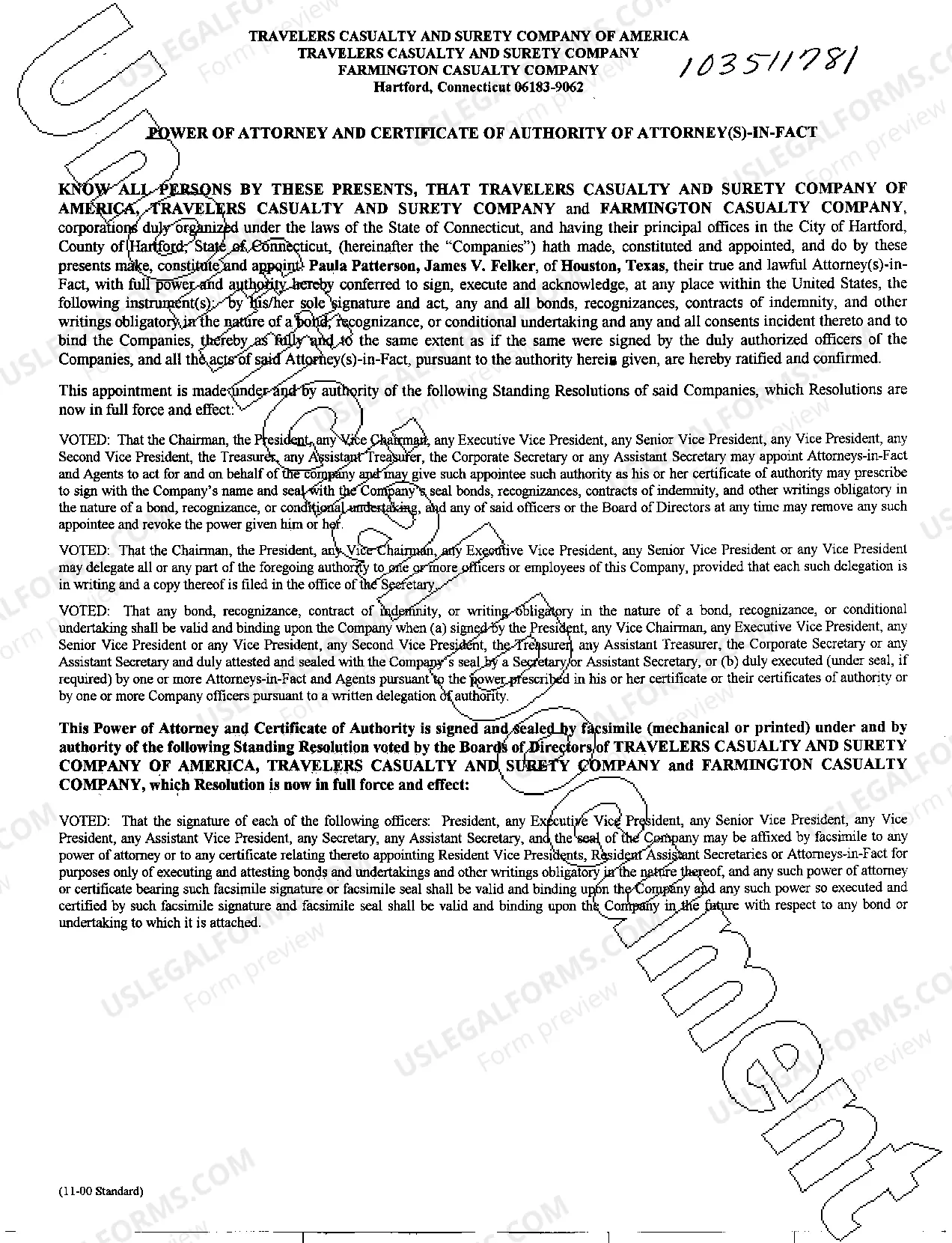

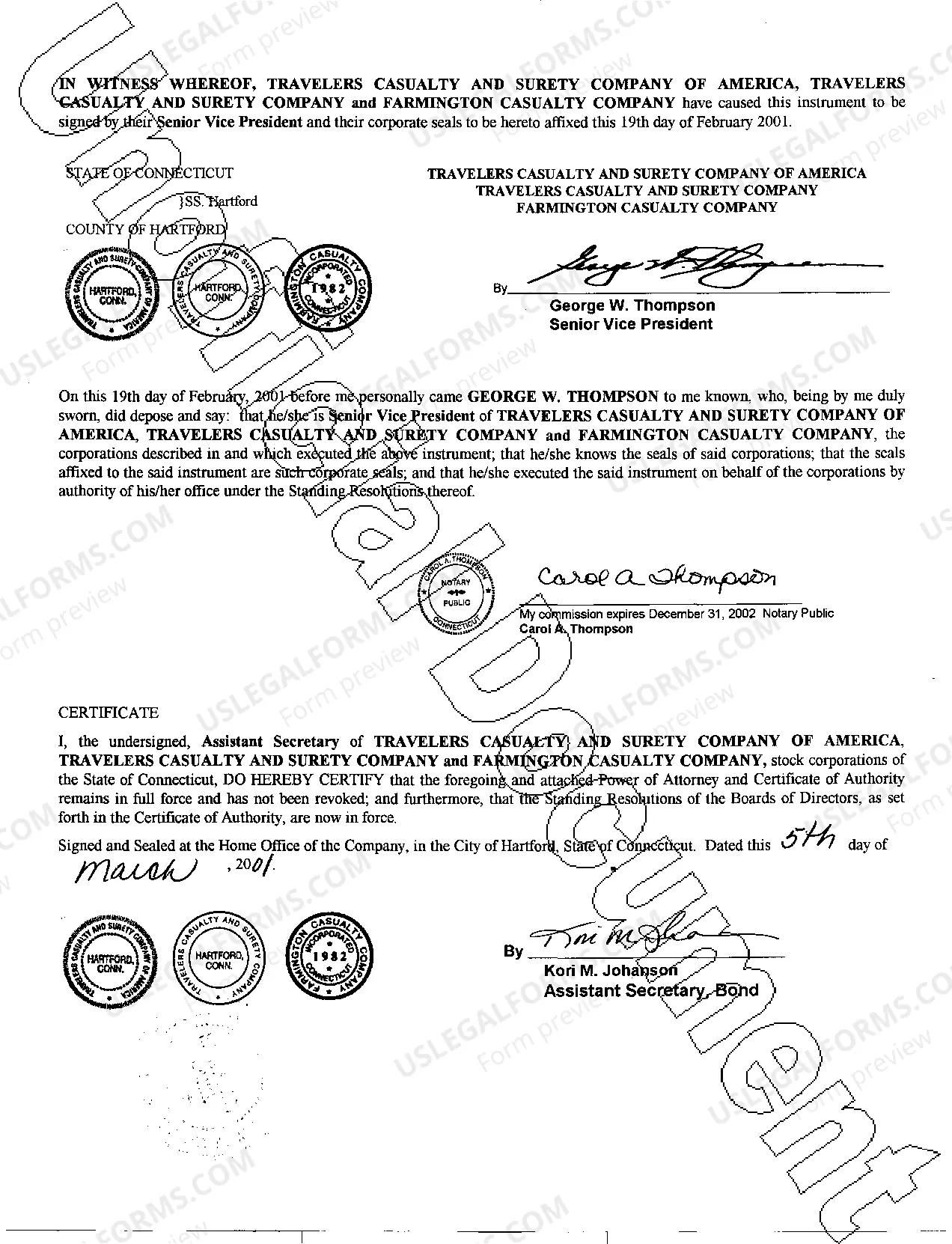

Carrollton Texas Plaintiff Bond For Sequestration: A Comprehensive Overview A Carrollton Texas Plaintiff Bond for sequestration is a legal instrument required in certain civil cases to compensate the defendant for any potential damages incurred during the sequestration of property. Sequestration refers to the temporary taking or securing of property by the court, usually requested by the plaintiff. In Carrollton, Texas, there are primarily two types of Plaintiff Bonds for sequestration: the Regular Plaintiff Bond and the Indigent Plaintiff Bond. 1. Regular Plaintiff Bond: The Regular Plaintiff Bond for sequestration is typically required when the plaintiff has sufficient financial means to cover any potential damages that may arise from the sequestration order. By posting this bond, the plaintiff guarantees the court that if the defendant suffers any financial loss due to the wrongful seizure and retention of their property during sequestration, they will be adequately compensated. 2. Indigent Plaintiff Bond: The Indigent Plaintiff Bond for sequestration is specifically designed for plaintiffs who are unable to bear the financial burden of a regular bond. To qualify for an indigent bond, the plaintiff must demonstrate their inability to pay by providing sufficient documentation and evidence of their financial situation. This bond allows indigent individuals to proceed with sequestration without significant financial strain. The process of obtaining a Plaintiff Bond for sequestration involves several steps: 1. Filing the Sequestration Petition: The plaintiff, through their attorney, files a sequestration petition with the Carrollton, Texas court. The petition should include specific details about the property to be sequestered, the reasons behind the request, and the estimated amount needed as security. 2. Bond Application: After the court reviews the sequestration petition, the plaintiff's attorney can apply for a Plaintiff Bond. The application usually requires providing financial information, supporting documents, and paying a premium to a licensed surety bond company (a surety agency or an insurance company that issues bonds). 3. Underwriting Process: During the underwriting process, the surety bond company assesses the plaintiff's financial credibility and determines the risk involved. Factors such as credit score, financial history, and collateral may be considered. Once approved, the bond is issued, guaranteeing the compensation amount according to the sequestration order. 4. Bond Execution: The executed Plaintiff Bond for sequestration is then filed with the court, and the plaintiff can proceed with the sequestration process legally. The bond ensures that if the court later determines the sequestration was improper or wrongful, the defendant's losses will be covered. In Carrollton, Texas, the Plaintiff Bond for sequestration serves as a critical financial safeguard, enabling plaintiffs to seek and obtain temporary control over property. It protects both the defendant's interests and the integrity of the legal process. Whether it's a Regular Plaintiff Bond or an Indigent Plaintiff Bond, obtaining the appropriate sequestration bond ensures compliance with Carrollton, Texas law and provides necessary financial coverage during the sequestration process.

Carrollton Texas Plaintiff Bond For Sequestration

Description

How to fill out Carrollton Texas Plaintiff Bond For Sequestration?

No matter what social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone with no law education to create such papers from scratch, mainly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms can save the day. Our service provides a huge library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you require the Carrollton Texas Plaintiff Bond For Sequestration or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Carrollton Texas Plaintiff Bond For Sequestration in minutes employing our trusted service. If you are presently an existing customer, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the Carrollton Texas Plaintiff Bond For Sequestration:

- Ensure the template you have chosen is specific to your area considering that the rules of one state or county do not work for another state or county.

- Review the form and go through a brief description (if provided) of scenarios the paper can be used for.

- If the form you chosen doesn’t suit your needs, you can start again and look for the needed form.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your login information or create one from scratch.

- Pick the payment method and proceed to download the Carrollton Texas Plaintiff Bond For Sequestration once the payment is done.

You’re good to go! Now you can go ahead and print the form or complete it online. In case you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.