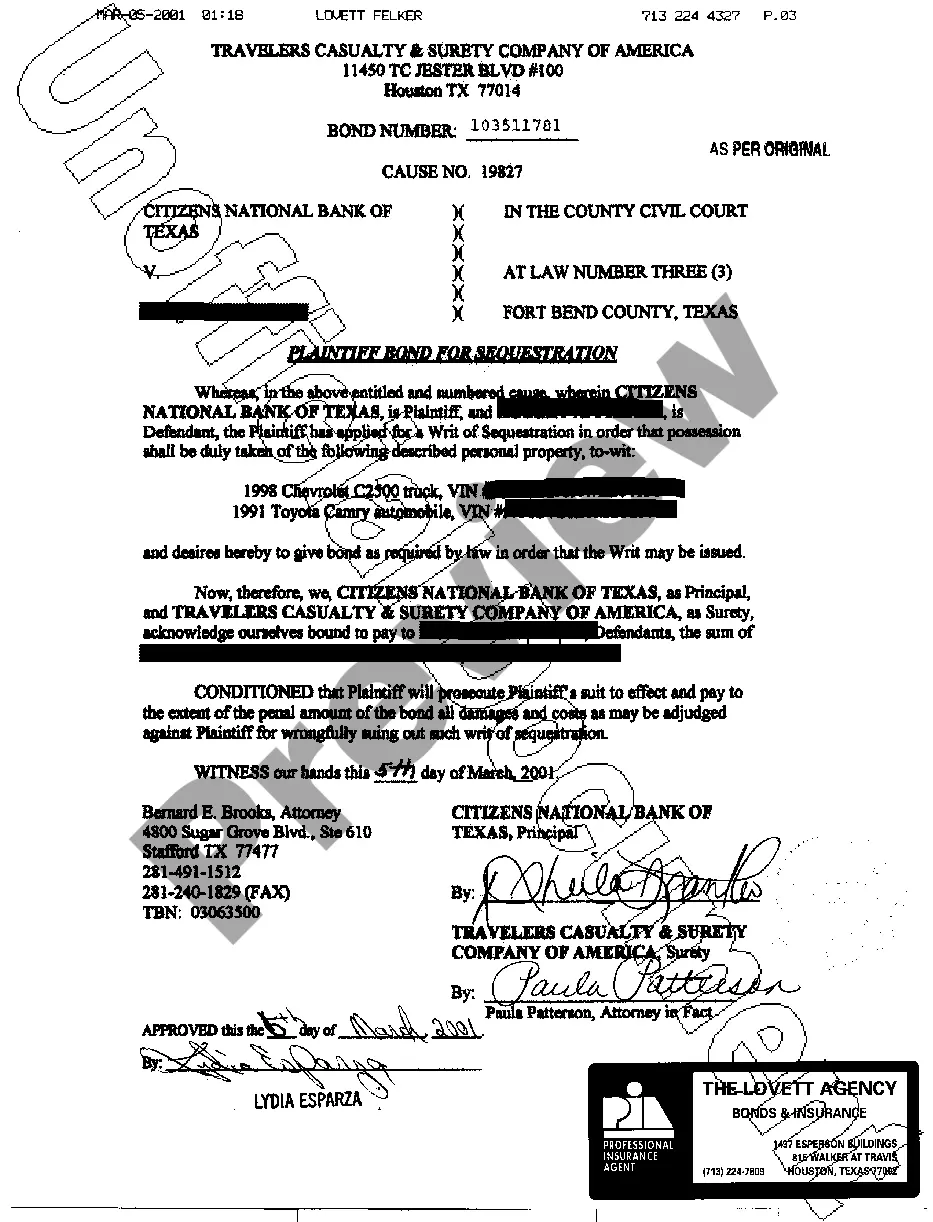

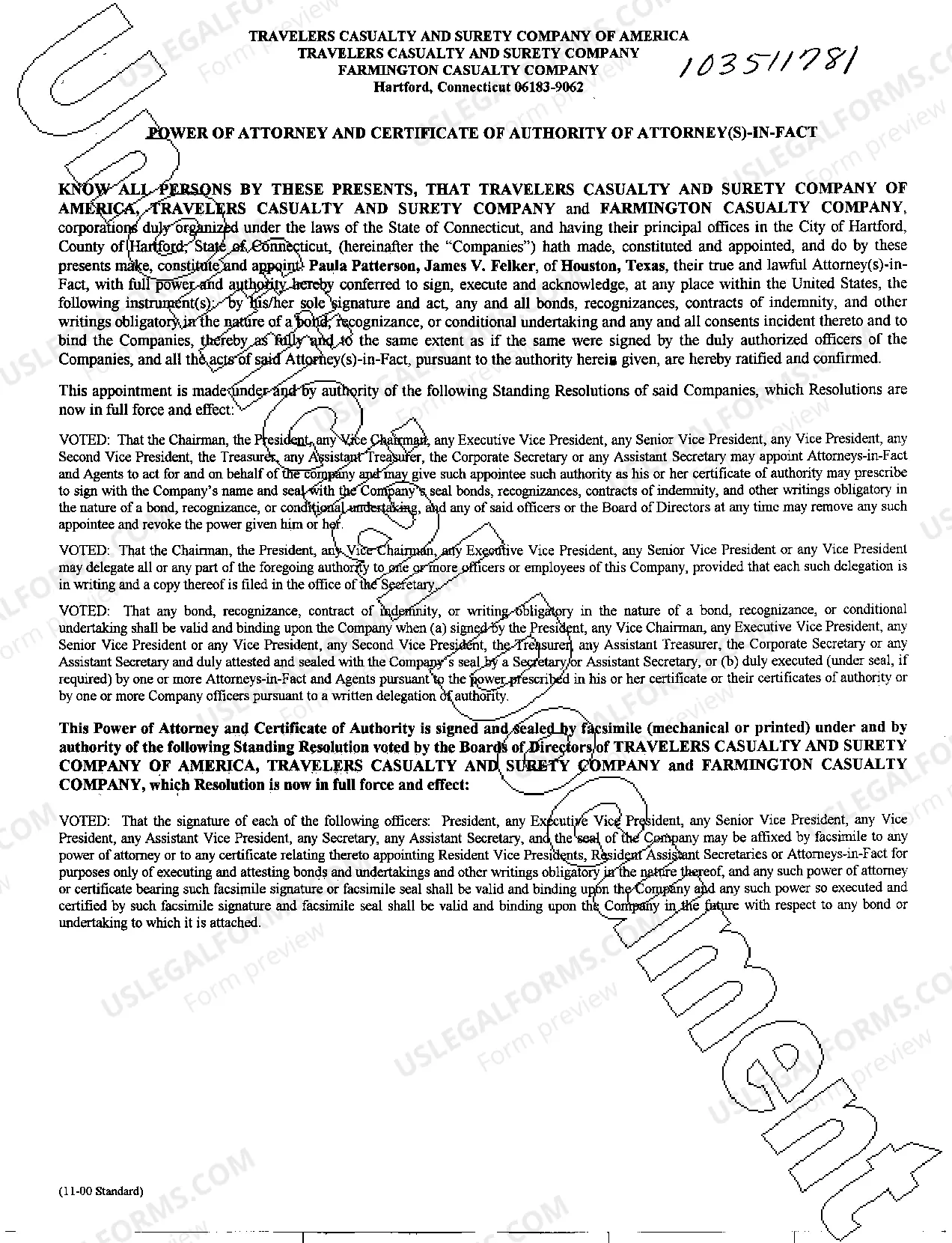

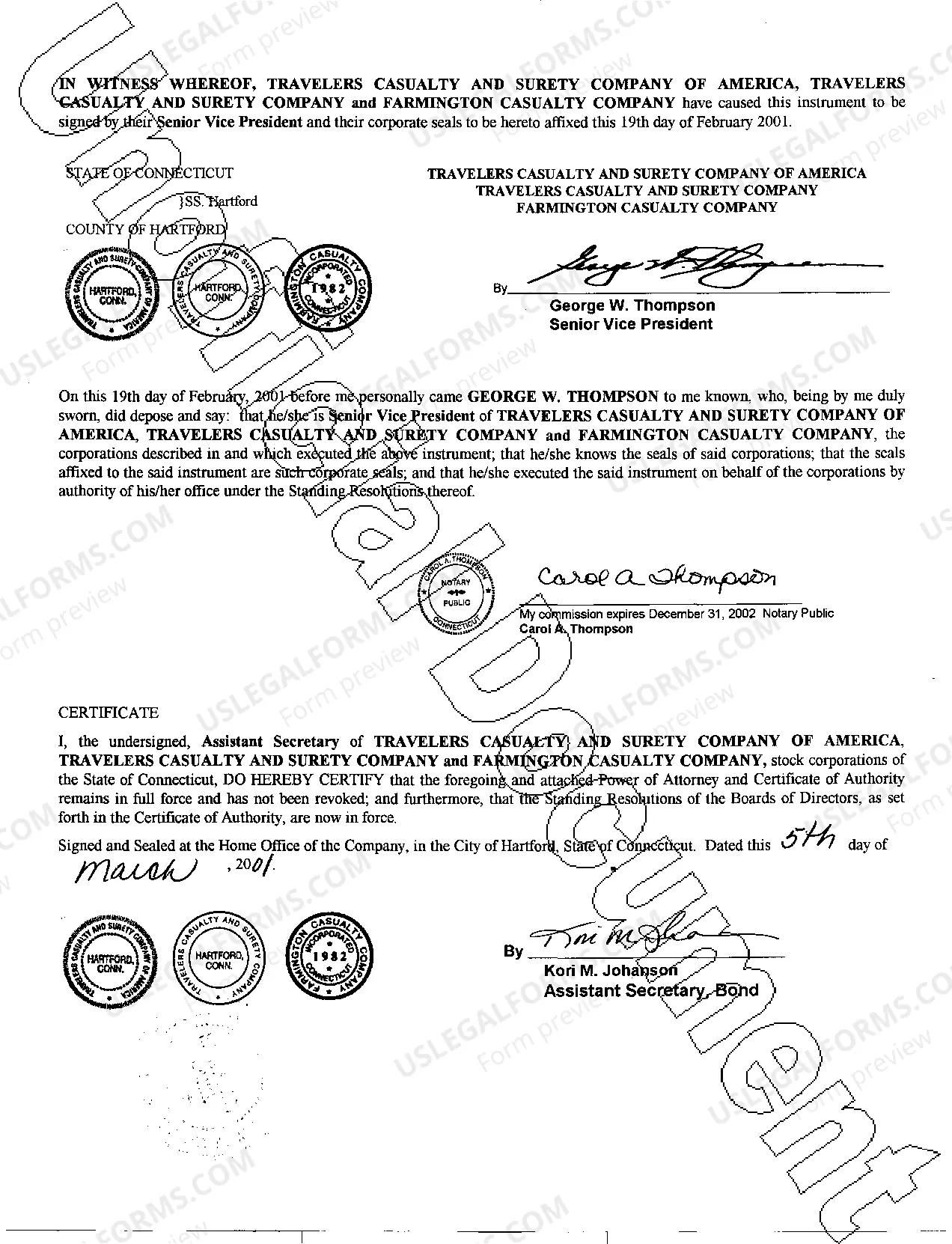

The Fort Worth Texas Plaintiff Bond for Sequestration is a legal instrument used in civil court cases to allow a plaintiff to request the seizure or sequestration of certain assets belonging to the defendant. This bond is typically required by the court to ensure that the plaintiff will cover any damages, costs, or losses that the defendant may suffer as a result of the sequestration. A plaintiff who believes that the defendant may dispose of or hide assets before a judgment is reached may file a motion for sequestration, seeking the court's permission to secure the defendant's assets. The purpose of sequestration is to prevent the defendant from dissipating their assets and to ensure that there will be sufficient funds to satisfy any judgment awarded to the plaintiff. To obtain the plaintiff bond for sequestration in Fort Worth, Texas, the plaintiff will need to engage a qualified surety company or an approved insurance carrier. The surety company will underwrite the bond and assume financial responsibility for the full amount of the bond, should the plaintiff fail to fulfill their obligations. While there may not be specific variations of the Fort Worth Texas Plaintiff Bond for Sequestration, the terms and conditions of the bond may vary depending on the court's requirements and the circumstances of the case. The bond amount will typically be determined by the court, taking into account the value of the assets to be sequestered and any potential damages or losses that the defendant may incur. It is important for plaintiffs to understand that obtaining a plaintiff bond for sequestration is a significant financial commitment. The bond premium, which is typically a percentage of the bond amount, will need to be paid by the plaintiff. Additionally, the plaintiff will be responsible for any costs associated with the sequestration process, such as hiring a third-party custodian to oversee the seized assets. By obtaining the Fort Worth Texas Plaintiff Bond for Sequestration, plaintiffs in civil court cases gain a valuable tool to protect their interests and preserve the availability of assets for potential judgment satisfaction. This bond ensures that the defendant's assets are securely held during the proceedings and serves as financial security for any potential damages or losses suffered by the defendant due to the sequestration. In summary, the Fort Worth Texas Plaintiff Bond for Sequestration is a legal requirement in civil court cases that allows plaintiffs to request the seizure of the defendant's assets. By obtaining this bond from a surety company, plaintiffs can ensure the availability of assets for potential recovery, while assuming financial responsibility for any damages or losses incurred by the defendant.

Fort Worth Texas Plaintiff Bond For Sequestration

Description

How to fill out Fort Worth Texas Plaintiff Bond For Sequestration?

Take advantage of the US Legal Forms and obtain instant access to any form sample you need. Our helpful platform with thousands of documents allows you to find and obtain virtually any document sample you will need. You are able to export, complete, and certify the Fort Worth Texas Plaintiff Bond For Sequestration in just a matter of minutes instead of browsing the web for many hours trying to find a proper template.

Using our collection is a wonderful strategy to improve the safety of your document submissions. Our experienced lawyers regularly review all the records to make certain that the forms are relevant for a particular state and compliant with new acts and regulations.

How can you get the Fort Worth Texas Plaintiff Bond For Sequestration? If you already have a subscription, just log in to the account. The Download button will be enabled on all the documents you look at. Furthermore, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, follow the instructions listed below:

- Open the page with the form you need. Make sure that it is the form you were hoping to find: check its title and description, and use the Preview function when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the saving procedure. Click Buy Now and select the pricing plan you like. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Save the document. Select the format to get the Fort Worth Texas Plaintiff Bond For Sequestration and modify and complete, or sign it according to your requirements.

US Legal Forms is probably the most significant and trustworthy form libraries on the internet. We are always ready to assist you in any legal process, even if it is just downloading the Fort Worth Texas Plaintiff Bond For Sequestration.

Feel free to make the most of our platform and make your document experience as convenient as possible!