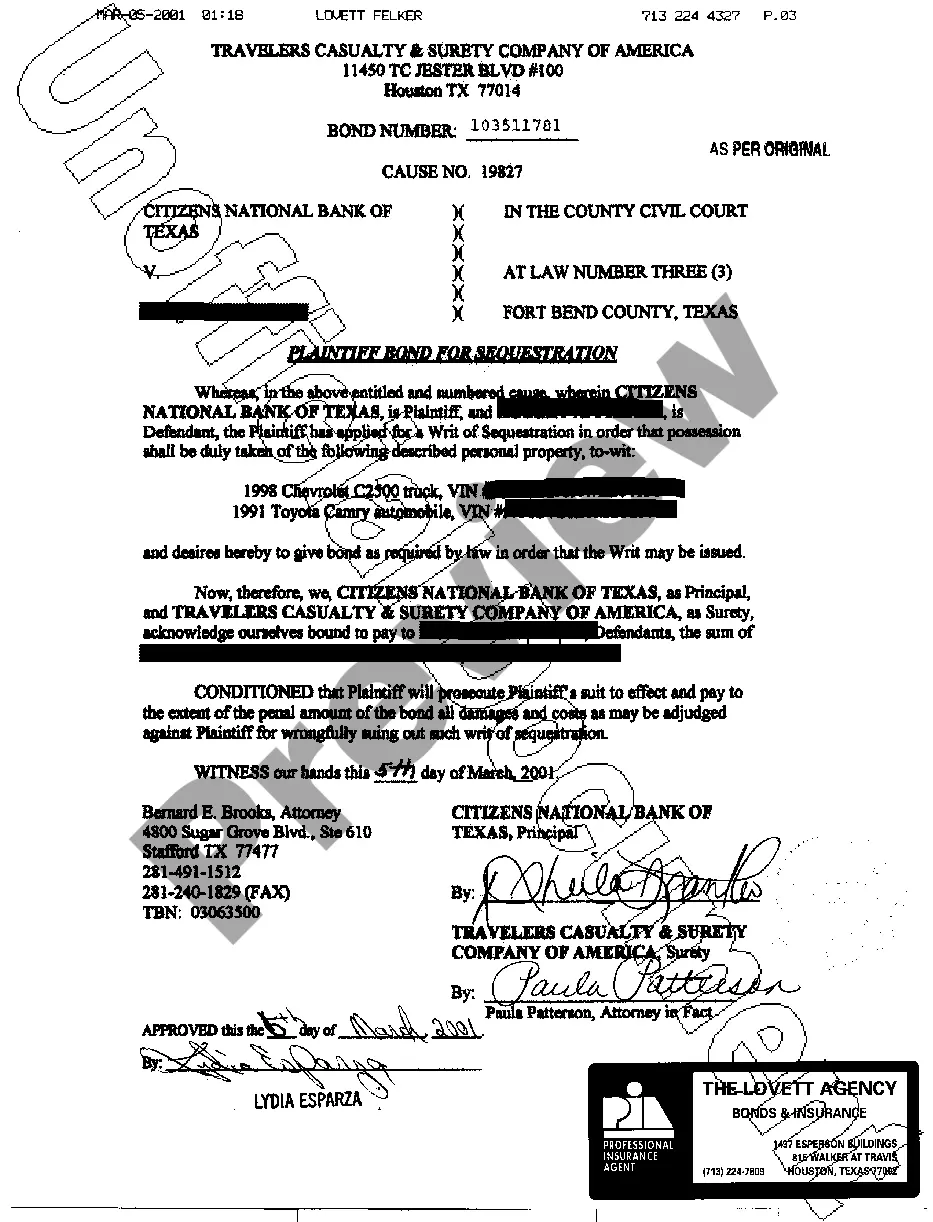

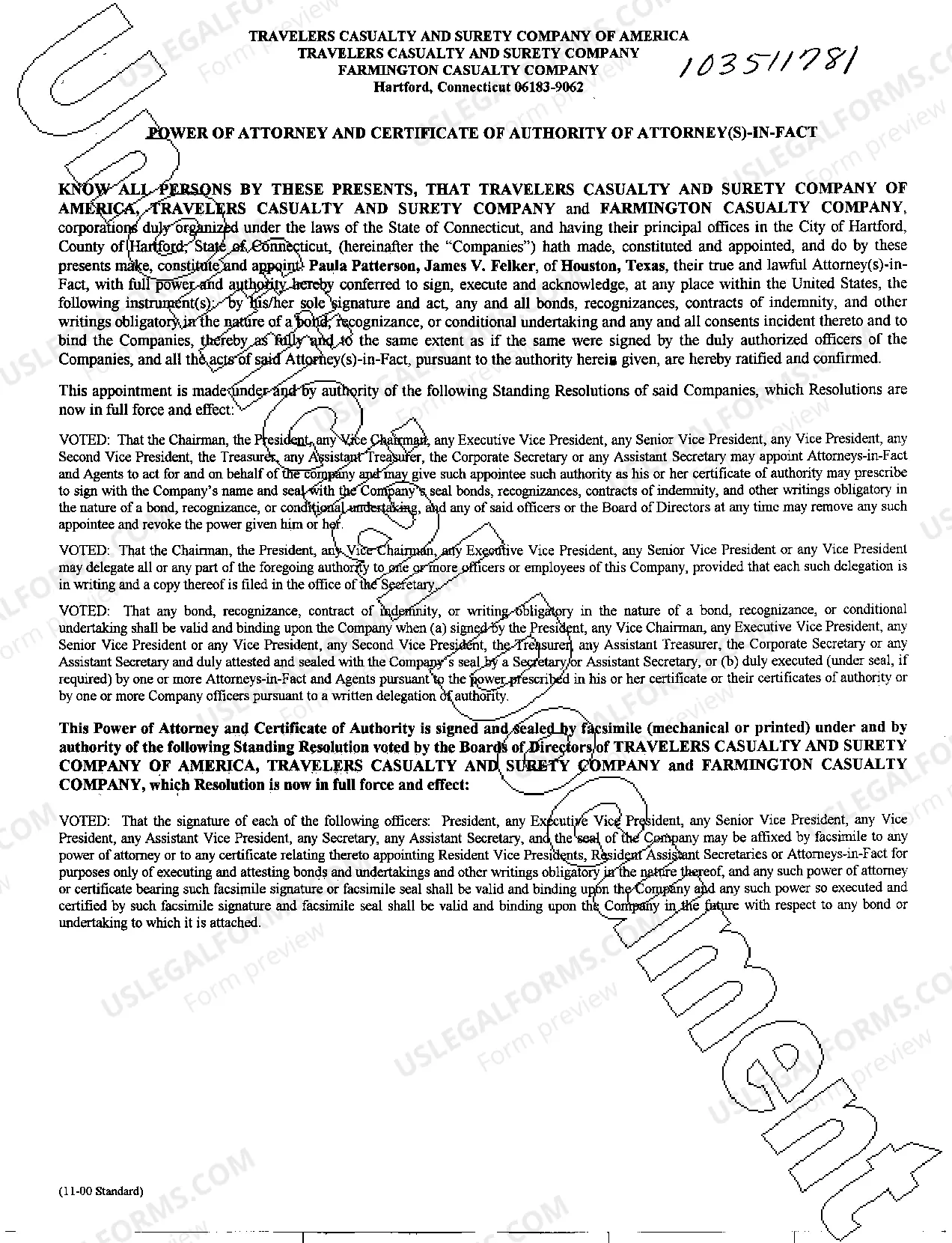

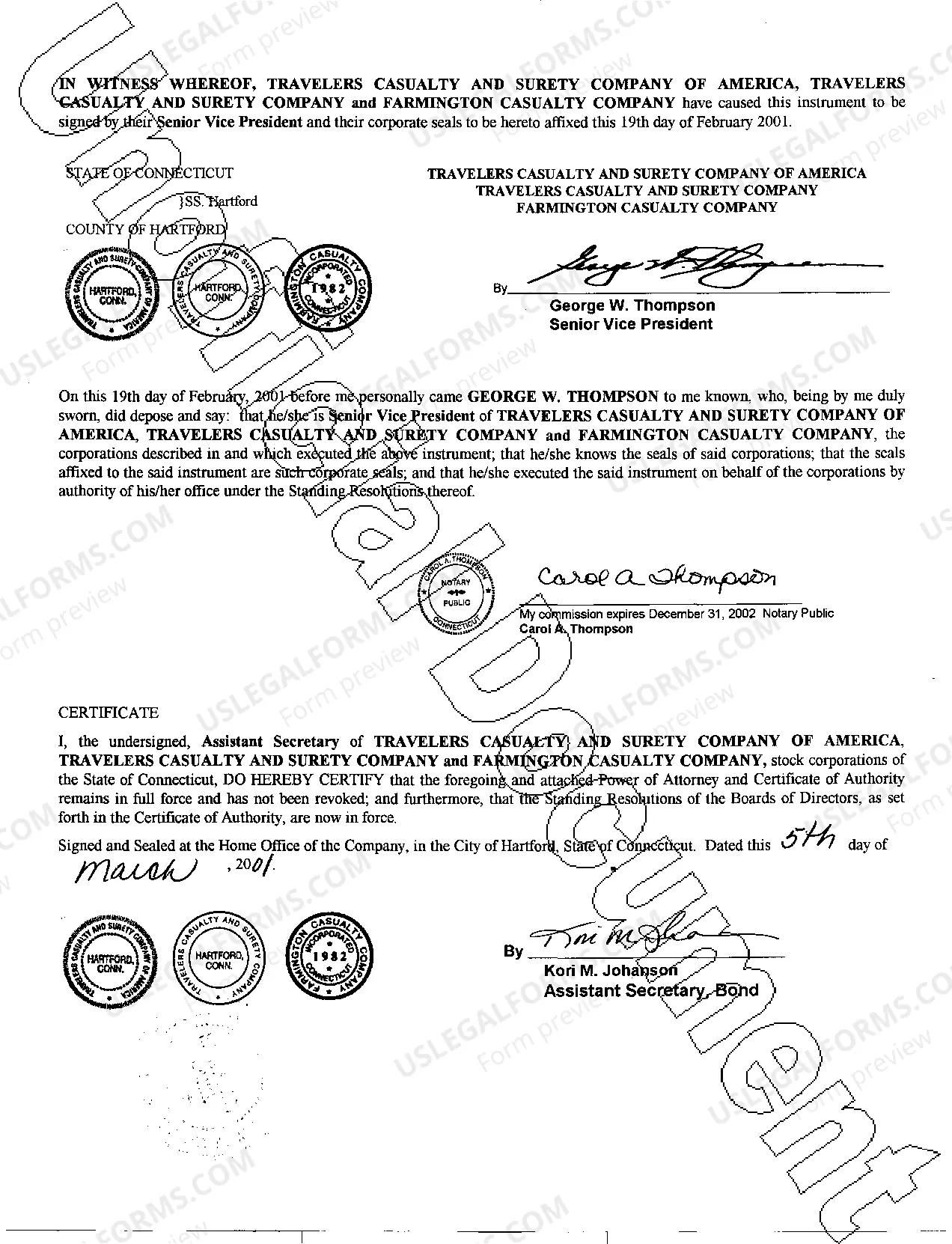

Harris Texas Plaintiff Bond for Sequestration is a legal document that provides assurance to the court that the plaintiff will indemnify the defendant against any damages or losses resulting from the sequestration of property. In simple terms, it serves as a financial guarantee for the temporary taking or freezing of assets or property during a lawsuit. Sequestration is a legal process commonly used in civil litigation, allowing the court to keep control of disputed property until the case's resolution. It is a mechanism employed to prevent the defendant from improperly disposing of assets or removing them from the jurisdiction, potentially denying the plaintiff of their rightful claims. There are two types of Harris Texas Plaintiff Bond for Sequestration: cash and surety bonds. A cash bond requires the plaintiff to deposit the full amount of the sequestrated property's value in cash with the court. This cash deposit acts as security and can be used to cover any potential losses suffered by the defendant. On the other hand, a surety bond involves a third-party surety company that assumes financial responsibility on behalf of the plaintiff. Instead of cash, the plaintiff pays a premium — a percentage of the bond amount – to the surety, which then issues the bond. The Harris Texas Plaintiff Bond for Sequestration is filed in court by the plaintiff and is a vital step in initiating the sequestration process. By obtaining this bond, the plaintiff assures the court and the defendant that they will be financially accountable for any damages or losses incurred. This bond is essential to safeguard the defendant's interests while ensuring that the plaintiff's claims are given fair consideration by the court. The Harris Texas Plaintiff Bond for Sequestration plays a significant role in protecting both parties' rights throughout the litigation process. It ensures that the defendant's assets are not wrongfully seized and that the plaintiff's claim is duly addressed. By obtaining this bond, the plaintiff demonstrates their seriousness in pursuing the lawsuit, while also offering reassurance to the court that they will uphold their legal responsibilities. In summary, the Harris Texas Plaintiff Bond for Sequestration is a crucial legal document utilized in civil litigation to guarantee compensation for any potential losses resulting from the temporary sequestration of property. It provides financial security for defendants, ensuring that they will be indemnified for any damages suffered. Whether a cash or surety bond, this legal instrument serves as a means to protect the rights of both parties involved in the lawsuit.

Harris Texas Plaintiff Bond For Sequestration

Description

How to fill out Harris Texas Plaintiff Bond For Sequestration?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Harris Texas Plaintiff Bond For Sequestration becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Harris Texas Plaintiff Bond For Sequestration takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Harris Texas Plaintiff Bond For Sequestration. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

If a defendant does not pay a judgment, the plaintiff can try to enforce the judgment by filing another lawsuit. For example, if the defendant owns several cars, the plaintiff can sue to have the car transferred to the plaintiff.

A motion to dismiss can be filed at any time. They are usually filed by defendants early on in the lawsuit, before they have filed an answer.

A defendant making a motion to dismiss must do so before filing an answer or other responsive pleading, and the motion is generally due when the defendant's answer would have been due (see FRCP 12(b)). Defendants may move to dismiss on the following grounds: Lack of subject matter jurisdiction (FRCP 12(b)(1)).

If you want to file a motion, the process is generally something like this: You write your motion. You file your motion with the court clerk. The court clerk inserts the date and time your motion will be heard by the judge. You ?serve? (mail) your motion to the other side.

You may dismiss or ?nonsuit? a case you filed at any time before you have introduced all your evidence by filing a Notice of Nonsuit with the court. See Texas Rules of Civil Procedure, Rule 162.

A motion to dismiss must be: (a) filed within 60 days after the first pleading containing the challenged cause of action is served on the movant; (b) filed at least 21 days before the motion is heard; and (c) granted or denied within 45 days after the motion is filed.

Under new Rule 91a, a party may move to dismiss a cause of action that has ?no basis in law or fact.? A claim has no basis in law if the allegations, taken as true, together with any reasonable inferences, ?do not entitle the claimant to relief.? A claim has no basis in fact if ?no reasonable person could believe the

Step 1 ? The Plaintiff should complete a small claims petition and pay the filing fee. Step 2 ? The Plaintiff should complete the application and affidavit for writ of sequestration. Step 3 ? The Clerk will immediately set the case for an ex parte hearing in order for the judge to set the bond.

Rule 91a ? Motion to Dismiss A Motion to Dismiss under Rule 91a must identify each cause of action the party seeks to dismiss and must specifically state the reasons the cause action has no basis in law or fact. served on the movant. o The Motion to Dismiss must be filed at least 21 days before the motion is heard.

Interesting Questions

More info

A federal judge threw out the redistricting plan for legislative districts and said that the boundaries were drawn deliberately to favor incumbents and keep minority Democrats away from the voter rolls. A federal judge who oversees elections in the state of Texas agreed, and called the maps “unjust and unconstitutional.” A federal judge from Texas' Western district found no discrimination on the part of the Texas Republican-led redistricting commission. But a court in the Eastern district of Texas struck down many of those maps, and the court that oversees elections for the entire state rejected the redistricting maps that were drawn. The case is still pending, however. [Government -Federal Government -Federal Government Court of Appeals of Texas. Dallas. Jan.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.