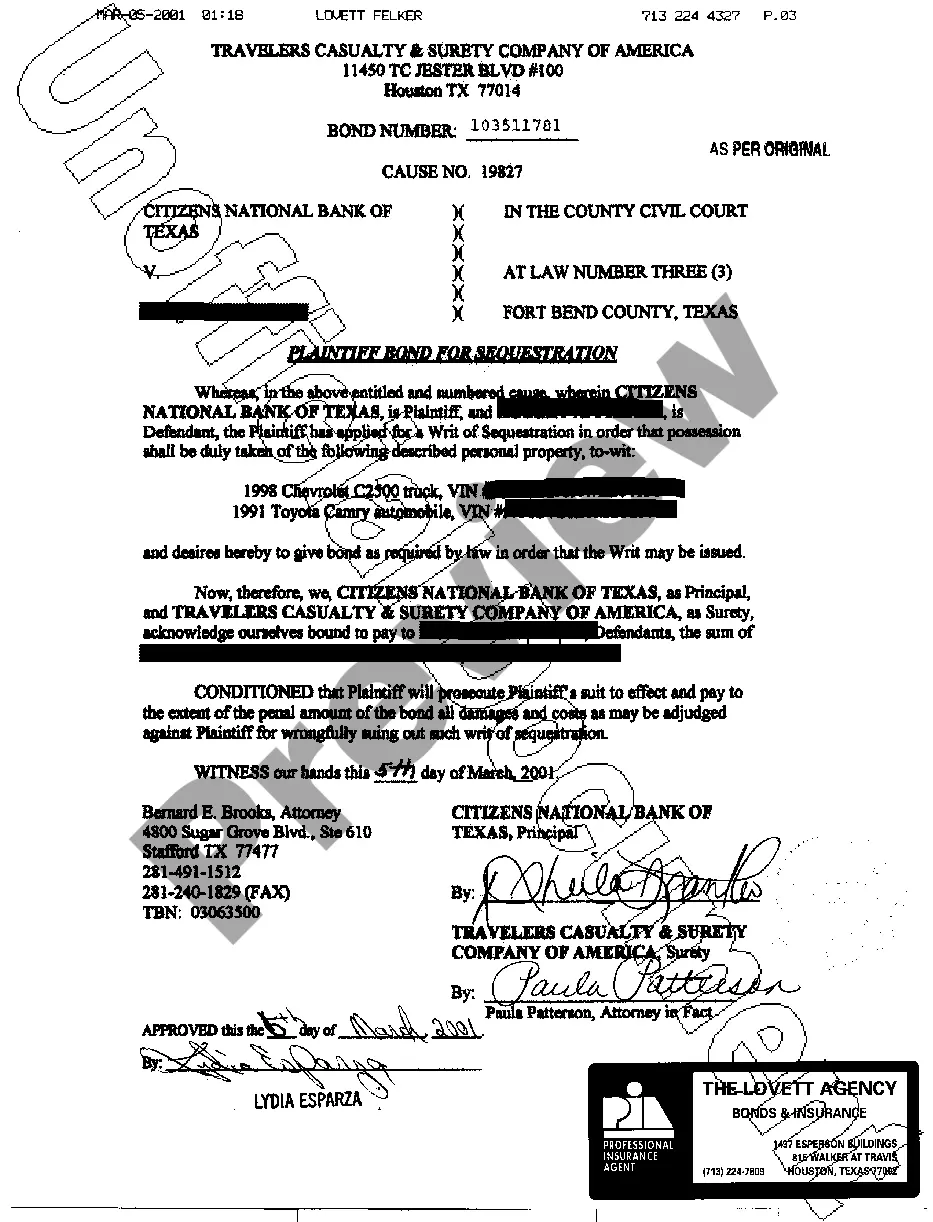

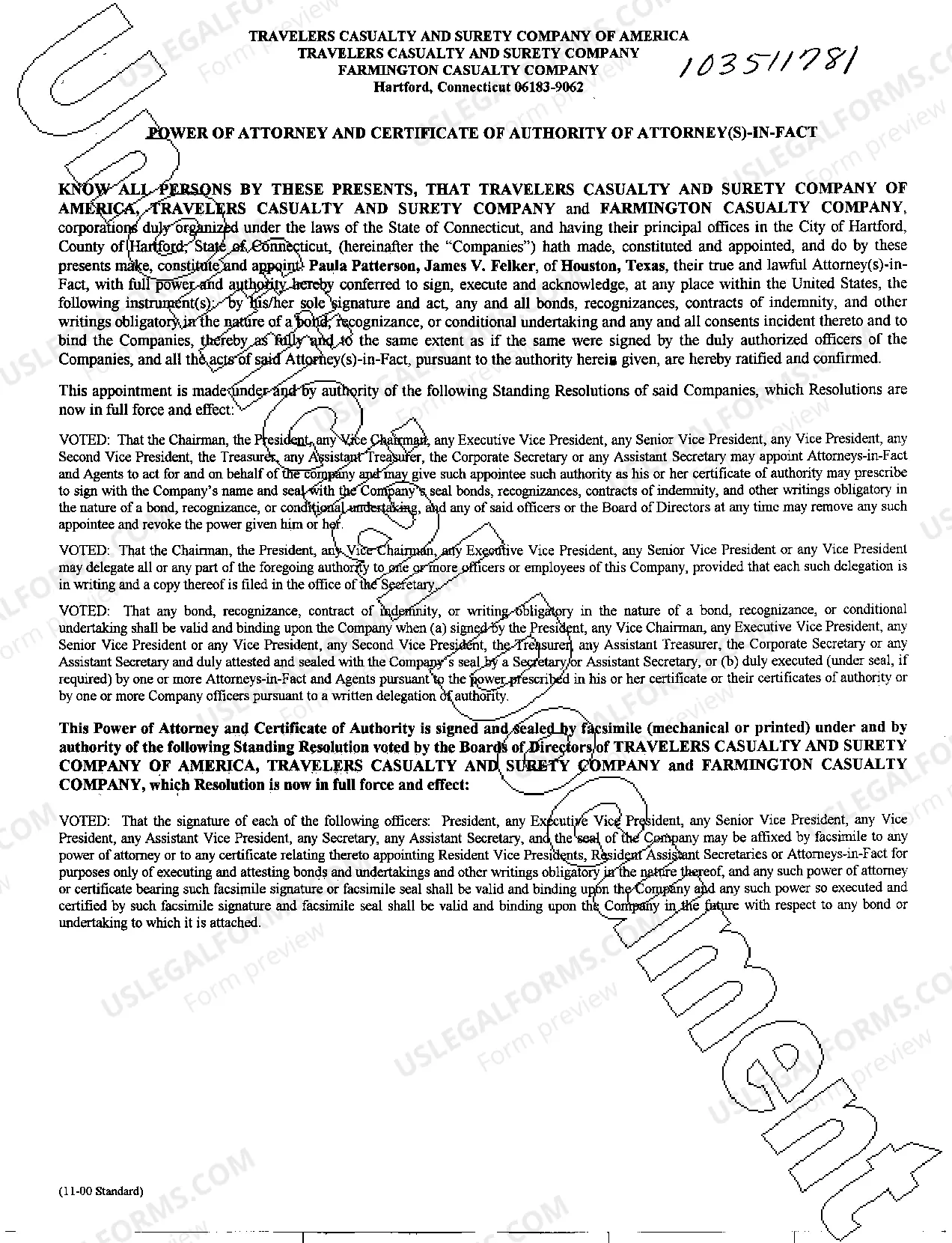

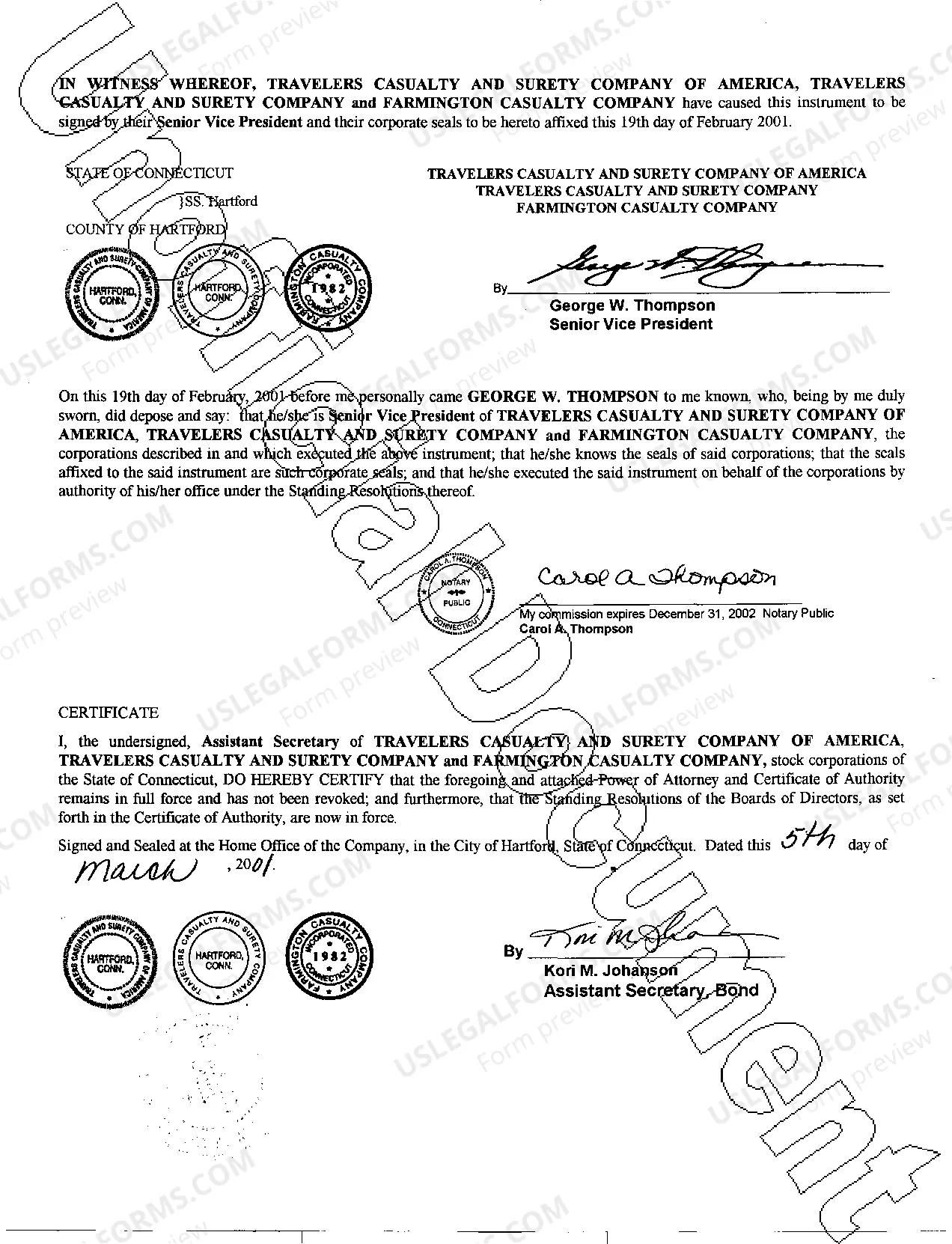

San Angelo Texas Plaintiff Bond for Sequestration is a legal instrument designed to protect the defendant's property or assets during the litigation process. When a plaintiff seeks a sequestration order from the court, aiming to secure and prevent the defendant from disposing of their assets, a plaintiff bond for sequestration becomes necessary in San Angelo, Texas. This type of bond assures the court that if the defendant suffers any financial loss as a result of a wrongful sequestration order, the plaintiff will compensate the defendant accordingly. By posting a plaintiff bond, the plaintiff takes responsibility for any damages incurred by the defendant due to the sequestration. In San Angelo, Texas, there are two primary types of plaintiff bonds for sequestration: 1. Cash Bond: This type of bond requires the plaintiff to deposit a specific amount of cash with the court or a designated authority. The cash amount is determined by the court and serves as collateral to cover any potential damages faced by the defendant. If the defendant proves the wrongful imposition of the sequestration order, they can claim compensation from the cash bond. 2. Surety Bond: A surety bond is a financial guarantee provided by a licensed surety company. In this case, the plaintiff pays a premium to the surety company, who then issues the bond on their behalf. This type of bond functions as a contract between the plaintiff, surety company, and the court. If the defendant suffers any damages due to an unjust sequestration order, they can file a claim against the surety bond to seek compensation. In summary, a San Angelo Texas Plaintiff Bond for Sequestration is a vital legal tool used to safeguard the defendant's assets when a sequestration order is sought by the plaintiff. It ensures that the plaintiff takes financial responsibility for any losses incurred by the defendant due to the improper imposition of the sequestration. The available types of bonds include cash bonds, where the plaintiff deposits a set amount of cash, and surety bonds, which involve a licensed surety company issuing the bond on behalf of the plaintiff.

San Angelo Texas Plaintiff Bond For Sequestration

Description

How to fill out San Angelo Texas Plaintiff Bond For Sequestration?

Take advantage of the US Legal Forms and get instant access to any form you want. Our beneficial platform with a huge number of document templates makes it simple to find and obtain almost any document sample you require. You can save, complete, and sign the San Angelo Texas Plaintiff Bond For Sequestration in just a matter of minutes instead of browsing the web for many hours looking for an appropriate template.

Using our catalog is a superb way to improve the safety of your record submissions. Our professional attorneys on a regular basis review all the documents to ensure that the forms are appropriate for a particular state and compliant with new laws and regulations.

How can you obtain the San Angelo Texas Plaintiff Bond For Sequestration? If you have a subscription, just log in to the account. The Download button will appear on all the documents you look at. Furthermore, you can find all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the instructions below:

- Find the form you need. Ensure that it is the form you were looking for: examine its title and description, and make use of the Preview option if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Download the document. Indicate the format to get the San Angelo Texas Plaintiff Bond For Sequestration and edit and complete, or sign it according to your requirements.

US Legal Forms is probably the most extensive and reliable document libraries on the web. Our company is always happy to help you in any legal procedure, even if it is just downloading the San Angelo Texas Plaintiff Bond For Sequestration.

Feel free to benefit from our platform and make your document experience as convenient as possible!