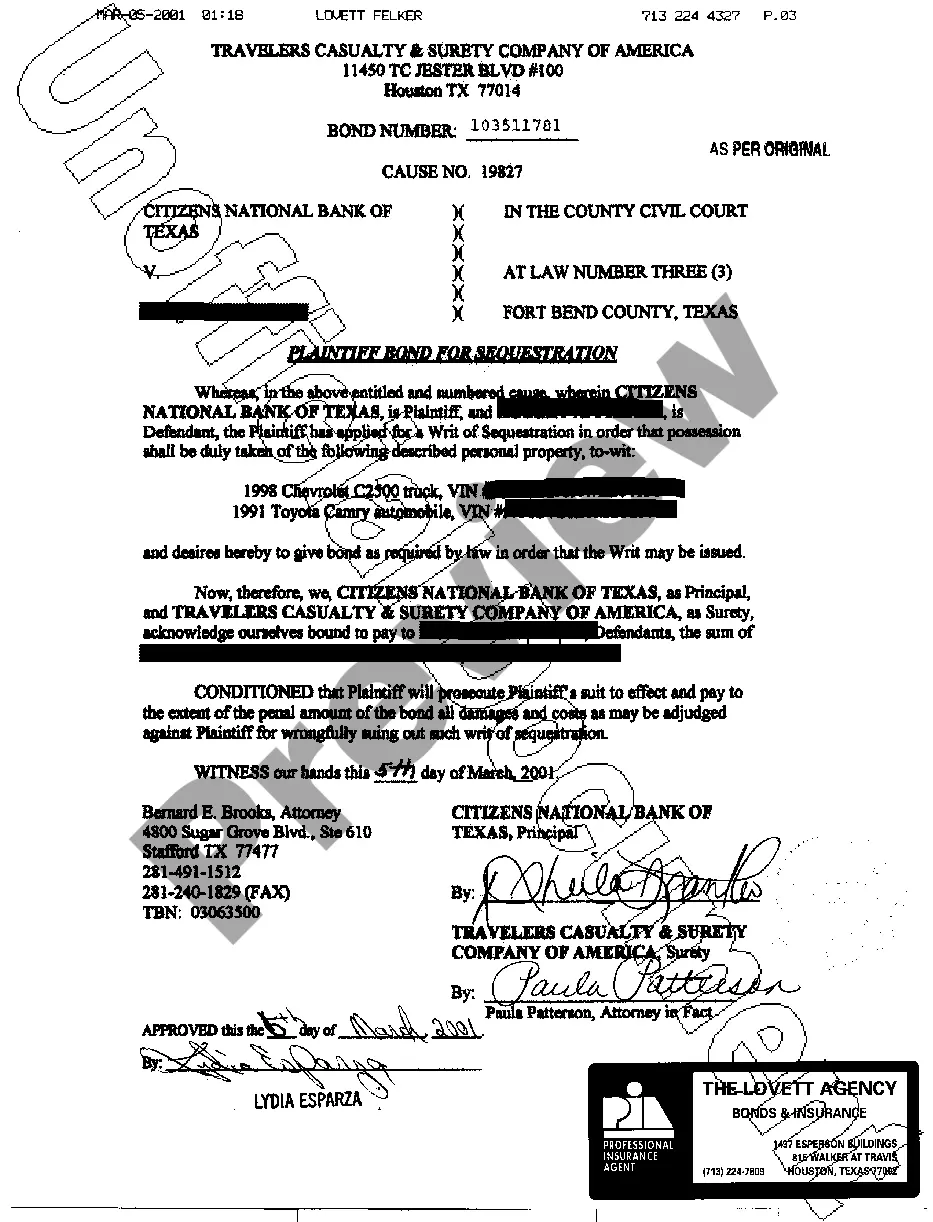

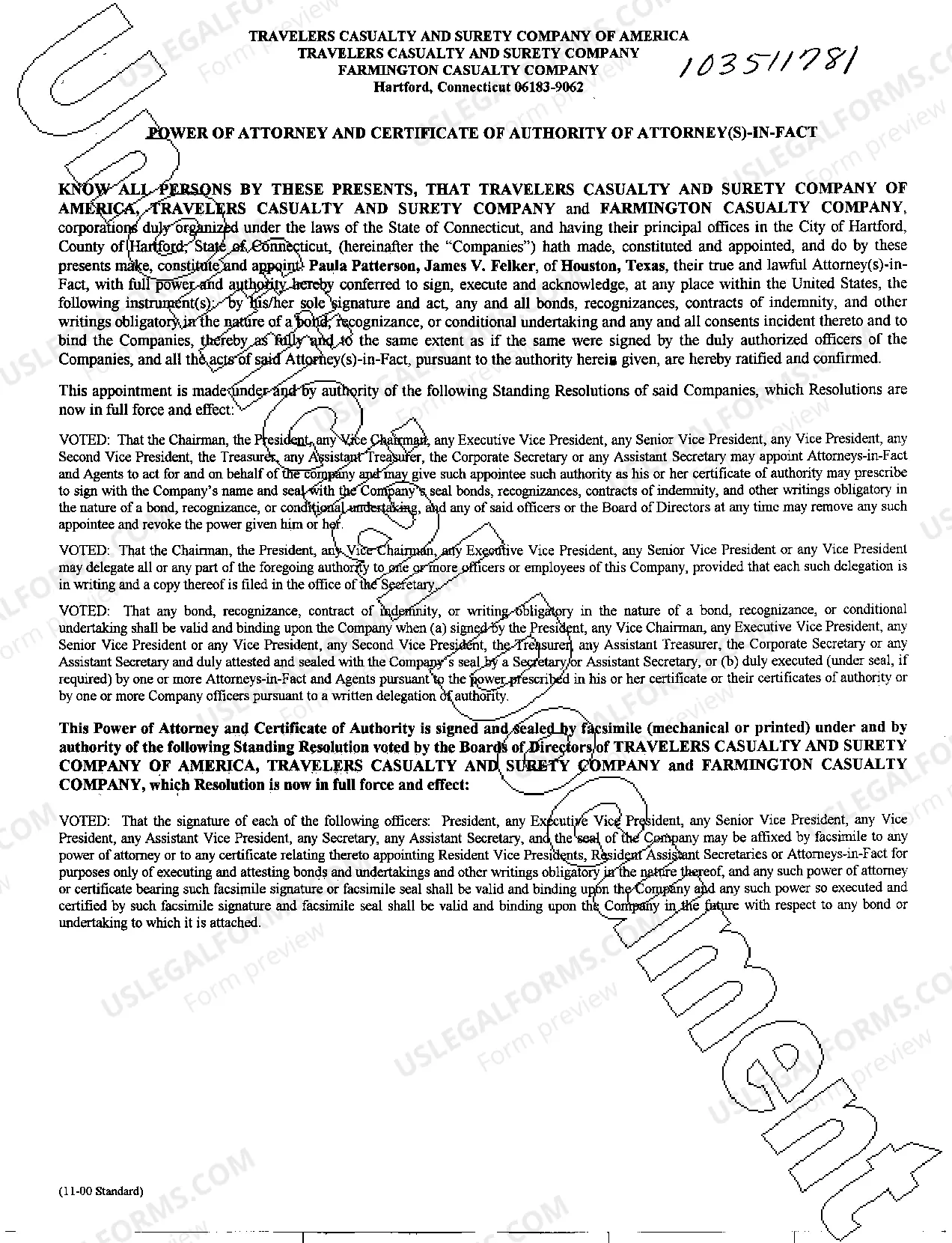

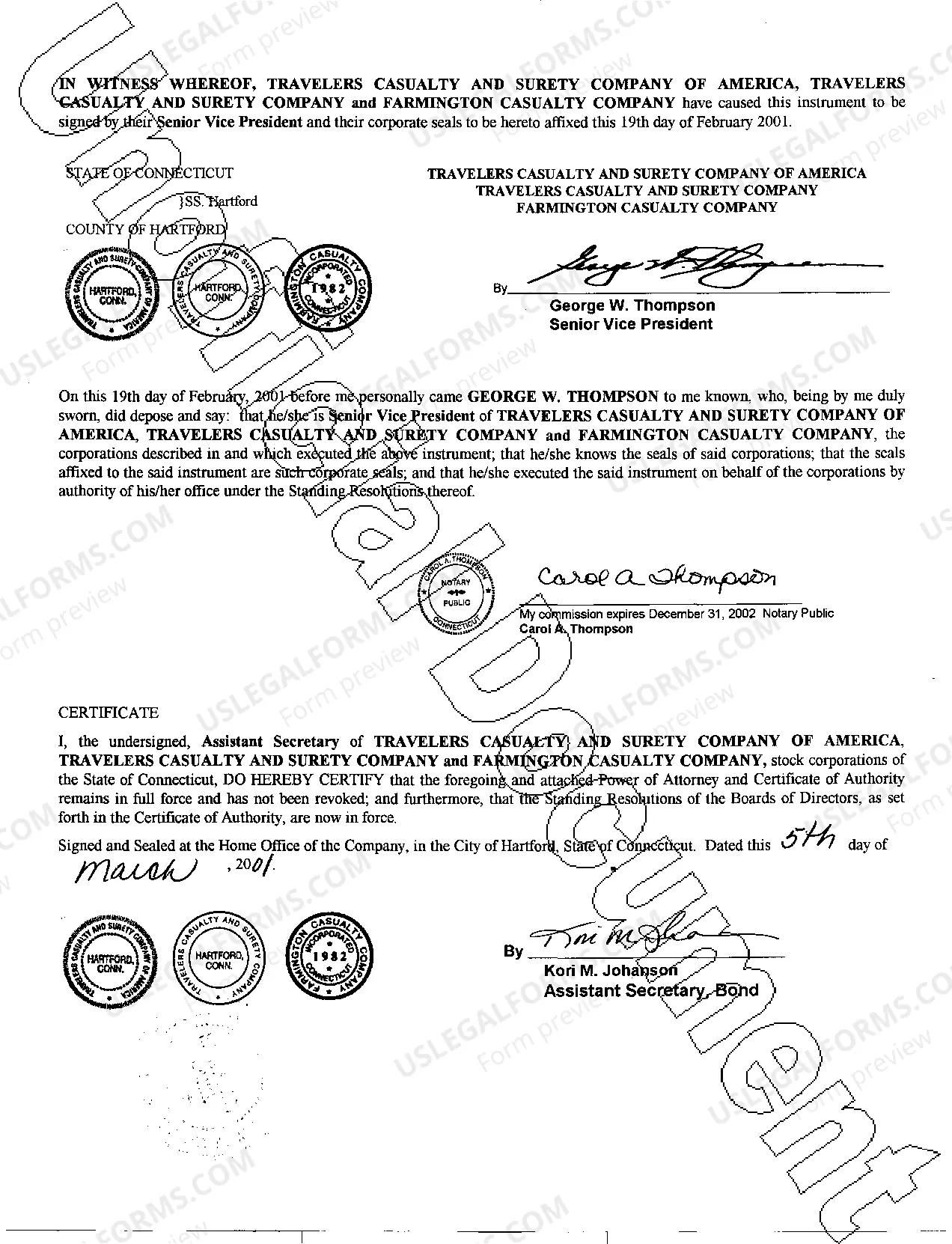

Waco Texas Plaintiff Bond For Sequestration: A Comprehensive Overview Introduction: In legal proceedings, the Waco Texas Plaintiff Bond for Sequestration plays a crucial role. It is a type of bond that ensures the defendant's property or assets are safeguarded during the litigation process. This article will provide a detailed description of what a plaintiff bond for sequestration entails, its purpose, and different types available in Waco, Texas. Definition and Purpose: A plaintiff bond for sequestration is a financial guarantee required by the courts, serving as collateral to protect the plaintiff's interests during a lawsuit. When a plaintiff seeks a sequestration order, which permits the removal and preservation of the defendant's assets, a bond becomes necessary. It aims to compensate the defendant for any potential losses resulting from the sequestration if the plaintiff fails to win the case. Types of Waco Texas Plaintiff Bond For Sequestration: 1. Temporary Sequestration Bond — This type of bond is typically required during the early stages of litigation when the court orders immediate sequestration of the defendant's assets or property. It provides temporary protection for the plaintiff until a final judgment is reached. 2. Permanent Sequestration Bond — Once the court grants a permanent sequestration order, this type of bond becomes necessary. It ensures the continued protection of the defendant's assets until the conclusion of the lawsuit. Unlike a temporary bond, a permanent sequestration bond may need higher coverage limits. 3. Contempt Sequestration Bond — In some cases, when a defendant violates a court-ordered sequestration by dissipating or hiding assets, the court may hold them in contempt. To release the defendant from contempt charges, a contempt sequestration bond is required. This bond provides security to the court, ensuring that the defendant will comply with future court orders. 4. Non-Resident Sequestration Bond — When the defendant resides outside of Waco, Texas, but has assets located within the jurisdiction, a non-resident sequestration bond comes into play. This bond helps protect the defendant's assets within the state during the litigation process. Process and Requirements: To obtain a plaintiff bond for sequestration in Waco, Texas, plaintiffs need to go through a specific process. The exact requirements may vary, but generally, the following steps are involved: 1. Filing a Lawsuit: The plaintiff initiates legal proceedings against the defendant, requesting sequestration of assets. 2. Petitioning the Court: The plaintiff requests a sequestration order from the court, providing valid reasons for asset preservation. 3. Bond Application: After obtaining the court's approval, the plaintiff applies for a plaintiff bond for sequestration through a respected surety bond provider or insurance company. 4. Underwriting and Approval Process: The surety or insurance company assesses the plaintiff's financials, creditworthiness, and the overall risk involved. Based on these factors, they determine the premium cost, coverage limits, and terms of the bond. 5. Bond Issuance: After the underwriting process, the surety bond provider or insurance company issues the plaintiff bond for sequestration. 6. Bond Coverage and Obligations: The bond must cover the total value of sequestered assets. The plaintiff is obligated to comply with any court orders related to the sequestration order. Conclusion: The Waco Texas Plaintiff Bond for Sequestration is an essential legal tool that safeguards a plaintiff's interests during a lawsuit. By understanding the various types of plaintiff bonds for sequestration available, such as temporary, permanent, contempt, and non-resident sequestration bonds, plaintiffs can choose the appropriate bond for their specific situation. Working with a reputable surety bond provider ensures a smooth process and provides the necessary financial security during litigation.

Waco Texas Plaintiff Bond For Sequestration

Description

How to fill out Waco Texas Plaintiff Bond For Sequestration?

Are you looking for a reliable and affordable legal forms supplier to get the Waco Texas Plaintiff Bond For Sequestration? US Legal Forms is your go-to choice.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of particular state and county.

To download the form, you need to log in account, locate the needed form, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Waco Texas Plaintiff Bond For Sequestration conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is intended for.

- Restart the search if the form isn’t good for your legal situation.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is completed, download the Waco Texas Plaintiff Bond For Sequestration in any available format. You can return to the website at any time and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal paperwork online for good.