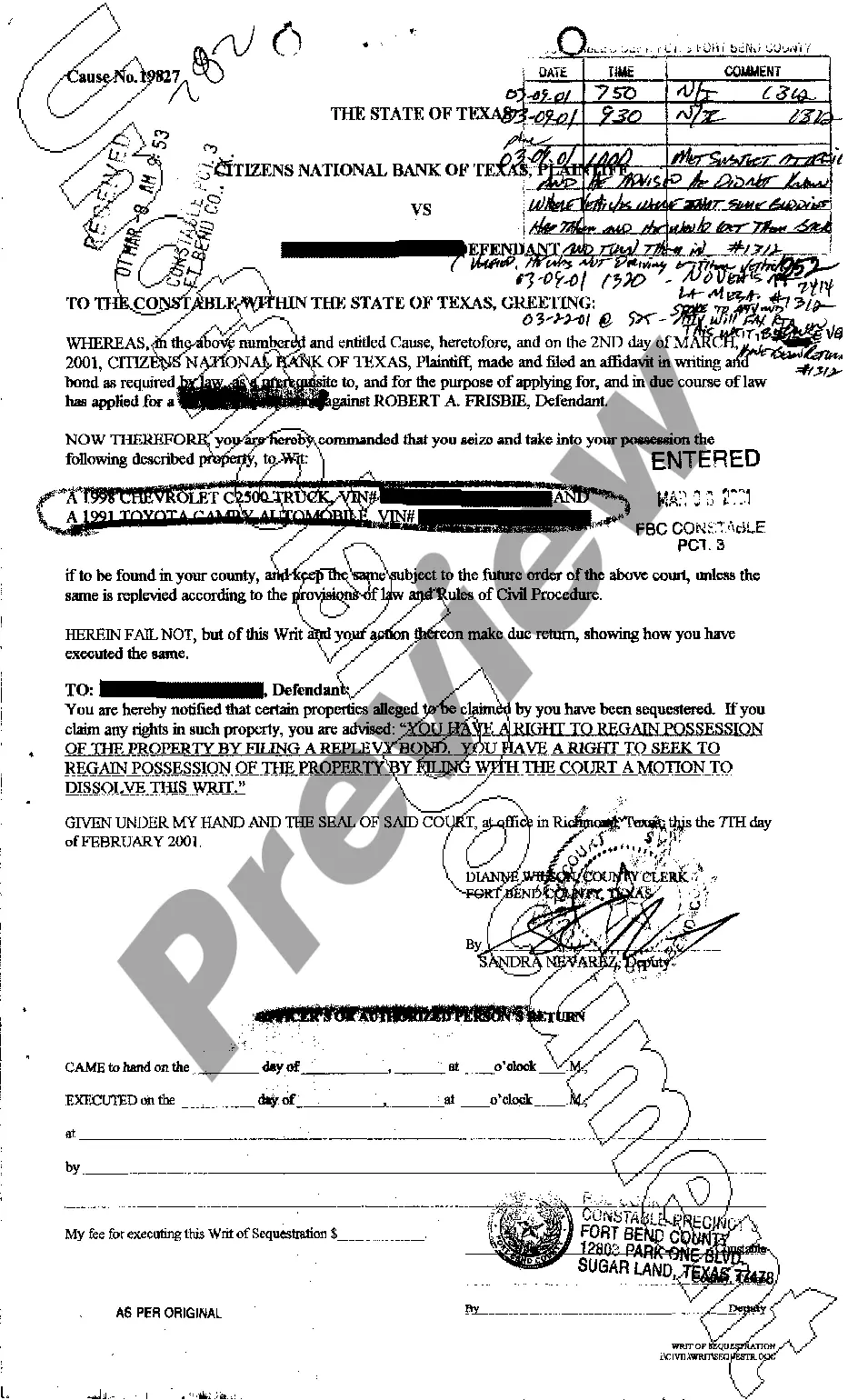

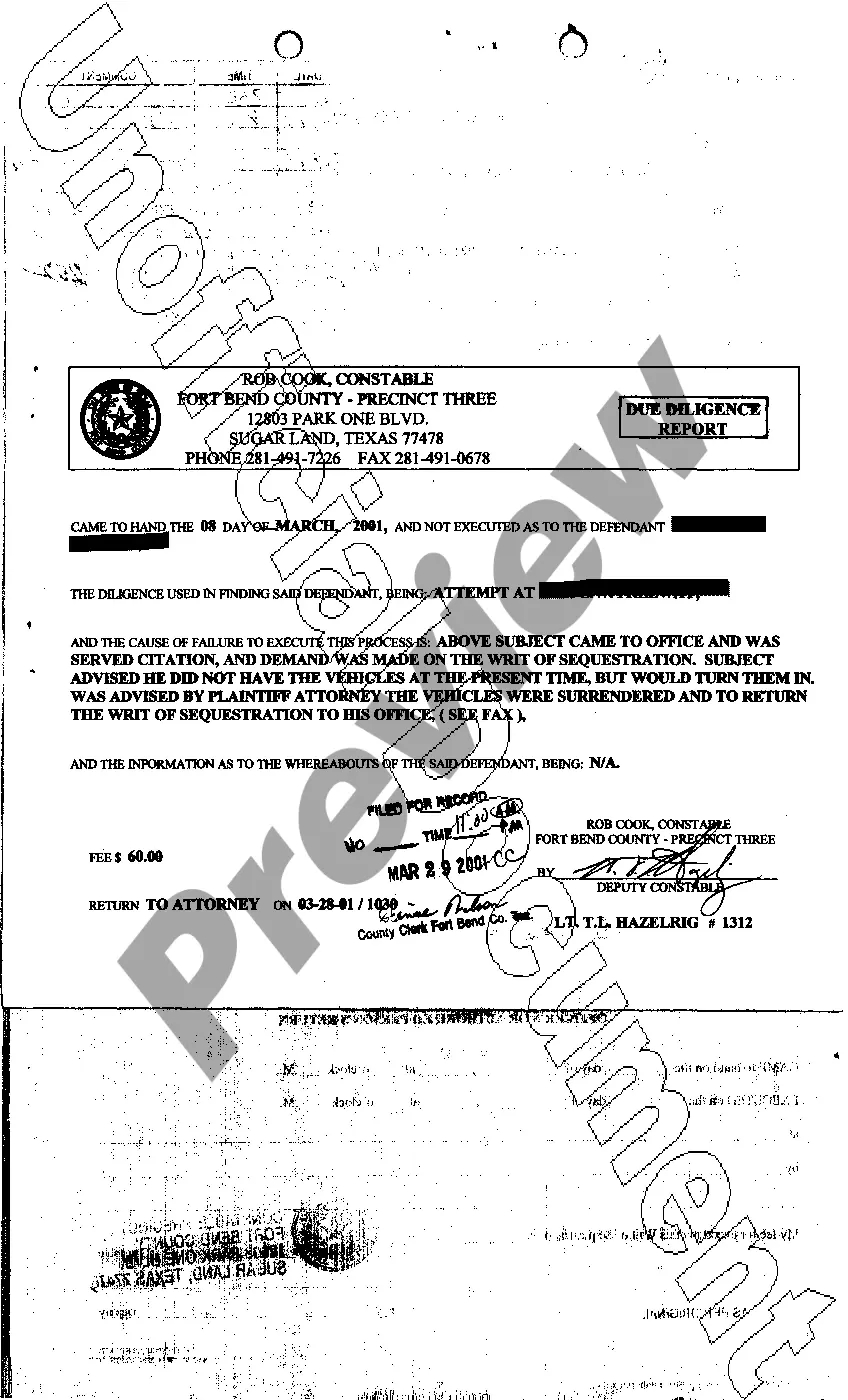

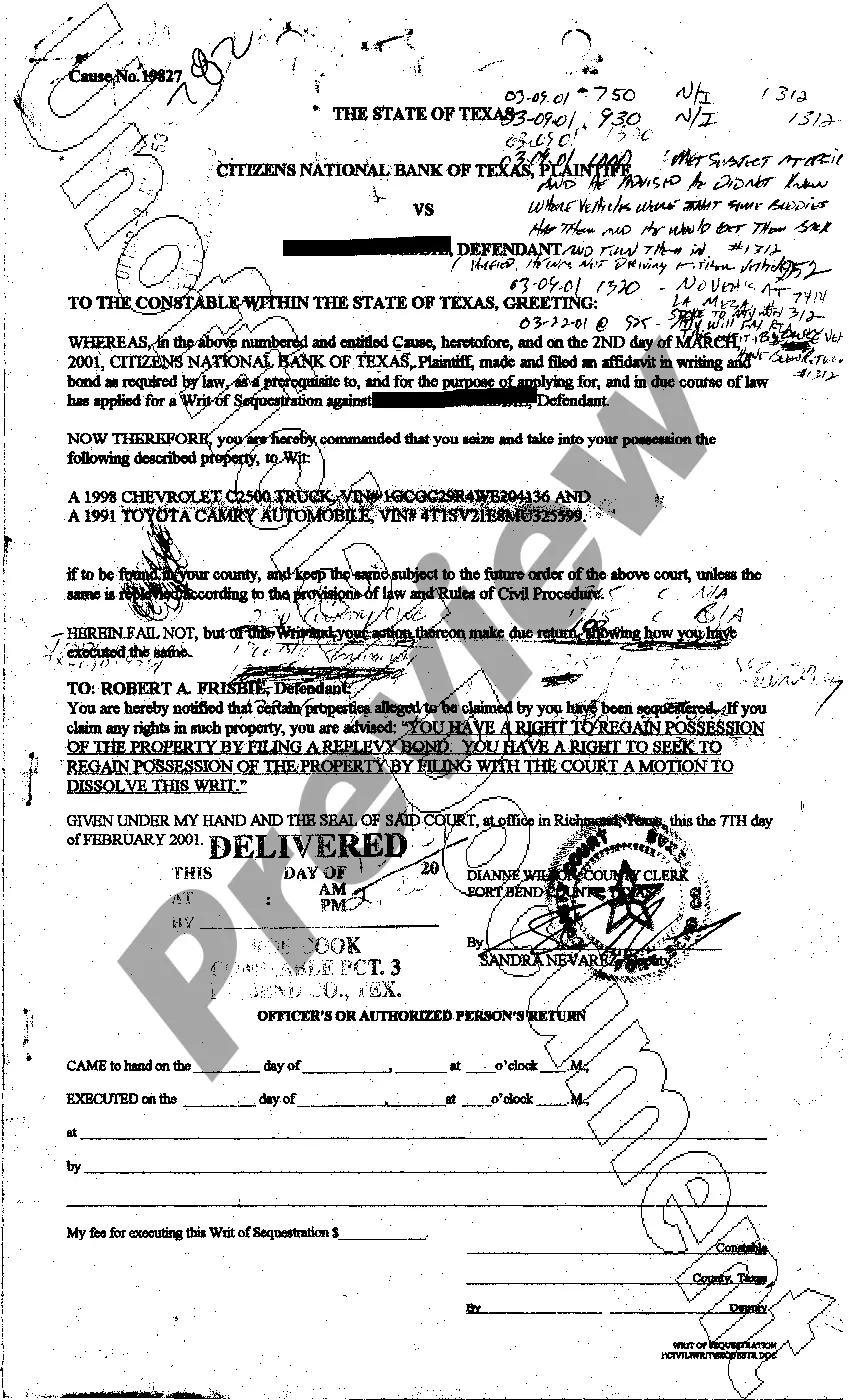

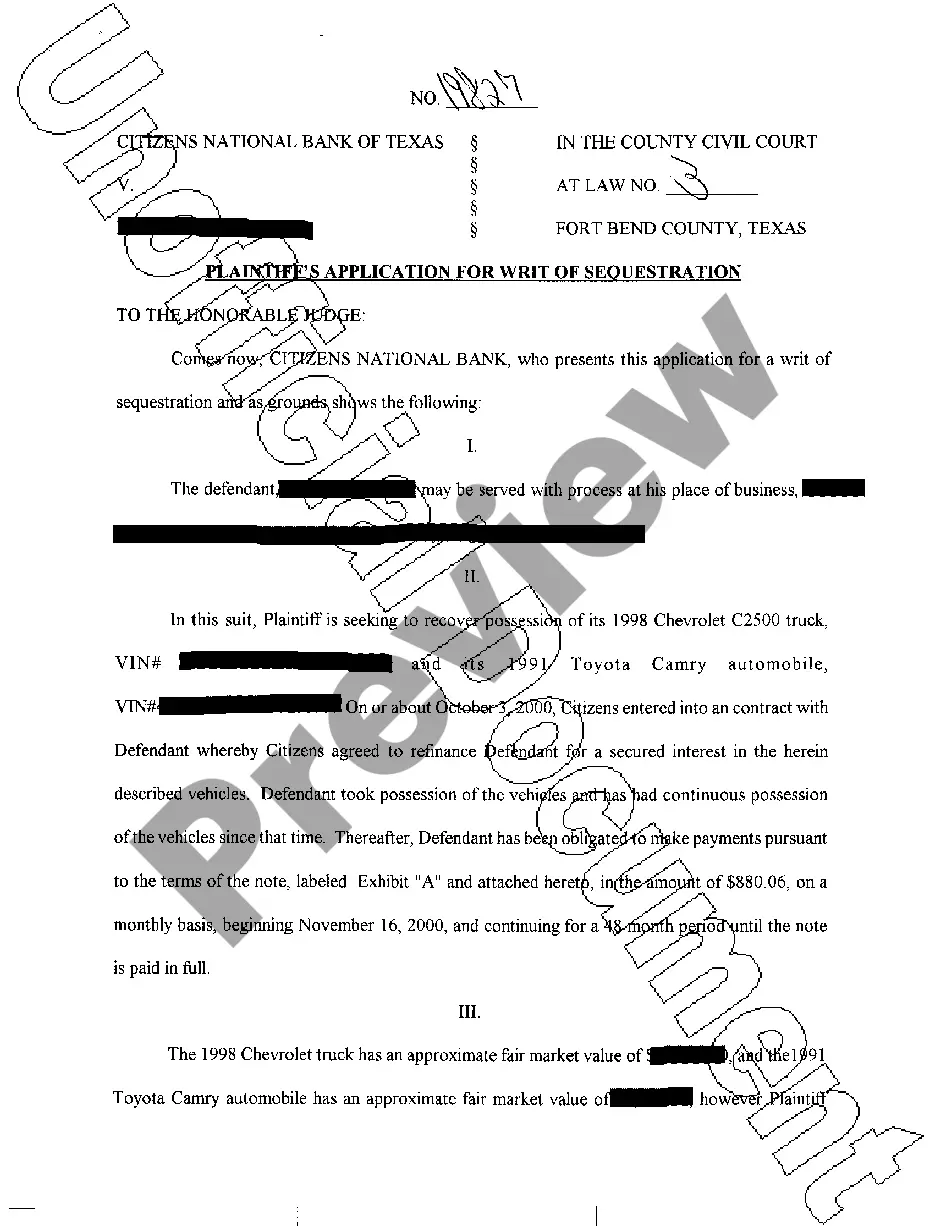

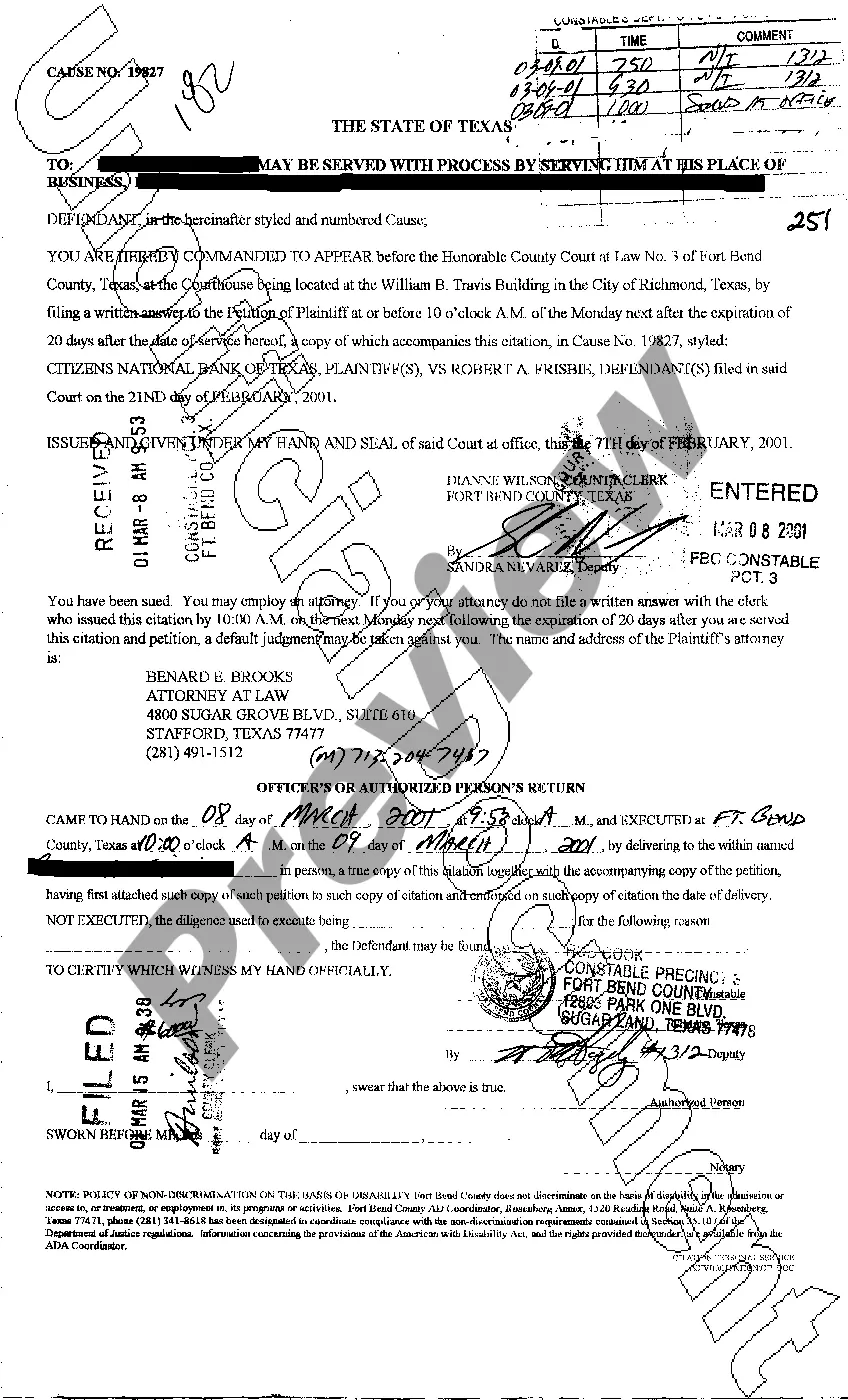

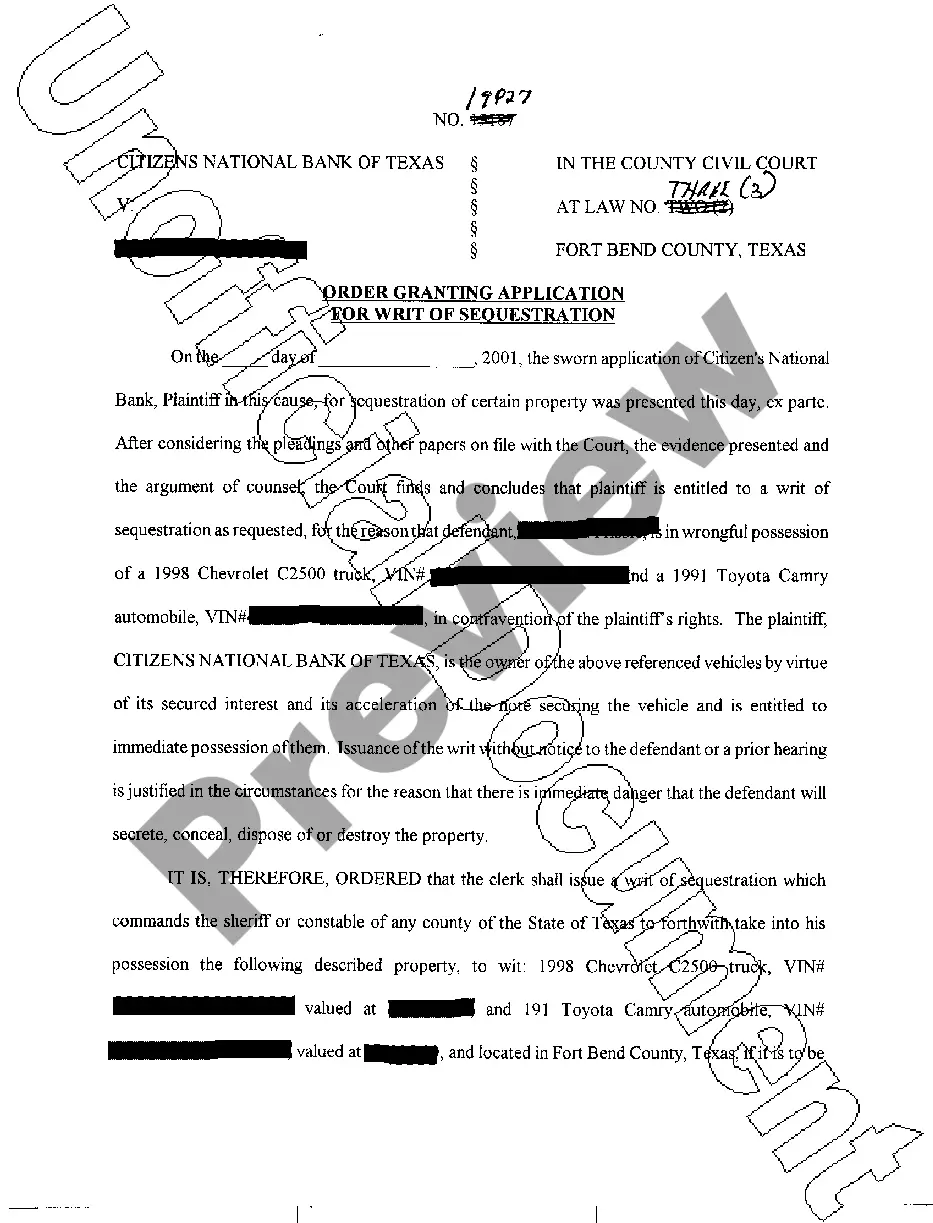

Houston Texas Writ of Sequestration

Description

How to fill out Texas Writ Of Sequestration?

Do you require a reliable and cost-effective legal forms provider to obtain the Houston Texas Writ of Sequestration? US Legal Forms is your preferred option.

Whether you need a fundamental agreement to establish guidelines for living with your partner or a collection of documents to progress your divorce through the courts, we have you covered.

Our site provides over 85,000 current legal document templates for personal and professional use. All templates we offer are not generic, but tailored according to the specifications of individual states and regions.

To acquire the document, you must Log In to your account, locate the necessary template, and click the Download button adjacent to it.

If the template does not suit your specific needs, restart your search.

You can now establish your account. Then, select the subscription plan and proceed with payment. Once the payment is completed, download the Houston Texas Writ of Sequestration in any offered format. You can return to the website anytime and redownload the document without additional cost.

- Please note that you can download your previously acquired document templates at any time from the My documents section.

- Are you unfamiliar with our platform? No problem.

- You can create an account with great ease, but first ensure that you complete the following tasks.

- Verify if the Houston Texas Writ of Sequestration aligns with your state and local regulations.

- Examine the details of the form (if provided) to discern the intended recipient and purpose of the document.

Form popularity

FAQ

Once issued, the writ of execution directs the sheriff to seize the non-exempt property and sell it. The proceeds of the sale are given to the creditor to satisfy all or part of the judgment.

Filing a Writ of Execution 30 days after obtaining a final judgment, a creditor can request a Writ of Execution from the clerk of the court. The creditor or the creditor's attorney will fill out a Writ of Execution form available at any county courthouse.

When a creditor gets a judgment against a debtor, the creditor has to take steps to get the judgment paid. This is called execution. This usually means that an officer of the law comes to the debtor's home or work place to take things owned by the debtor. The things that are taken are sold to pay the judgment.

Step 1 ? The Plaintiff should complete a small claims petition and pay the filing fee. Step 2 ? The Plaintiff should complete the application and affidavit for writ of sequestration. Step 3 ? The Clerk will immediately set the case for an ex parte hearing in order for the judge to set the bond.

While a state writ can be filed at any time, if you wait too long after your conviction is final, a court will often dismiss your application under the doctrine known as laches (a legal doctrine which basically means you should have complained about the violation earlier).

A replevin bond is a judicial surety bond which provides indemnity to the law enforcement officer that executes a writ of replevin and protection to the party subject to the replevin. A defendant or other party from whom specific property was seized may suffer damages as a result of said seizure.

The Writ of Execution is served to a county constable or sheriff, who must ?without delay? levy the real and personal property of the judgment debtor unless directed to do otherwise. If more than one Writ of Execution is served, then the assets are distributed in the order the writs are received.

If a defendant does not pay a judgment, the plaintiff can try to enforce the judgment by filing another lawsuit. For example, if the defendant owns several cars, the plaintiff can sue to have the car transferred to the plaintiff.

How Long Is a Writ of Execution Good for? According to Texas Rule of Civil Procedure 34.001, a Writ of Execution for a money judgment can be applied for within 10 years of the entry of a judgment and is good for just as long. Within the 10 year period, the writ can be renewed at any time for an additional 10 years.