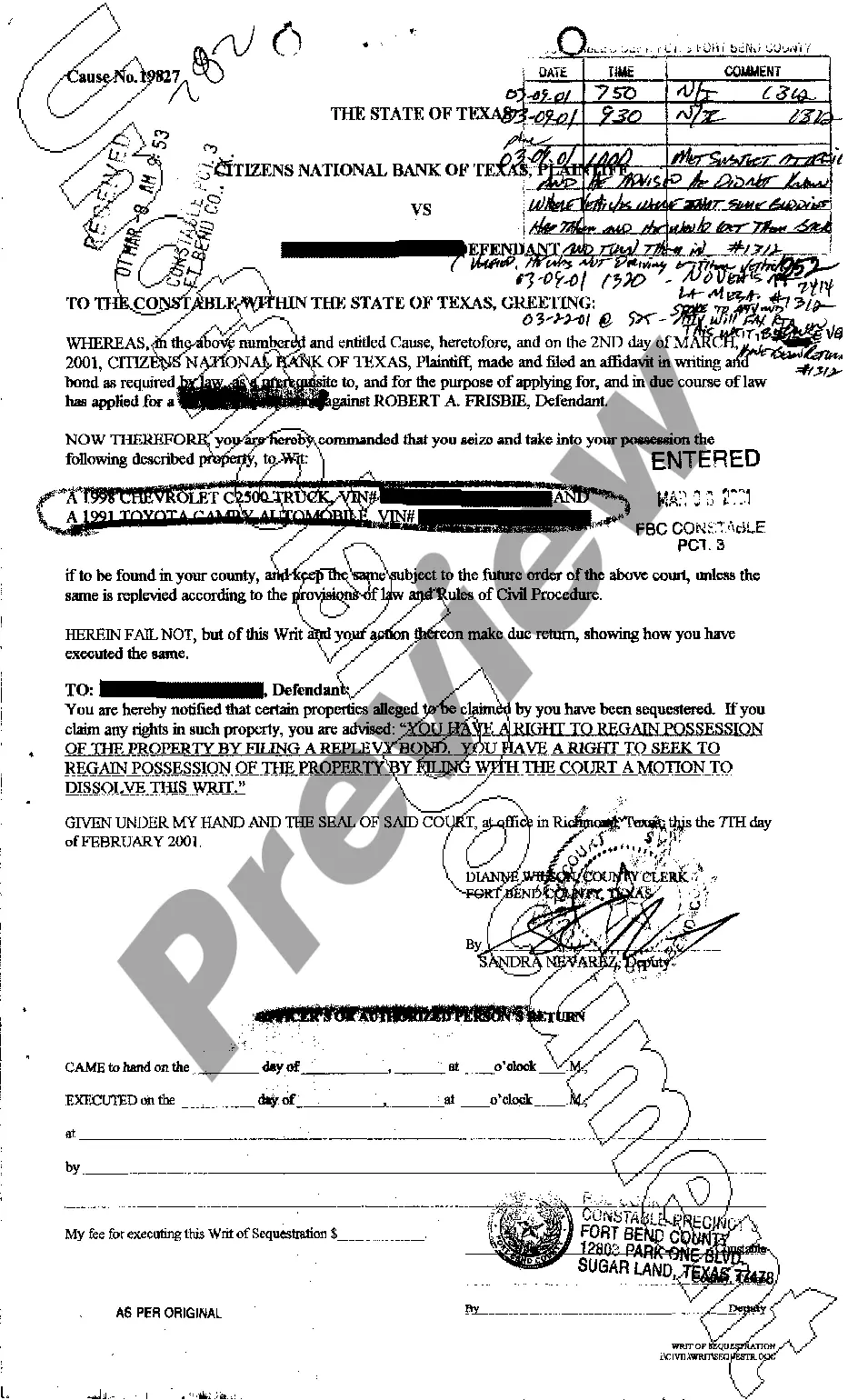

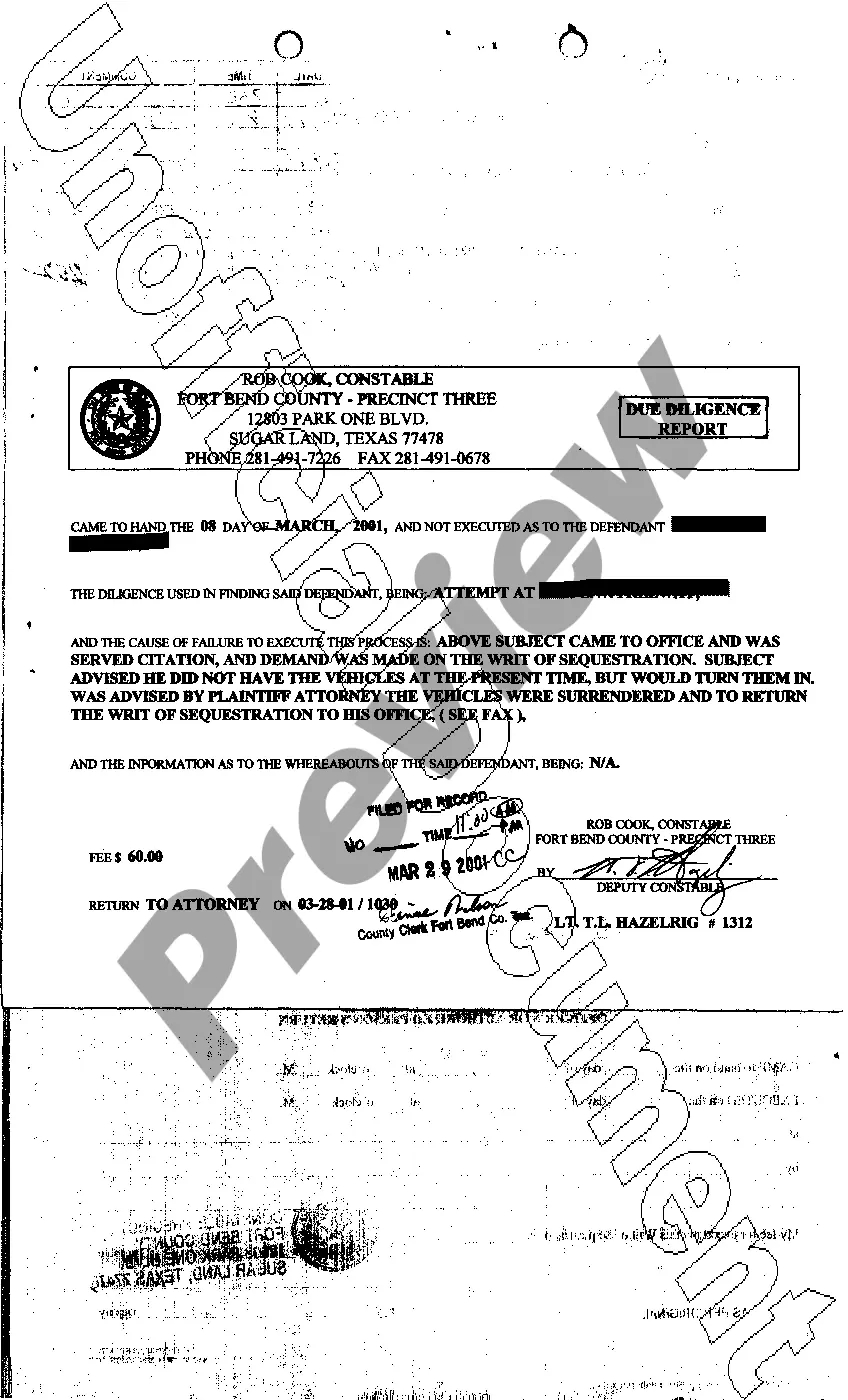

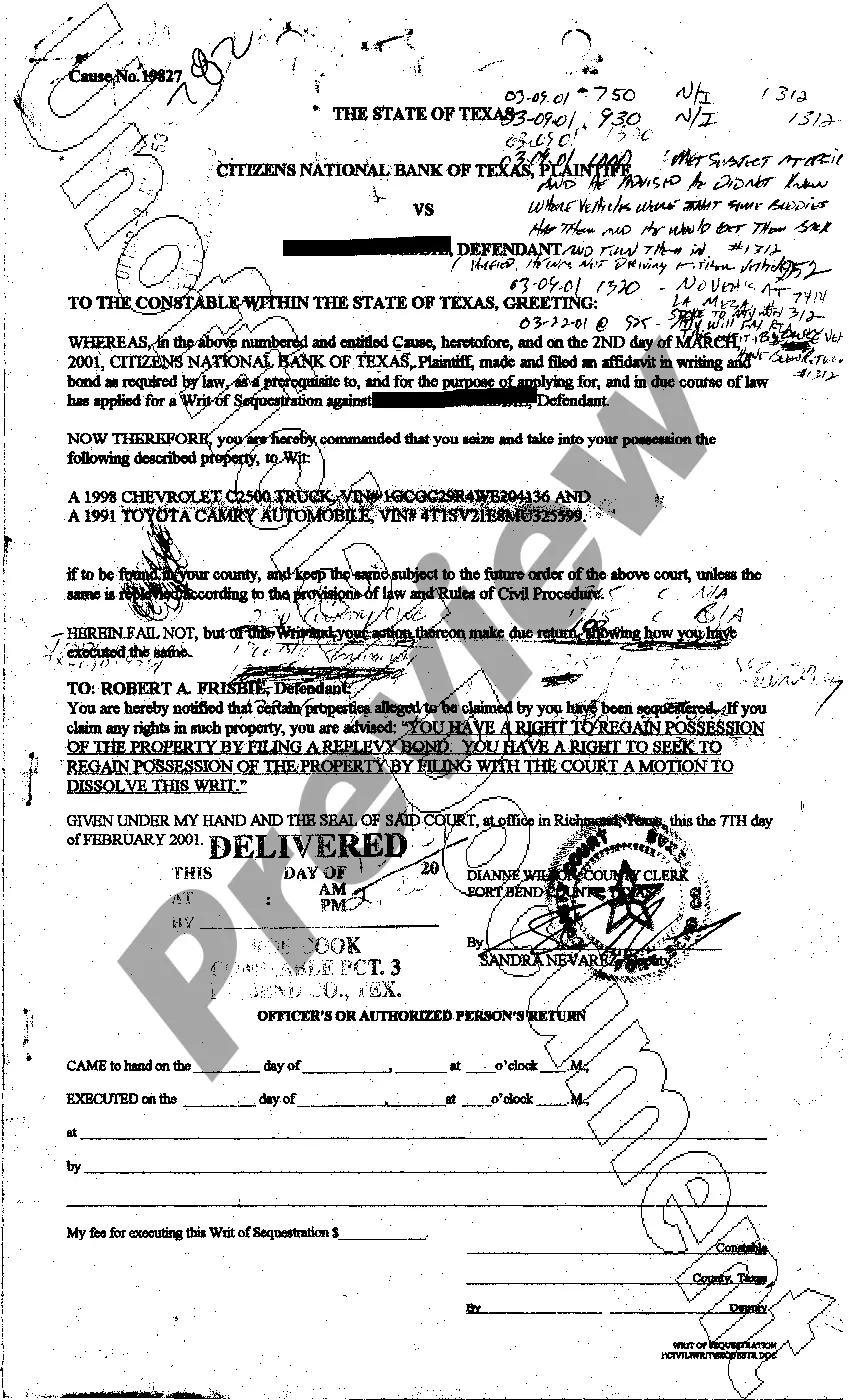

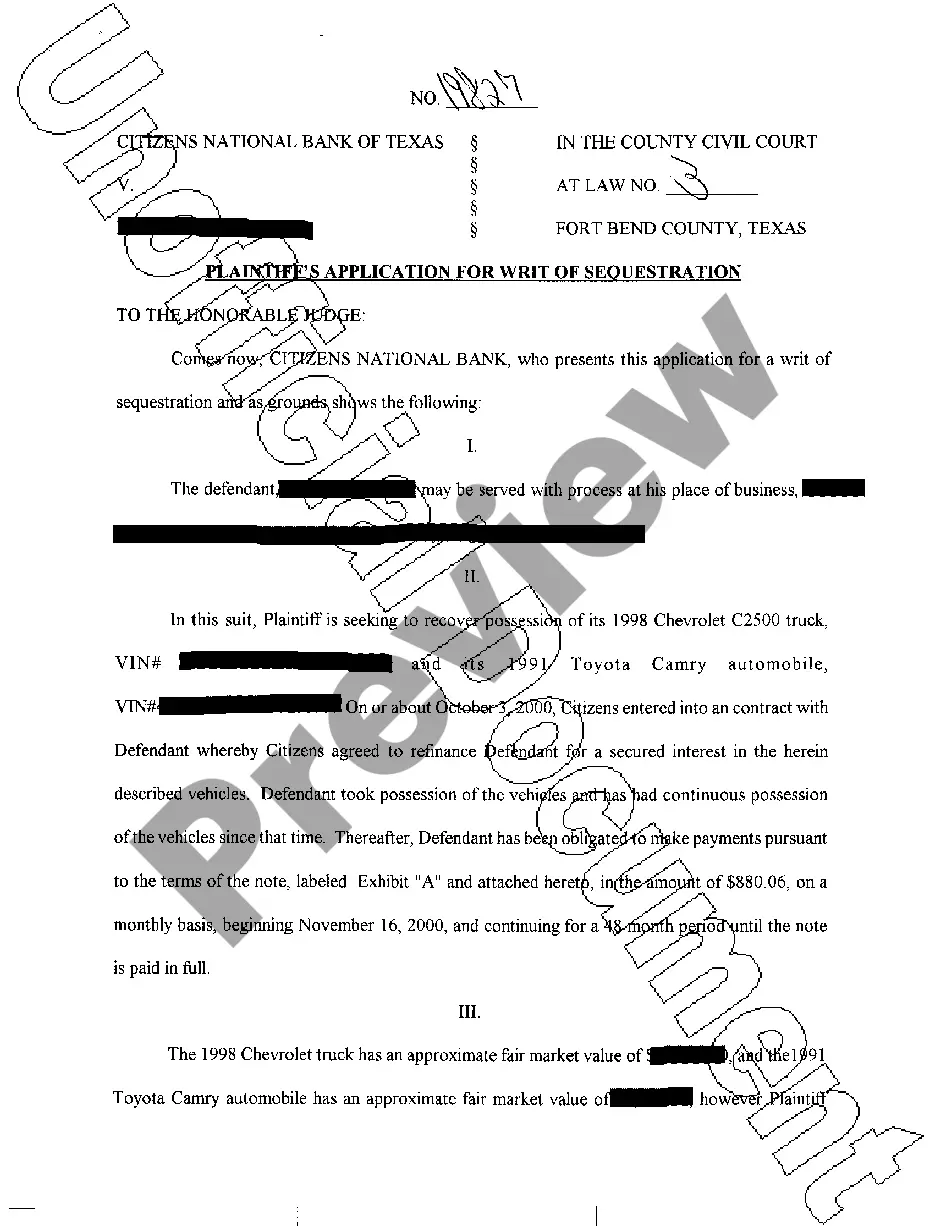

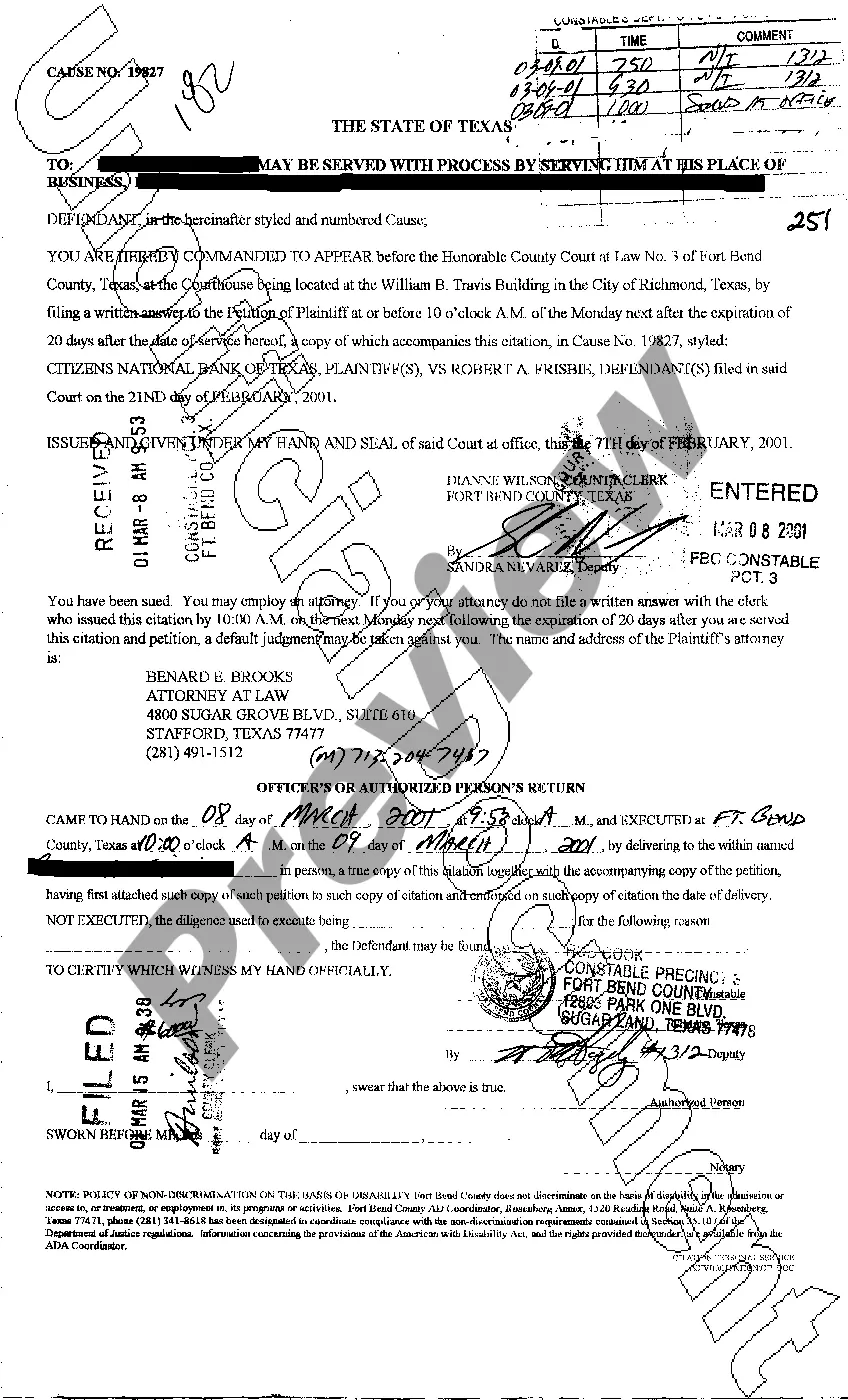

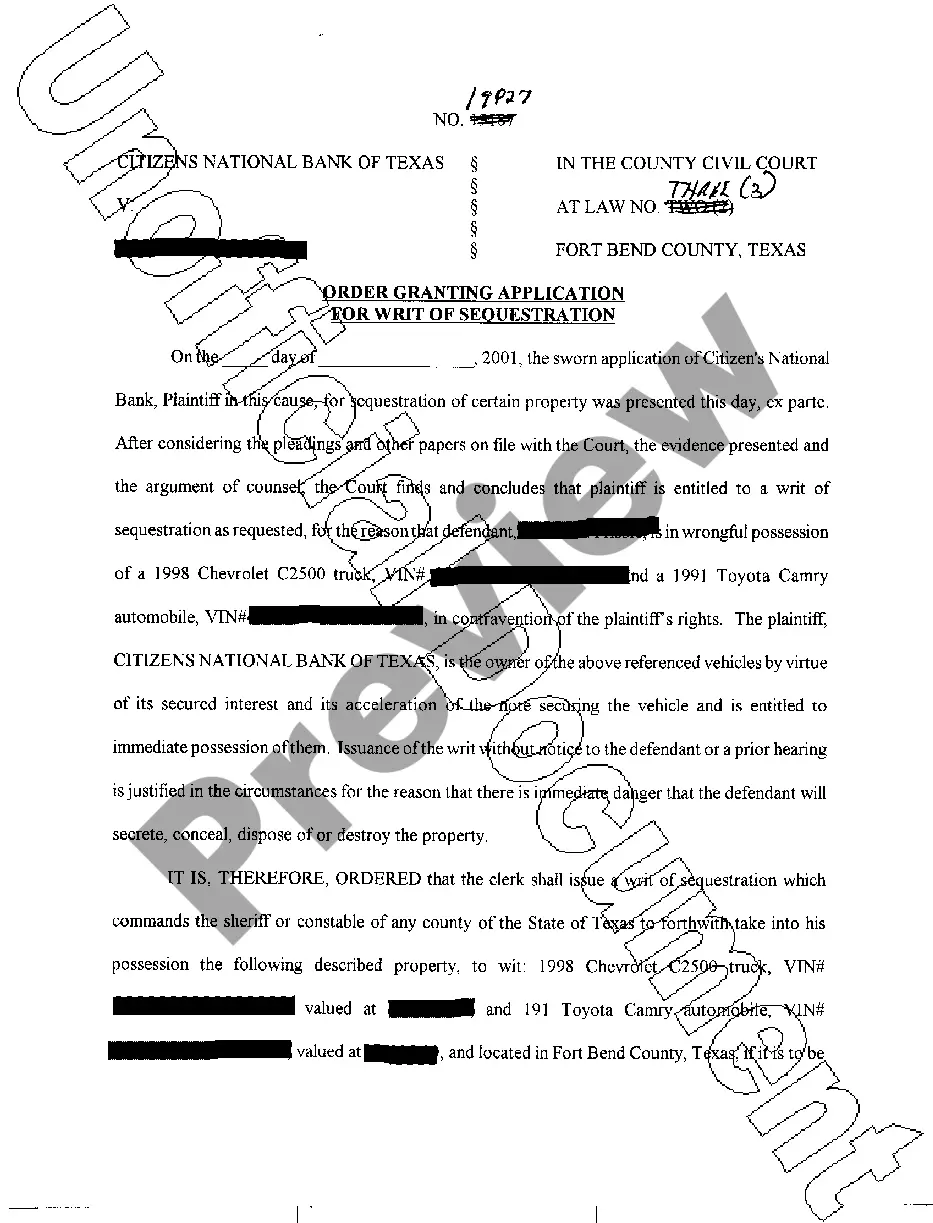

Tarrant Texas Writ of Sequestration

Description

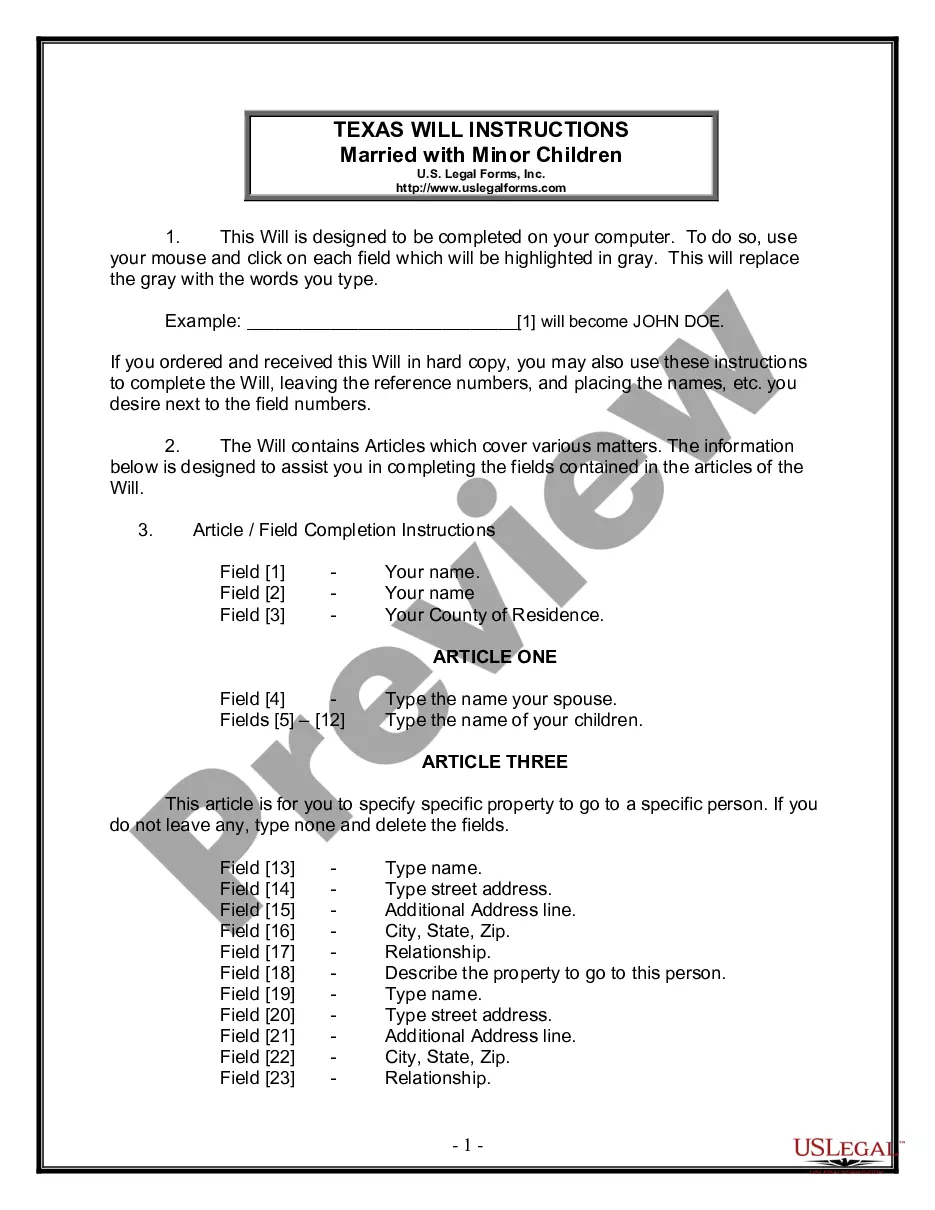

How to fill out Texas Writ Of Sequestration?

If you are in search of a legitimate form template, it’s hard to discover a superior destination than the US Legal Forms website – one of the most extensive online repositories.

With this repository, you can obtain a myriad of form examples for business and personal use categorized by type and location, or by keywords.

Utilizing our premium search feature, acquiring the most recent Tarrant Texas Writ of Sequestration is as straightforward as 1-2-3.

Verify your choice. Opt for the Buy now button. Afterwards, select your preferred pricing option and provide the necessary credentials to create an account.

Complete the payment. Use your credit card or PayPal account to finalize the signup process.

- Furthermore, the accuracy of each and every entry is validated by a team of skilled attorneys who routinely assess the templates on our site and refresh them in line with the latest state and county regulations.

- If you are already familiar with our platform and have an active account, all you need to access the Tarrant Texas Writ of Sequestration is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, just adhere to the steps outlined below.

- Ensure you have opened the sample you seek. Read its description and utilize the Preview option to review its content.

- If it doesn’t satisfy your requirements, take advantage of the Search bar at the top of the page to locate the desired document.

Form popularity

FAQ

In Texas, the court typically issues a writ of possession after a successful eviction lawsuit. This legal document allows a landlord to regain possession of a rental property. The Tarrant Texas Writ of Sequestration operates similarly, allowing property to be secured pending the outcome of litigation. For comprehensive assistance, you can rely on USLegalForms to navigate the process efficiently.

The duration for a writ of possession to be processed in Texas can vary based on the court's schedule and the specifics of the case. In general, once filed, it may take several days to a few weeks before an order is issued. Understanding timelines is essential, especially when considering a Tarrant Texas Writ of Sequestration, as it can affect your planning. Staying in touch with your legal representation will help keep you informed throughout this process.

To file a writ of sequestration in Texas, you need to prepare an application that outlines your case and submit it to the appropriate court. Gathering evidence to support your claim is important, as it will help the court understand why the writ is necessary. If you're unfamiliar with the process, resources like US Legal Forms can guide you through the steps of obtaining a Tarrant Texas Writ of Sequestration. Legal assistance may also be beneficial to ensure all paperwork is correctly filed.

After you file for a writ of possession in Texas, the court will review your application. If granted, the order allows law enforcement to take possession of the property in dispute. In conjunction with the Tarrant Texas Writ of Sequestration, this process ensures that your claim for the property is respected and that you have the support of the legal system. Once the writ is issued, it's crucial to follow up on enforcement to ensure your rights are upheld.

Yes, a writ of possession must be served to the appropriate parties in order to be effective. This ensures that individuals are informed of the court's decision and have the opportunity to respond. The Tarrant Texas Writ of Sequestration works similarly, as proper service ensures that all parties know about the seizure of property. Understanding the process and properly executing service can streamline your legal journey.

In Texas, the rule of sequestration allows a party to obtain a court order to have property seized in order to secure its availability for a legal proceeding. The Tarrant Texas Writ of Sequestration is a vital tool, allowing you to protect your interests in disputes over property. By obtaining this writ, you ensure that the property remains safely under the court's control until the matter can be resolved. This process helps to prevent any unauthorized use or disposal of the property.

In Texas, a writ of execution is valid for 90 days from the date it is issued. During this time, you can take action to seize property and enforce a judgment. If the property is not seized within this period, you may need to request a new writ. To better understand the process, consider using the resources available through US Legal Forms, especially for Tarrant Texas Writ of Sequestration.

The rule 10 motion to withdraw allows attorneys in Texas to exit a case with the court’s permission, ensuring that clients are not left unrepresented. When dealing with Tarrant Texas Writ of Sequestration, understanding this rule can help you recognize the importance of having qualified legal representation throughout your case. This motion provides a structured way for legal professionals to maintain ethical standards while protecting client interests. If you face a situation involving representation, uslegalforms can help clarify your options.

In Texas, you typically have 10 years to file a writ of execution, starting from the date of the judgment. This time limit is crucial in cases involving Tarrant Texas Writ of Sequestration, as it ensures the timely enforcement of your legal rights. Staying informed about this deadline can greatly enhance your ability to retrieve owed amounts. If you need assistance with this process, consider leveraging resources from uslegalforms for guidance.

The rule of sequestration involves obtaining a court order to seize or take possession of a person’s property to preserve it during litigation. In Tarrant Texas Writ of Sequestration cases, this legal tool helps prevent the loss of assets while the matter is resolved in court. Utilizing this rule can offer peace of mind, knowing your interests are protected during the legal process. Understanding the rule can empower you to take decisive action in your legal matters.