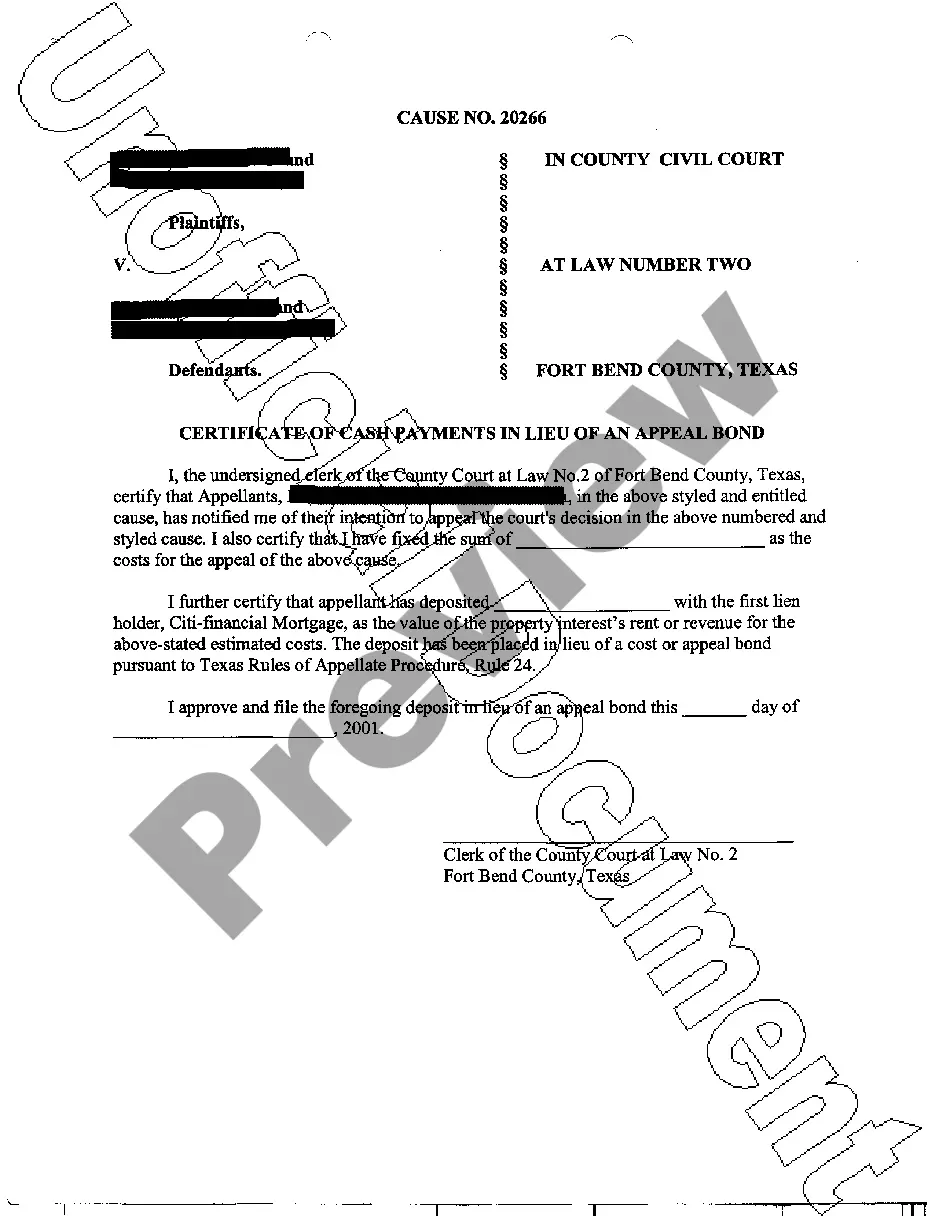

The Dallas Texas Certificate of Cash Payments in Lieu of Bond is a financial instrument that allows individuals or businesses to provide an alternative form of security instead of posting a traditional bond. This certificate is often used in various legal situations where a bond is required, such as in civil cases, criminal cases, or administrative proceedings. The purpose of the Certificate of Cash Payments in Lieu of Bond is to ensure that the involved parties have sufficient funds to cover any potential liability or damages incurred. By providing cash payments in lieu of a bond, individuals or businesses can demonstrate their ability to meet financial obligations while avoiding the need to tie up their capital in a traditional bond. There are different types of Dallas Texas Certificate of Cash Payments in Lieu of Bond, depending on the nature of the case or proceeding. Some common examples include: 1. Civil Certificate of Cash Payments in Lieu of Bond: This type of certificate is frequently used in civil litigation cases, such as personal injury claims or contract disputes. It allows the plaintiff or defendant to provide a cash payment as an alternative to a bond, ensuring that they can cover any potential damages or losses. 2. Criminal Certificate of Cash Payments in Lieu of Bond: In criminal cases, individuals charged with a crime may choose to provide a cash payment instead of posting bond. This type of certificate enables the accused party to secure their release from jail while demonstrating their ability to fulfill any financial obligations tied to the proceedings. 3. Administrative Certificate of Cash Payments in Lieu of Bond: In administrative proceedings, where government agencies oversee matters such as licensing or permits, individuals or businesses may be required to provide a bond. However, they also have the option to use a Certificate of Cash Payments in Lieu of Bond, allowing them to provide cash as an alternative form of security. The Dallas Texas Certificate of Cash Payments in Lieu of Bond is a flexible financial tool that serves as an alternative to traditional bonds. It provides individuals and businesses with greater liquidity while still fulfilling their legal obligations. This option allows parties to allocate their financial resources effectively, ensuring they can cover potential liabilities without tying up their capital in a bond.

Dallas Texas Certificate of Cash Payments in Lieu of Bond

Description

How to fill out Dallas Texas Certificate Of Cash Payments In Lieu Of Bond?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Dallas Texas Certificate of Cash Payments in Lieu of Bond becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Dallas Texas Certificate of Cash Payments in Lieu of Bond takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Dallas Texas Certificate of Cash Payments in Lieu of Bond. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

A family member, the offender, or a third party (as in an associate or a bail bondsman who is able to deal in cash bonds) can post the cash-only bond money in most courts. State regulations often allow a court to apply the cash bond payment to any punishments or fines imposed during the defendant's sentence.

What is a cash bond? A cash bond is cash held as a guarantee of payment. When you bail someone out of jail the easiest option is to post the full amount in cash. If you post bail with cash the bond court holds the full amount to ensure you show up for your court date.

Do you get bail money back in Texas? After paying the bail amount, the defendant still has to go to trial. If the defendant appears in court for trial, they get their money back. However, if the defendant defaults to the court trial, they will not get their money back.

The main difference between a cash bond and a surety bond is the number of parties involved. Cash bonds only involve two parties, you and the owner. In a surety bond, there is a third party, the surety company. The term surety refers to any party that guarantees the payment of a debt or performance of a contract.

However, if the full amount of bail must be posted, the defendant has what is referred to as a cash-only bond. This means the judge mandates that the defendant cover the full cost in the form of a cash deposit, providing reassurance that he or she will return for the scheduled court date.

Translation. For those accused of a felony, the defendant is generally entitled to a personal bond after 90 days of incarceration have elapsed if the defendant has not been indicted.

What does full cash bond mean? It means that the court will only accept the full cash amount to release someone from jail. In these instances, you'll have to pay the exact amount in cash or use a credit or debit card to complete payment. Bail bonds will not be accepted.

Cash Bonds: A cash bond is just that - a bond that may only be paid with cash. Should you appear for trial, or should the charges be disposed of before trial, the amount posted will be refunded. If you do not appear, all cash posted will be forfeit.

Any person who deposits a cash bail can request that the funds be returned to him/her by submitting to the Court a written document entitled, Application For Return of Cash Bail. The Court will then decide if all or part of the funds should be returned to the depositor.

Cash-Only Bond Payment An individual who pays the cash-only bond at the jail is required to pay the entire amount. This means that the jail does not provide change for large bills or an inexact amount of money.

More info

More than 80 percent of the estates probated in the past four years include a financial agreement that requires certain employees to handle their employers' money and property. These are all great reasons to go to the State Insurance Commission to make sure your employee and the school district is fulfilling its obligations, and you aren't responsible. It is also a good thing to do if a party is unable to make court required payments and the party should have an independent administrator to handle the situation, because then your assets are secure, and you won't be responsible. Check into paying your attorney's fees if there are any. This is a special type of bankruptcy, but there have been a few court records showing that it's possible. If you have an attorney, and are filing your bankruptcy, I'd think about that. This is more a question and answer type of process than something you can just do. What if I need a payment plan for an item that has a balance due?

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.