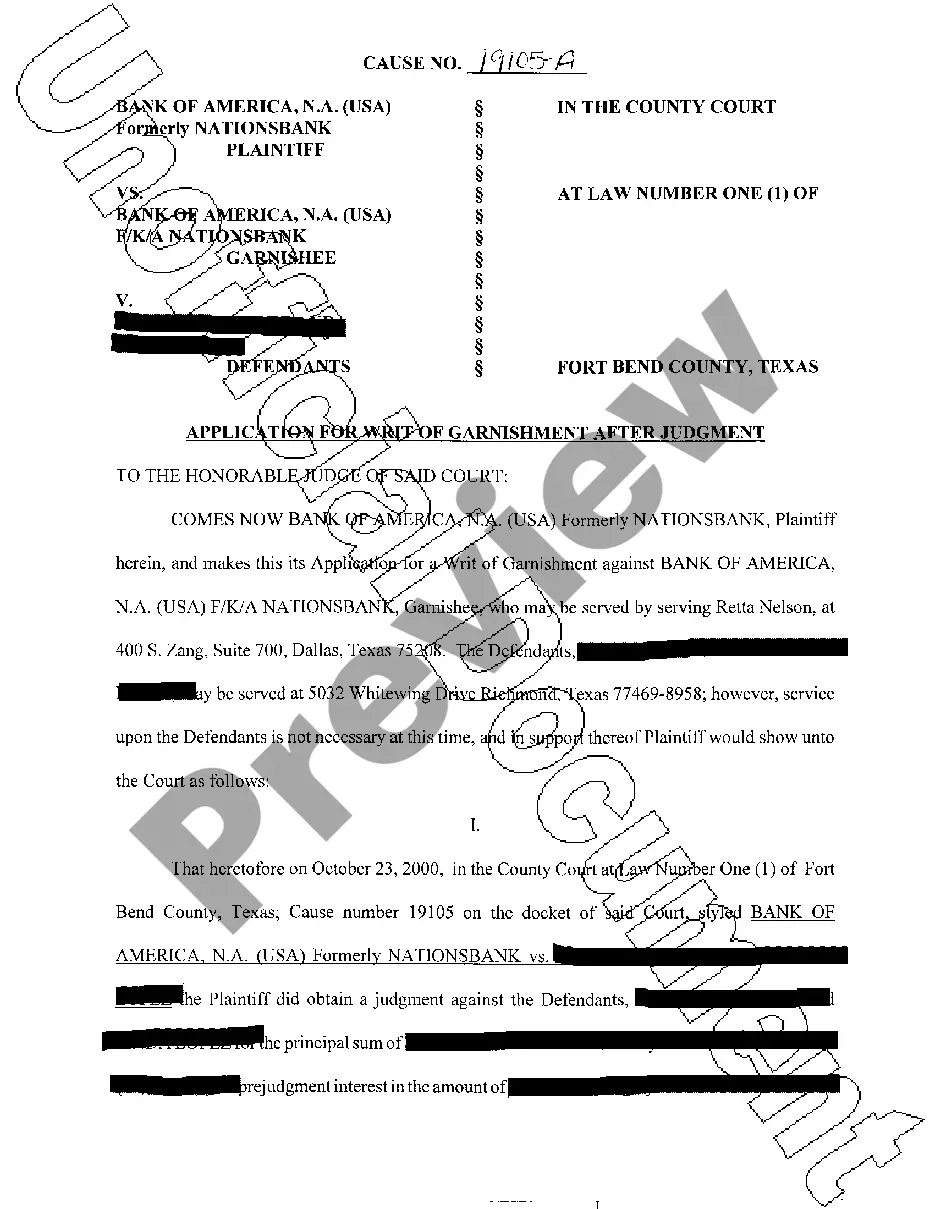

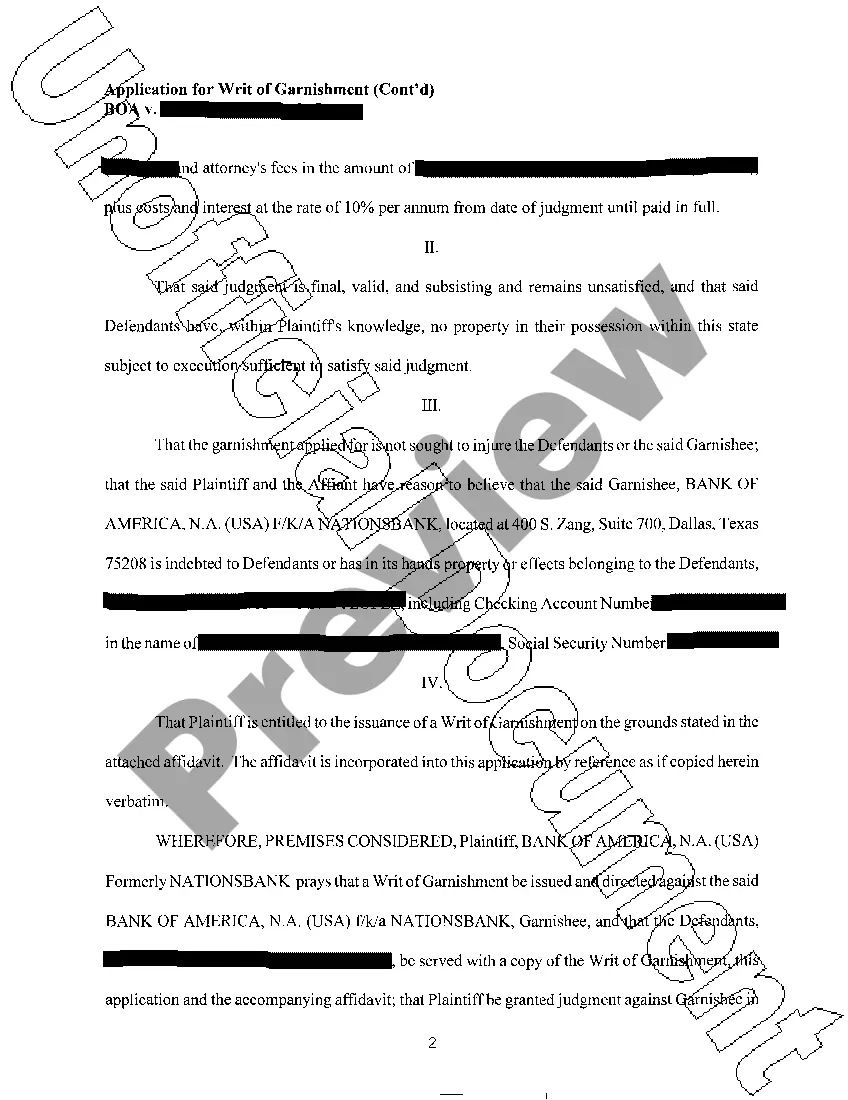

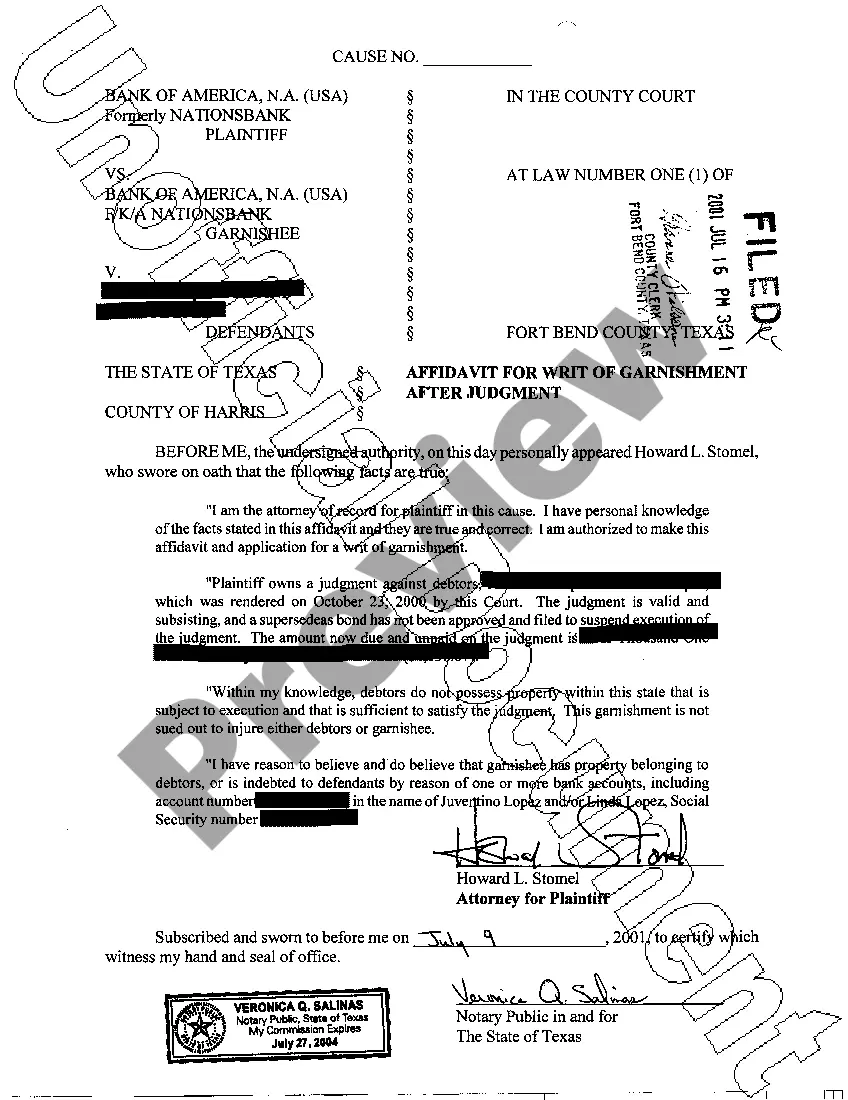

The Carrollton Texas Application for Writ of Garnishment is a legal document used in the state of Texas to initiate the process of garnishing wages or other income of a debtor. This application is typically filed by a creditor or a judgment holder who wishes to collect on a debt that is owed to them. A writ of garnishment is a court order, issued by the appropriate legal authority, which allows the creditor to collect a portion of the debtor's wages, bank accounts, or other assets in order to satisfy the outstanding debt. This legal process ensures that the creditor receives the appropriate amount owed, while providing the debtor with a reasonable means to pay off their debt. Carrollton, Texas has specific guidelines and procedures for filing an application for a writ of garnishment. The application must be submitted to the appropriate court, along with the required supporting documentation and fees. The debtor must be properly notified of the garnishment and given an opportunity to respond or contest the application if they believe it is unjust. It is important to note that the Carrollton Texas Application for Writ of Garnishment can be used for various types of debts, including but not limited to: 1. Wage garnishment: This type of garnishment allows the creditor to collect a portion of the debtor's wages directly from their employer. The employer is legally obligated to withhold the specified amount and send it to the creditor. 2. Bank account garnishment: With this type of garnishment, the creditor can collect funds directly from the debtor's bank account(s). The bank is required to freeze the specified amount and release it to the creditor. 3. Property or asset garnishment: In some cases, the creditor may seek to garnish specific assets or property owned by the debtor. This can include seizing and selling assets such as vehicles, real estate, or valuable possessions to satisfy the debt. 4. Other sources of income: The Carrollton Texas Application for Writ of Garnishment can also be used to collect funds from other sources of income, such as rental income, royalty payments, or retirement benefits. When filing the Carrollton Texas Application for Writ of Garnishment, it is crucial to provide accurate and detailed information about the debtor, their outstanding debt, and the reasons for seeking garnishment. Any errors or omissions on the application could lead to delays or even dismissal of the garnishment request. In summary, the Carrollton Texas Application for Writ of Garnishment is a legal tool that allows creditors to collect outstanding debts by garnishing wages, bank accounts, or other assets owned by the debtor.

Carrollton Texas Application for Writ of Garnishment

State:

Texas

City:

Carrollton

Control #:

TX-G0406

Format:

PDF

Instant download

This form is available by subscription

Description

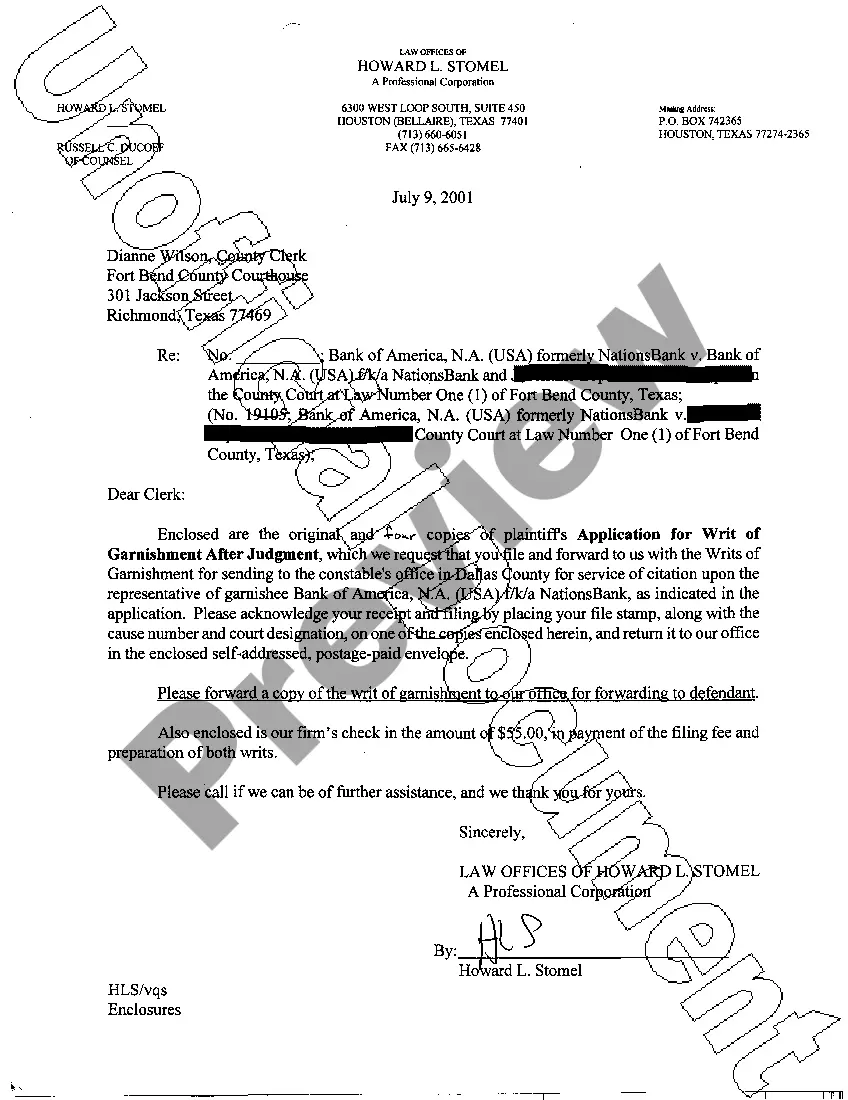

A01 Application for Writ of Garnishment

The Carrollton Texas Application for Writ of Garnishment is a legal document used in the state of Texas to initiate the process of garnishing wages or other income of a debtor. This application is typically filed by a creditor or a judgment holder who wishes to collect on a debt that is owed to them. A writ of garnishment is a court order, issued by the appropriate legal authority, which allows the creditor to collect a portion of the debtor's wages, bank accounts, or other assets in order to satisfy the outstanding debt. This legal process ensures that the creditor receives the appropriate amount owed, while providing the debtor with a reasonable means to pay off their debt. Carrollton, Texas has specific guidelines and procedures for filing an application for a writ of garnishment. The application must be submitted to the appropriate court, along with the required supporting documentation and fees. The debtor must be properly notified of the garnishment and given an opportunity to respond or contest the application if they believe it is unjust. It is important to note that the Carrollton Texas Application for Writ of Garnishment can be used for various types of debts, including but not limited to: 1. Wage garnishment: This type of garnishment allows the creditor to collect a portion of the debtor's wages directly from their employer. The employer is legally obligated to withhold the specified amount and send it to the creditor. 2. Bank account garnishment: With this type of garnishment, the creditor can collect funds directly from the debtor's bank account(s). The bank is required to freeze the specified amount and release it to the creditor. 3. Property or asset garnishment: In some cases, the creditor may seek to garnish specific assets or property owned by the debtor. This can include seizing and selling assets such as vehicles, real estate, or valuable possessions to satisfy the debt. 4. Other sources of income: The Carrollton Texas Application for Writ of Garnishment can also be used to collect funds from other sources of income, such as rental income, royalty payments, or retirement benefits. When filing the Carrollton Texas Application for Writ of Garnishment, it is crucial to provide accurate and detailed information about the debtor, their outstanding debt, and the reasons for seeking garnishment. Any errors or omissions on the application could lead to delays or even dismissal of the garnishment request. In summary, the Carrollton Texas Application for Writ of Garnishment is a legal tool that allows creditors to collect outstanding debts by garnishing wages, bank accounts, or other assets owned by the debtor.

Free preview

How to fill out Carrollton Texas Application For Writ Of Garnishment?

If you’ve already used our service before, log in to your account and download the Carrollton Texas Application for Writ of Garnishment on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Carrollton Texas Application for Writ of Garnishment. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!