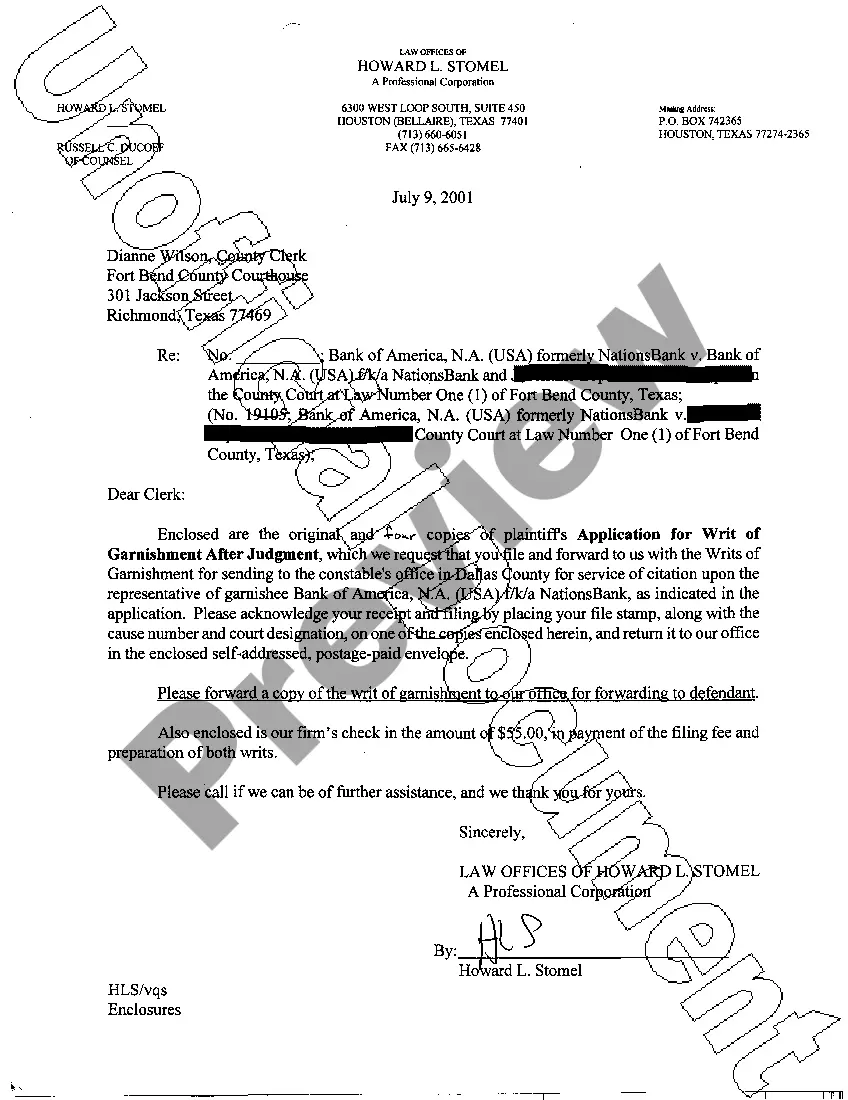

Collin Texas Application for Writ of Garnishment is a legal document that allows creditors to collect the debts owed to them by an individual or business entity residing in Collin County, Texas. This application is filed with the court to initiate the process of garnishing the debtor's wages, bank accounts, or other assets to satisfy the outstanding debt. The Collin Texas Application for Writ of Garnishment is designed to aid creditors in recovering their owed funds by legally compelling the debtor's employer or financial institutions to withhold a portion of the debtor's income or freeze their bank accounts. This process ensures that the debt is paid off in a timely manner while adhering to the legal procedures outlined by the state of Texas. There are several types of Collin Texas Applications for Writ of Garnishment, each tailored to specific circumstances: 1. Writ of Garnishment for Issued Earnings: This application is used when a creditor seeks to garnish a debtor's wages or salary. Once approved by the court, the employer is notified and bound by law to withhold a specific percentage or amount from the debtor's paycheck until the debt is satisfied. 2. Writ of Garnishment for Bank Accounts: This application is utilized when a creditor wishes to garnish funds held in the debtor's bank account(s). Once approved, the financial institution is directed to freeze the debtor's account(s) and withhold the specified amount determined by the court. 3. Writ of Garnishment for Other Property: In some cases, creditors may seek to garnish assets such as real estate, vehicles, or other property owned by the debtor. This application allows the court to order the seizure and sale of the specified property to satisfy the outstanding debt. 4. Writ of Garnishment for Judgment Debtor's Property: This application is filed by creditors who have obtained a judgment against the debtor in court. It allows them to garnish the debtor's property to enforce the judgment and collect the owed amount. Regardless of the type, the Collin Texas Application for Writ of Garnishment must be completed accurately and submitted to the appropriate court. It is crucial for creditors to consult with an attorney or legal professional familiar with Texas garnishment laws to ensure proper execution of the application and adherence to established procedures.

Collin Texas Application for Writ of Garnishment

Description

How to fill out Collin Texas Application For Writ Of Garnishment?

Make use of the US Legal Forms and get immediate access to any form you require. Our beneficial platform with a large number of document templates makes it simple to find and obtain virtually any document sample you require. You are able to download, complete, and certify the Collin Texas Application for Writ of Garnishment in a few minutes instead of browsing the web for several hours searching for a proper template.

Utilizing our catalog is a superb strategy to increase the safety of your form submissions. Our professional legal professionals regularly check all the records to make sure that the forms are relevant for a particular state and compliant with new acts and regulations.

How can you get the Collin Texas Application for Writ of Garnishment? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you look at. Additionally, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction listed below:

- Open the page with the template you require. Ensure that it is the template you were looking for: check its headline and description, and utilize the Preview function when it is available. Otherwise, utilize the Search field to find the needed one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order using a credit card or PayPal.

- Export the document. Indicate the format to get the Collin Texas Application for Writ of Garnishment and change and complete, or sign it for your needs.

US Legal Forms is probably the most extensive and reliable document libraries on the web. Our company is always ready to help you in any legal process, even if it is just downloading the Collin Texas Application for Writ of Garnishment.

Feel free to take full advantage of our platform and make your document experience as straightforward as possible!

Form popularity

FAQ

You can try and get your money (called 'enforcing your judgment') by asking the court for: a warrant of control. an attachment of earnings order. a third-party debt order. a charging order.

Lynne Finley is a Texas native who has lived and practiced law in Collin County for more than 26 years.

Lieutenant General Michael Carl Gould (born December 21, 1953) is a retired senior officer of the United States Air Force who served as the 18th Superintendent of the United States Air Force Academy.

Do Judgments Expire in Texas? Judgments awarded in Texas to a non-government creditor are generally valid for ten years but they can be renewed for longer. If a judgment is not renewed, it will become dormant.

A judgement will state that you have not paid your debt and it will reflect on your credit record for 5 years. When a judgement is granted, a creditor can apply for a warrant where the sheriff can attach goods such as your furniture and sell these to pay your debt.

On their own motion, the district judges issue this standing order, which shall apply to suits for dissolution of marriage and suits affecting the parent-child relationship, for the protection of the parties and their children, and for the preservation of their property.

Lynne Finley, District Clerk.

Texas law provides that every county in the state have a Small Claims Court as a forum for settling legal disputes involving cases for money damages up to $10,000. It costs approximately $85 to file a case. You can represent yourself in Small Claims Court or have an attorney.

If a defendant does not pay a judgment, the plaintiff can try to enforce the judgment by filing another lawsuit. For example, if the defendant owns several cars, the plaintiff can sue to have the car transferred to the plaintiff.

What Happens After the Filing of a Motion for Default Judgment? After the motion for default judgment is filed and served upon the defendant, the defendant has an opportunity to respond. The defendant's response should state a valid reason why they didn't respond within the 20 day period to respond to complaints.