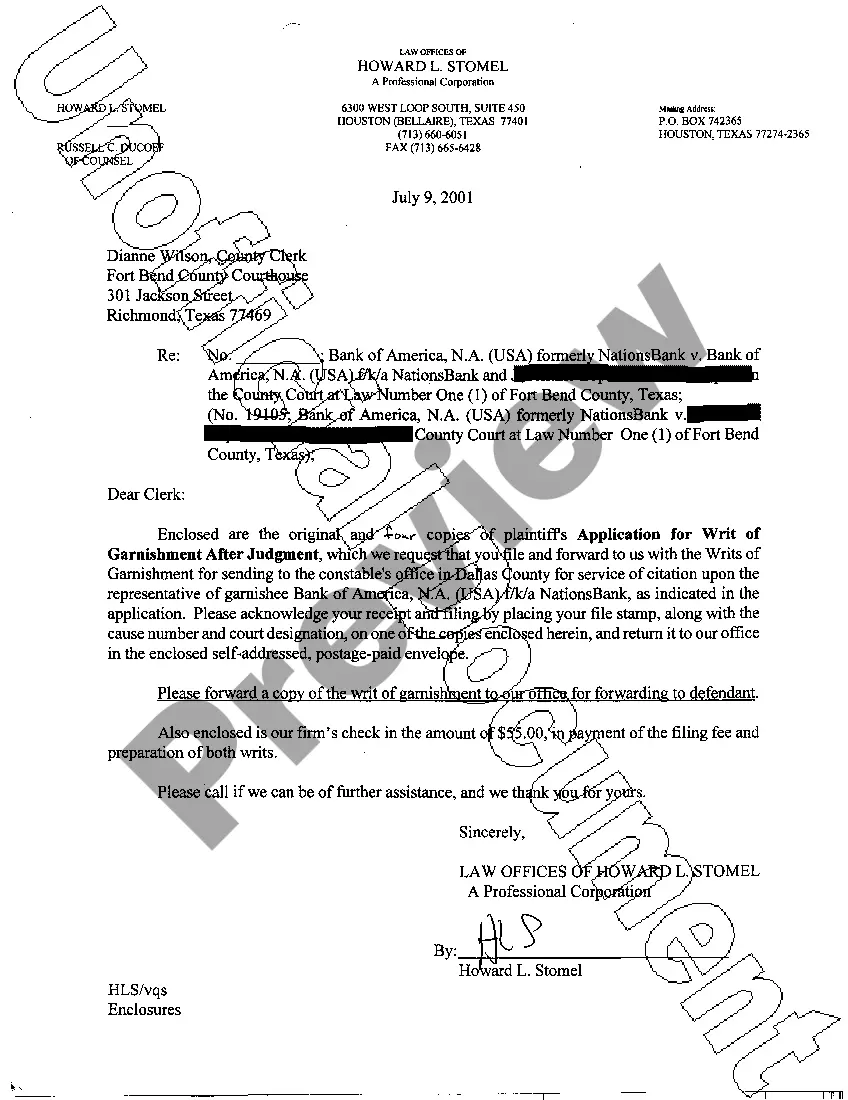

Laredo, Texas Application for Writ of Garnishment: A Comprehensive Overview In Laredo, Texas, an Application for Writ of Garnishment is a legal process through which a judgment creditor seeks to collect a debt by requesting that a portion of the debtor's wages, bank accounts, or other assets be withheld and transferred directly to the creditor. This writ serves as a powerful tool to enforce judgments and recover unpaid debts. The Laredo, Texas Application for Writ of Garnishment typically involves the following key steps: 1. Filing of the Application: To initiate the process, the judgment creditor (the party owed the debt) files an Application for Writ of Garnishment with the appropriate Laredo court. This application includes essential details such as the debtor's name, address, and amount owed. It is crucial to accurately complete this documentation to ensure the successful enforcement of the judgment. 2. Service of Process: Once the Application for Writ of Garnishment is filed, it is essential to serve the necessary notice and copies of the application and related documents to the debtor. Proper service ensures that the debtor is aware of the garnishment proceedings and has an opportunity to respond or challenge the garnishment. 3. Waiting Period and Response: After being served, the debtor typically has a specific period to respond, typically around 14 days, depending on the type of debt and jurisdiction. The debtor may choose to challenge the garnishment on legal grounds, such as claiming exemptions or disputing the validity of the debt. However, it should be noted that failing to respond within the given timeframe can result in a default judgment, making it crucial for debtors to act promptly. Types of Laredo, Texas Application for Writ of Garnishment: 1. Writ of Garnishment on Earnings: This type of garnishment targets the debtor's wages. The employer is then legally obligated to withhold a specific percentage of the debtor's earnings and forward it to the judgment creditor until the debt is satisfied or the court orders otherwise. 2. Writ of Garnishment on Bank Accounts: This writ allows the creditor to seize funds directly from the debtor's bank accounts. Once served, the bank freezes the specified amount of funds for a determined period, after which they are sent to the creditor if the debt remains unpaid. 3. Writ of Garnishment on Property: In some cases, certain properties owned by the debtor can be subject to garnishment. However, this process may require additional legal steps, such as obtaining a lien on the property or going through a separate foreclosure process, depending on the nature and location of the property. It is vital for both creditors and debtors in Laredo, Texas, to understand the Application for Writ of Garnishment process thoroughly. While it provides an effective means for creditors to collect unpaid debts, debtors should be aware of their legal rights and available defenses to potentially challenge or minimize the impact of a garnishment. Seeking legal advice from a qualified attorney is highly recommended navigating this complex legal procedure successfully.

Laredo Texas Application for Writ of Garnishment

Description

How to fill out Laredo Texas Application For Writ Of Garnishment?

If you are looking for a valid form, it’s difficult to choose a more convenient service than the US Legal Forms website – one of the most comprehensive libraries on the internet. Here you can find a huge number of form samples for company and individual purposes by types and states, or keywords. With our advanced search function, finding the latest Laredo Texas Application for Writ of Garnishment is as easy as 1-2-3. Additionally, the relevance of each and every file is verified by a group of professional attorneys that on a regular basis check the templates on our website and update them according to the latest state and county laws.

If you already know about our system and have an account, all you should do to get the Laredo Texas Application for Writ of Garnishment is to log in to your account and click the Download button.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have found the sample you require. Look at its information and utilize the Preview function (if available) to explore its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to get the appropriate file.

- Confirm your choice. Click the Buy now button. Following that, select the preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Make use of your bank card or PayPal account to finish the registration procedure.

- Get the form. Indicate the file format and download it on your device.

- Make changes. Fill out, edit, print, and sign the obtained Laredo Texas Application for Writ of Garnishment.

Each and every form you save in your account has no expiry date and is yours permanently. You always have the ability to gain access to them via the My Forms menu, so if you need to receive an extra duplicate for editing or creating a hard copy, you can return and export it once again at any moment.

Take advantage of the US Legal Forms extensive library to get access to the Laredo Texas Application for Writ of Garnishment you were seeking and a huge number of other professional and state-specific templates in one place!