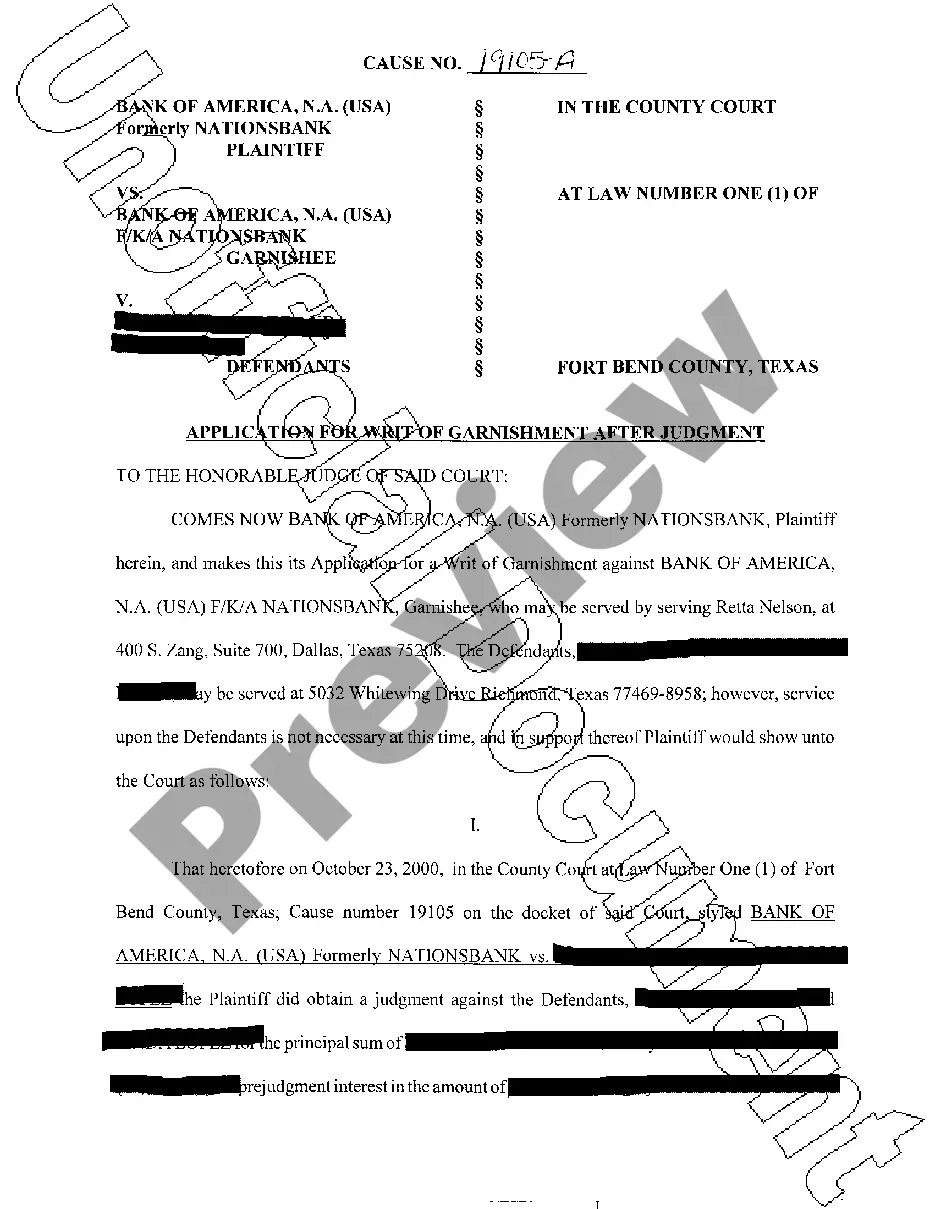

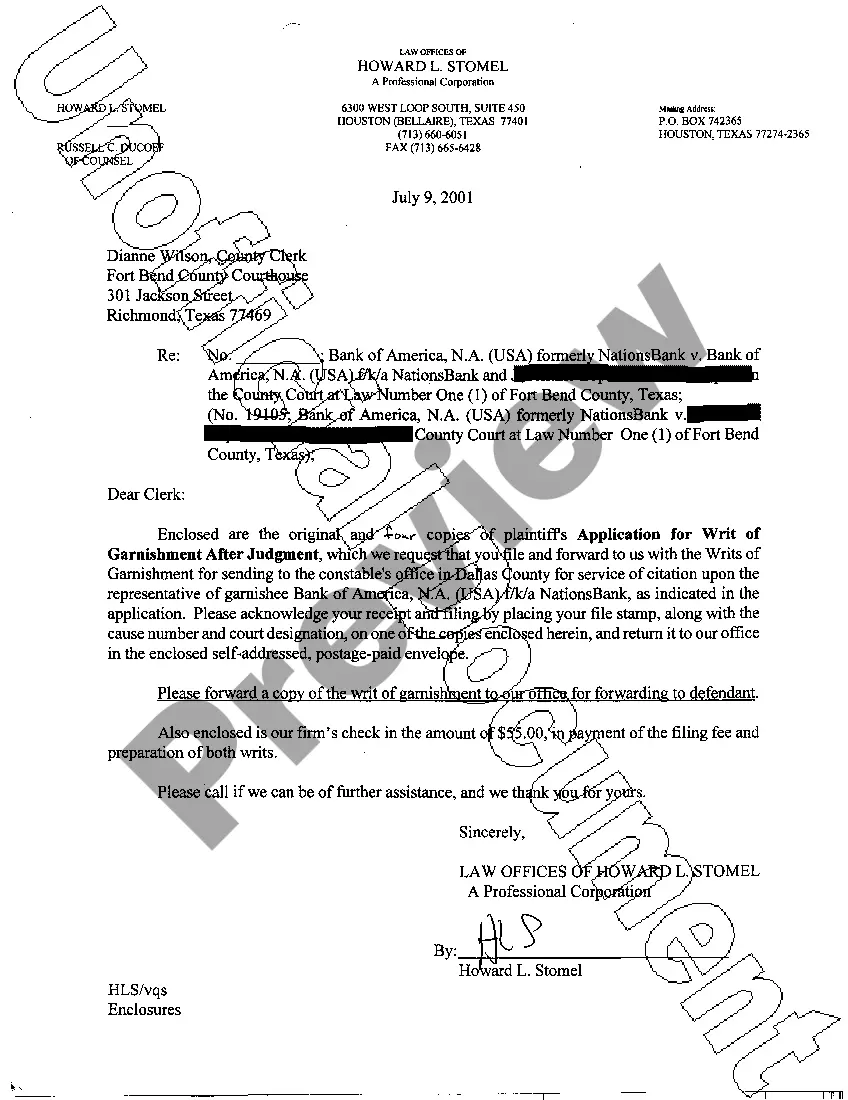

McKinney Texas Application for Writ of Garnishment

Description

How to fill out Texas Application For Writ Of Garnishment?

We consistently aim to reduce or circumvent legal repercussions when navigating intricate legal or financial issues.

To achieve this, we seek legal remedies that, generally speaking, can be quite expensive. However, not all legal situations are of equal intricacy. The majority of them can be managed by ourselves.

US Legal Forms is a web-based repository of current DIY legal documents that cover anything from wills and power of attorney to articles of incorporation and petitions for dissolution. Our collection empowers you to handle your legal affairs independently without enlisting the help of legal advisors.

We provide access to legal document frameworks that aren’t always available to the public. Our samples are tailored to specific states and regions, which significantly streamlines the search process.

Ensure that the McKinney Texas Application for Writ of Garnishment complies with the laws and regulations of your state and locality. Furthermore, it’s essential to review the outline of the form (if available), and if you detect any inconsistencies with your initial requirements, seek an alternative form. Once you confirm that the McKinney Texas Application for Writ of Garnishment is suitable for your needs, you can choose a subscription plan and proceed with payment. You can then download the document in any preferred format. Throughout our 24 years in operation, we have assisted millions of individuals by providing ready-to-customize and current legal forms. Benefit from US Legal Forms today to save time and energy!

- Take advantage of US Legal Forms whenever you wish to obtain and download the McKinney Texas Application for Writ of Garnishment or any other document with ease and security.

- Simply Log In to your account and click the Get button next to it.

- In case you misplace the form, you can always redownload it from the My documents tab.

- The process is equally simple if you’re new to the website! You can create your account in just a few minutes.

Form popularity

FAQ

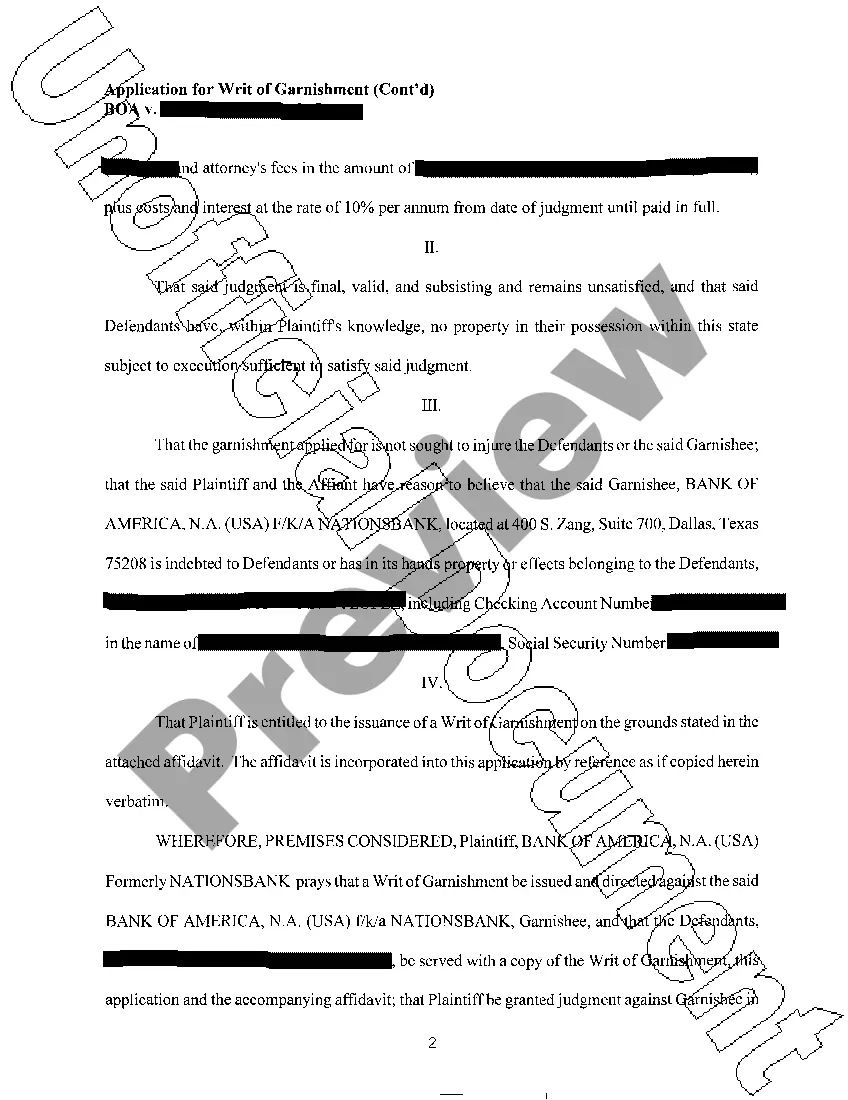

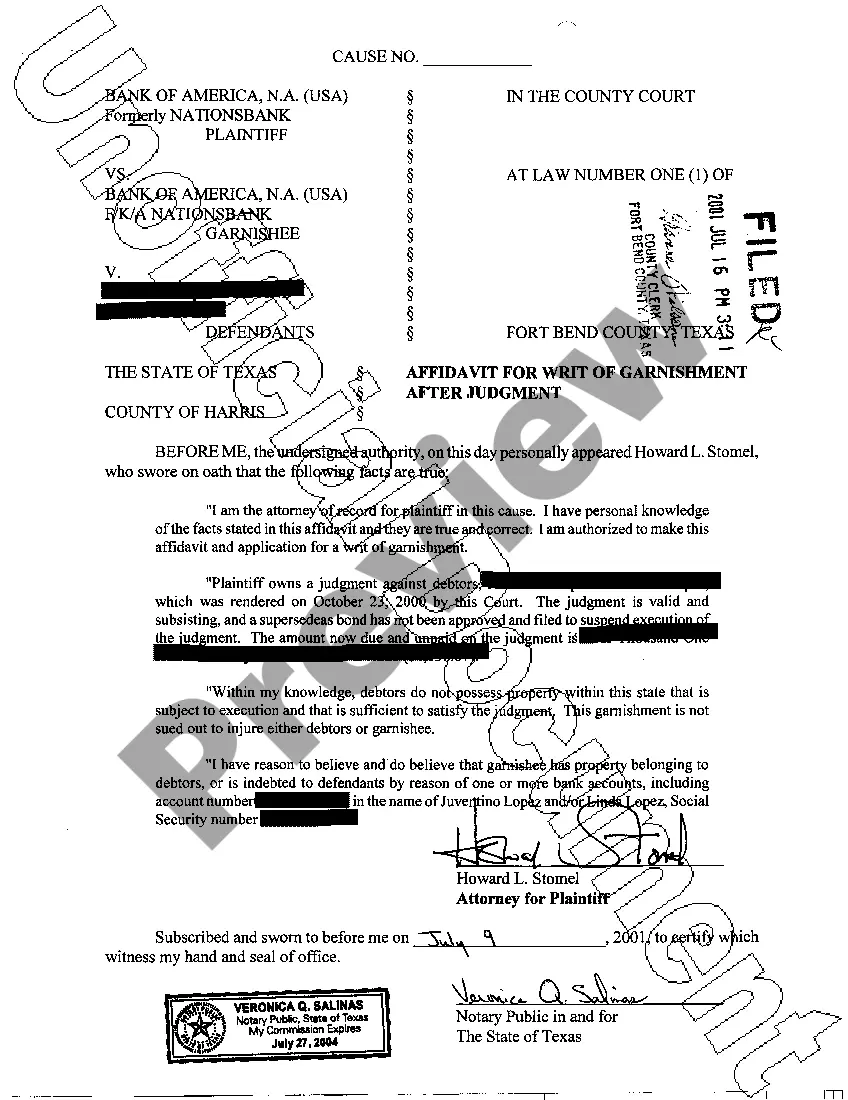

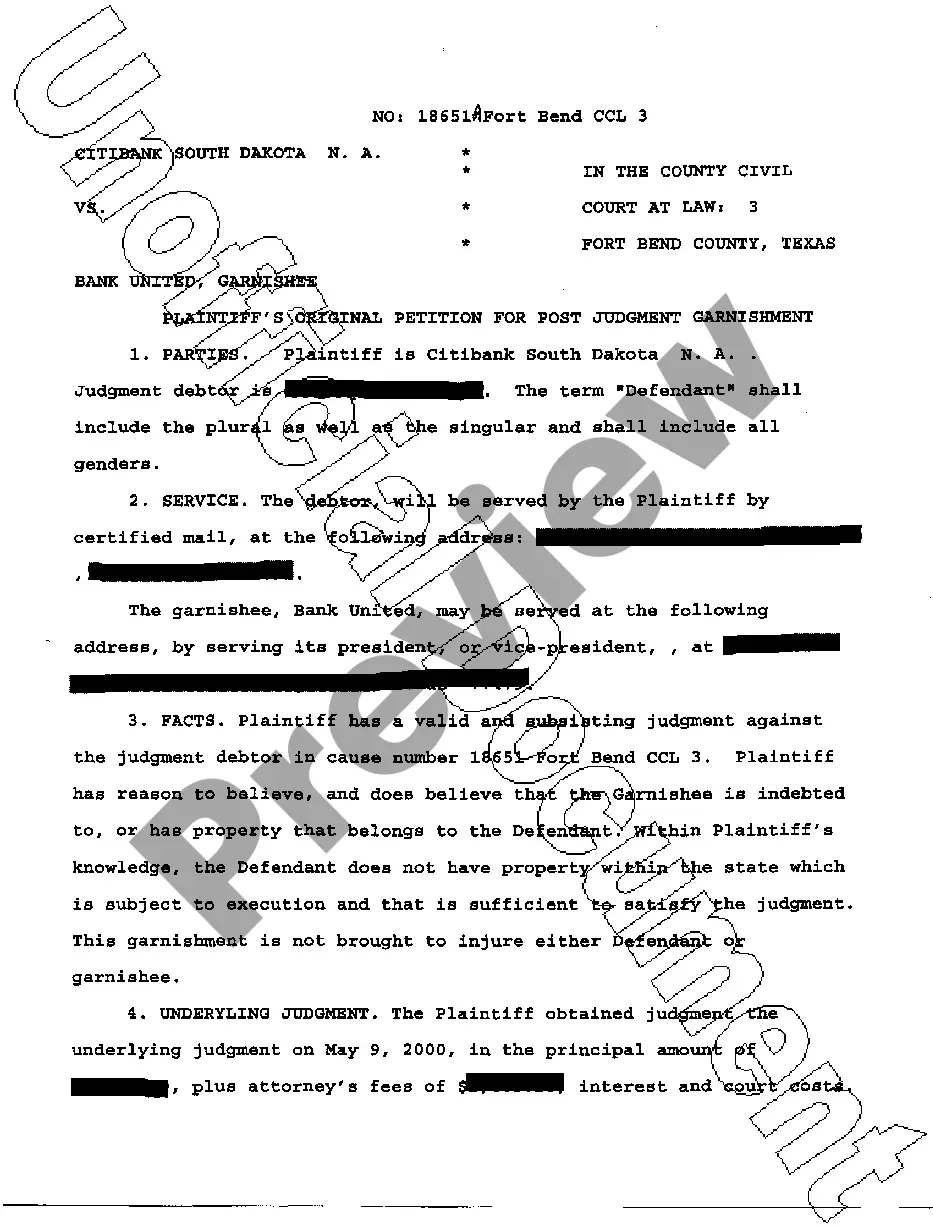

A writ of garnishment in Texas allows a creditor to collect funds directly from a debtor's paycheck or bank account. The creditor must first obtain a court order through a McKinney Texas Application for Writ of Garnishment, then serve it to the employer or bank. Once the writ is served, the employer or bank is legally required to withhold the specified amount until the debt is settled. This ensures a streamlined collection process for creditors.

A writ of execution and garnishment serve different purposes in Texas law. A writ of execution allows a creditor to seize a debtor's property to satisfy a judgment, while garnishment specifically targets a debtor's earnings or funds held by third parties, such as banks. Knowing the distinctions can help you decide the right approach. Utilizing the McKinney Texas Application for Writ of Garnishment can simplify this process.

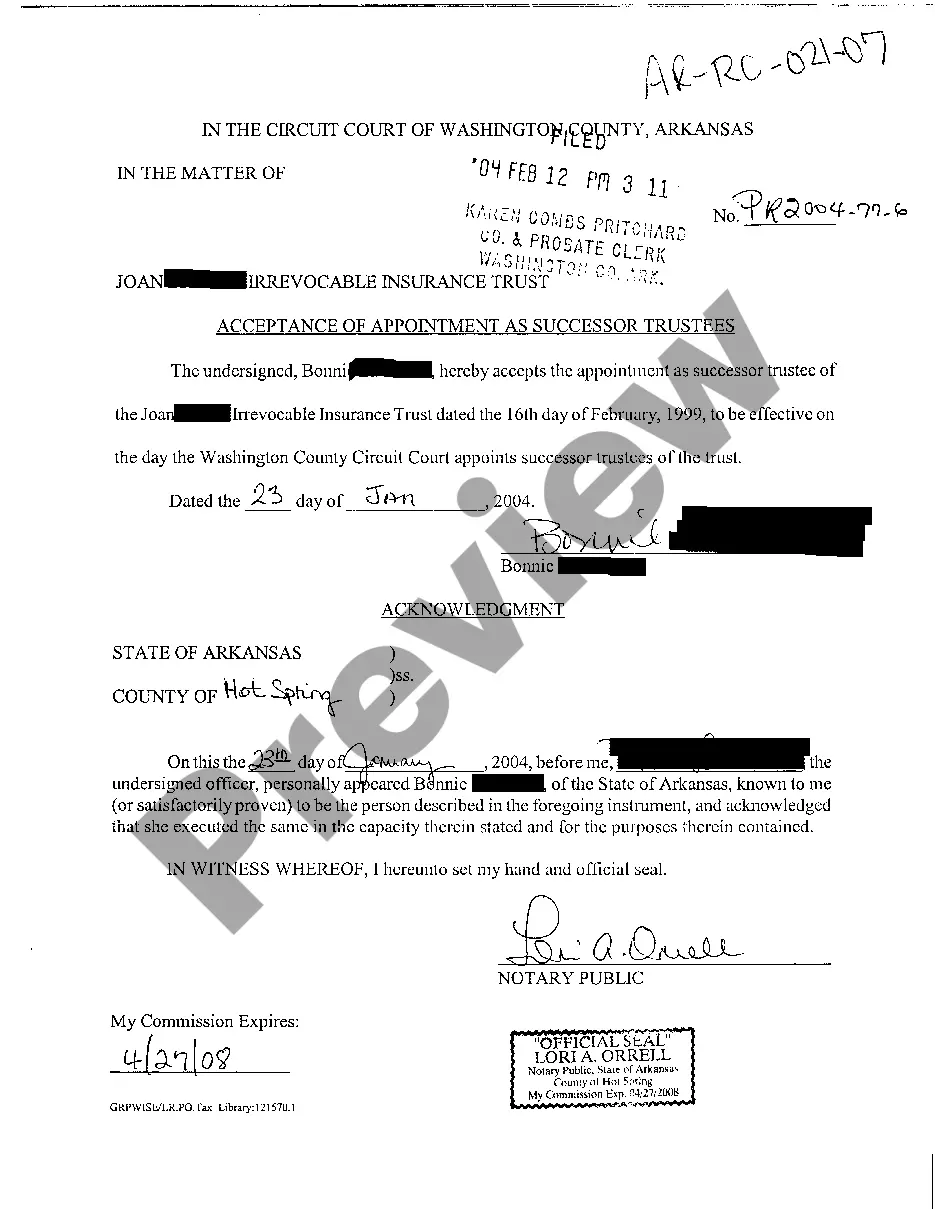

In Texas, certain assets are protected from seizure in a judgment. Exempt property includes your homestead, certain personal property, retirement accounts, and insurance policies. Understanding these protections is vital when dealing with a McKinney Texas Application for Writ of Garnishment. Always consult with a legal expert to navigate these complex rules effectively.

If an employer ignores a wage garnishment in Texas, they could face serious consequences. The court may hold the employer in contempt, resulting in fines or other penalties. Additionally, the employee can pursue further legal action to enforce the garnishment. It's essential to follow the proper procedures outlined in the McKinney Texas Application for Writ of Garnishment to ensure compliance.

The main distinction between a writ of execution and a writ of garnishment lies in their purpose. A writ of execution allows a creditor to seize specific assets owned by the debtor, such as property or personal belongings. In contrast, the McKinney Texas Application for Writ of Garnishment targets funds held by a third party, like a bank or employer, thereby freezing those assets until the debt is settled. Understanding these differences can help you choose the appropriate legal remedy for debt collection.

Protecting your bank account from garnishment in Texas involves a few strategies. First, ensure that you are aware of your rights as a debtor, as certain funds may be exempt from garnishment. It may also be wise to consult legal experts or utilize services like the USLegalForms platform for guidance on your specific situation. Being proactive can help you manage your finances and safeguard your assets against potential garnishments.

Yes, you can file a writ of garnishment in Texas if you hold a valid court judgment against a debtor. The process begins with the McKinney Texas Application for Writ of Garnishment, which you submit to the local court. If accepted, the court issues the writ, enabling you to garnish the debtor's assets. However, it is essential to follow Texas laws to ensure that your garnishment is lawful and enforceable.

A writ of garnishment in Collin County allows a creditor to collect a debt by seizing funds directly from the debtor's bank account or wages. With the McKinney Texas Application for Writ of Garnishment, this legal process enables creditors to ensure they receive owed amounts efficiently. The writ legally binds the garnishee to withhold payments to the debtor until the debt is satisfied. It is a valuable tool for creditors in ensuring debt recovery.

To obtain a writ of garnishment in Texas, you must first file the appropriate application in court. For the McKinney Texas Application for Writ of Garnishment, gather necessary documents, including court judgments and creditor information. After filing, the court will review your request and, if approved, issue the writ. You will then serve the writ to the bank or employer holding the debtor's assets.

To stop wage garnishment in New York, you can file a motion to vacate the judgment or negotiate a settlement with your creditor. It's advisable to gather all relevant financial documents to support your case. While the process in NY is unique, using the McKinney Texas Application for Writ of Garnishment may provide insight into similar legal frameworks. Always consult a legal expert to navigate the complexities.