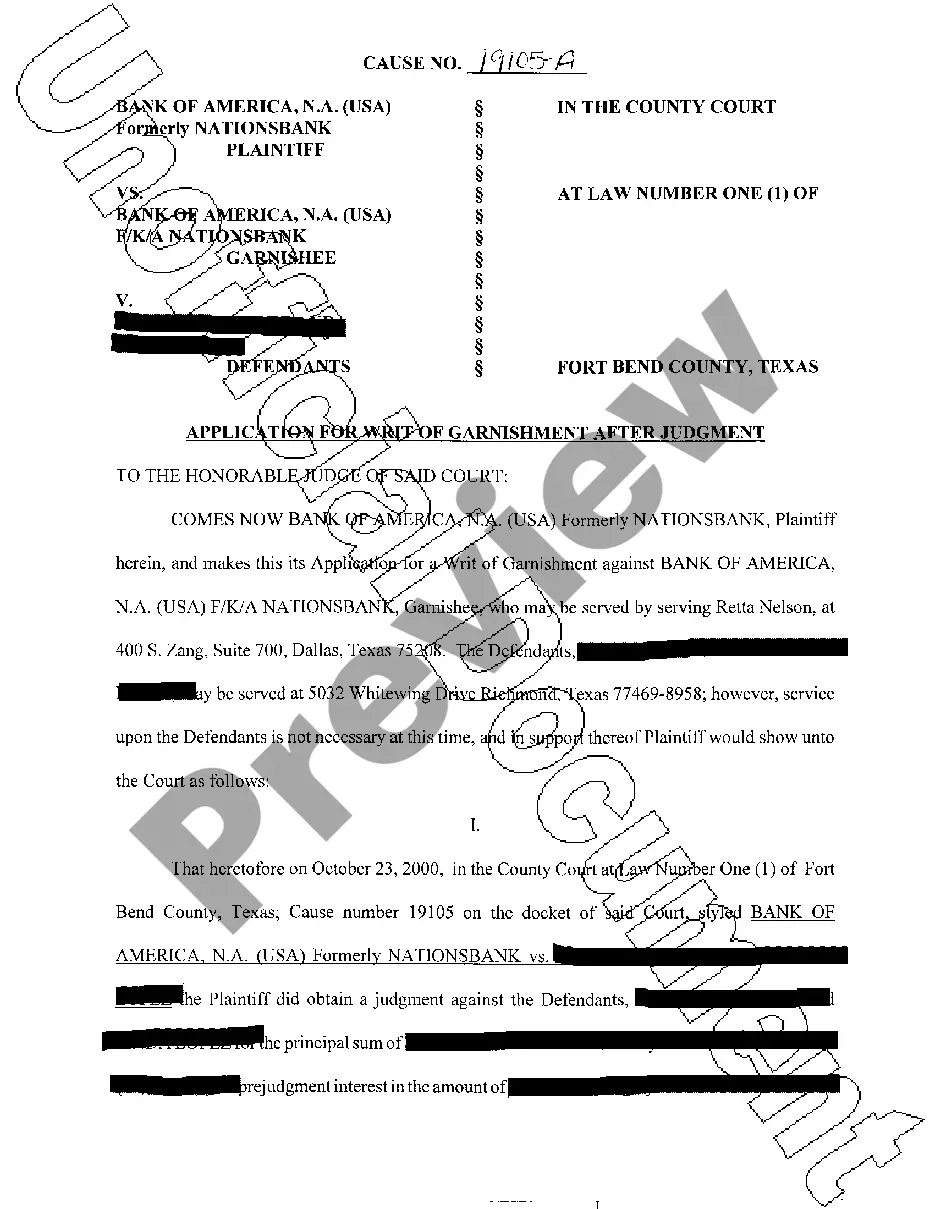

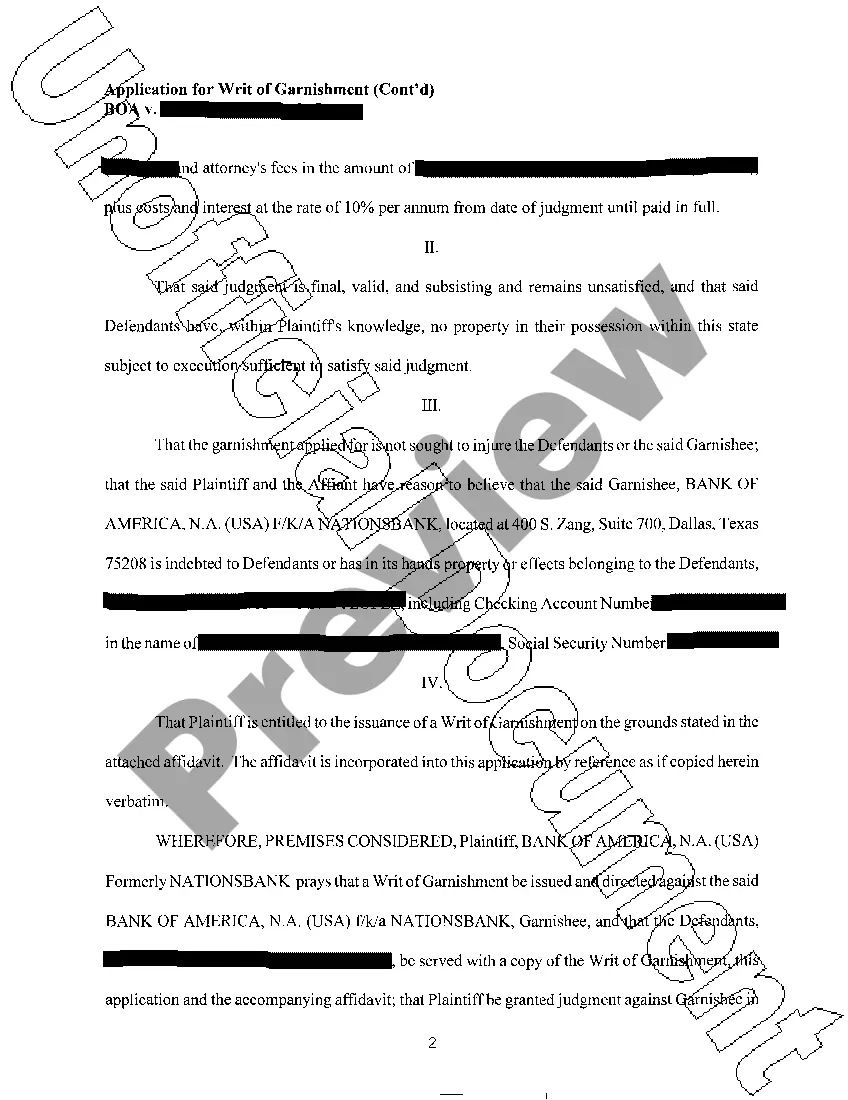

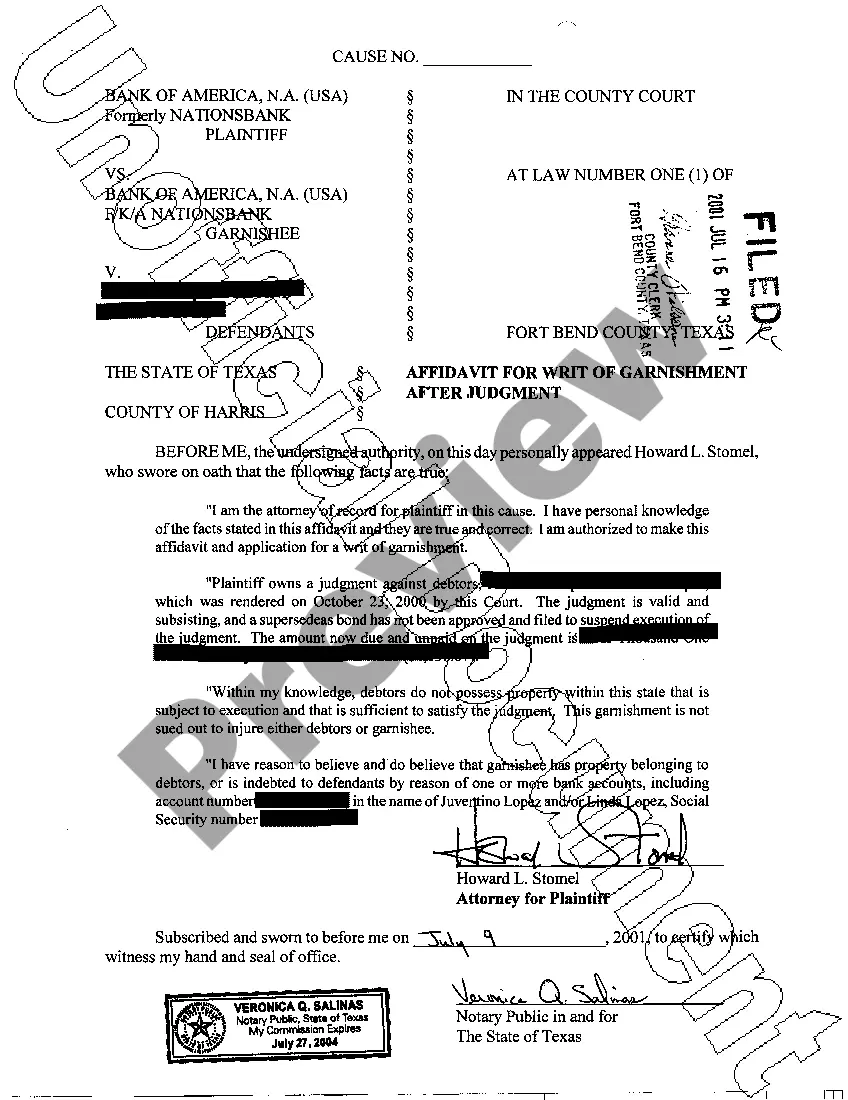

The Mesquite Texas Application for Writ of Garnishment is a legal document used by creditors to collect unpaid debts from a debtor's wages or bank accounts. This application is filed with the court to request the issuance of a writ of garnishment, which allows the creditor to withhold a portion of the debtor's income or seize the funds from their bank account. Keywords: Mesquite Texas, application, writ of garnishment, legal document, creditors, unpaid debts, wages, bank accounts, court, issuance, withhold, income, seize, funds. There are two types of Mesquite Texas Application for Writ of Garnishment: 1. Writ of Garnishment for Wages: This type of application allows a creditor to garnish a debtor's wages. The creditor can request a certain percentage or amount to be deducted from the debtor's paycheck until the debt is fully paid. The employer is legally obligated to withhold the specified amount and remit it to the creditor. 2. Writ of Garnishment for Bank Accounts: This type of application enables a creditor to collect unpaid debts directly from a debtor's bank account. Once the writ of garnishment is issued, the creditor can seize the funds available in the debtor's account up to the owed amount. The bank is then required to freeze the funds and release them to the creditor. In both cases, the Mesquite Texas Application for Writ of Garnishment must include accurate and detailed information about the debtor, the creditor, and the outstanding debt. It should also outline the reasons for seeking garnishment and provide supporting documentation to substantiate the claim. It is important to note that the application must comply with the specific requirements and procedures set forth by the state of Texas and the courts of Mesquite. Failure to meet these requirements may result in the application being denied or dismissed. Before submitting the Mesquite Texas Application for Writ of Garnishment, it is advisable for creditors to consult with an attorney to ensure proper adherence to the applicable laws and regulations. Professional guidance can help streamline the process and increase the chances of a successful garnishment.

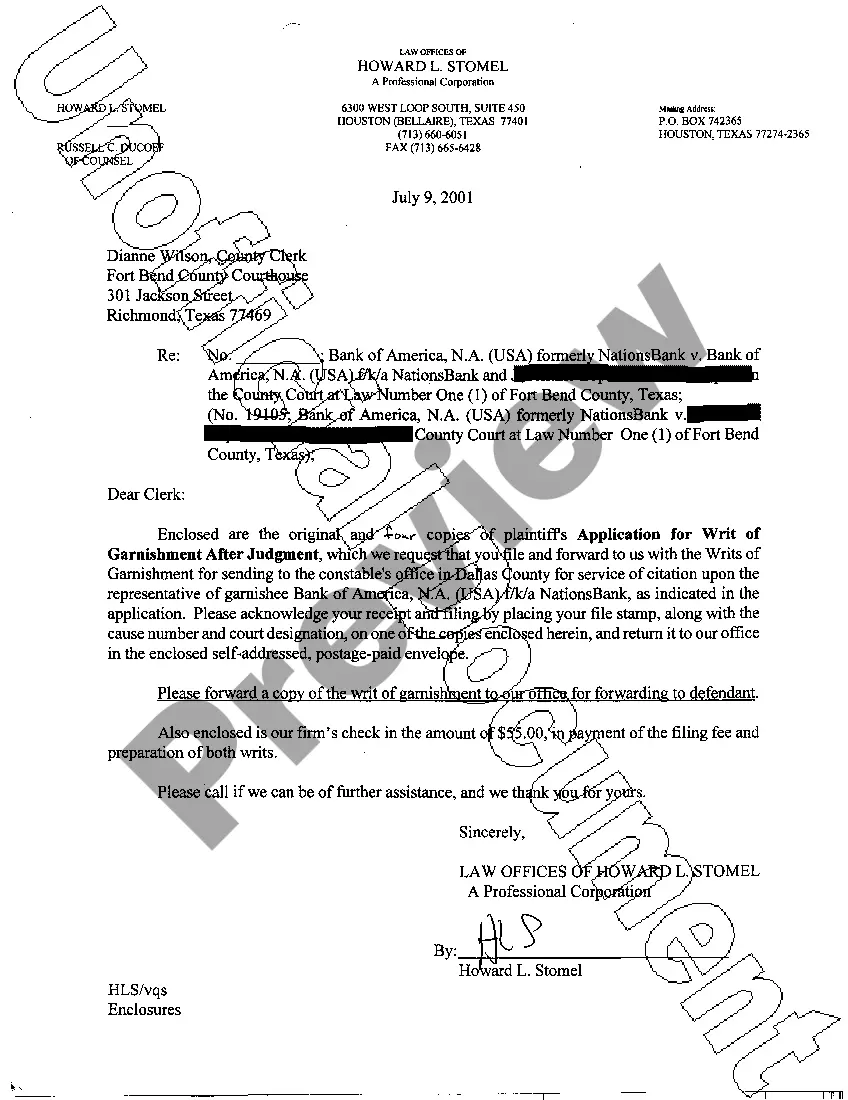

Mesquite Texas Application for Writ of Garnishment

Description

How to fill out Mesquite Texas Application For Writ Of Garnishment?

We always strive to reduce or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we apply for legal services that, as a rule, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to a lawyer. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Mesquite Texas Application for Writ of Garnishment or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Mesquite Texas Application for Writ of Garnishment adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Mesquite Texas Application for Writ of Garnishment is proper for your case, you can select the subscription option and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!