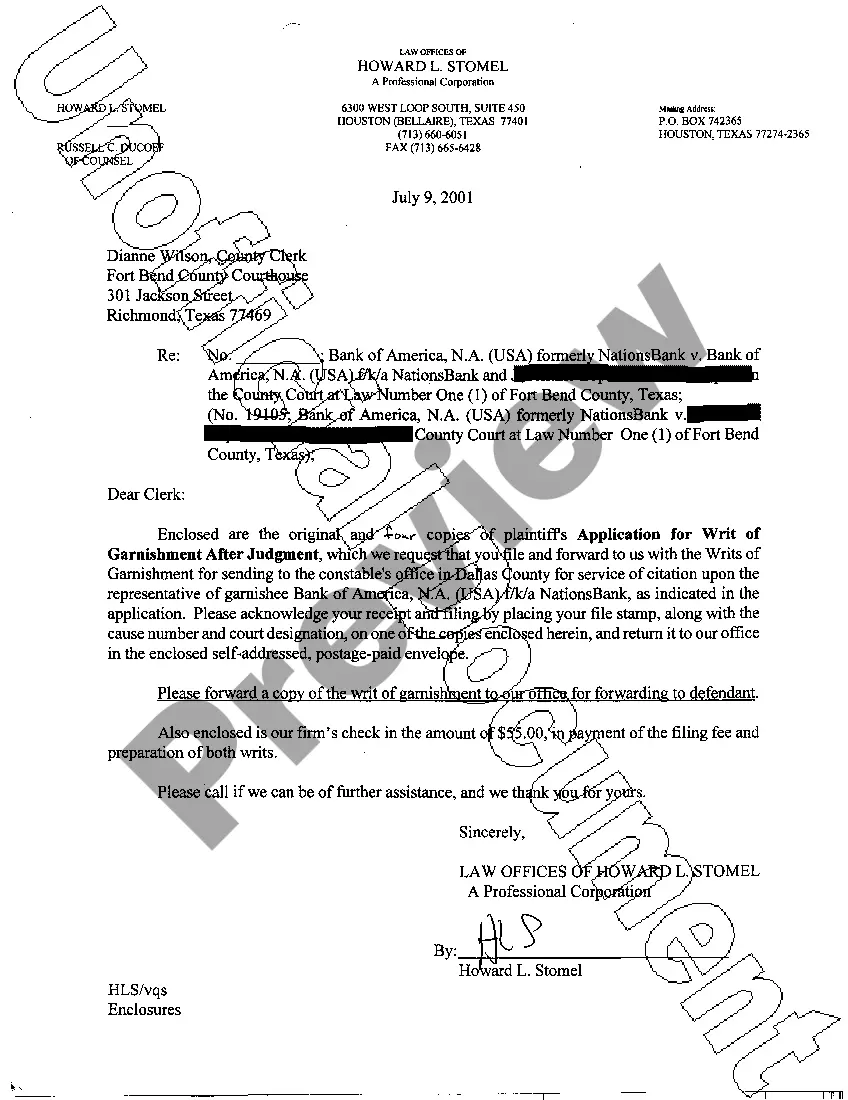

The Pasadena Texas Application for Writ of Garnishment is a legal document used in Pasadena, Texas to enforce the collection of a debt. This application is filed by a creditor seeking to garnish the wages or assets of a debtor who has failed to fulfill their financial obligations. The purpose of the Pasadena Texas Application for Writ of Garnishment is to enable creditors to recover money owed to them by obtaining a court order that allows them to seize the debtor's wages, bank accounts, or other assets. By doing so, the creditor aims to satisfy the debt through involuntary means. There are different types of Pasadena Texas Applications for Writ of Garnishment, depending on the specific circumstances and nature of the debt. These include: 1. Wage Garnishment Application: This type of garnishment allows creditors to collect a portion of the debtor's wages directly from their employer. The court orders the employer to deduct a specified amount from the debtor's paycheck and send it to the creditor until the debt is fully paid. 2. Bank Account Garnishment Application: With this type of garnishment, creditors can freeze and seize funds from the debtor's bank account(s) to satisfy the outstanding debt. The court order directs the bank to withhold a specific amount or the entire balance, which is then transferred to the creditor. 3. Property Garnishment Application: When a debtor owns property, such as real estate or vehicles, creditors can apply for a writ of garnishment to have these assets sold or liquidated. The proceeds from the sale are then used to settle the debts. 4. Third-Party Garnishment Application: In certain cases, a creditor may attempt to garnish funds owed to the debtor by a third party. For example, if the debtor is owed money from a lawsuit settlement or inheritance, the creditor may apply for a writ of garnishment to have those funds redirected towards debt repayment. Overall, the Pasadena Texas Application for Writ of Garnishment serves as a powerful tool for creditors in Pasadena, Texas to recover outstanding debts from debtors who have failed to fulfill their financial obligations. It provides a legal avenue for creditors to obtain court orders allowing them to seize wages, bank accounts, property, or third-party funds, ultimately seeking to satisfy the debt.

The Pasadena Texas Application for Writ of Garnishment is a legal document used in Pasadena, Texas to enforce the collection of a debt. This application is filed by a creditor seeking to garnish the wages or assets of a debtor who has failed to fulfill their financial obligations. The purpose of the Pasadena Texas Application for Writ of Garnishment is to enable creditors to recover money owed to them by obtaining a court order that allows them to seize the debtor's wages, bank accounts, or other assets. By doing so, the creditor aims to satisfy the debt through involuntary means. There are different types of Pasadena Texas Applications for Writ of Garnishment, depending on the specific circumstances and nature of the debt. These include: 1. Wage Garnishment Application: This type of garnishment allows creditors to collect a portion of the debtor's wages directly from their employer. The court orders the employer to deduct a specified amount from the debtor's paycheck and send it to the creditor until the debt is fully paid. 2. Bank Account Garnishment Application: With this type of garnishment, creditors can freeze and seize funds from the debtor's bank account(s) to satisfy the outstanding debt. The court order directs the bank to withhold a specific amount or the entire balance, which is then transferred to the creditor. 3. Property Garnishment Application: When a debtor owns property, such as real estate or vehicles, creditors can apply for a writ of garnishment to have these assets sold or liquidated. The proceeds from the sale are then used to settle the debts. 4. Third-Party Garnishment Application: In certain cases, a creditor may attempt to garnish funds owed to the debtor by a third party. For example, if the debtor is owed money from a lawsuit settlement or inheritance, the creditor may apply for a writ of garnishment to have those funds redirected towards debt repayment. Overall, the Pasadena Texas Application for Writ of Garnishment serves as a powerful tool for creditors in Pasadena, Texas to recover outstanding debts from debtors who have failed to fulfill their financial obligations. It provides a legal avenue for creditors to obtain court orders allowing them to seize wages, bank accounts, property, or third-party funds, ultimately seeking to satisfy the debt.