Pearland Texas Application for Writ of Garnishment is a legal document used to enforce a court judgment or collect money owed to a creditor from a debtor. A garnishment allows the creditor to obtain funds directly from the debtor's wages, bank accounts, or other assets. In Pearland, Texas, there are different types of Applications for Writ of Garnishment, depending on the specific circumstances and the type of debt being pursued. Some common types include: 1. Wages and Salary Garnishment: This type of garnishment allows creditors to collect a portion of the debtor's income directly from their employer. The application will outline the amount to be garnished and provide supporting documentation such as the judgment or court order. 2. Bank Account Garnishment: When a debtor fails to pay their debts, a creditor may seek a writ of garnishment to access funds in the debtor's bank accounts. The application will specify the bank and account details, as well as the amount to be garnished. 3. Property or Asset Garnishment: In some cases, a creditor may seek to garnish specific assets owned by the debtor, such as real estate, vehicles, or other valuable possessions. The application will provide details of the property or assets to be garnished and their estimated value. The Pearland Texas Application for Writ of Garnishment requires specific information to be included, such as: 1. Creditor Information: The application must include the creditor's name, address, and contact information. This ensures that the debtor and relevant parties are aware of the garnishment action. 2. Debtor Information: The application should provide the debtor's name, address, and any other known contact information. It is essential to accurately identify the debtor to enforce the garnishment effectively. 3. Judgment Details: The application should include information about the court judgment or order that granted the creditor the right to garnish the debtor's wages or assets. This may include the court name, case number, and judgment amount. 4. Garnishment Details: The application must outline the specific amount of money or assets to be garnished. It should also specify the source of garnishment, such as wages, bank accounts, or property. 5. Supporting Documentation: Relevant supporting documents must be attached to the application, such as copies of the judgment, court order, or any required notices to the debtor. These documents provide evidence of the creditor's legal authority to pursue the garnishment. It is crucial to follow the proper legal procedures and consult with a qualified attorney or legal professional to ensure accurate completion of the Pearland Texas Application for Writ of Garnishment. Failure to comply with the required guidelines may lead to the application being rejected or delayed, hindering the creditor's ability to collect the owed debt.

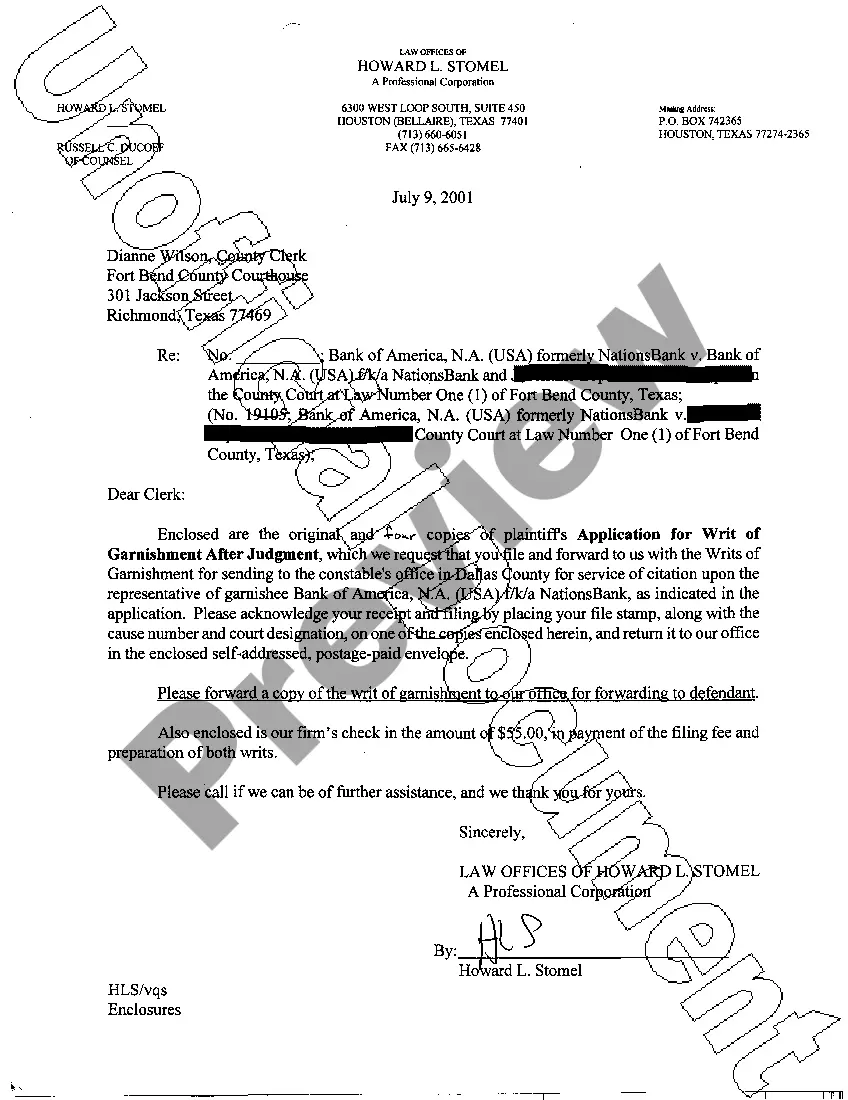

Pearland Texas Application for Writ of Garnishment

Description

How to fill out Pearland Texas Application For Writ Of Garnishment?

Make use of the US Legal Forms and have instant access to any form template you require. Our useful website with thousands of templates allows you to find and obtain almost any document sample you want. You are able to download, fill, and certify the Pearland Texas Application for Writ of Garnishment in just a matter of minutes instead of browsing the web for hours attempting to find the right template.

Utilizing our collection is a superb way to raise the safety of your form submissions. Our professional attorneys regularly check all the records to ensure that the templates are relevant for a particular state and compliant with new acts and polices.

How do you get the Pearland Texas Application for Writ of Garnishment? If you already have a profile, just log in to the account. The Download button will appear on all the samples you look at. Moreover, you can get all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the instructions below:

- Open the page with the template you need. Ensure that it is the form you were looking for: verify its headline and description, and use the Preview option if it is available. Otherwise, use the Search field to find the appropriate one.

- Start the saving procedure. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the document. Choose the format to obtain the Pearland Texas Application for Writ of Garnishment and edit and fill, or sign it for your needs.

US Legal Forms is probably the most extensive and trustworthy form libraries on the web. We are always happy to help you in virtually any legal case, even if it is just downloading the Pearland Texas Application for Writ of Garnishment.

Feel free to make the most of our platform and make your document experience as convenient as possible!