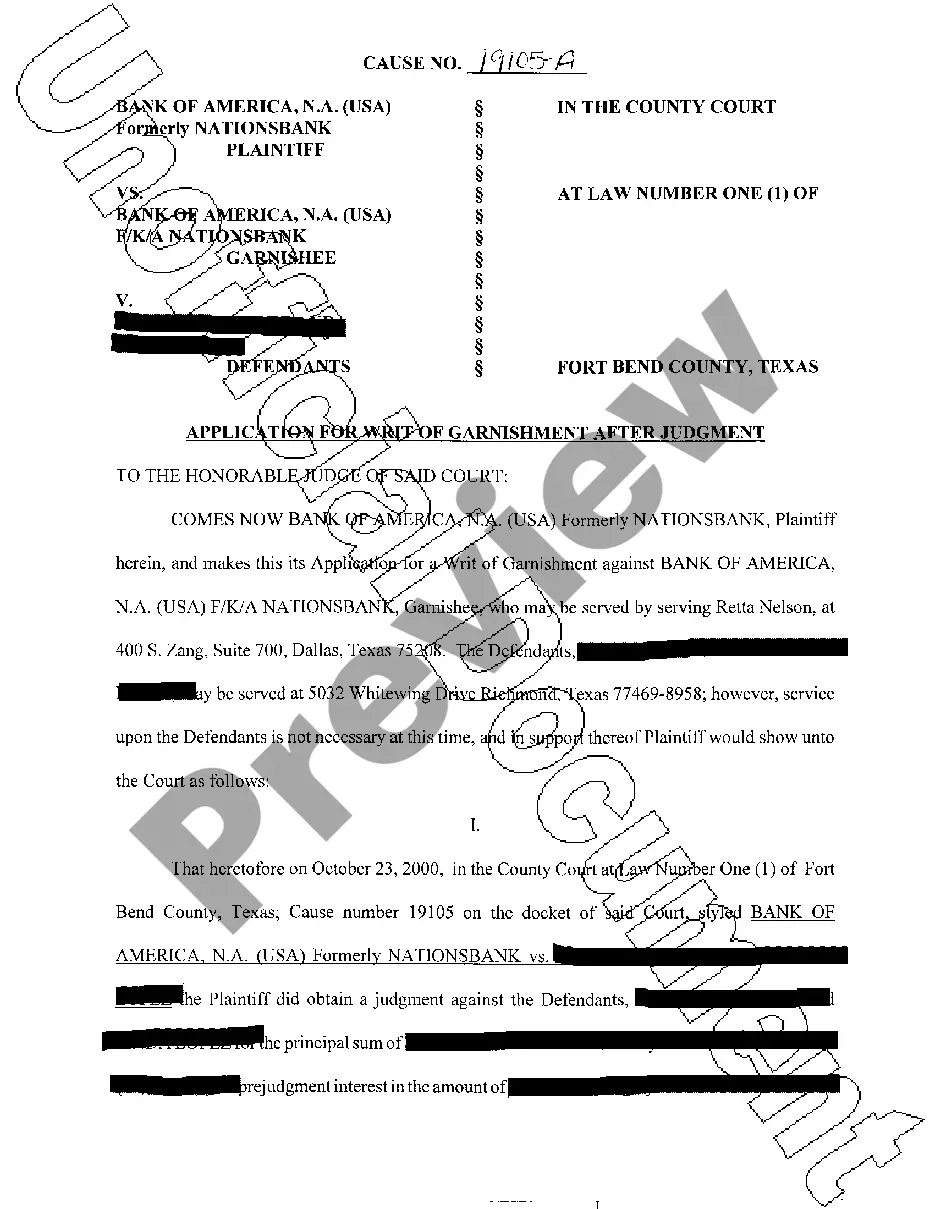

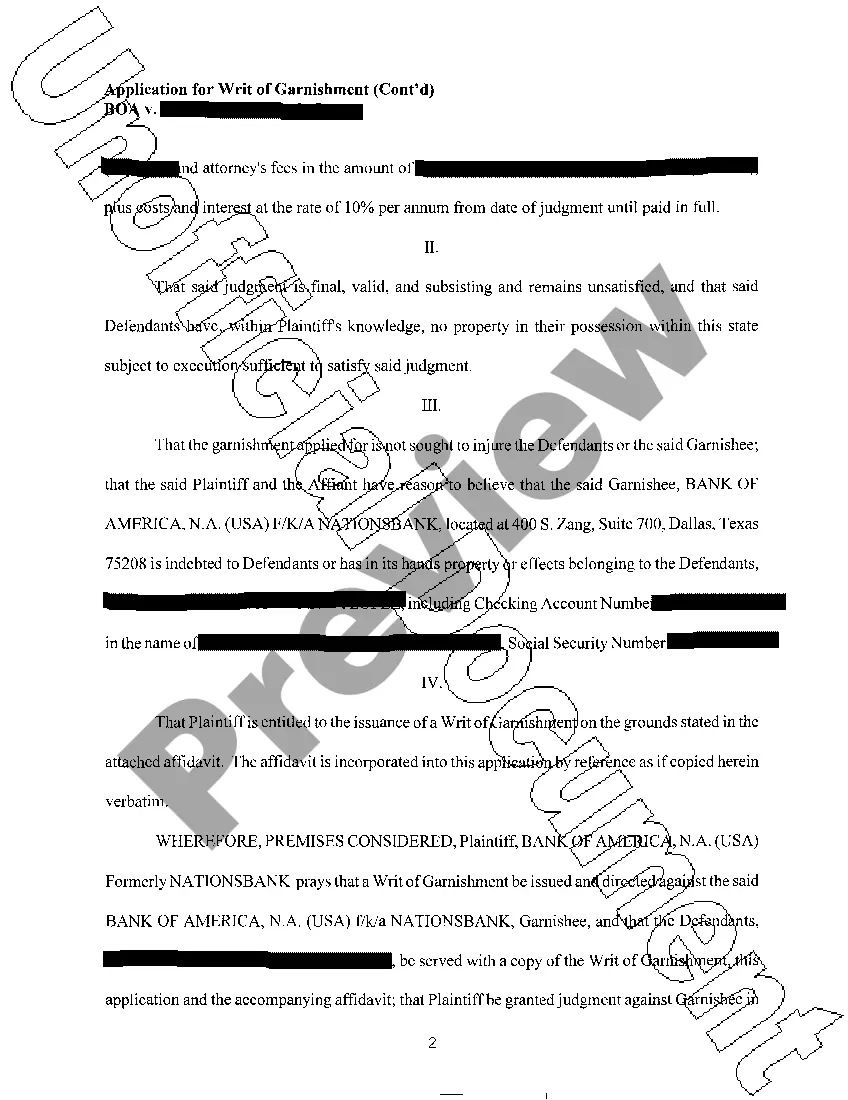

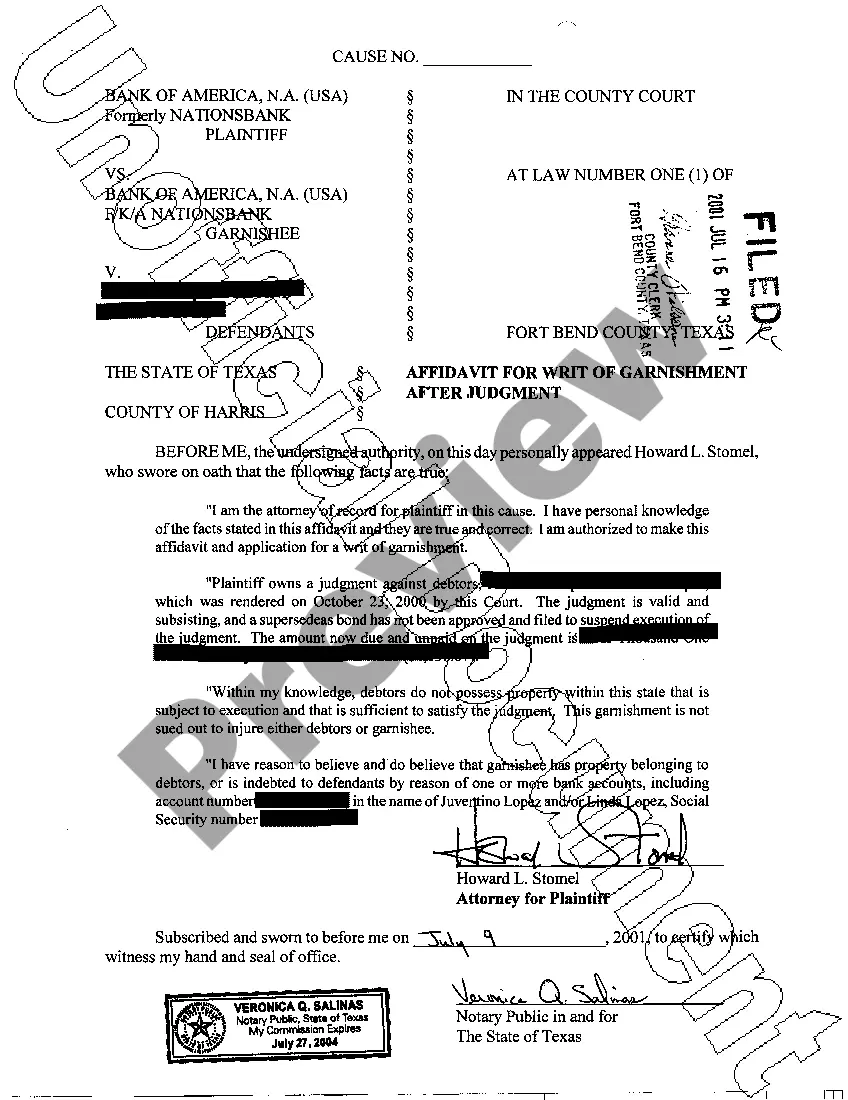

Travis Texas Application for Writ of Garnishment is a legal document filed in Travis County, Texas, to enforce a judgment and recover debts owed by a debtor. This application initiates the process of garnishing the debtor's wages, bank accounts, or other assets to satisfy the outstanding judgment. The Travis Texas Application for Writ of Garnishment is an important tool for creditors seeking to collect on their judgment and ensure timely payment. It serves as a formal request to the court to authorize the garnishment process, allowing the creditor to seize a portion of the debtor's income or assets to settle the debt. Keywords: Travis Texas, Application for Writ of Garnishment, legal document, Travis County, Texas, judgment, debt, debtor, creditor, garnishment process, wages, bank accounts, assets, payment, court, authorize, seize, settle. There are different types of Travis Texas Application for Writ of Garnishment, depending on the specific type of debt or asset being targeted for collection. Some common types include: 1. Wage Garnishment: This type of garnishment allows the creditor to deduct a certain portion of the debtor's wages directly from their employer to satisfy the debt. It is a recurring garnishment that continues until the debt is fully repaid or a court order terminates it. 2. Bank Account Garnishment: With this type of garnishment, the creditor can freeze and seize funds from the debtor's bank accounts to satisfy the outstanding judgment. The bank is legally required to cooperate and release the funds to the creditor. 3. Property or Asset Garnishment: In cases where the debtor owns valuable property or assets, such as real estate, vehicles, or valuable possessions, the creditor can seek a writ of garnishment to seize and sell these assets to recover the debt. The proceeds from the sale are then applied towards the judgment. 4. Third-Party Garnishment: This form of garnishment is used when the debtor owes money to a third party, such as an employer or contractor. The creditor can request a writ of garnishment to redirect the owed funds directly to them, bypassing the debtor. 5. Federal Garnishment: In certain instances, federal laws and regulations may apply to garnishments, such as cases involving federal taxes or federal student loans. These garnishments may differ from the standard Travis Texas Application for Writ of Garnishment and require compliance with federal guidelines. It is important for creditors to consult with an attorney or legal professional to understand the specific requirements and procedures involved in filing a Travis Texas Application for Writ of Garnishment, as the process can be complex and subject to specific rules and regulations.

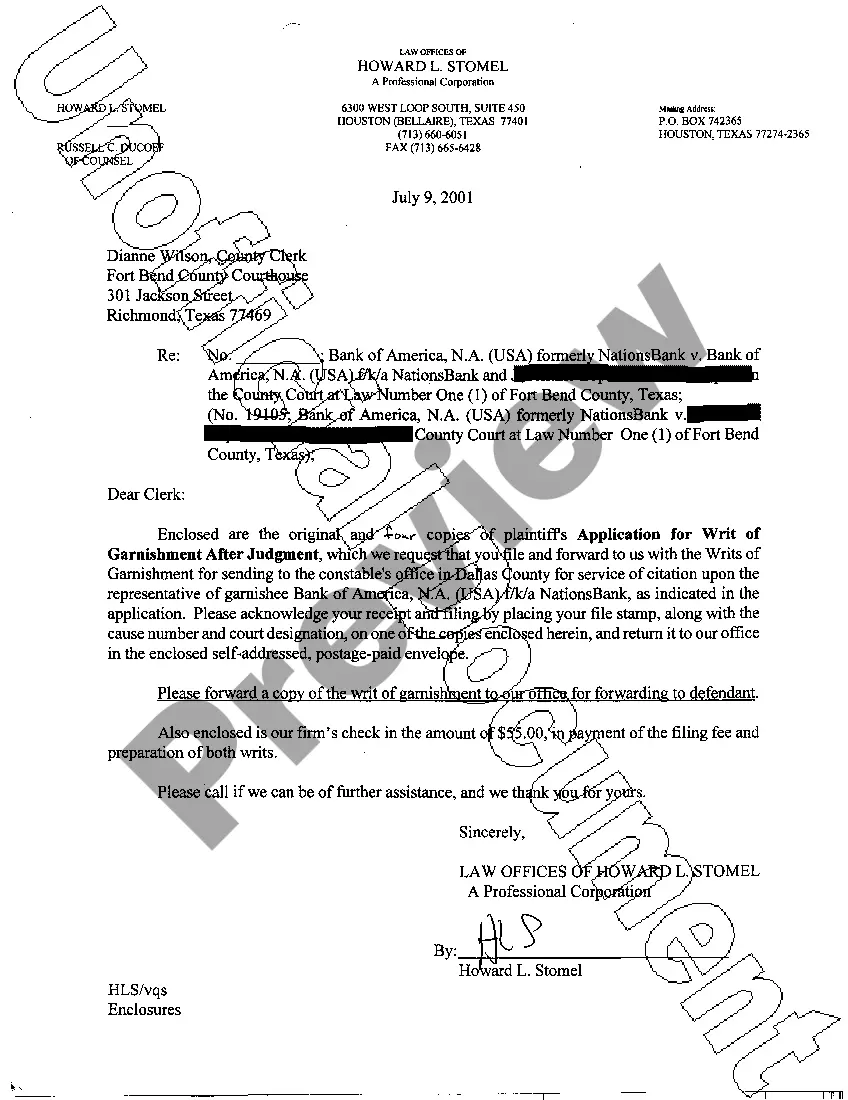

Travis Texas Application for Writ of Garnishment

Description

How to fill out Travis Texas Application For Writ Of Garnishment?

If you are looking for a valid form, it’s impossible to choose a better service than the US Legal Forms website – probably the most considerable libraries on the internet. With this library, you can get a huge number of document samples for business and personal purposes by categories and states, or keywords. With the advanced search feature, getting the most up-to-date Travis Texas Application for Writ of Garnishment is as elementary as 1-2-3. In addition, the relevance of each record is confirmed by a group of skilled lawyers that on a regular basis review the templates on our website and update them based on the newest state and county demands.

If you already know about our system and have an account, all you need to receive the Travis Texas Application for Writ of Garnishment is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions below:

- Make sure you have opened the sample you require. Look at its description and make use of the Preview feature (if available) to check its content. If it doesn’t meet your requirements, utilize the Search option at the top of the screen to find the appropriate document.

- Affirm your selection. Select the Buy now option. Following that, pick the preferred subscription plan and provide credentials to register an account.

- Make the transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Receive the form. Select the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the received Travis Texas Application for Writ of Garnishment.

Every single form you add to your account has no expiration date and is yours forever. It is possible to access them using the My Forms menu, so if you need to get an additional version for editing or printing, you may come back and download it once again anytime.

Make use of the US Legal Forms professional collection to get access to the Travis Texas Application for Writ of Garnishment you were looking for and a huge number of other professional and state-specific samples on one platform!