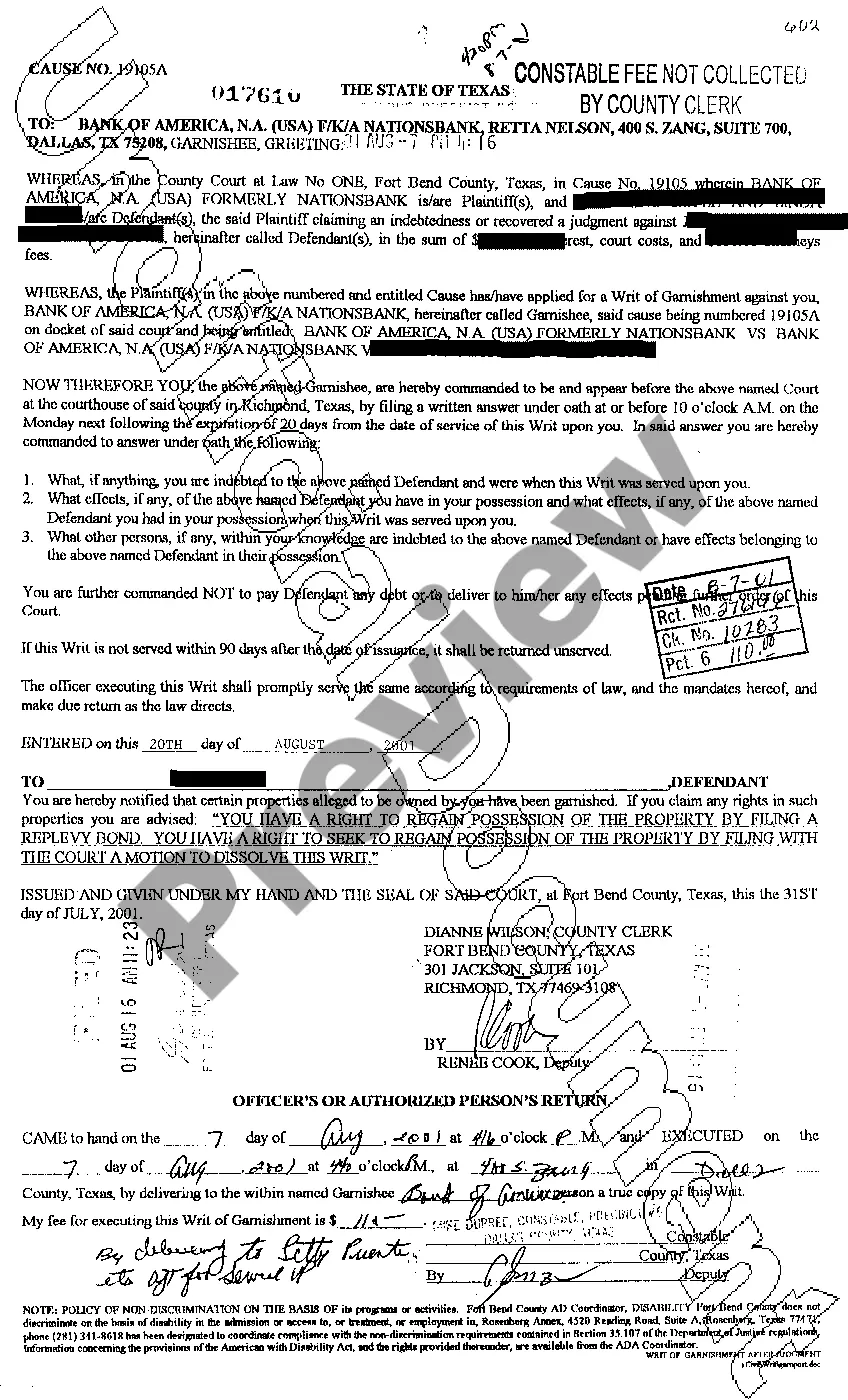

Amarillo, Texas Writ of Garnishment: A Comprehensive Guide to Understanding the Different Types In Amarillo, Texas, a Writ of Garnishment is a legal process that allows a creditor to collect a debt owed by an individual or business by redirecting a portion of their wages, bank accounts, or other assets towards satisfying the outstanding amount. It is crucial to familiarize oneself with the various types of Writ of Garnishments in Amarillo, Texas, as their applications and procedures may vary. 1. Wage Garnishment: Also known as wage withholding, this type of Amarillo Writ of Garnishment enables a creditor to collect a debt directly from an employee's wages. Upon obtaining a court order, the employer is obligated to deduct a specific percentage or amount from the employee's paycheck and forward it to the creditor until the debt is repaid. 2. Bank Account Garnishment: In cases where a debtor fails to pay a debt, a creditor may seek a Writ of Garnishment for Bank Account. This legal tool authorizes the creditor to freeze and possibly seize funds in the debtor's bank account to satisfy the outstanding debt. However, some types of funds like Social Security benefits may be exempt from this type of garnishment. 3. Property Garnishment: If a debtor owns valuable assets like real estate, vehicles, or other property, a creditor can obtain a Writ of Garnishment against those assets. This allows the creditor to place a lien on the property, preventing the debtor from selling or transferring it until the debt is repaid. In some cases, the creditor may even force the sale of the property to obtain funds necessary to satisfy the debt. 4. Federal Non-Wage Garnishment: While most wage garnishments fall under state laws, certain types of federal debts such as unpaid taxes, federal student loans, or child support can be garnished under federal regulations. It is essential to seek advice from a legal professional or consult the specific federal agency involved to understand the relevant rules and procedures. When pursuing a Writ of Garnishment in Amarillo, Texas, it is crucial to adhere to the proper legal channels and obtain the necessary court orders. Additionally, it is important for both creditors and debtors to be aware of their rights and limitations during the garnishment process. Seeking legal counsel and understanding the specific rules and exemptions in Amarillo, Texas, is highly recommended ensuring proper compliance and protect one's rights. To recap, a Writ of Garnishment in Amarillo, Texas, allows a creditor to collect unpaid debts by redirecting wages, freezing bank accounts, or placing liens on property. The four main types of garnishment include Wage Garnishment, Bank Account Garnishment, Property Garnishment, and Federal Non-Wage Garnishment for certain federal debts. Seeking professional advice is advisable for both creditors and debtors to navigate this legal process effectively.

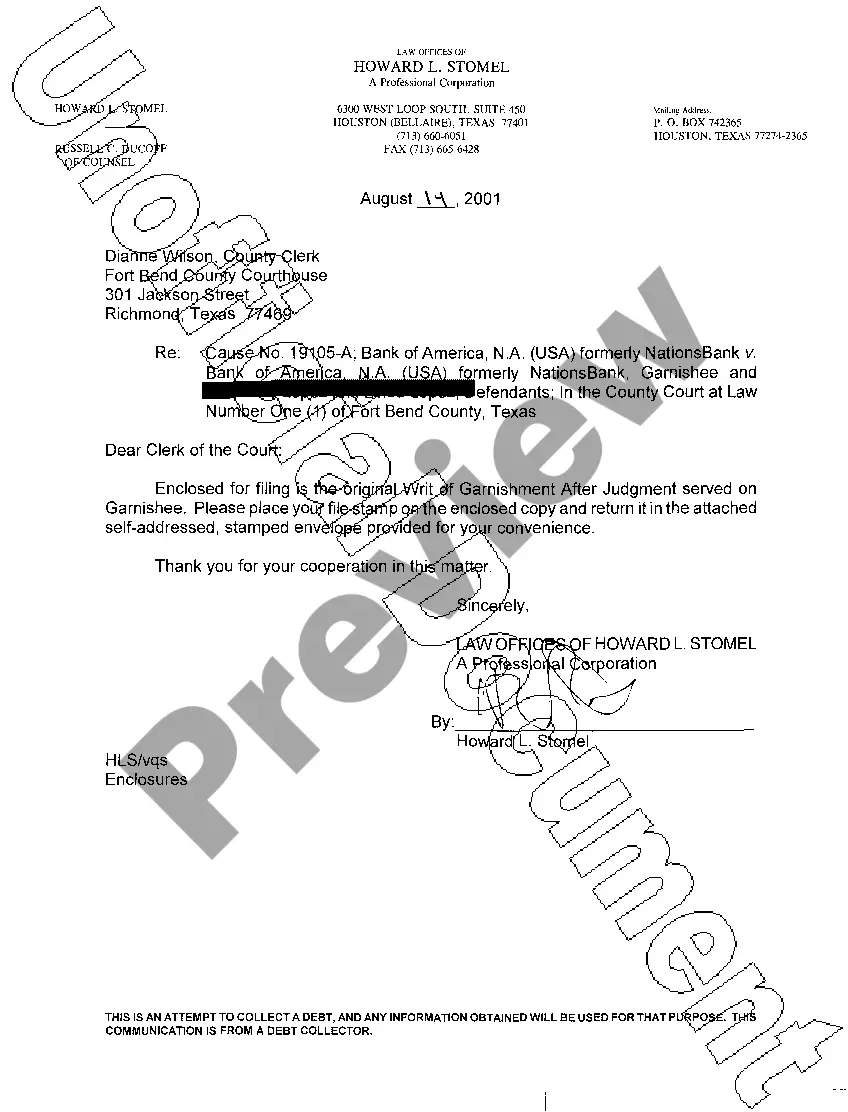

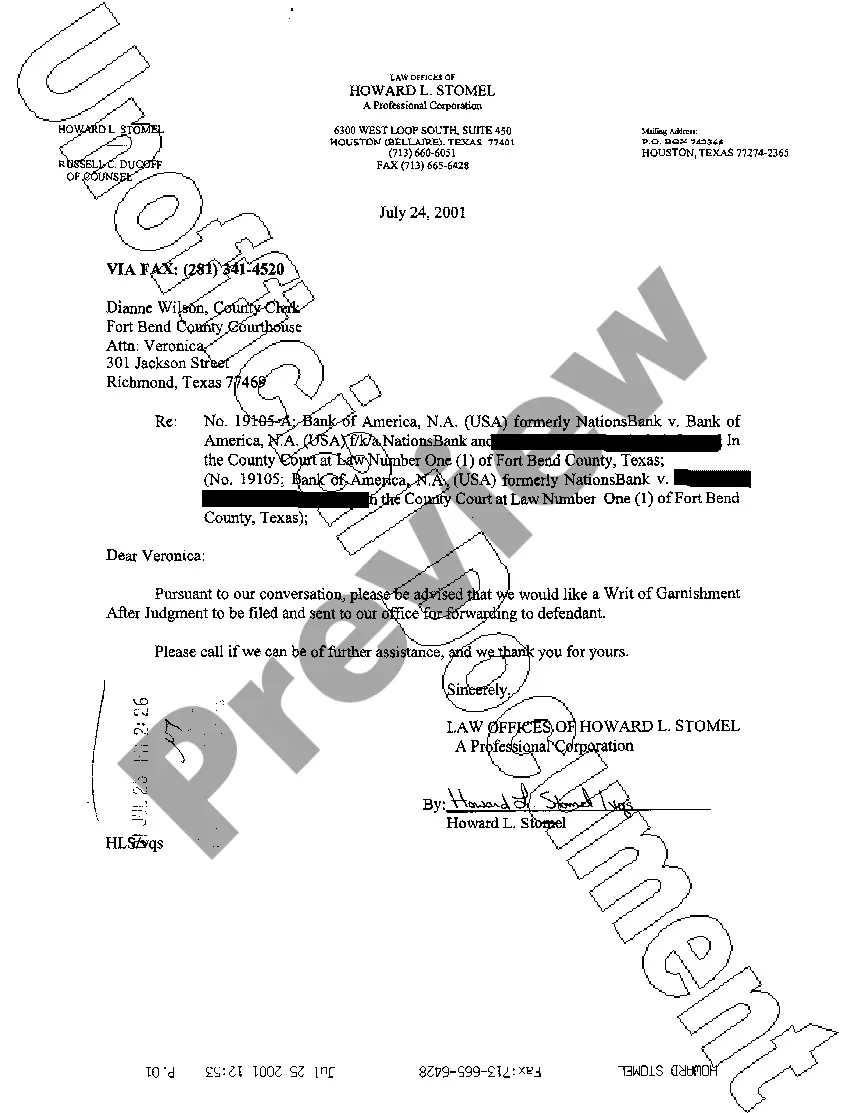

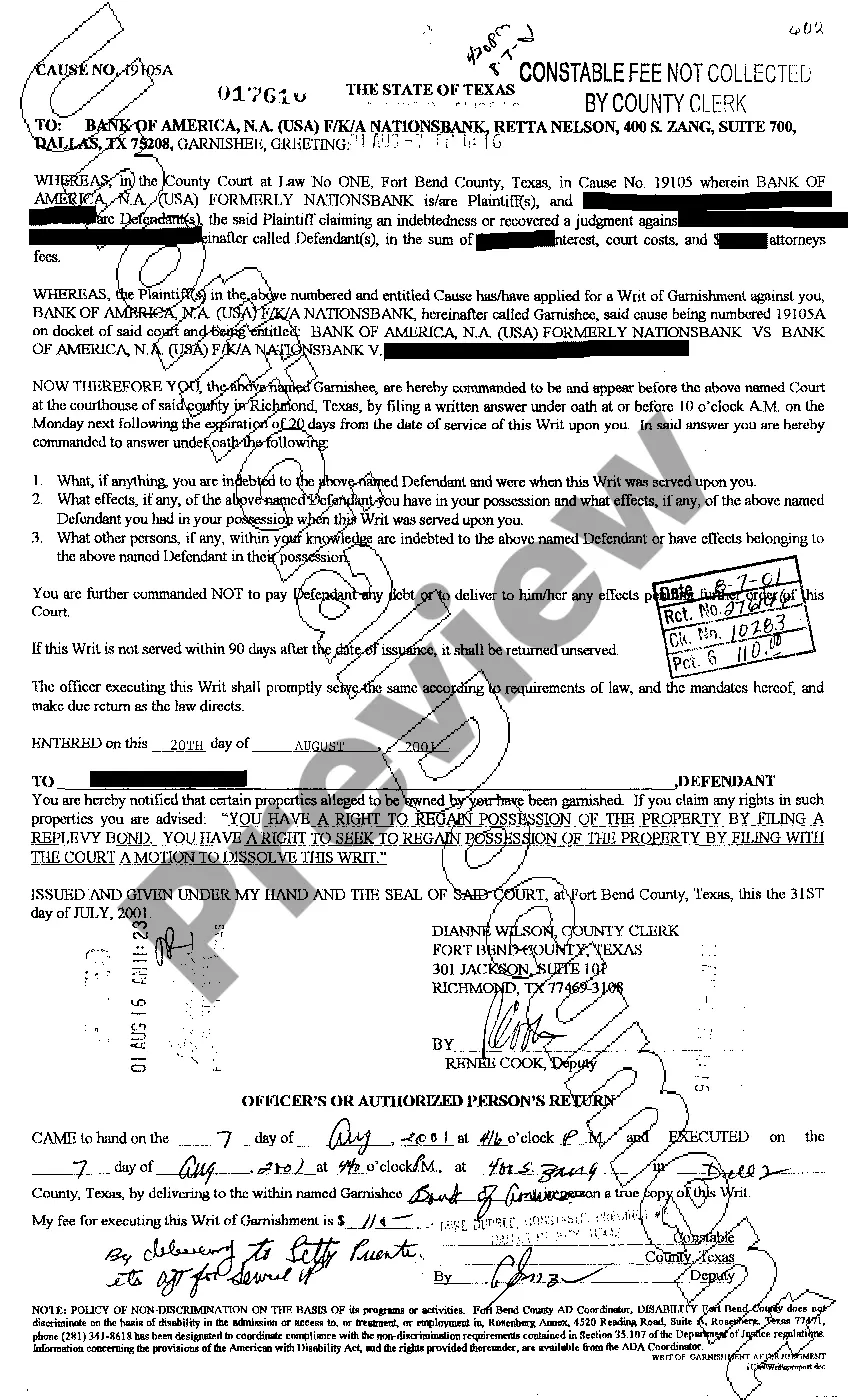

Amarillo Texas Writ of Garnishment

Description

How to fill out Amarillo Texas Writ Of Garnishment?

If you are searching for a valid form template, it’s impossible to choose a better place than the US Legal Forms site – one of the most considerable online libraries. With this library, you can find thousands of templates for organization and personal purposes by types and regions, or key phrases. With our high-quality search option, finding the newest Amarillo Texas Writ of Garnishment is as easy as 1-2-3. Additionally, the relevance of each and every file is verified by a team of skilled lawyers that on a regular basis check the templates on our website and revise them in accordance with the latest state and county laws.

If you already know about our system and have a registered account, all you need to get the Amarillo Texas Writ of Garnishment is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions below:

- Make sure you have opened the sample you need. Look at its description and make use of the Preview feature (if available) to explore its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to find the proper record.

- Affirm your decision. Click the Buy now option. Following that, select your preferred subscription plan and provide credentials to register an account.

- Process the transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Choose the format and download it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Amarillo Texas Writ of Garnishment.

Every template you save in your account does not have an expiry date and is yours permanently. You always have the ability to gain access to them via the My Forms menu, so if you need to have an additional version for enhancing or printing, you can return and download it again whenever you want.

Take advantage of the US Legal Forms extensive catalogue to get access to the Amarillo Texas Writ of Garnishment you were looking for and thousands of other professional and state-specific samples on one website!