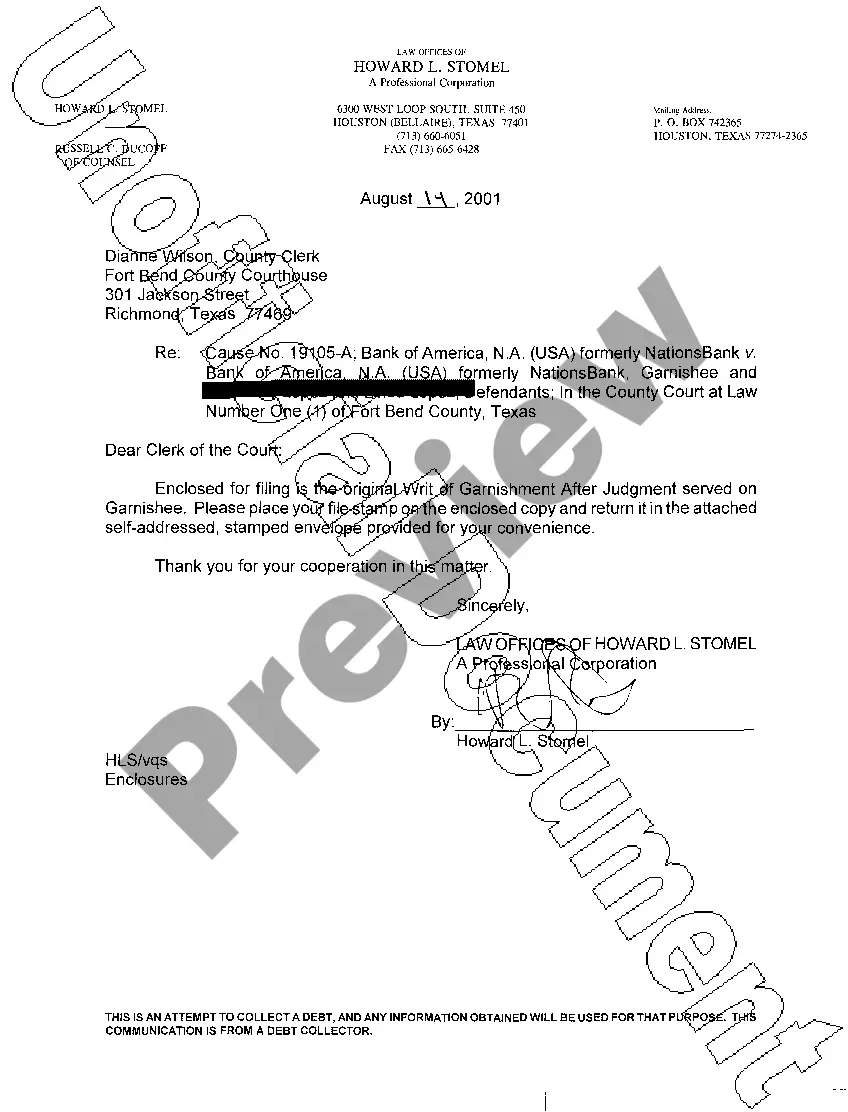

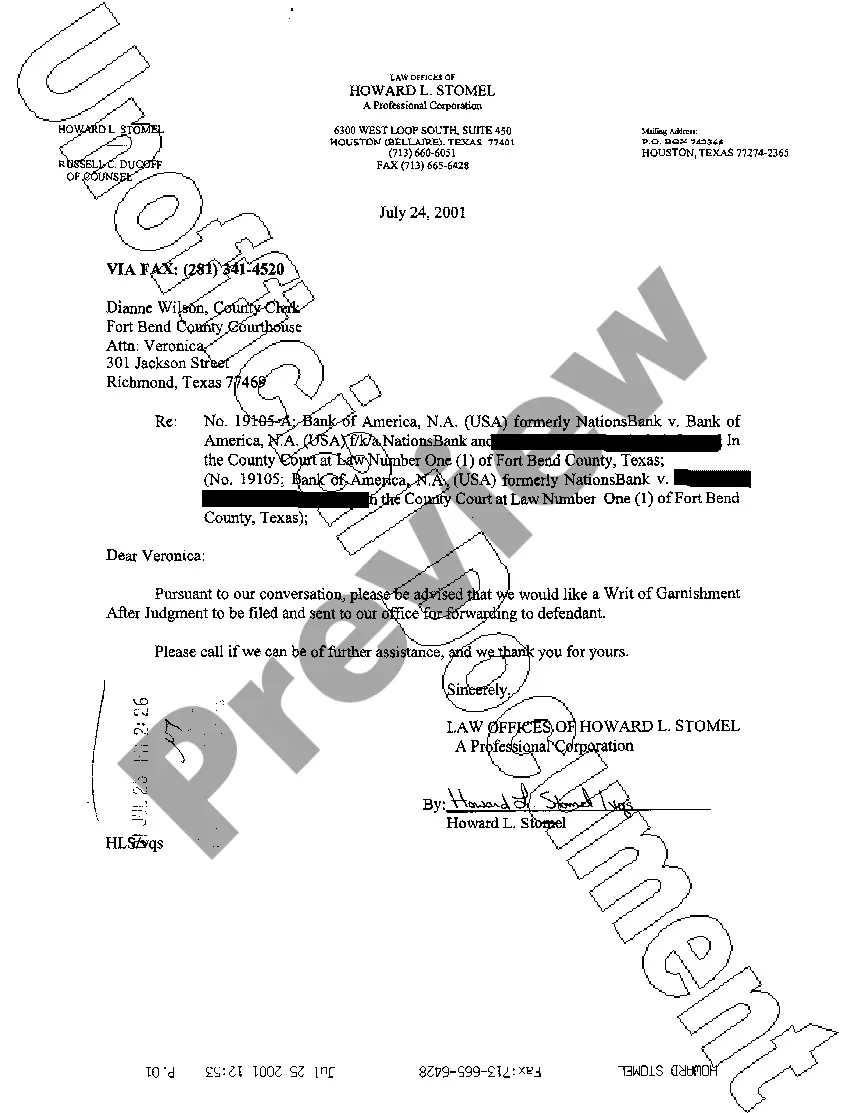

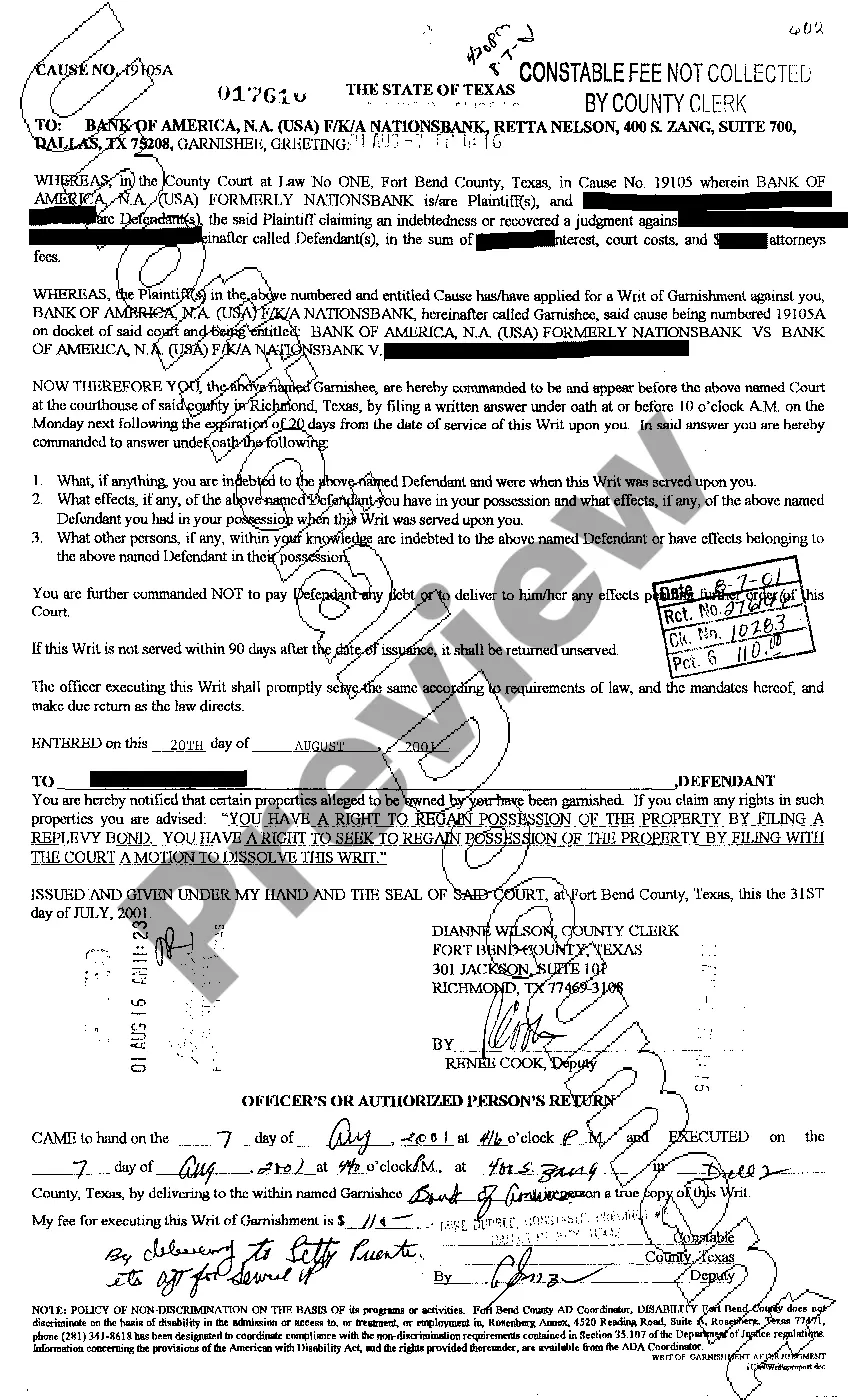

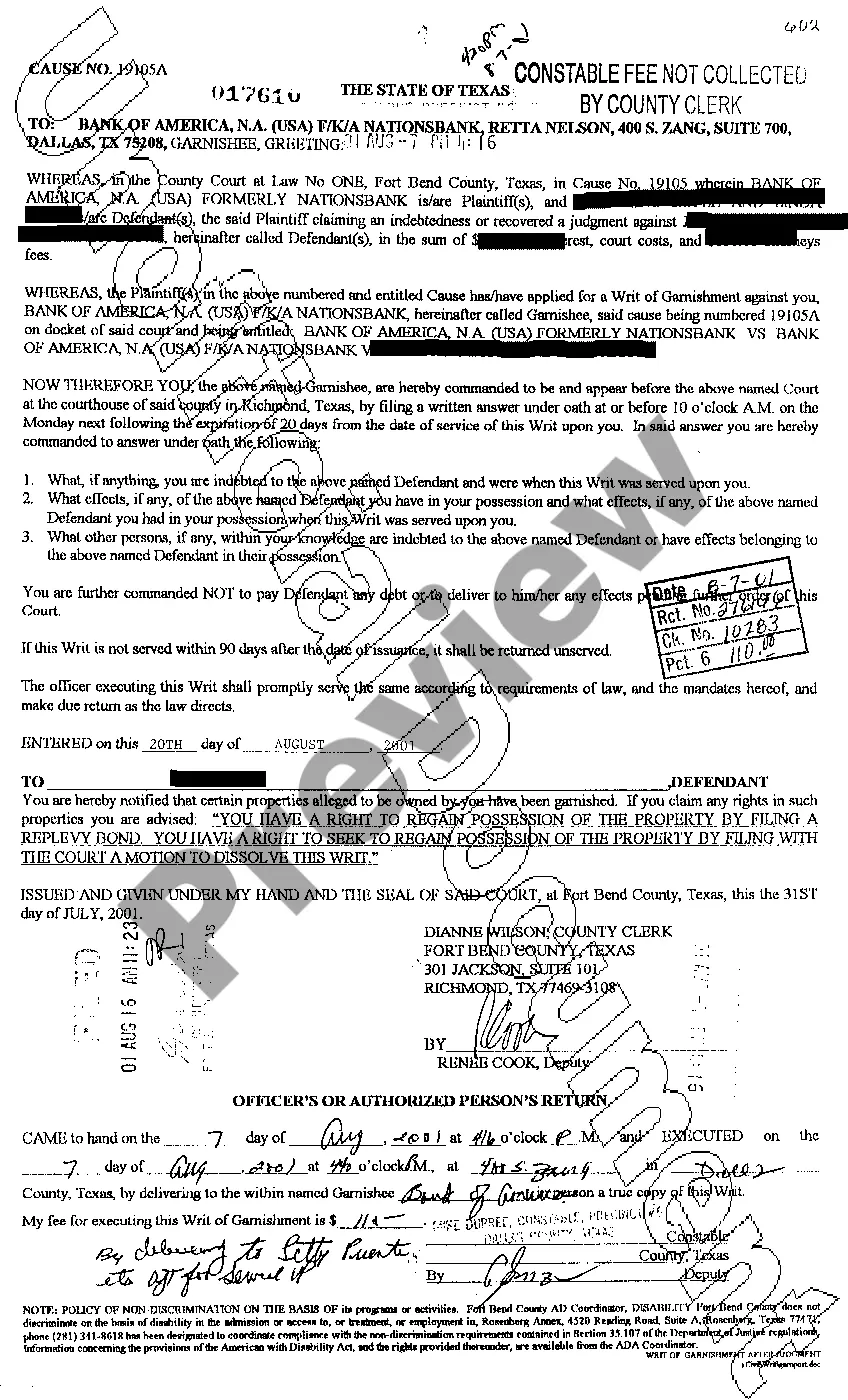

The Bexar Texas Writ of Garnishment is a legal document issued by a court that allows a creditor to collect a debt owed by a debtor from a third party. It is commonly used as a means to enforce a judgment or facilitate debt recovery. This writ is specific to Bexar County, Texas, and follows the guidelines and procedures outlined by Texas law. In Bexar County, there are generally two types of Writs of Garnishment that can be filed: Writ of Garnishment for Earnings and Writ of Garnishment for Non-Earnings. 1. Writ of Garnishment for Earnings: This type of writ allows creditors to collect a debt directly from the debtor's wages, salary, commissions, bonuses, or other earnings. The employer of the debtor becomes the garnishee, and they are legally required to withhold a portion of the debtor's earnings and remit it to the creditor until the debt is satisfied. 2. Writ of Garnishment for Non-Earnings: This writ applies to various assets and funds that are not wages or earnings. It allows creditors to collect debts from sources such as bank accounts, rental income, accounts receivable, or other property owned by the debtor. The garnishee, in this case, may be a bank, a tenant, a customer, or any third party that owes money to the debtor. To initiate a Bexar Texas Writ of Garnishment, a creditor must file a legal document with the court, specifying the details of the debt and providing evidence of the debtor's failure to pay. Once the writ is approved by the court, it is served to the garnishee, who then becomes legally obligated to withhold and surrender the specified funds or assets to the creditor according to the terms outlined in the writ. It is essential to note that the Bexar Texas Writ of Garnishment must comply with the Texas Civil Practice and Remedies Code and adhere to the specific rules and regulations set by the court. Additionally, there are certain exemptions and limitations on the amount of money that can be garnished, depending on the debtor's income and the type of debt involved. In conclusion, the Bexar Texas Writ of Garnishment is a legal mechanism that enables creditors in Bexar County, Texas, to collect outstanding debts from debtors by compelling third parties, such as employers or financial institutions, to withhold and surrender a portion of the debtor's wages or non-earning assets. It is crucial for both creditors and debtors to understand their rights and obligations under this writ, and consult with legal professionals for proper guidance.

The Bexar Texas Writ of Garnishment is a legal document issued by a court that allows a creditor to collect a debt owed by a debtor from a third party. It is commonly used as a means to enforce a judgment or facilitate debt recovery. This writ is specific to Bexar County, Texas, and follows the guidelines and procedures outlined by Texas law. In Bexar County, there are generally two types of Writs of Garnishment that can be filed: Writ of Garnishment for Earnings and Writ of Garnishment for Non-Earnings. 1. Writ of Garnishment for Earnings: This type of writ allows creditors to collect a debt directly from the debtor's wages, salary, commissions, bonuses, or other earnings. The employer of the debtor becomes the garnishee, and they are legally required to withhold a portion of the debtor's earnings and remit it to the creditor until the debt is satisfied. 2. Writ of Garnishment for Non-Earnings: This writ applies to various assets and funds that are not wages or earnings. It allows creditors to collect debts from sources such as bank accounts, rental income, accounts receivable, or other property owned by the debtor. The garnishee, in this case, may be a bank, a tenant, a customer, or any third party that owes money to the debtor. To initiate a Bexar Texas Writ of Garnishment, a creditor must file a legal document with the court, specifying the details of the debt and providing evidence of the debtor's failure to pay. Once the writ is approved by the court, it is served to the garnishee, who then becomes legally obligated to withhold and surrender the specified funds or assets to the creditor according to the terms outlined in the writ. It is essential to note that the Bexar Texas Writ of Garnishment must comply with the Texas Civil Practice and Remedies Code and adhere to the specific rules and regulations set by the court. Additionally, there are certain exemptions and limitations on the amount of money that can be garnished, depending on the debtor's income and the type of debt involved. In conclusion, the Bexar Texas Writ of Garnishment is a legal mechanism that enables creditors in Bexar County, Texas, to collect outstanding debts from debtors by compelling third parties, such as employers or financial institutions, to withhold and surrender a portion of the debtor's wages or non-earning assets. It is crucial for both creditors and debtors to understand their rights and obligations under this writ, and consult with legal professionals for proper guidance.