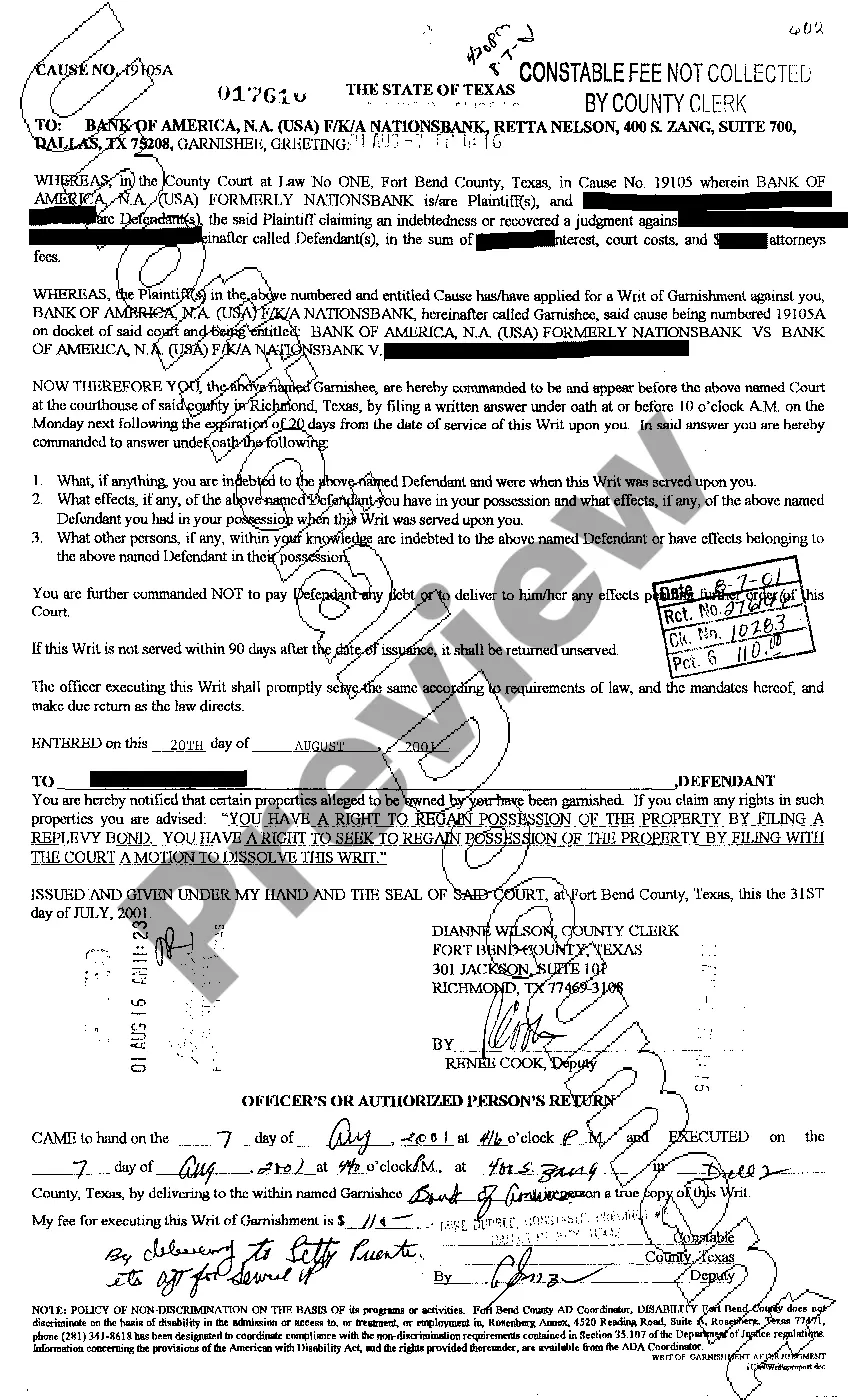

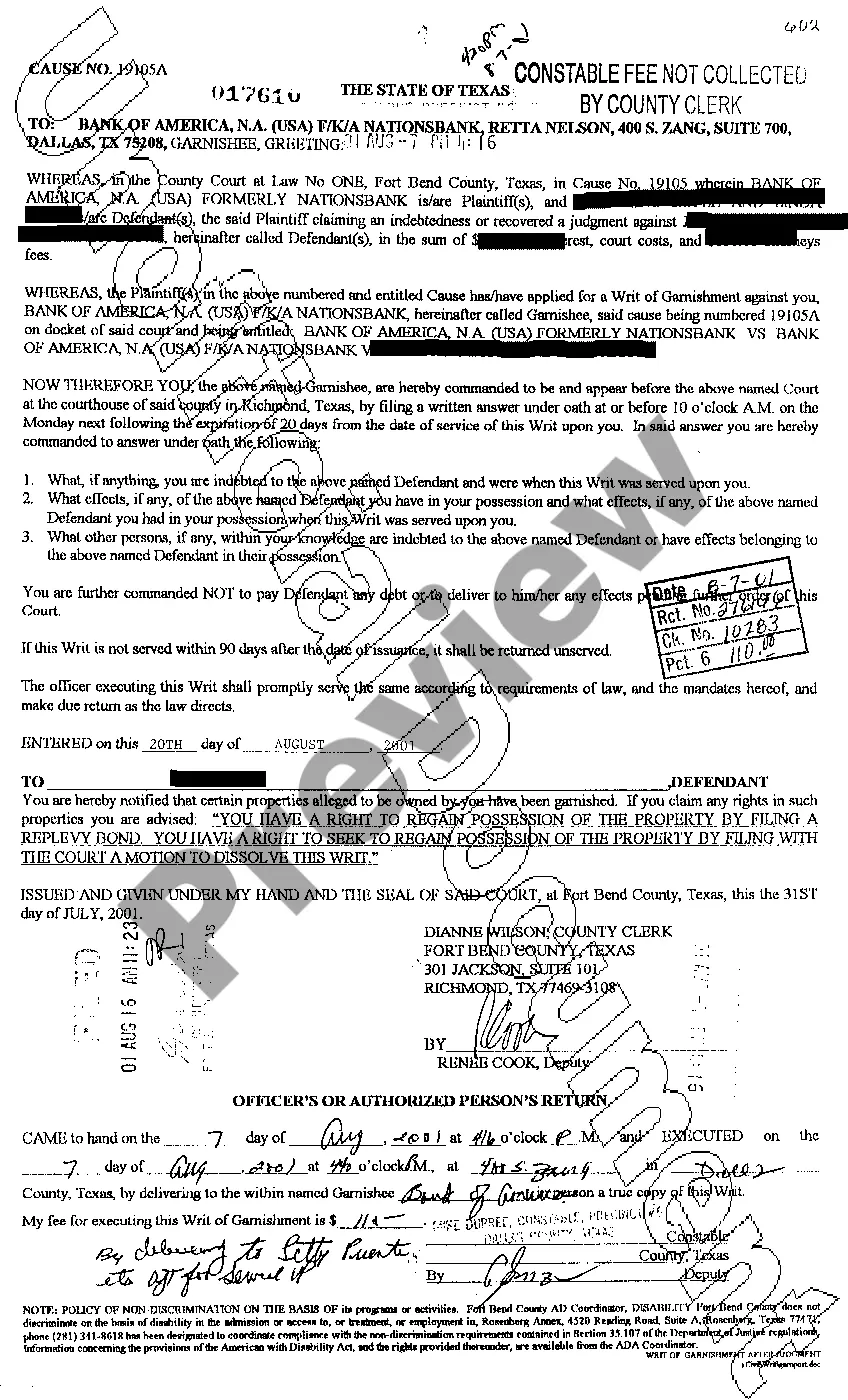

Collin Texas Writ of Garnishment refers to a legal procedure that allows a creditor to collect debts owed by a debtor residing in Collin County, Texas. This writ enables the creditor to seize the debtor's assets, such as bank accounts or wages, in order to satisfy the debt. Keywords: Collin Texas, Writ of Garnishment, legal procedure, creditor, collect debts, debtor, Collin County, seize assets, satisfy debt. In Collin County, there are two main types of Writ of Garnishment that can be filed by a creditor: 1. Writ of Garnishment for Property other than Earnings: This type of writ allows a creditor to seize non-wage assets owned by the debtor. Examples of such assets can include bank accounts, real estate property, vehicles, or other personal belongings. Once the writ is issued, the sheriff of Collin County will serve it to the garnishee (a third party that holds the debtor's assets). The garnishee is then required to freeze the identified assets and withhold them to satisfy the debt. 2. Writ of Garnishment for Earnings: This writ enables a creditor to garnish the debtor's wages or salary. After the writ is issued, it is served to the debtor's employer, who is then obligated to withhold a portion of the debtor's wages until the debt is settled. The amount that can be garnished from the debtor's earnings is subject to certain limits imposed by Texas law. In both types of Writ of Garnishment, the creditor must follow specific legal procedures and obtain a court order before initiating the garnishment process. The debtor also has certain rights, such as the opportunity to challenge the garnishment in court or claim exemptions to protect certain assets or income from being seized. It is important to note that the Collin Texas Writ of Garnishment process is governed by state laws and regulations, which may vary from other jurisdictions. Therefore, it is advisable for creditors and debtors in Collin County, Texas, to seek legal advice from an attorney who specializes in debt collection and garnishment cases.

Collin Texas Writ of Garnishment

Description

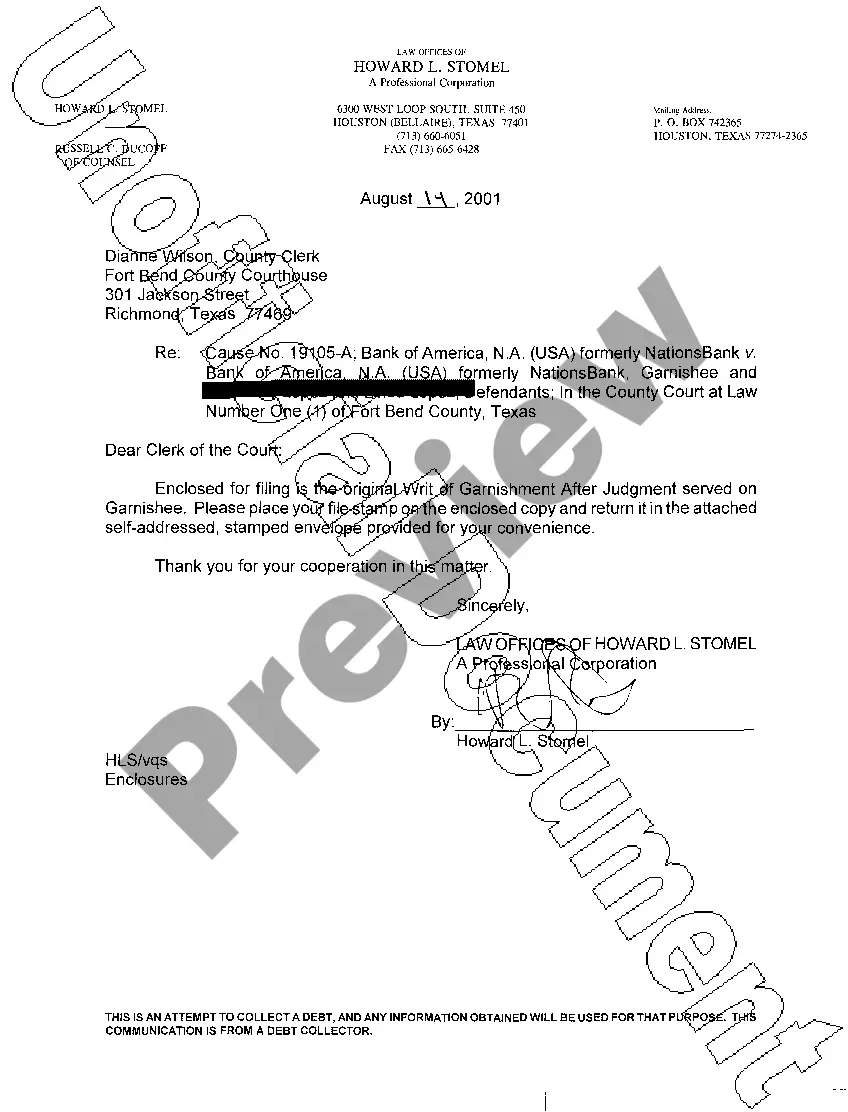

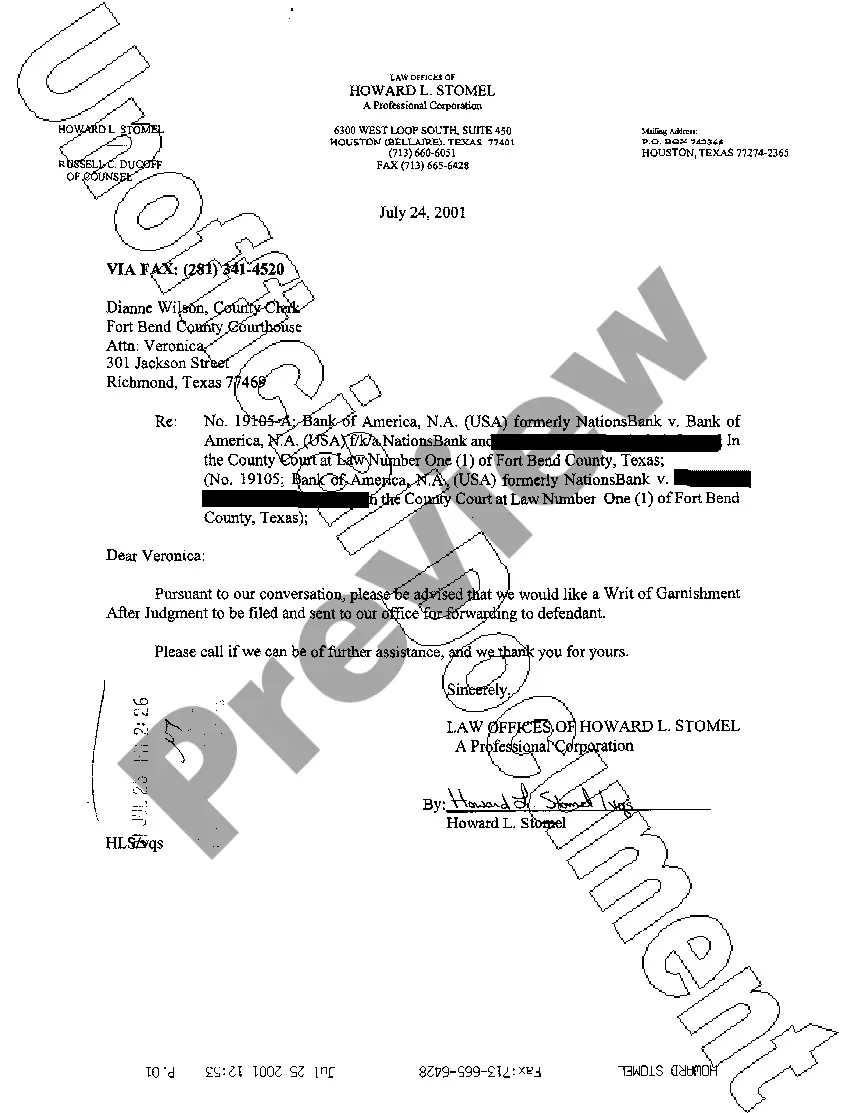

How to fill out Collin Texas Writ Of Garnishment?

If you’ve already utilized our service before, log in to your account and download the Collin Texas Writ of Garnishment on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make certain you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Collin Texas Writ of Garnishment. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!

Form popularity

FAQ

How long does it take to evict someone in Texas? From start to finish approximately three weeks ? 3 days from notice to vacate to filing of suit ? 8-10 days to serve the citation -The law requires the defendant have a least six days no more than 10 days notice before the hearing.

Lawyers call these a ?statute of limitations.? To see if you have waited too long, determine how long it has been since you have suffered the wrong for which you are going to sue. In most cases, you must bring your lawsuit within two years of when the problem arises.

If you lent someone money, you can sue them in small claims court if they failed to pay you back. If your landlord didn't return your security deposit, you can sue them in small claims. If you are owed money because someone hit your car and you had to repair it, you can sue them in small claims court.

In most cases, the person who is owed money has the option to take legal action. This may include filing a lawsuit, contacting a debt collector, or requesting that the money be transferred to a bank account. There are specific laws that govern these different actions, and each situation will be different.

A judgement will state that you have not paid your debt and it will reflect on your credit record for 5 years. When a judgement is granted, a creditor can apply for a warrant where the sheriff can attach goods such as your furniture and sell these to pay your debt.

You can try and get your money (called 'enforcing your judgment') by asking the court for: a warrant of control. an attachment of earnings order. a third-party debt order. a charging order.

On the occasion of a party's first appearance through counsel, the attorney whose signature first appears on the initial pleadings for any party shall be the attorney in charge, unless another attorney is specifically designated therein.

Do Judgments Expire in Texas? Judgments awarded in Texas to a non-government creditor are generally valid for ten years but they can be renewed for longer. If a judgment is not renewed, it will become dormant.

In order to file a lawsuit in Texas, you must first make sure that you have a valid and viable legal claim. If so, then you may file a petition with the proper state court, which is a legal document akin to a complaint in other states that requests a court provide a certain remedy.

Of course, even where default judgment is entered, that is not necessarily the end of the matter. The defendant may be able to have the judgment set aside if it can persuade the court that it has a real prospect of successfully defending the claim or there is some other good reason why the judgment should be set aside.