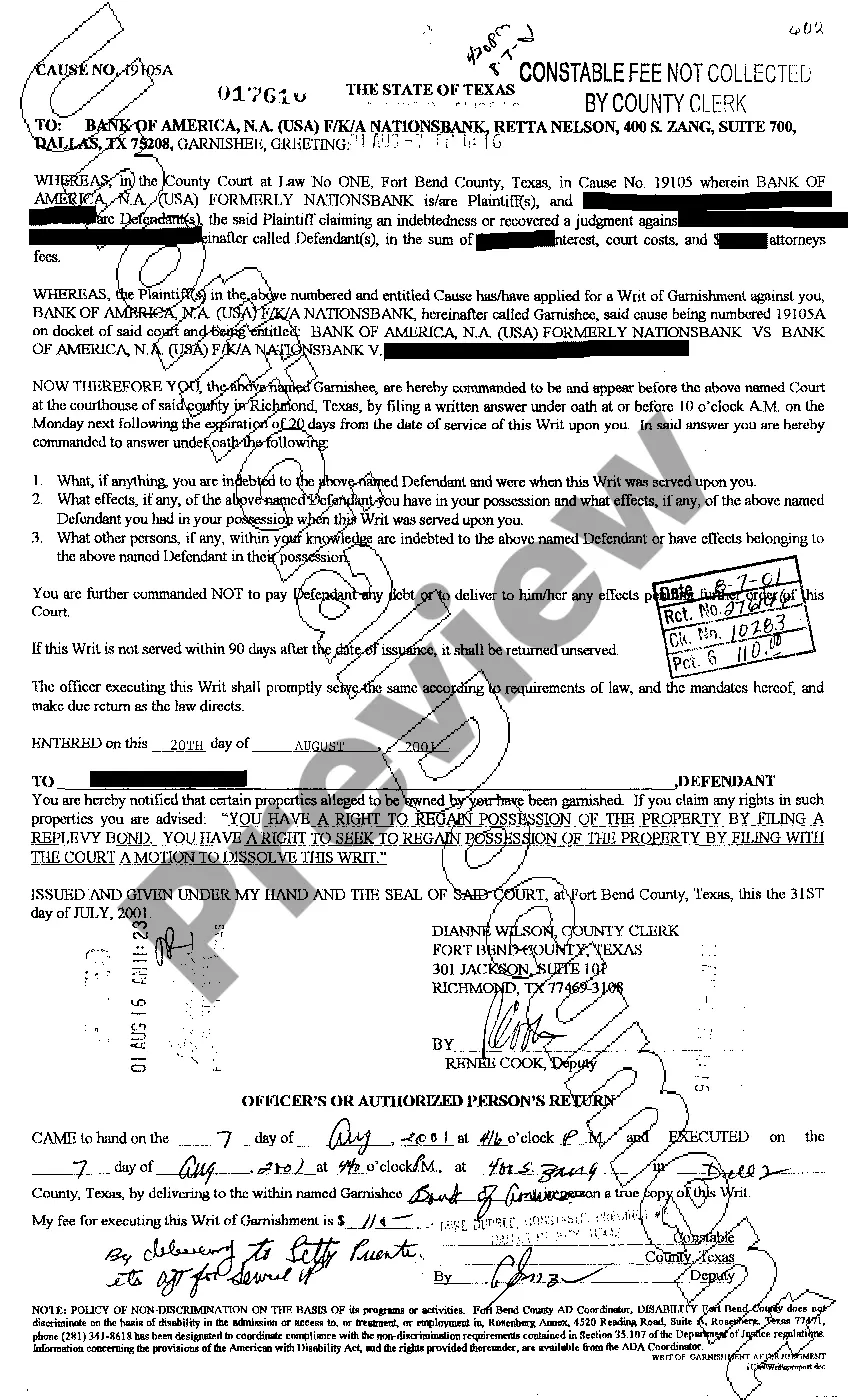

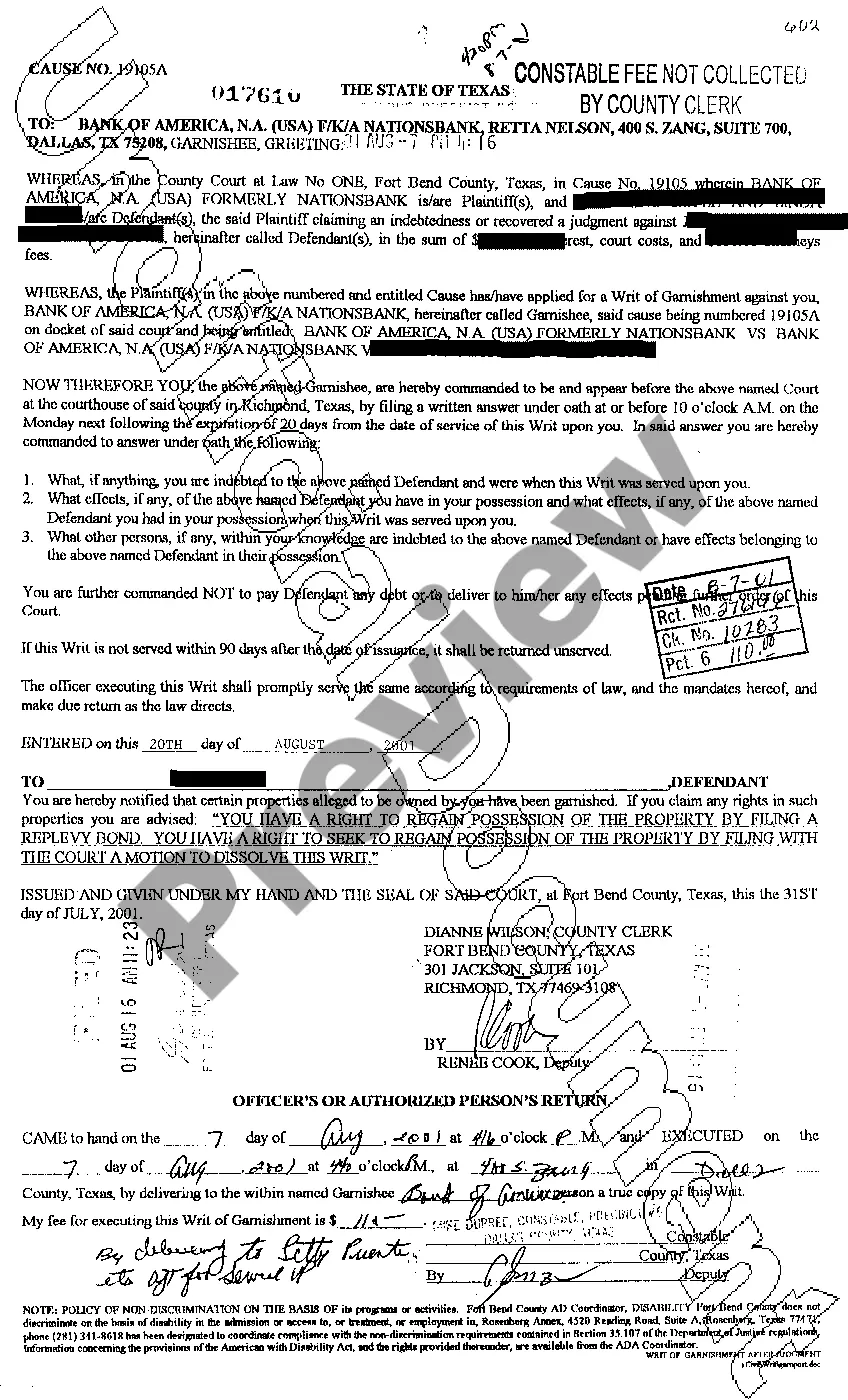

The Frisco Texas Writ of Garnishment is a legal process used to collect debts owed by a debtor. It allows a creditor to seize a portion of the debtor's wages or assets in order to satisfy the outstanding debt. This legal tool is often used when the debtor fails to respond to collection efforts or refuses to make voluntary payments. In Frisco, Texas, there are different types of Writ of Garnishment that can be utilized depending on the nature of the debt and the assets available. These include: 1. Wage Garnishment: This type of garnishment allows a creditor to collect a percentage of the debtor's wages directly from their employer until the debt is fully satisfied. The maximum garnishment amount is usually limited by state law. 2. Bank Account Garnishment: A creditor can obtain a Writ of Garnishment to freeze the debtor's bank account and withdraw funds up to the amount owed. This type of garnishment provides the creditor with immediate access to the debtor's funds, ensuring prompt debt repayment. 3. Property Garnishment: In some cases, a creditor may choose to garnish the debtor's personal property or assets in order to satisfy the debt. This could include seizing and selling valuable belongings such as vehicles, real estate, or other valuable assets. 4. Federal and State Tax Refund Garnishment: If the debtor is owed a tax refund from the federal or state government, a creditor can obtain a Writ of Garnishment to redirect the refund to satisfy the outstanding debt. It is important to note that the process of obtaining a Writ of Garnishment in Frisco, Texas, or any other jurisdiction, requires following specific legal procedures and obtaining court approval. The debtor must be notified of the garnishment and given an opportunity to challenge it if they believe it is unjust or improper. Overall, the Frisco Texas Writ of Garnishment is a powerful legal remedy for creditors seeking to collect on outstanding debts. By utilizing different types of garnishments, creditors can strategically pursue repayment and recover what is owed to them.

Frisco Texas Writ of Garnishment

Description

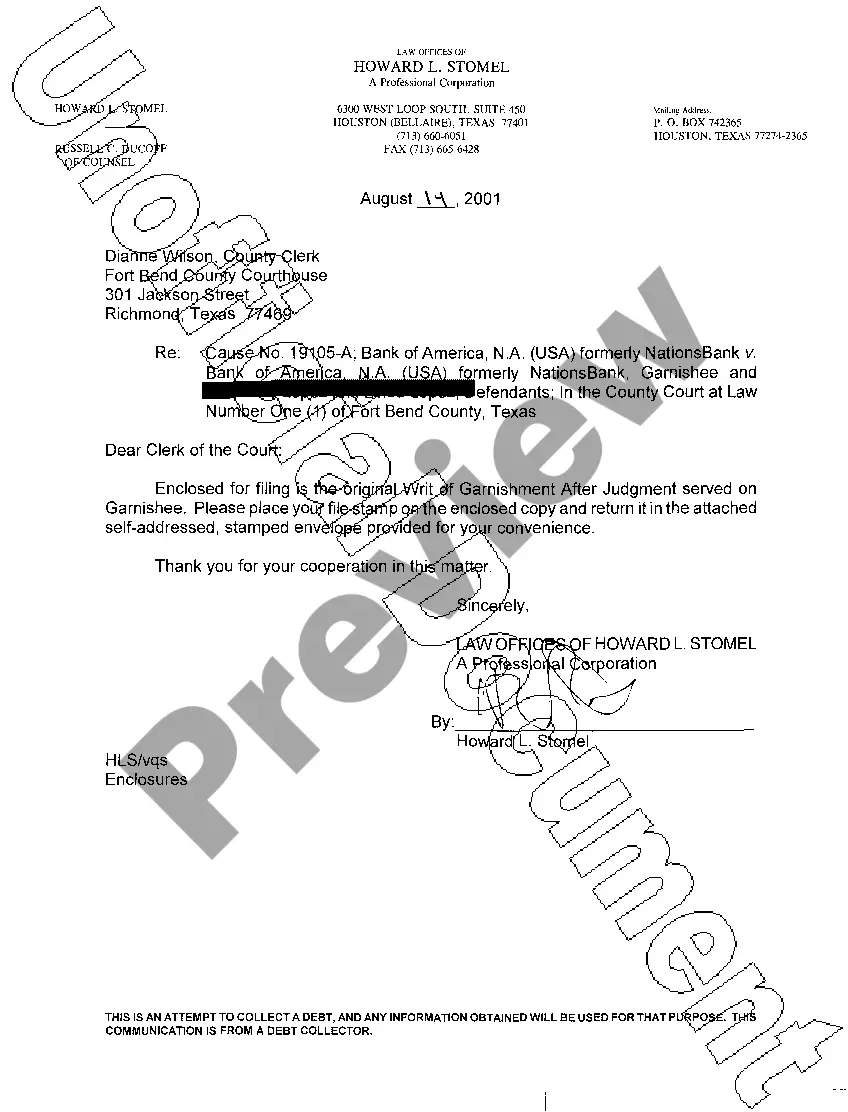

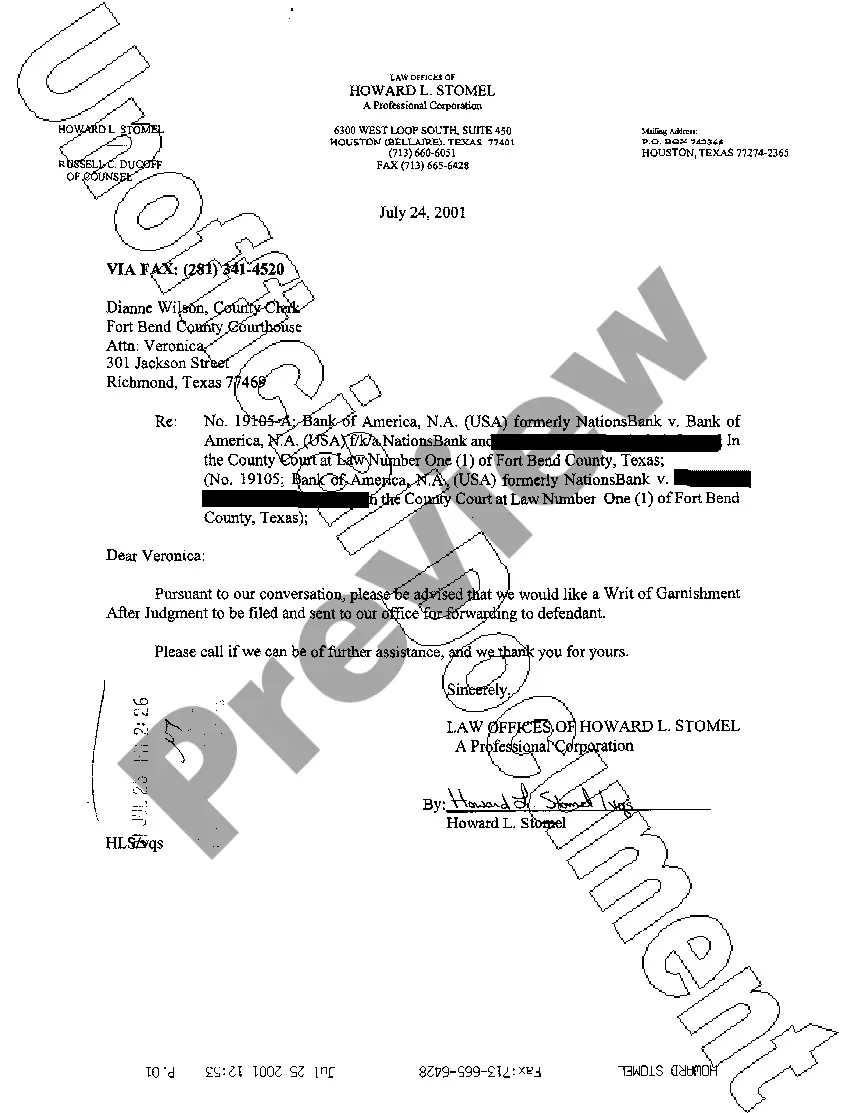

How to fill out Frisco Texas Writ Of Garnishment?

Finding authentic templates tailored to your local laws can be difficult unless you access the US Legal Forms library.

It's an online collection of over 85,000 legal documents catering to both personal and professional requirements and various real-world situations.

All the forms are suitably categorized by usage area and jurisdiction, making it as simple as pie to find the Frisco Texas Writ of Garnishment.

The process will require just a few additional steps for newcomers.

- Examine the Preview mode and document description.

- Ensure you’ve selected the correct one that aligns with your needs and fully matches your local jurisdiction criteria.

- Search for another template if necessary.

- If you notice any discrepancies, use the Search tab above to locate the accurate one. If it fits your criteria, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

To stop wage garnishment in Texas, you can request a hearing to contest the garnishment or argue for exemptions. Providing evidence of financial hardship can also play a crucial role in easing the impact of a Frisco Texas Writ of Garnishment. Additionally, engaging a legal service like USLegalForms can help you draft the necessary forms and take the right steps to halt the garnishment process.

Yes, you can sue your employer for unpaid wages in Texas, but the process can be complex. If your employer is withholding your wages illegally, you may file a claim in civil court. Using a Frisco Texas Writ of Garnishment can also help you collect any awarded amounts once you win the case. Legal advice can strengthen your position and guide you through the necessary steps.

In Texas, the process of garnishment follows specific rules outlined in state law. A creditor must first obtain a judgment before they can issue a Frisco Texas Writ of Garnishment. Moreover, certain income types, such as Social Security benefits or unemployment payments, are generally protected from garnishment. It's essential to understand these regulations to navigate garnishment effectively.

Yes, there are a few strategies to explore if you face wage garnishment due to a Frisco Texas Writ of Garnishment. First, you can negotiate directly with the creditor to settle the debt for a lower amount. Additionally, you might qualify for exemptions that can limit or stop the garnishment. Consulting a legal expert can help you identify your options.

To stop a garnishment, you can file a motion with the court to dispute the writ or negotiate a payment agreement with your creditor. Additionally, exploring bankruptcy may offer protection and halt the garnishment process. If you need professional help, consider using uslegalforms to find the necessary legal documents and guidance tailored to a Frisco Texas writ of garnishment. Taking action promptly can significantly reduce the stress of garnishment.

A writ of garnishment in Texas is a legal action that allows a creditor to receive payment directly from a debtor's wages or account funds. This court order helps ensure the creditor collects the debt owed while adhering to specific legal procedures. Understanding the nuances of the Frisco Texas Writ of Garnishment can be crucial for both creditors and debtors navigating this complex process.

To protect your bank account from garnishment in Texas, consider using exempt funds such as Social Security or disability benefits. Additionally, establishing a proper defense in court, or negotiating with creditors can prevent involuntary seizures. Resources like UsLegalForms can help you find the necessary documentation and legal advice when dealing with a Frisco Texas Writ of Garnishment.

A writ of garnishment in Collin County is a legal document that allows creditors to collect debts directly from a debtor's wages or bank accounts. This process must follow specific state laws and court procedures to ensure fairness and legality. Learning about the Frisco Texas Writ of Garnishment can empower creditors and debtors alike to understand their respective rights.

The primary difference between a writ of execution and garnishment in Texas is how they enforce judgments. A writ of execution involves seizing and selling a debtor's property, while garnishment specifically targets wages or bank accounts for direct collection. Familiarizing yourself with the Frisco Texas Writ of Garnishment can clarify how these legal tools interact.

In Texas, only certain creditors can legally garnish your wages, including those with a court judgment against you for unpaid debts. Typical examples include creditors for child support, taxes, and certain loans. Understanding the guidelines around Frisco Texas Writ of Garnishment can help you navigate these situations and ensure compliance.