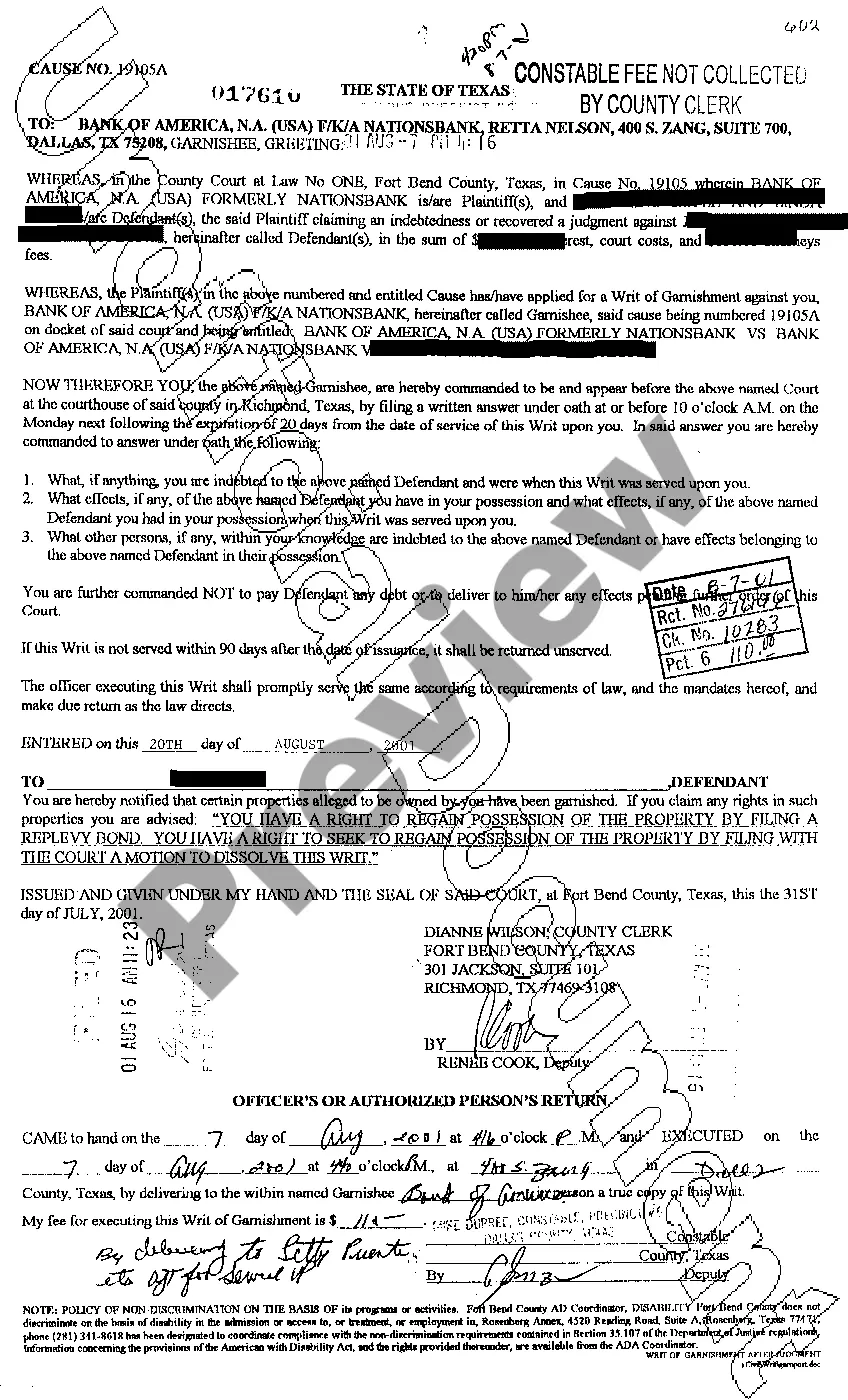

The Grand Prairie Texas Writ of Garnishment is a legal document that allows creditors to collect on a debt owed by an individual or business entity. It is a court order obtained to withhold a portion of the debtor's wages, bank accounts, or other assets to satisfy the outstanding debt. There are several types of Grand Prairie Texas Writ of Garnishments, each serving a different purpose based on the type of debt and the assets involved. Some common types include: 1. Wages Garnishment: This type of garnishment allows a creditor to collect a portion of a debtor's wages directly from their paycheck. The amount that can be garnished is usually limited to a percentage of the debtor's disposable earnings, ensuring they have enough income to cover basic living expenses. 2. Bank Account Garnishment: In this scenario, a creditor can garnish funds directly from the debtor's bank account(s). The amount that can be garnished is subject to certain limitations, but it can be a useful method for collection if the debtor has sufficient funds in their account. 3. Property Garnishment: This writ allows a creditor to seize and sell the debtor's property in order to satisfy the debt. Real estate, vehicles, and valuable personal belongings can be subject to garnishment if the court deems it necessary. 4. Third-Party Garnishment: In some cases, a creditor can garnish funds owed to the debtor by a third party. This includes but is not limited to, insurance settlements, rental income, and other sources of money owed to the debtor. The Grand Prairie Texas Writ of Garnishment is a powerful tool for creditors seeking to collect on outstanding debts. However, it is crucial to note that the debtor has certain rights and protections under Texas law, including the ability to challenge the garnishment in court if they believe it is unjust or unlawful. Overall, the Grand Prairie Texas Writ of Garnishment serves as a legal mechanism for creditors to recover funds owed to them, using various methods tailored to the specific circumstances of the debt and the assets involved. It is important for both creditors and debtors to understand their rights and obligations in the garnishment process to ensure a fair and lawful resolution.

Grand Prairie Texas Writ of Garnishment

Description

How to fill out Grand Prairie Texas Writ Of Garnishment?

If you are searching for an authentic form template, it’s hard to find a superior platform compared to the US Legal Forms website – likely the most comprehensive collections available online.

Here you can acquire thousands of document samples for both business and personal use sorted by categories and regions, or by keywords.

With our enhanced search feature, obtaining the latest Grand Prairie Texas Writ of Garnishment is as simple as 1-2-3.

Every form you add to your user account has no expiration date and belongs to you indefinitely.

You can always access them through the My documents section, so if you need another copy for editing or printing, you can return and download it again at any time.

- Additionally, the accuracy of each document is validated by a team of experienced attorneys who regularly assess the templates on our site and refresh them according to the latest state and county requirements.

- If you are already familiar with our platform and possess an account, all you have to do to obtain the Grand Prairie Texas Writ of Garnishment is to Log In to your user profile and click on the Download button.

- If you are using US Legal Forms for the first time, just follow the steps outlined below.

- Ensure you have accessed the sample you wish to review. Inspect its description and use the Preview feature to look through its content. If it doesn’t fulfill your requirements, take advantage of the Search option at the top of the page to find the appropriate file.

- Validate your choice. Click on the Buy now button. After that, select the preferred pricing option and provide details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the sign-up process.

- Obtain the form. Select the file format and download it onto your device.

- Make modifications. Complete, modify, print, and sign the received Grand Prairie Texas Writ of Garnishment.

Form popularity

FAQ

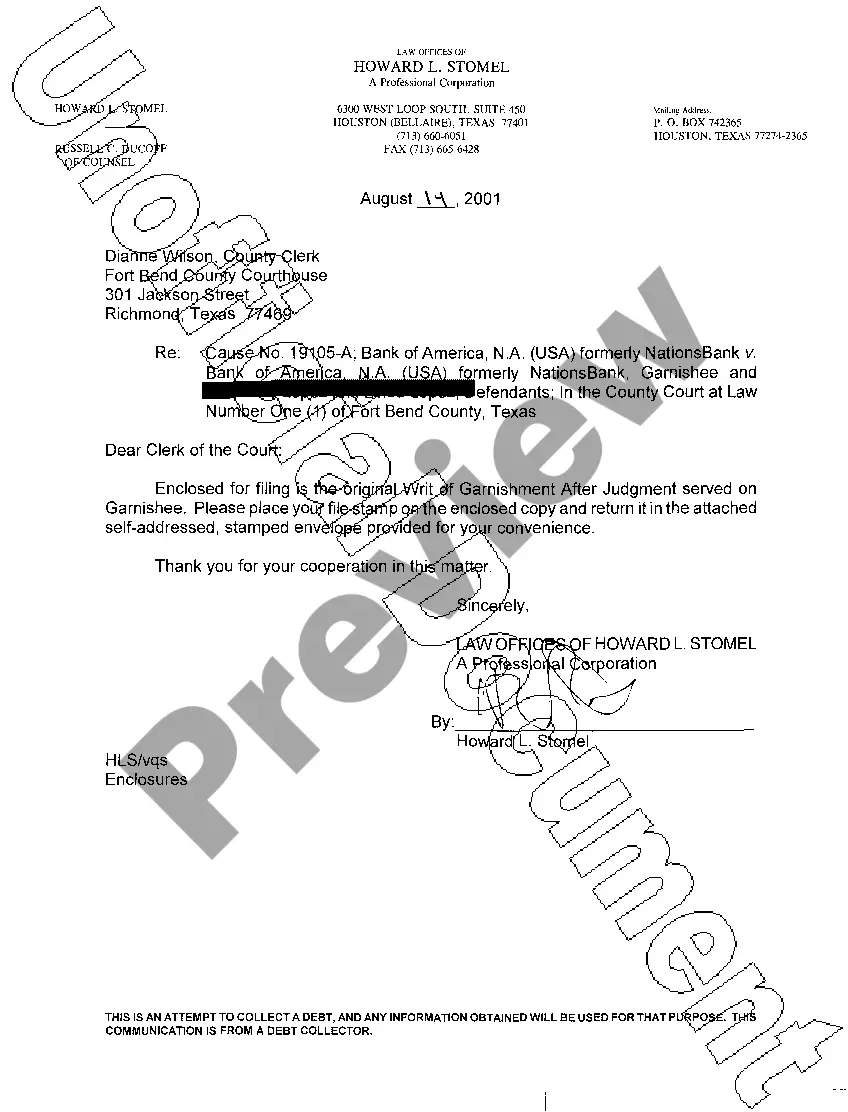

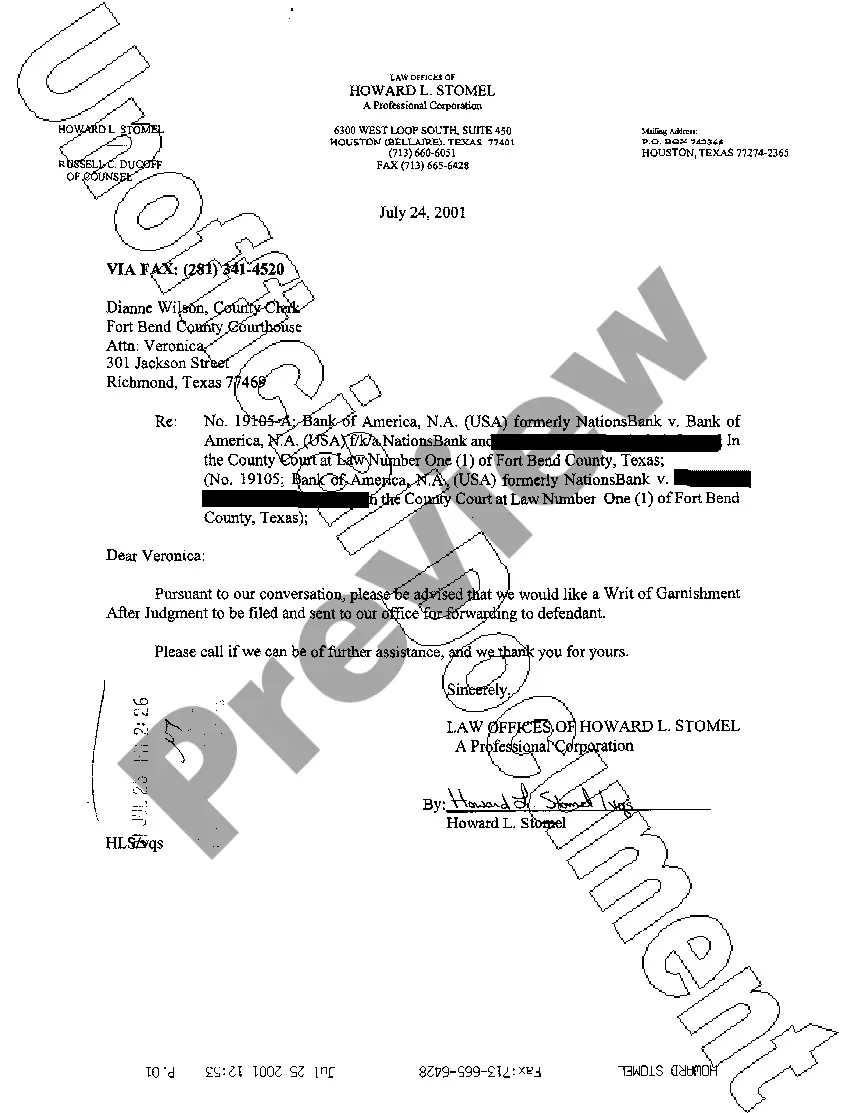

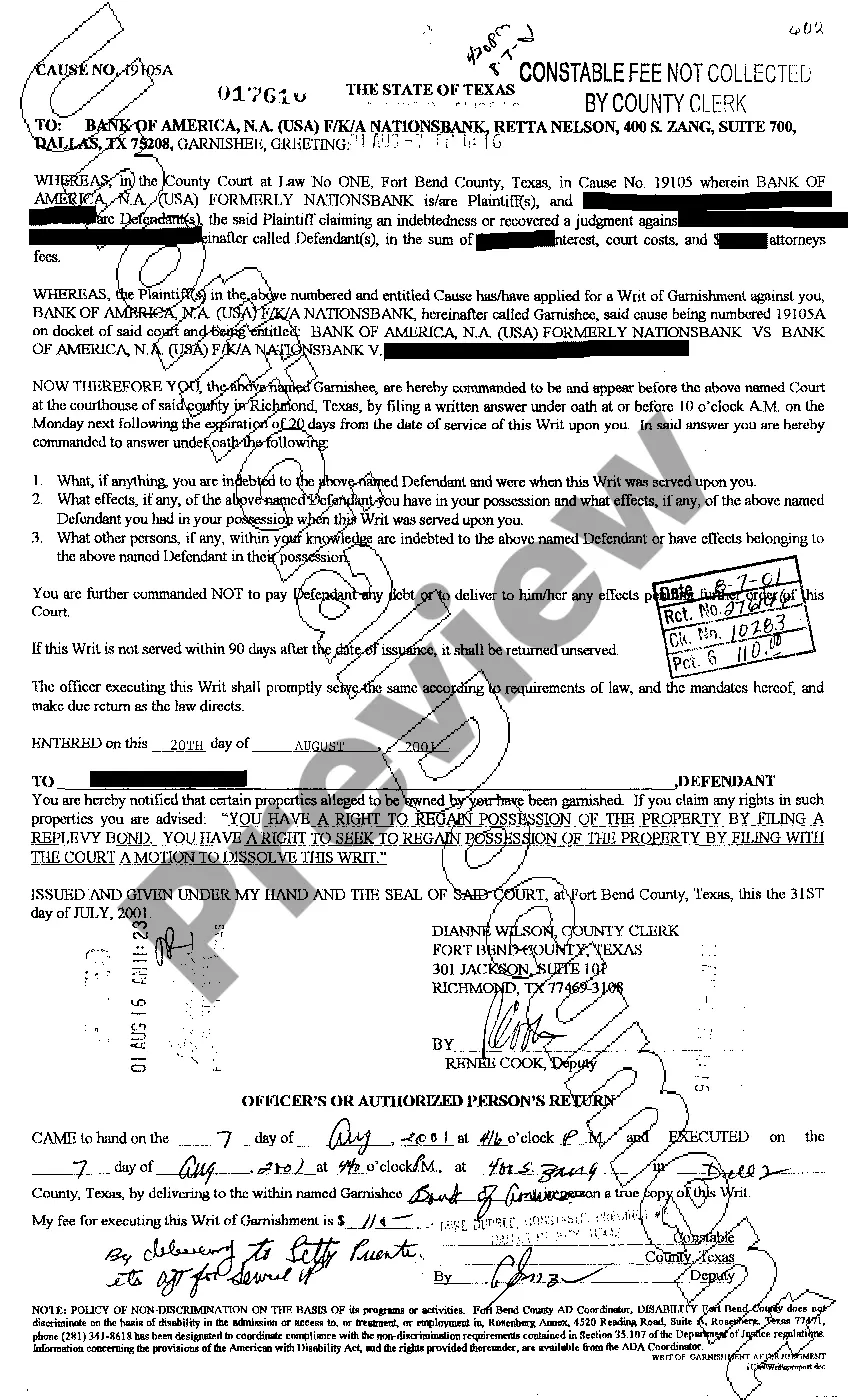

To file a writ of garnishment in Texas, first, ensure you have a valid judgment against the debtor. Next, complete the appropriate forms, which include the application for the writ and relevant affidavits. You must then file these documents with the court that issued your judgment. After the court approves your application, a sheriff or constable can serve the writ on the garnishee, allowing you to collect the owed amounts. Using platforms like USLegalForms can simplify this process by providing easy-to-use templates and guidance specifically for filing a Grand Prairie Texas writ of garnishment.

If an employer ignores a wage garnishment in Texas, they may face legal consequences. The court can hold the employer in contempt, which could result in fines or other penalties. Additionally, the employee may seek legal recourse, potentially leading to further complications for the employer. To ensure compliance with a Grand Prairie Texas Writ of Garnishment, it's essential for employers to understand their responsibilities and take the matter seriously.

To obtain a writ of garnishment in Texas, you must first file a petition with the court where you have a judgment. Following that, the court will issue the writ if it finds your request valid. USLegalForms can simplify this process by providing essential forms and instructions related to the Grand Prairie Texas Writ of Garnishment.

In Texas, certain creditors can legally garnish your wages. This includes government agencies, like the IRS for tax debts, and private creditors after obtaining a court judgment against you. Understanding the specifics of the Grand Prairie Texas Writ of Garnishment can help you navigate these situations more effectively.

To protect your bank account from garnishment in Texas, you can consider several strategies. Firstly, keep your exempt funds, like Social Security or disability payments, separate from other income. Additionally, consulting with a legal expert about the Grand Prairie Texas Writ of Garnishment may help you understand your rights and the best protective measures.

Yes, you can file a writ of garnishment in Texas. This legal action allows creditors to collect debts by seizing funds directly from a debtor's bank account or wages. If you need assistance with filing, platforms like USLegalForms can provide you with the necessary forms and guidance tailored to Grand Prairie Texas Writ of Garnishment.

§§ 63.001-. 008 (Vernon 1986). In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor.

WHO MAY ISSUE. The clerk of a district or county court or a justice of the peace may issue a writ of garnishment returnable to his court. Acts 1985, 69th Leg., ch. 959, Sec.

The writ of garnishment orders the third party to surrender the defendant's assets to the court in order to satisfy a judgment against the defendant. With a writ of garnishment in place, creditors such as banks and credit cards can pull directly from defendants' bank accounts under Texas garnishment laws.