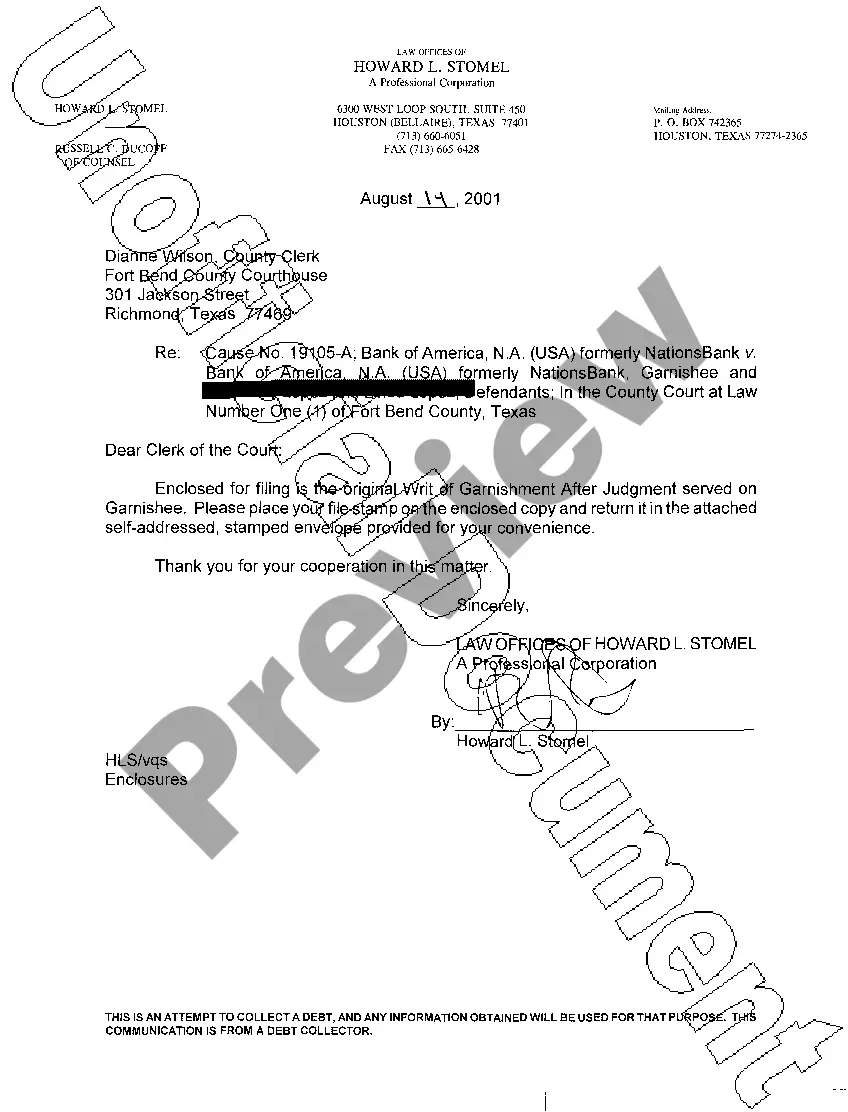

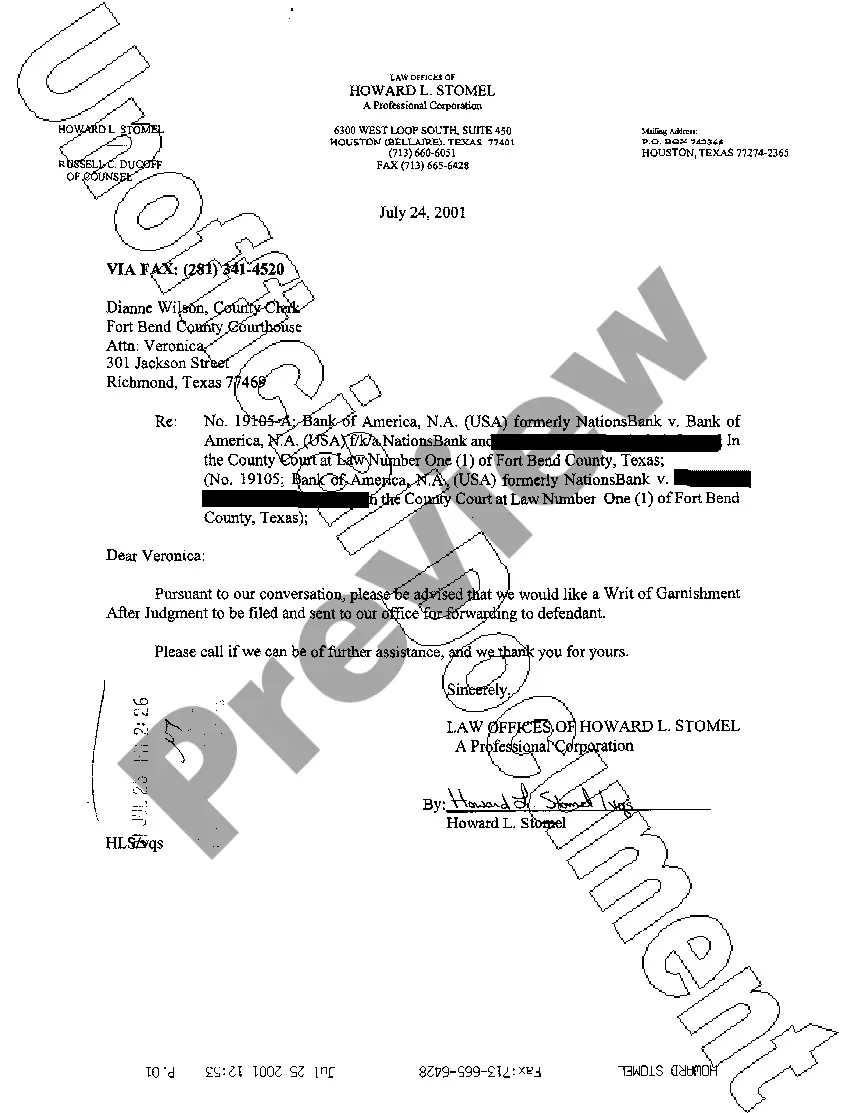

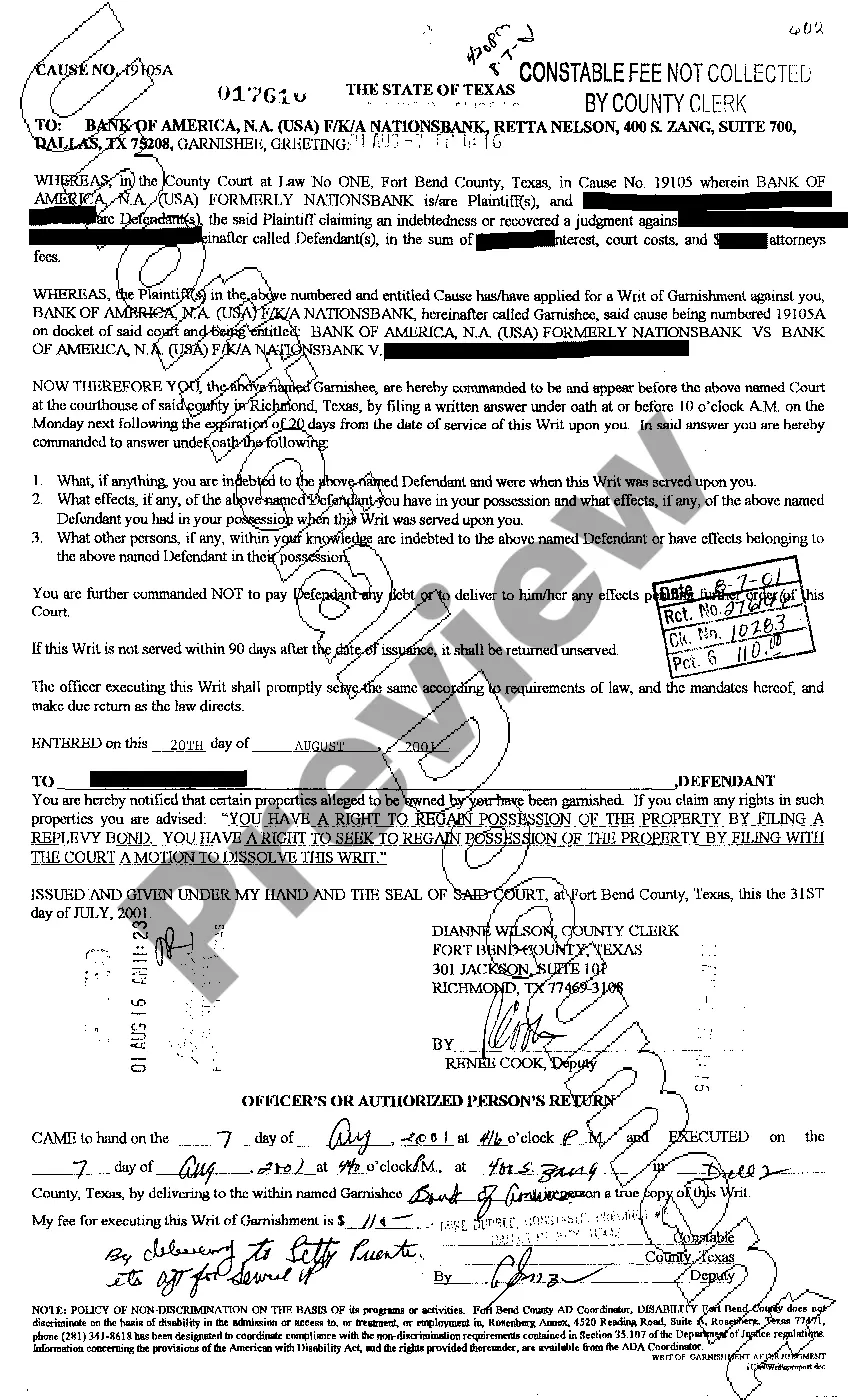

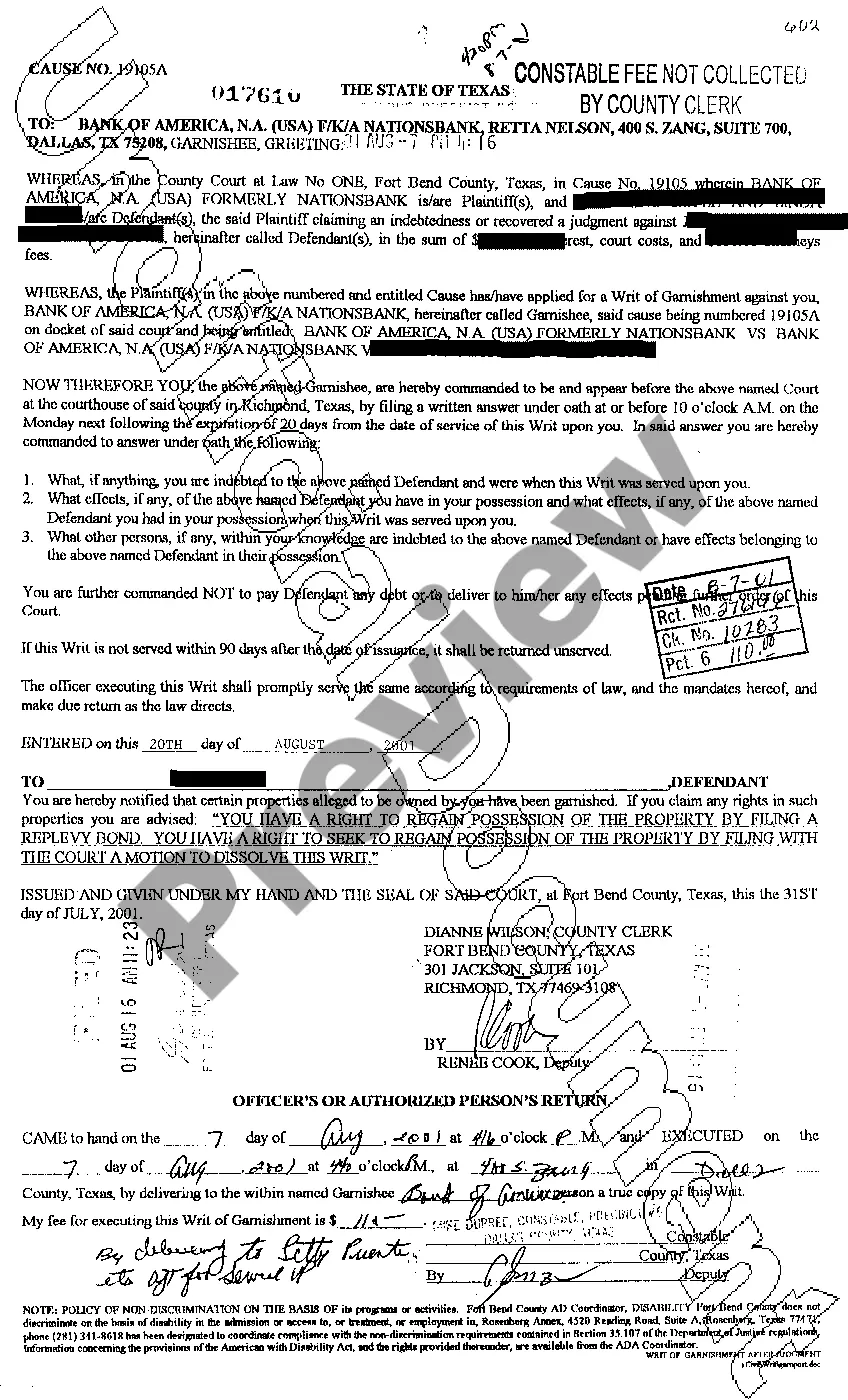

The Houston Texas Writ of Garnishment is a legal procedure used to collect on a debt owed by a person or business located in Houston, Texas. A writ of garnishment is a court order that allows a creditor to collect money or assets from a debtor to satisfy a debt. This process involves the seizure of the debtor's property or funds held by a third party, such as a bank, employer, or other financial institution. There are several types of Houston Texas Writ of Garnishment, each with its specific purpose. The most common types include: 1. Writ of Garnishment for Consumer Debt: This type of garnishment is used to collect unpaid debts owed by individuals for consumer-related purposes, such as credit card debts, medical bills, or personal loans. 2. Writ of Garnishment for Child Support: This garnishment is employed to collect overdue child support payments from the liable parent. It allows the Child Support Division to withhold a portion of the debtor's income or seize their assets to satisfy the unpaid support obligations. 3. Writ of Garnishment for Taxes: In cases where a person or business owes unpaid taxes to the state or federal government, a writ of garnishment can be issued to collect the outstanding tax debt. The taxing authority, such as the Texas Comptroller or Internal Revenue Service (IRS), can garnish wages, bank accounts, or other assets to recover the owed taxes. 4. Writ of Garnishment for Student Loans: This type of garnishment is specifically used to collect overdue student loan payments. The holder of the loan, typically a federal agency or a private loan service, can garnish wages, bank accounts, or other assets to recoup the unpaid balance. It is important to note that a Houston Texas Writ of Garnishment must follow specific legal procedures and require the involvement of the court. The creditor must file a lawsuit against the debtor and obtain a judgment in their favor, granting them the authority to pursue garnishment. Additionally, certain exemptions may apply to protect a portion of the debtor's income or assets from being garnished, such as minimum wage limits or exempted property. Overall, the Houston Texas Writ of Garnishment is a legal tool used to enforce the collection of various types of debts owed by individuals or businesses in Houston, Texas. It allows creditors to seize funds or assets held by third parties to satisfy the outstanding debt promptly.

Houston Texas Writ of Garnishment

Description

How to fill out Houston Texas Writ Of Garnishment?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone with no law background to create this sort of papers from scratch, mostly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes in handy. Our service offers a massive library with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you need the Houston Texas Writ of Garnishment or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Houston Texas Writ of Garnishment in minutes using our trustworthy service. If you are presently an existing customer, you can go ahead and log in to your account to download the needed form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the Houston Texas Writ of Garnishment:

- Ensure the template you have found is specific to your location since the regulations of one state or area do not work for another state or area.

- Preview the form and read a short outline (if available) of scenarios the document can be used for.

- In case the one you selected doesn’t meet your requirements, you can start over and look for the necessary form.

- Click Buy now and choose the subscription plan you prefer the best.

- with your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Houston Texas Writ of Garnishment as soon as the payment is through.

You’re all set! Now you can go ahead and print out the form or complete it online. In case you have any problems locating your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.