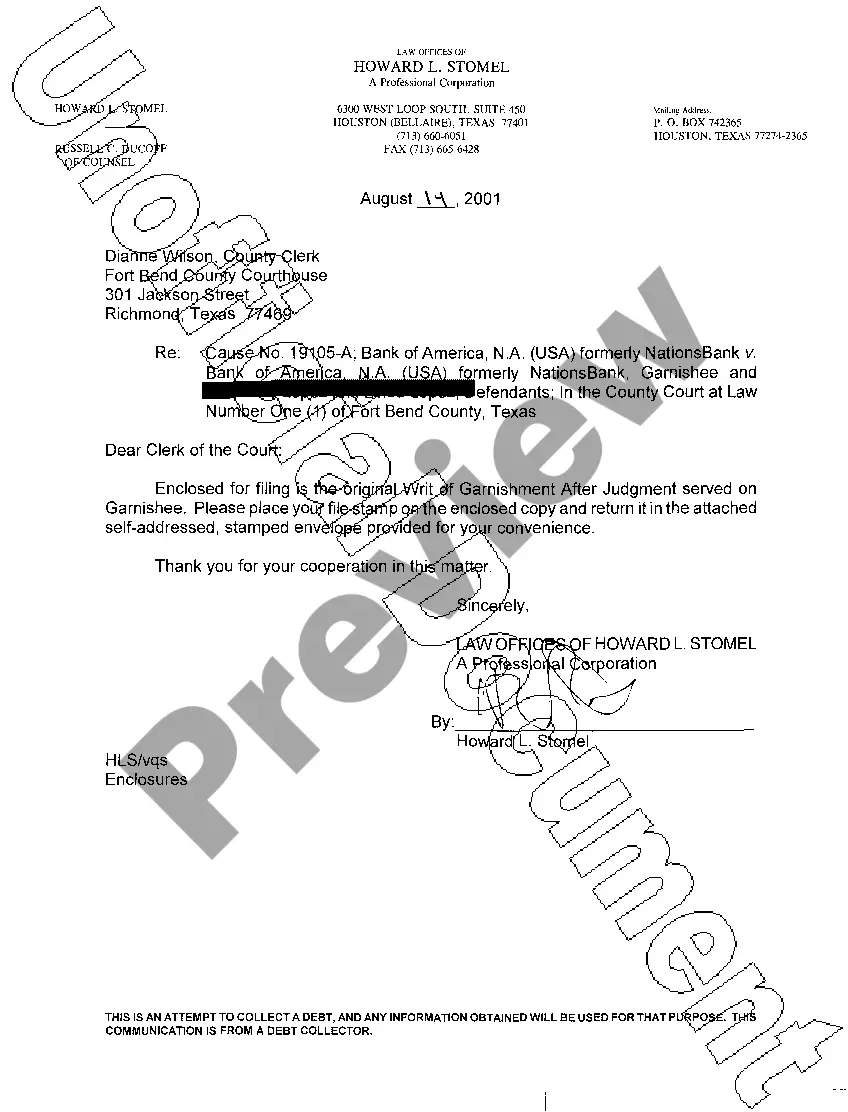

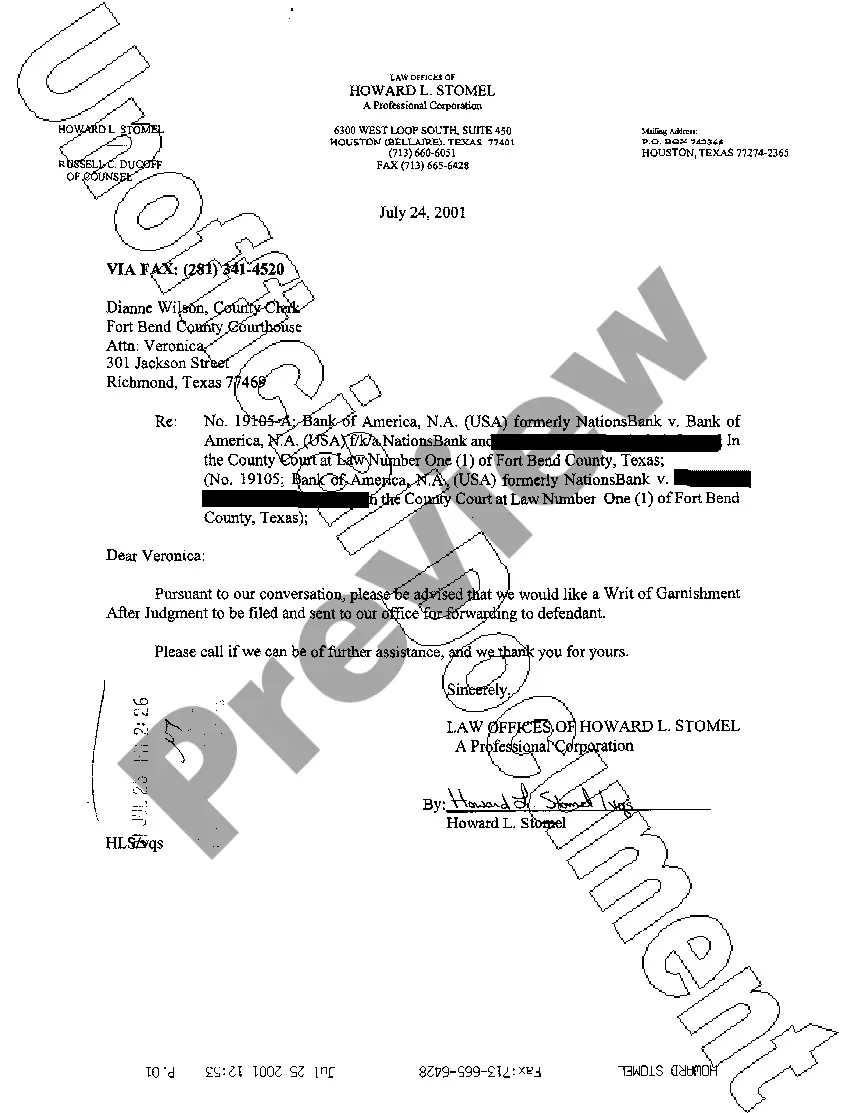

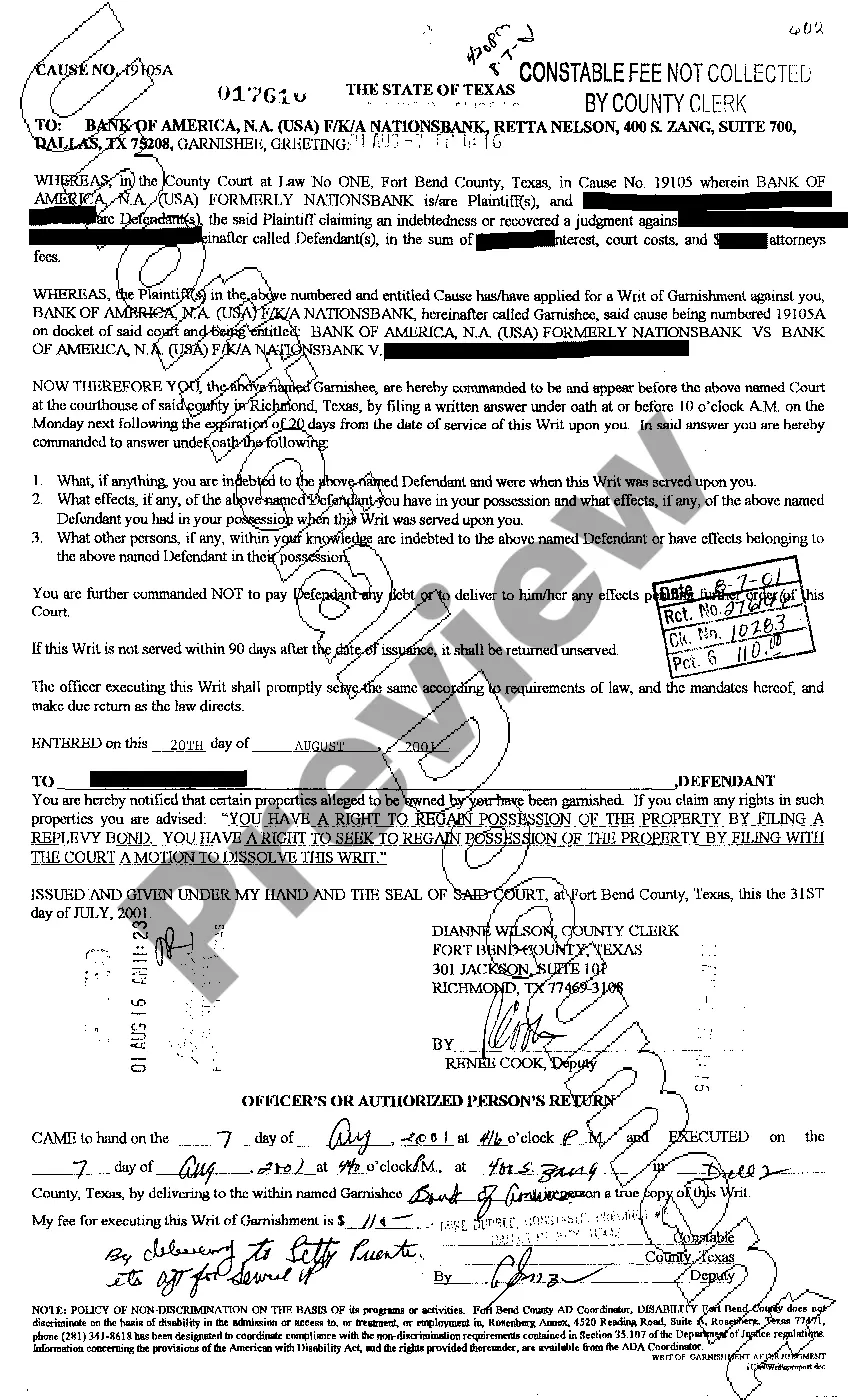

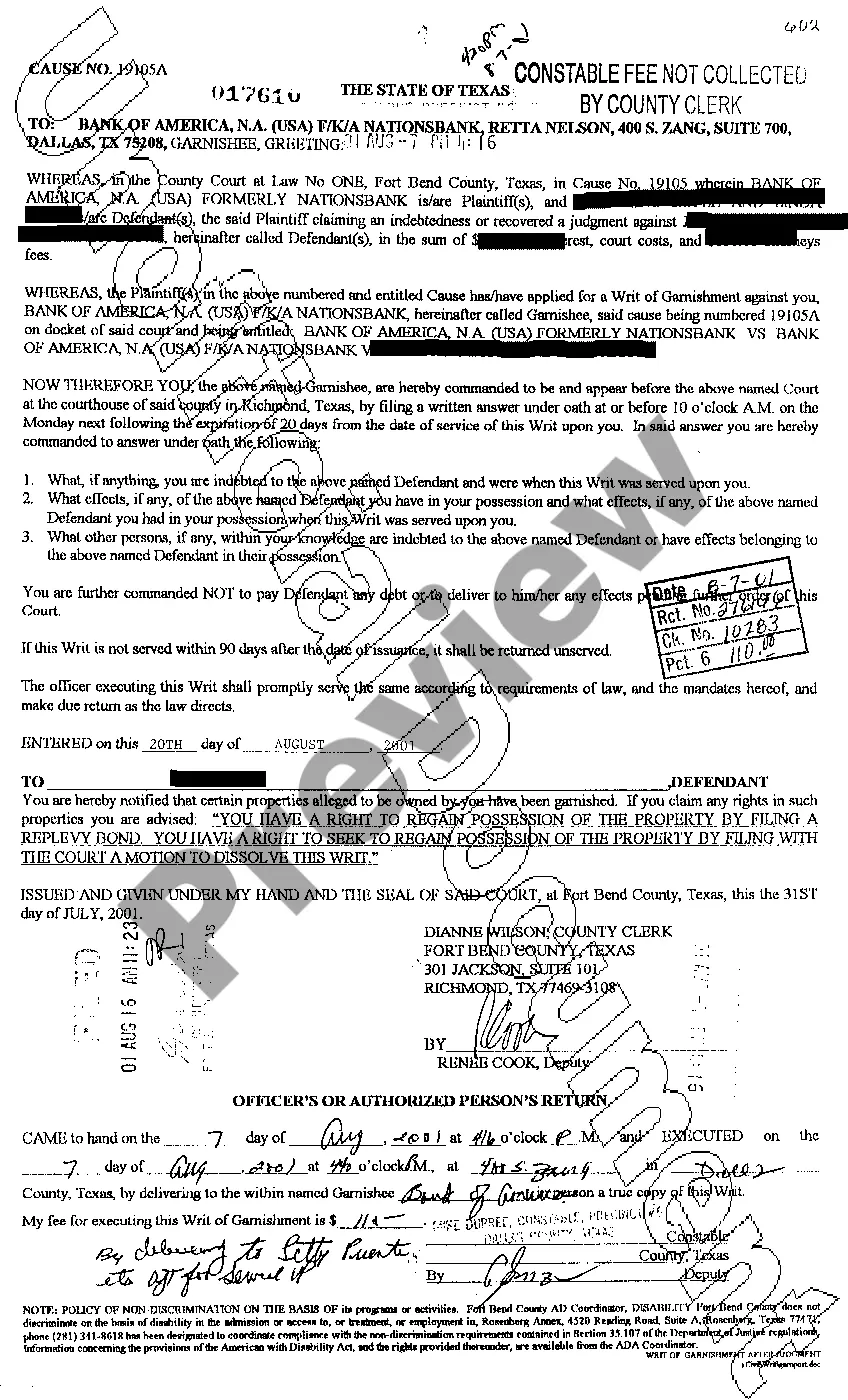

A writ of garnishment is a legal document issued by a court that enables a creditor to collect a debt owed by a debtor. In Killeen, Texas, a writ of garnishment follows similar procedures and guidelines as in other parts of the state. Killeen, Texas Writ of Garnishment is a court order that allows a creditor to seize a portion of a debtor's wages or other assets to satisfy an unpaid debt. This legal tool is often used by creditors to collect on judgments obtained through successful lawsuits against the debtor. Keywords: Killeen Texas, writ of garnishment, court order, creditor, debtor, legal document, unpaid debt, wages, assets, judgment, successful lawsuit. Within the realm of Killeen, Texas Writ of Garnishment, there are several types that can be pursued depending on the circumstances and the nature of the debt. It is important to understand these variations to determine the appropriate course of action. Here are some distinct types of writ of garnishment that can be utilized in Killeen, Texas: 1. Wage Garnishment: This type of garnishment is the most common and allows creditors to deduct a portion of a debtor's wages directly from their paycheck. The garnished amount is typically a percentage determined by the court, ensuring that the debtor still has enough income to cover necessary living expenses. 2. Bank Account Garnishment: In this case, a creditor can freeze the funds in a debtor's bank account and then collect the owed amount directly from the account. However, certain exemptions may apply, protecting a portion of the funds for essential expenses like rent or groceries. 3. Property Garnishment: This involves the seizure and potential sale of the debtor's assets, such as vehicles, real estate, or other valuable possessions, to satisfy the debt owed. The proceeds from the sale are then used to settle the outstanding debt. Keywords: Killeen Texas, writ of garnishment, wage garnishment, bank account garnishment, property garnishment, seizure, sale, debtor's wages, bank account, assets, outstanding debt. It is crucial for both creditors and debtors in Killeen, Texas, to be aware of the regulations and requirements surrounding writs of garnishment. The process for obtaining and enforcing a writ of garnishment must comply with state and federal laws, ensuring fair and just treatment for all parties involved. In conclusion, a Killeen Texas Writ of Garnishment is a legal tool that allows creditors to collect unpaid debts from debtors. This court-issued document can take different forms depending on the specific circumstances, such as wage garnishment, bank account garnishment, or property garnishment. Understanding the nuances of these writs is essential to navigate the debt collection process effectively.

Killeen Texas Writ of Garnishment

Description

How to fill out Killeen Texas Writ Of Garnishment?

Make use of the US Legal Forms and have instant access to any form template you want. Our useful website with a large number of templates makes it easy to find and get virtually any document sample you require. It is possible to download, fill, and sign the Killeen Texas Writ of Garnishment in just a matter of minutes instead of surfing the Net for many hours trying to find an appropriate template.

Using our catalog is a wonderful way to improve the safety of your form filing. Our experienced attorneys regularly check all the documents to ensure that the forms are relevant for a particular region and compliant with new acts and polices.

How do you obtain the Killeen Texas Writ of Garnishment? If you have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. Moreover, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Open the page with the form you need. Make certain that it is the form you were hoping to find: verify its headline and description, and make use of the Preview feature if it is available. Otherwise, use the Search field to look for the needed one.

- Start the saving process. Select Buy Now and choose the pricing plan you like. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the document. Pick the format to obtain the Killeen Texas Writ of Garnishment and modify and fill, or sign it for your needs.

US Legal Forms is probably the most extensive and reliable template libraries on the internet. Our company is always happy to assist you in any legal case, even if it is just downloading the Killeen Texas Writ of Garnishment.

Feel free to make the most of our form catalog and make your document experience as straightforward as possible!