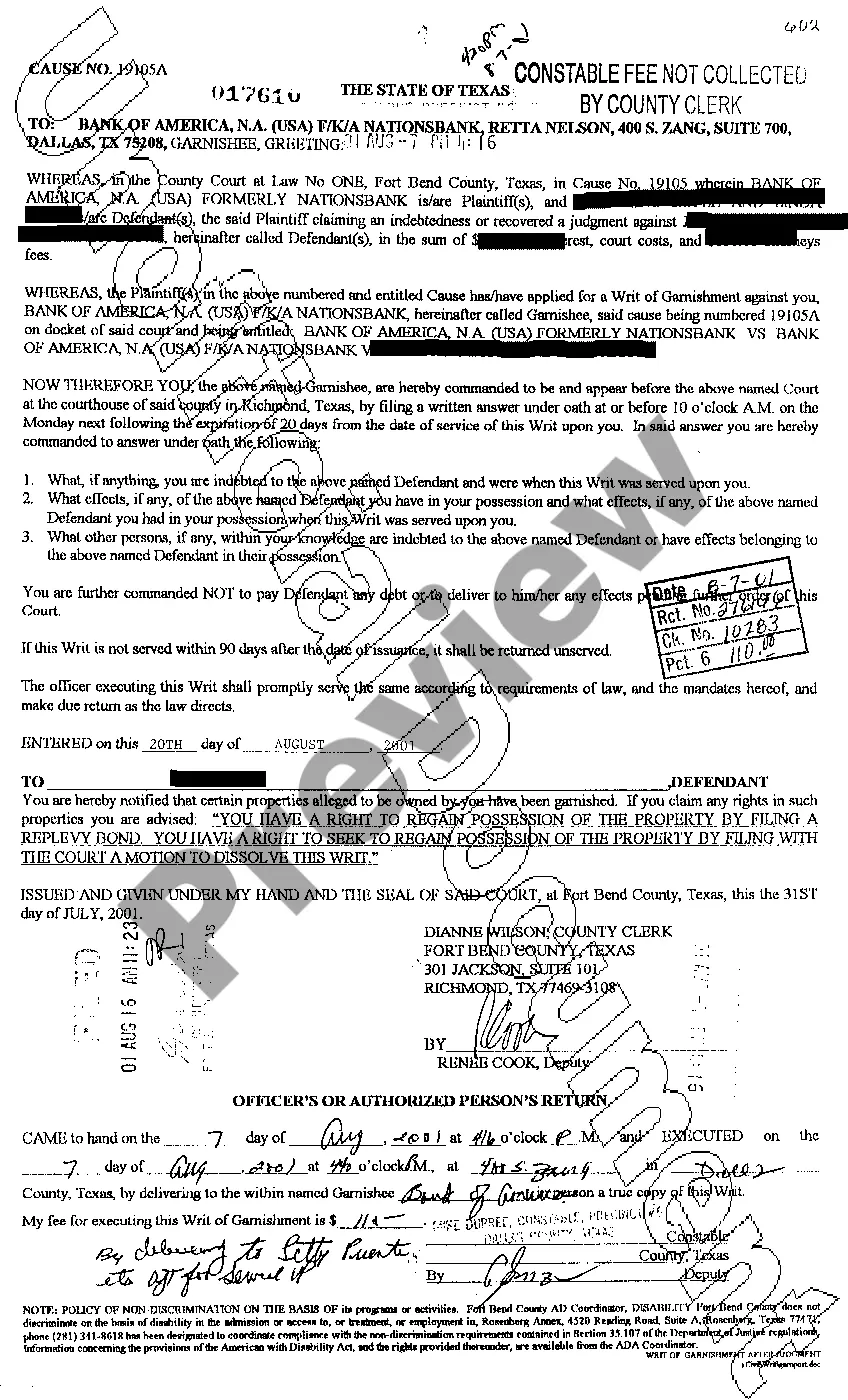

Lewisville Texas Writ of Garnishment is a legal process used to collect outstanding debts from individuals or entities who owe money to a creditor. It is an order issued by the court that allows the creditor to seize a portion of the debtor's wages, bank accounts, or other assets to satisfy the debt. In Lewisville, Texas, there are two main types of Writ of Garnishment: 1. Texas Writ of Garnishment for Consumer Debt: This type of garnishment applies to individuals who owe debts for personal, family, or household purposes. It allows creditors to garnish wages, bank accounts, and other non-exempt assets of the debtor. 2. Texas Writ of Garnishment for Non-Consumer Debt: This type of garnishment applies to businesses or individuals who owe debts for non-consumer purposes, such as business loans or unpaid rent. It enables the creditor to garnish the debtor's business accounts, assets, or other sources of income. When a creditor obtains a Writ of Garnishment in Lewisville, Texas, they must follow specific procedures and guidelines set forth by the law. They must provide proper notice to the debtor about the garnishment and comply with legal limits on the amount of wages or assets that can be garnished. It's important to note that certain types of income or assets may be exempt from garnishment in Lewisville, Texas, such as public benefits, child support payments, or retirement funds. These exemptions aim to protect debtors from excessive financial hardship caused by the garnishment process. If a debtor receives a Writ of Garnishment, it is crucial to seek legal advice and understand their rights and options. They may be able to challenge the garnishment or negotiate a repayment plan with the creditor to satisfy the debt. In summary, the Lewisville Texas Writ of Garnishment is a legal order that allows creditors to collect outstanding debts from debtors by seizing a portion of their wages, bank accounts, or assets. It is important for both creditors and debtors to understand the different types of garnishment and the applicable laws to ensure fair and lawful debt collection practices.

Lewisville Texas Writ of Garnishment

Description

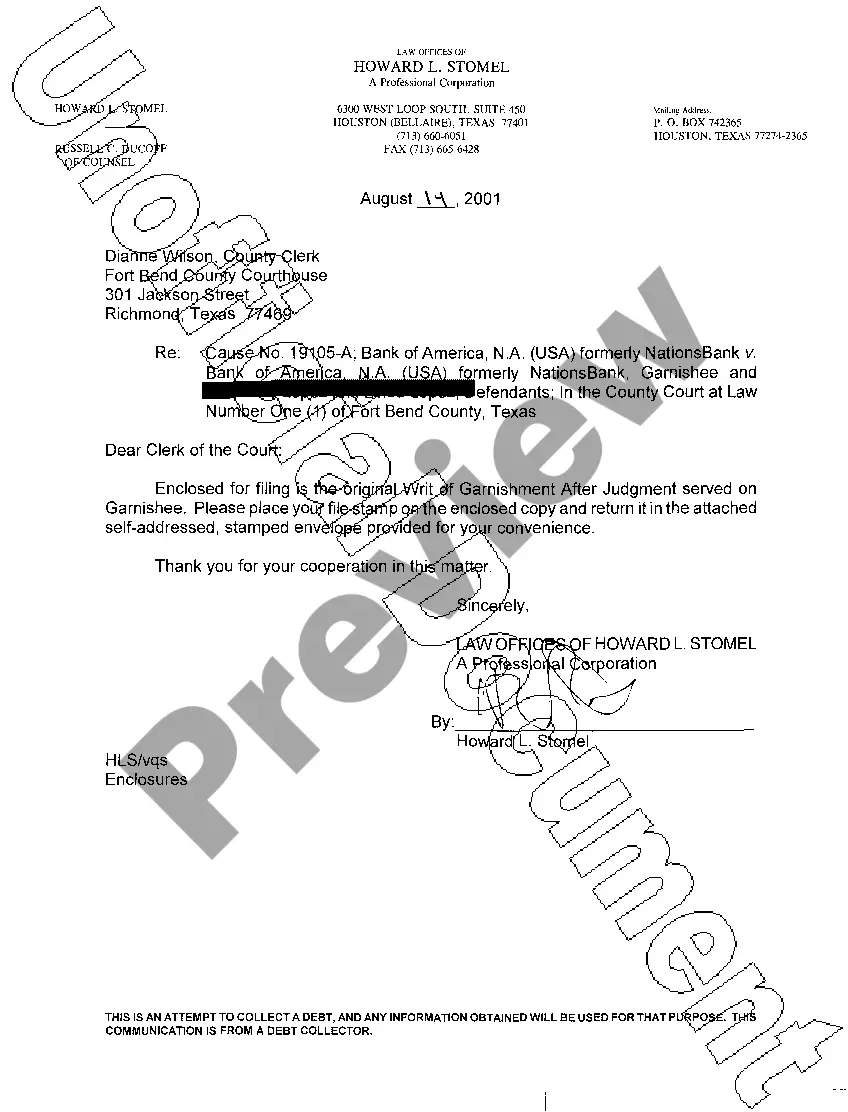

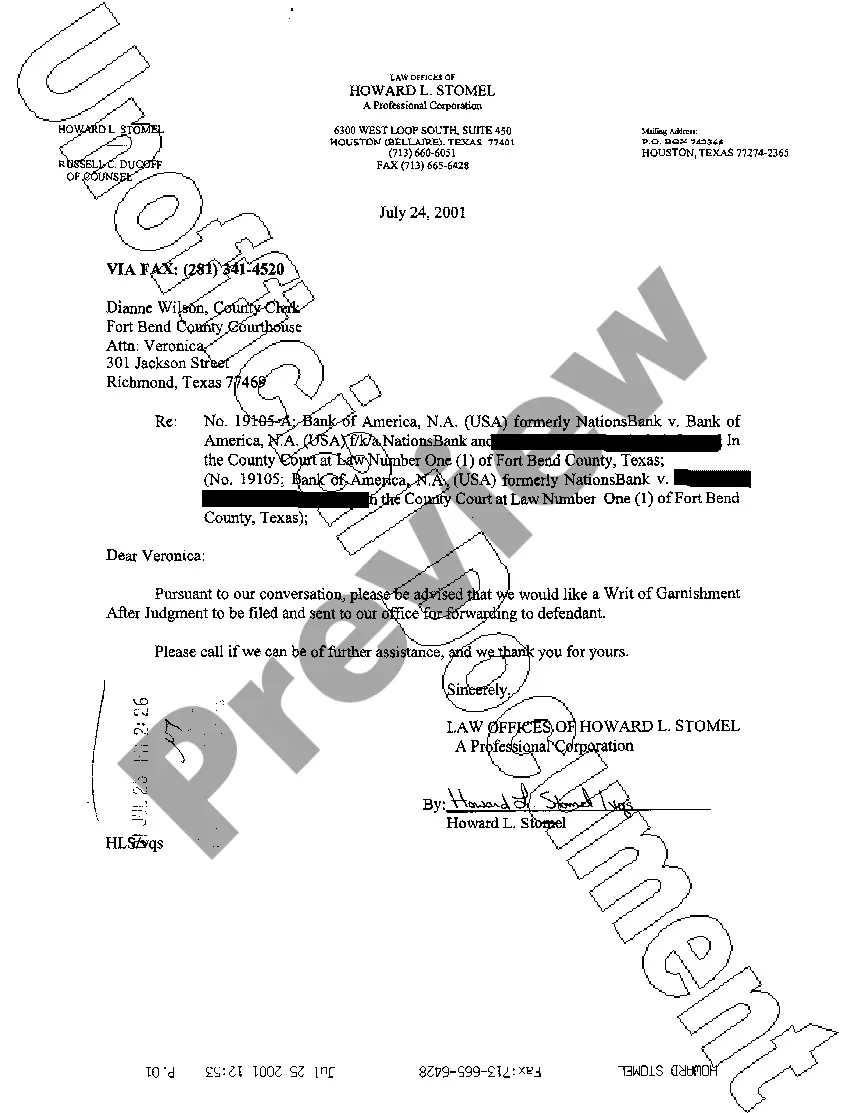

How to fill out Lewisville Texas Writ Of Garnishment?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney solutions that, as a rule, are very expensive. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Lewisville Texas Writ of Garnishment or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Lewisville Texas Writ of Garnishment adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Lewisville Texas Writ of Garnishment is suitable for you, you can select the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

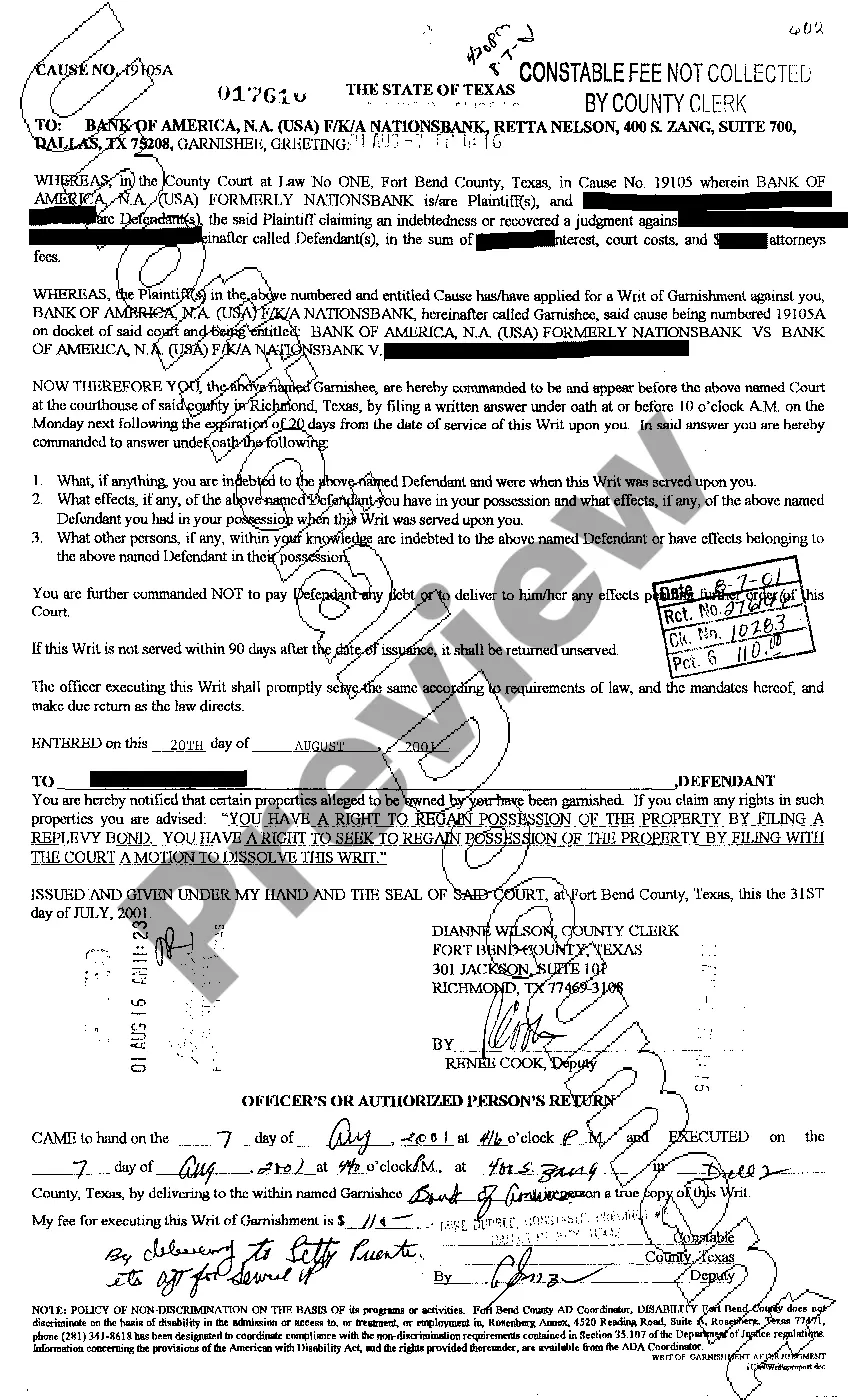

Specifically, Texas Rule of Civil Procedure 658, Application for Writ of Garnishment and Order, states that a plaintiff may file an application for a writ of garnishment of a bank account in Texas ?either at the commencement of a lawsuit or at any time during its progress.? Tex.

§§ 63.001-. 008 (Vernon 1986). In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor.

Filing a Writ of Execution 30 days after obtaining a final judgment, a creditor can request a Writ of Execution from the clerk of the court. The creditor or the creditor's attorney will fill out a Writ of Execution form available at any county courthouse.

Once issued, the writ of execution directs the sheriff to seize the non-exempt property and sell it. The proceeds of the sale are given to the creditor to satisfy all or part of the judgment.

In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor. It is the third party, the bank or financial institution, which receives the Writ of Garnishment.

WHO MAY ISSUE. The clerk of a district or county court or a justice of the peace may issue a writ of garnishment returnable to his court. Acts 1985, 69th Leg., ch. 959, Sec.

A judgment is valid for 10 years and can be enforced at any time during those that time. It is not uncommon for a creditor to seek to enforce a judgment that is close to ten years old. There are also ways to renew the judgment, so that it can be enforced for even longer than ten years.

The writ of garnishment orders the third party to surrender the defendant's assets to the court in order to satisfy a judgment against the defendant. With a writ of garnishment in place, creditors such as banks and credit cards can pull directly from defendants' bank accounts under Texas garnishment laws.