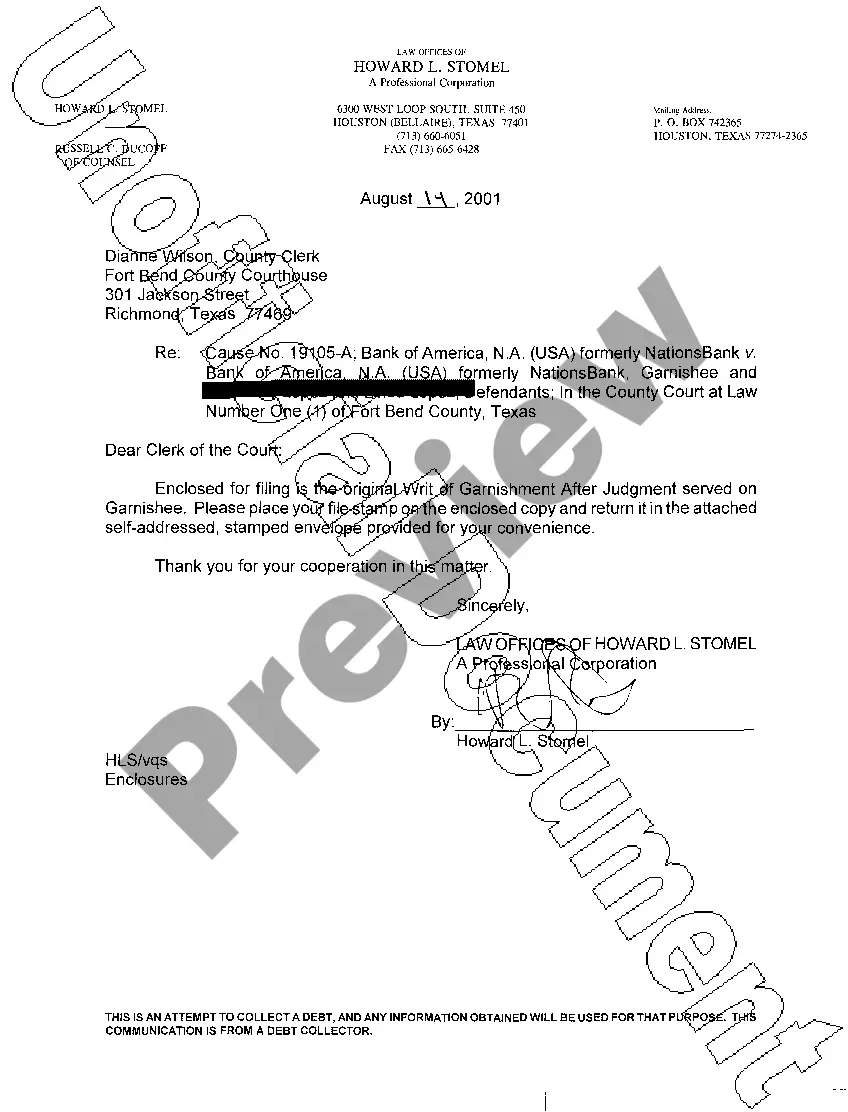

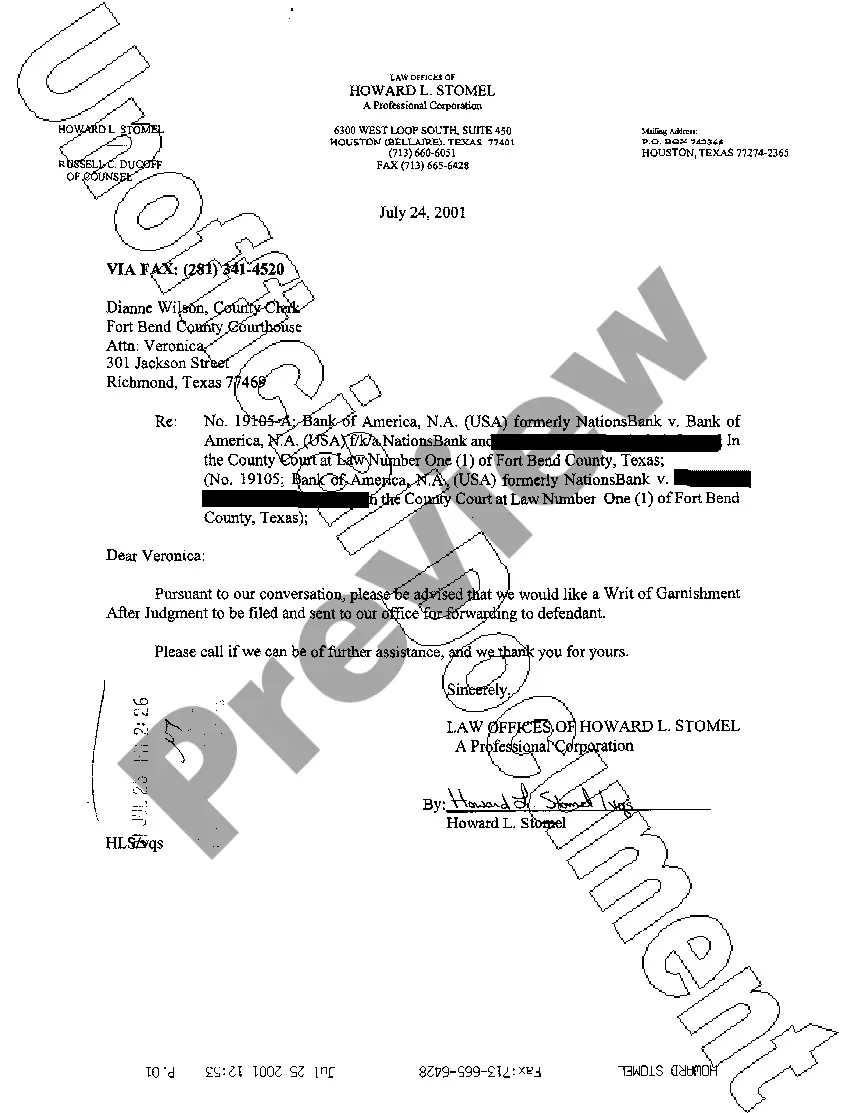

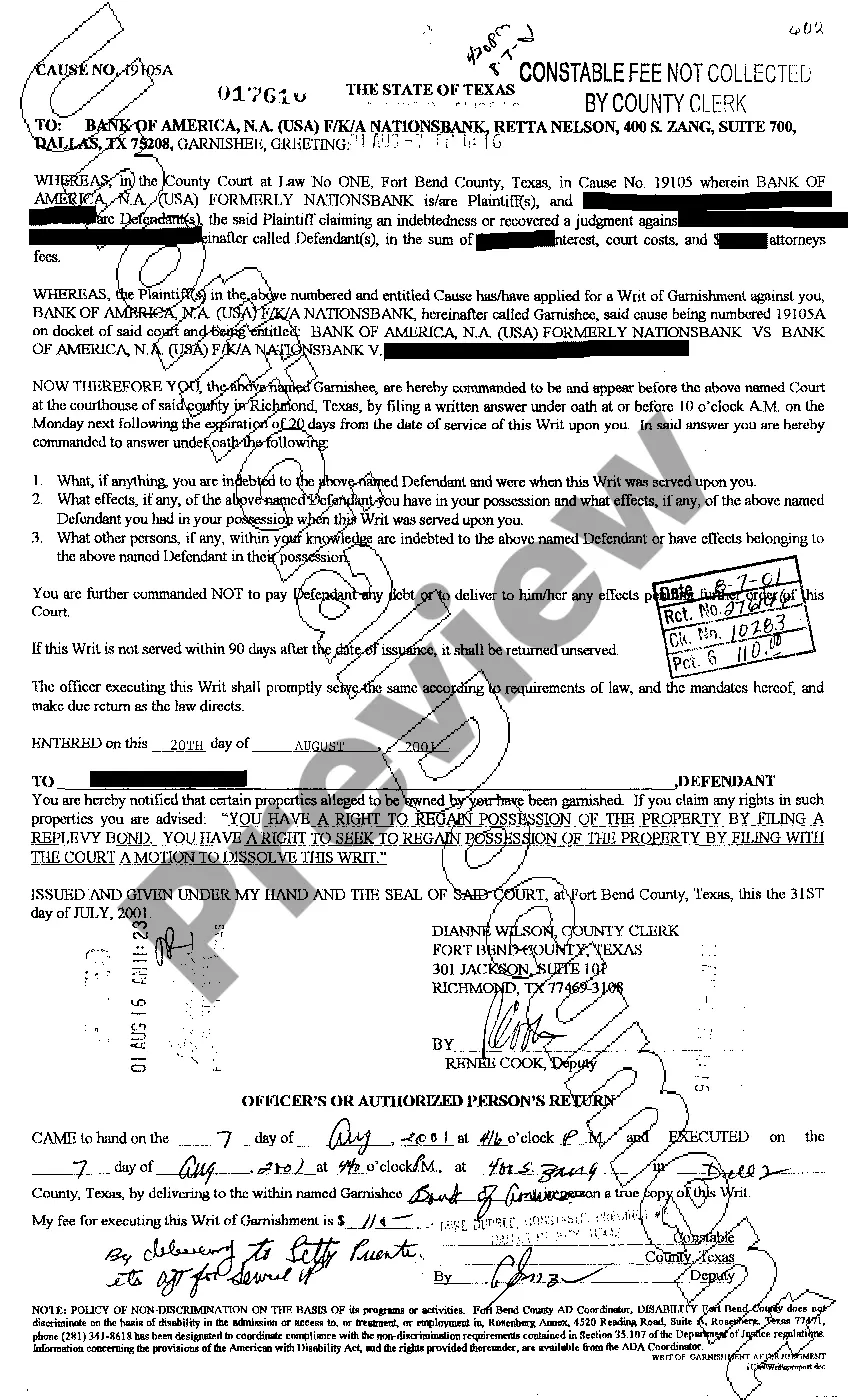

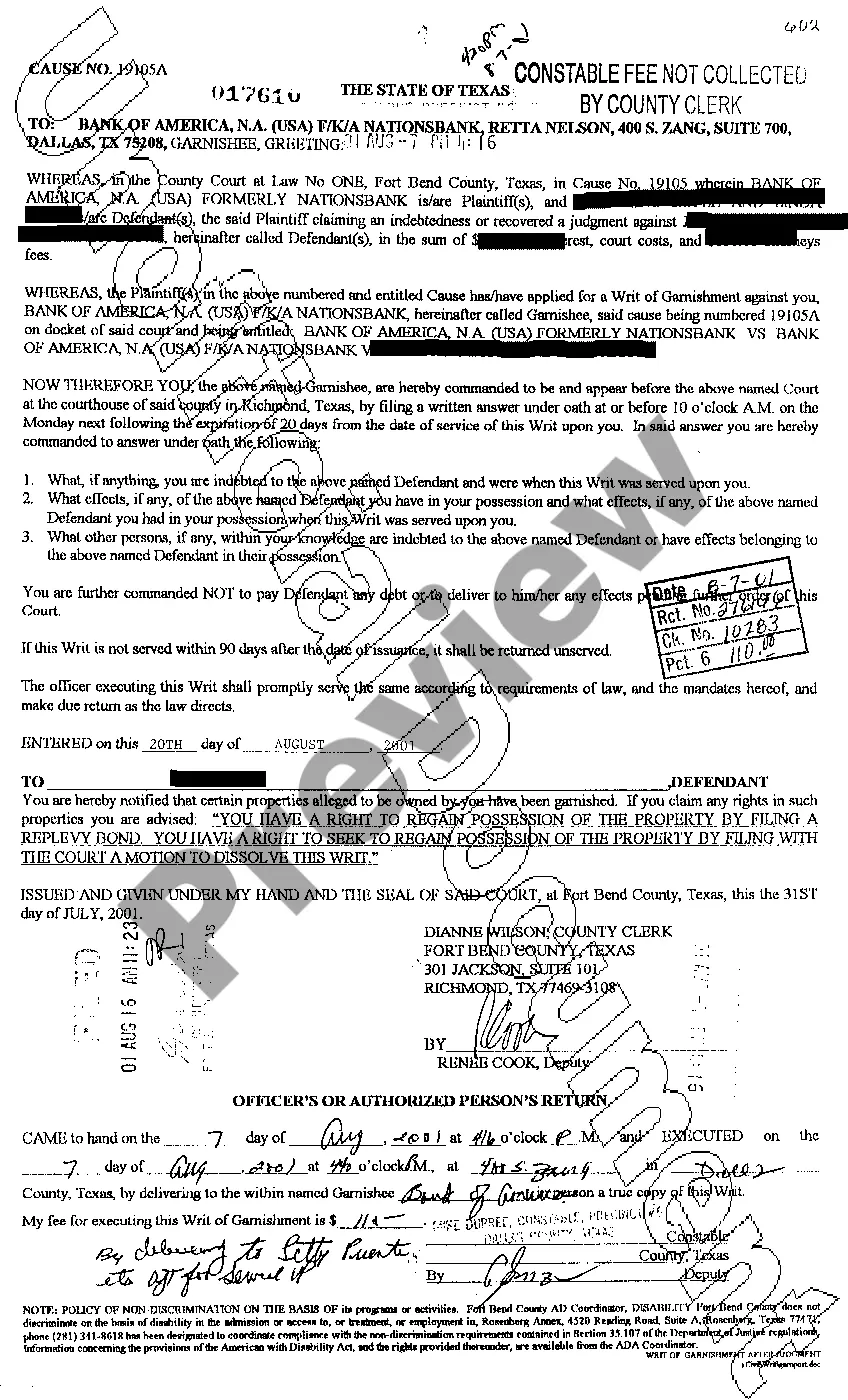

The McKinney Texas Writ of Garnishment is a legal process used to collect unpaid debts or judgments from individuals or businesses located in McKinney, Texas. A writ of garnishment allows a creditor to collect money directly from a debtor's wages, bank accounts, or other assets to satisfy the debt. There are different types of McKinney Texas Writs of Garnishment that can be pursued depending on the specific circumstances: 1. Writ of Continuing Garnishment: This type of garnishment allows a creditor to continuously collect a portion of the debtor's wages or salary until the debt is fully satisfied. The employer is required by law to withhold a certain percentage from the debtor's wages and submit it directly to the creditor to cover the debt. 2. Writ of Bank Garnishment: With a bank garnishment, the creditor can seize funds held in the debtor's bank accounts to fulfill the outstanding debt. The bank is served with the writ and is obliged to freeze the debtor's account and transfer the funds to the creditor. However, there are certain exemptions and limitations on the amount that can be garnished from someone's bank account. 3. Writ of Property Garnishment: A property garnishment allows a creditor to seize and sell the debtor's non-exempt assets such as vehicles, real estate, or other valuable belongings to satisfy the debt. This type of garnishment is typically used when the debtor does not have sufficient income or funds in a bank account. 4. Writ of Federal Benefit Garnishment: In certain cases, the federal government may issue a writ of garnishment on behalf of federal agencies, such as the Internal Revenue Service (IRS) or the Social Security Administration (SSA). This allows the government to collect unpaid taxes or other debts by garnishing wages, bank accounts, or federal benefits received by the debtor. It's important to note that the process and regulations for obtaining a McKinney Texas Writ of Garnishment can vary depending on the type of debt, the debtor's specific circumstances, and the applicable state and federal laws. It is advisable for creditors or debtors involved in garnishment proceedings to seek legal counsel to understand their rights, obligations, and potential exemptions.

McKinney Texas Writ of Garnishment

Description

How to fill out McKinney Texas Writ Of Garnishment?

If you have previously utilized our service, sign in to your account and download the McKinney Texas Writ of Garnishment onto your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it following your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to acquire your file.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to effortlessly discover and save any template for your personal or professional requirements!

- Ensure you’ve located a suitable document. Review the description and utilize the Preview feature, if available, to verify if it fulfills your requirements. If it does not fit your needs, employ the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your McKinney Texas Writ of Garnishment. Choose the file format for your document and save it on your device.

- Fill out your sample. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

To obtain a McKinney Texas writ of garnishment, you must start by filing a petition in the appropriate court. Next, gather relevant information about the debtor and their assets. Once the court issues the writ, you can serve it to the financial institution or employer holding the debtor’s funds. For a streamlined process, consider using US Legal Forms, which provides templates and guidance to help you navigate the process smoothly.

To stop a wage garnishment in Texas, you can file a motion with the court to challenge the garnishment. Valid defenses might include improper notices or exemptions applicable to your situation. Engaging with experienced legal professionals can provide guidance on how to effectively utilize the McKinney Texas Writ of Garnishment laws to protect your income.

A writ of garnishment in Collin County is a legal document that allows a creditor to obtain a portion of a debtor's wages directly from their employer. This process follows the guidelines provided by Texas law and typically requires a court order. If you need assistance navigating this process, consider using platforms like US Legal Forms for valuable resources.

A writ of execution allows a creditor to seize non-exempt property to satisfy a debt, while a writ of garnishment specifically targets funds owed to the debtor, such as wages. Both processes serve different purposes in debt recovery. Knowing how each works can empower you to make informed decisions if you face potential garnishment or execution.

In Texas, debt collectors can pursue old debt for up to four years after the last payment was made. This time frame is defined by the Texas statute of limitations on debt collection. If you receive communication from a collector, consult a legal professional to ensure they are following proper protocols, especially regarding McKinney Texas Writ of Garnishment.

Yes, an out of state creditor can garnish wages in Texas, but they must first obtain a judgment in a Texas court. The creditor must follow the state's legal processes to enforce the judgment using a McKinney Texas Writ of Garnishment. If you face this situation, it's advisable to consult with a local attorney to understand your rights and options.

A writ of garnishment in Texas allows creditors to collect what they are owed directly from your bank account or wages. The process typically begins with a court order that enables the creditor to take the designated funds. Connecting with resources that explain the McKinney Texas writ of garnishment can give you the clarity you need, whether you are a debtor or a creditor looking to enforce a legal claim successfully.

If an employer ignores a wage garnishment in Texas, they may face legal repercussions such as fines or penalties. The creditor may take further action against the employer for non-compliance, putting them at risk. Understanding the implications of the McKinney Texas writ of garnishment can help both employees and employers navigate this serious issue and ensure compliance with legal requirements.

The most effective way to stop a garnishment is to act quickly by addressing the underlying debt or contesting the writ. You can file a motion to quash the writ of garnishment if you believe it was issued improperly. Engaging with experts on the McKinney Texas writ of garnishment can provide you with tailored strategies, making it easier to navigate this challenging situation.

To protect your bank account from garnishment in Texas, it is crucial to understand your legal rights and exemptions. You may consider filing an exemption request which can safeguard certain funds, such as disability payments and social security benefits. Additionally, staying proactive by consulting with a legal professional can guide you through the McKinney Texas writ of garnishment and help you take the necessary steps to shield your finances.