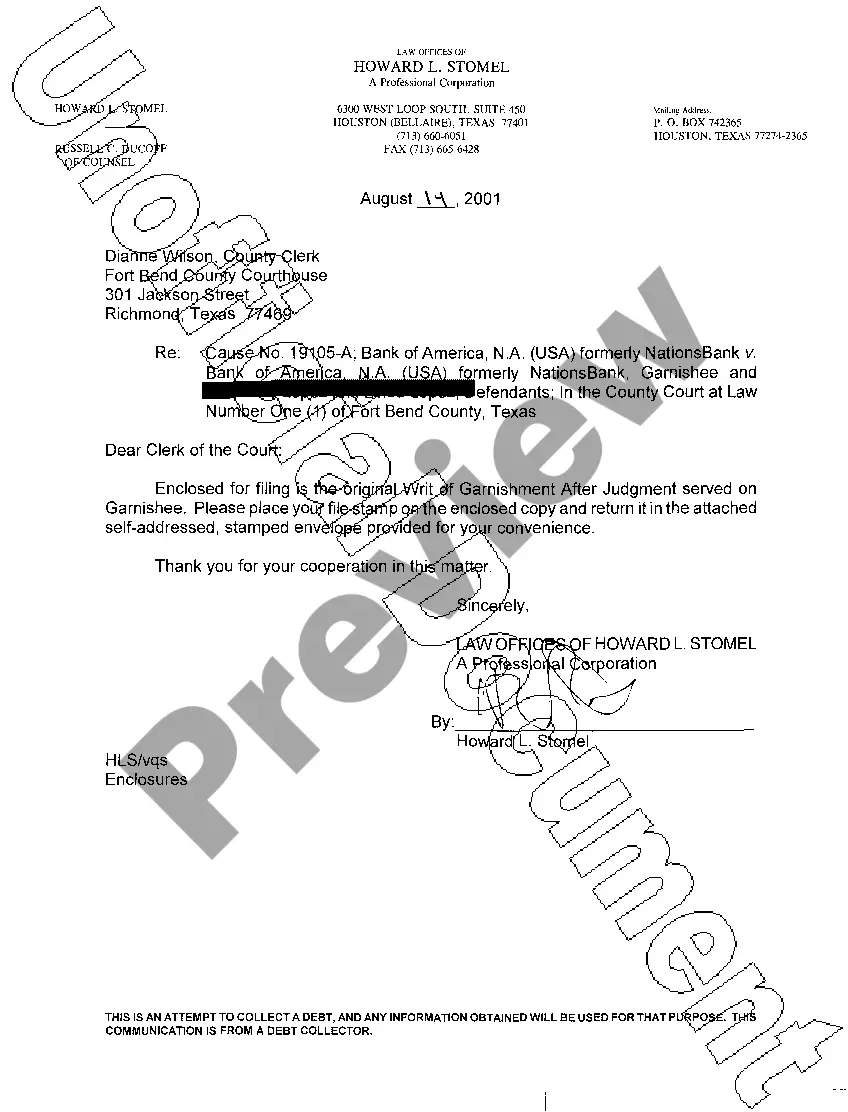

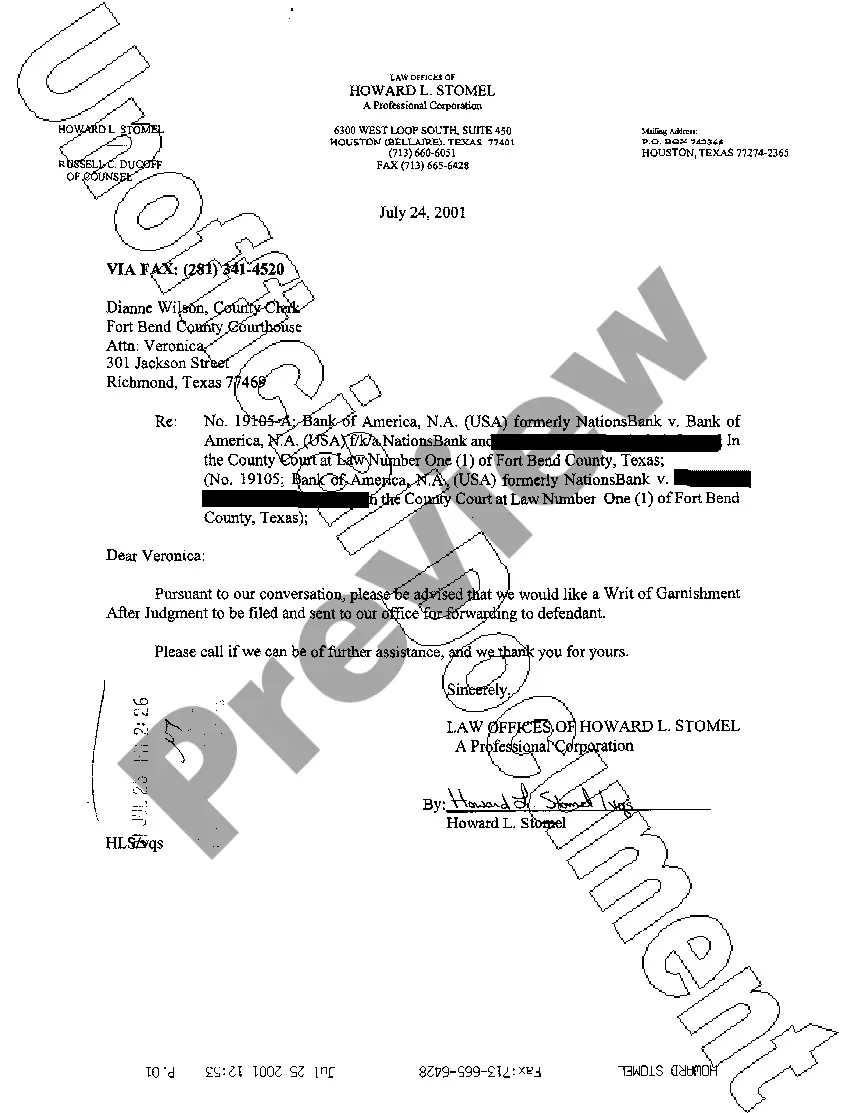

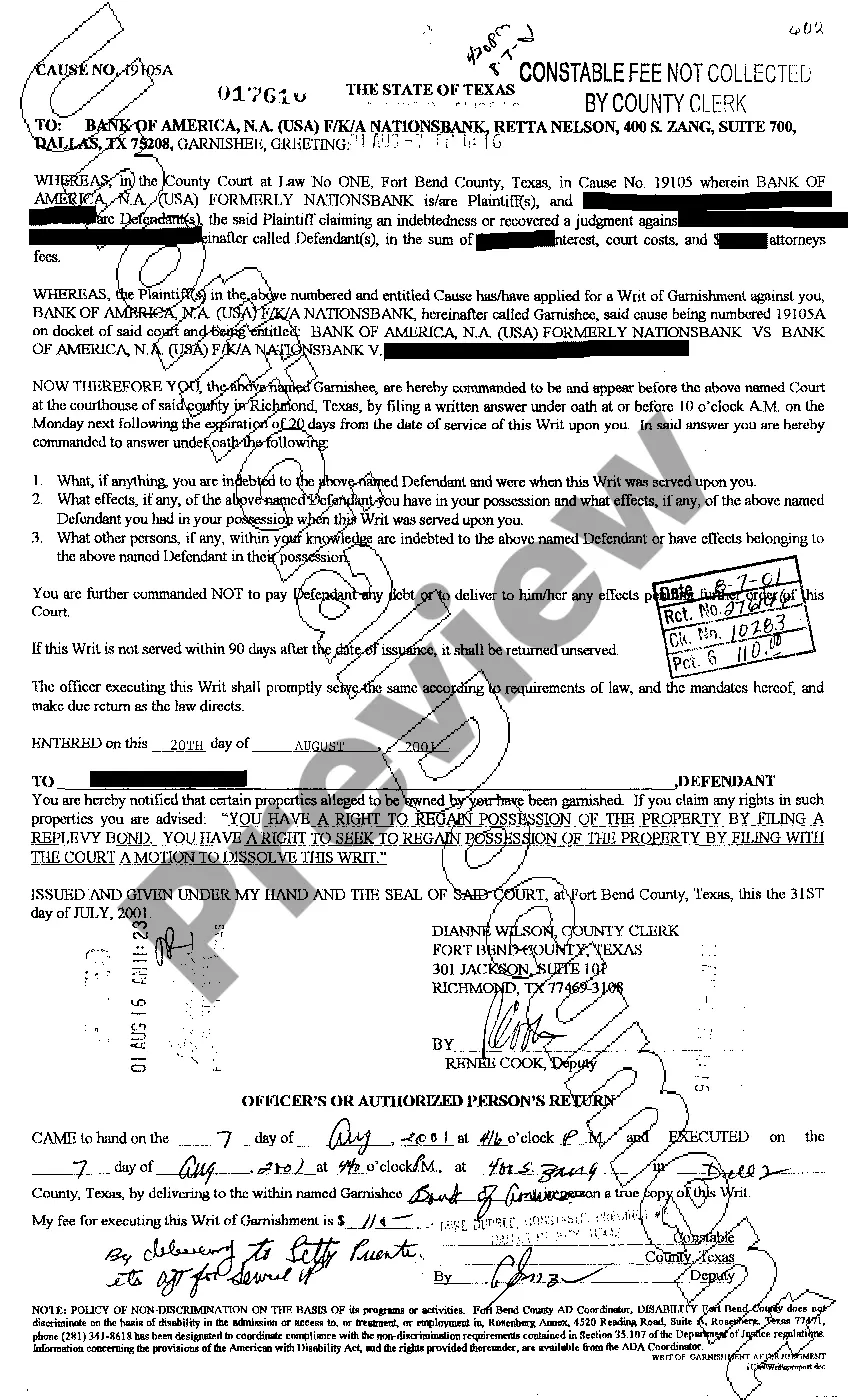

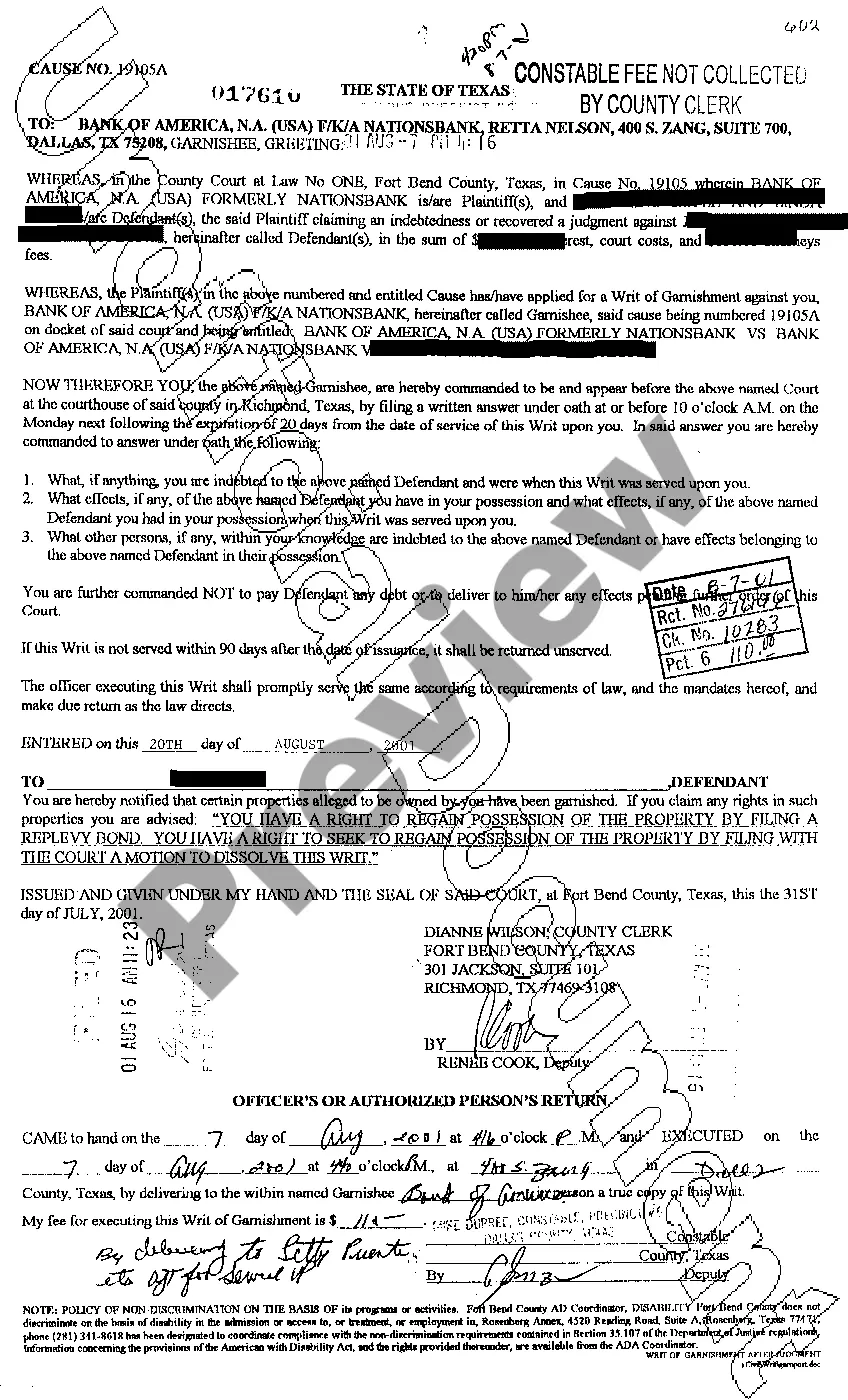

Plano Texas Writ of Garnishment: A Detailed Description of Types and Process In Plano, Texas, a Writ of Garnishment is a legal tool that allows a judgment creditor to collect debt owed by a debtor, directly from the debtor's wages, bank accounts, or other sources of income. This legal process is governed by Texas state laws and can be initiated by creditors who have obtained a judgment against a debtor but have not received payment. There are two main types of Writ of Garnishment commonly used in Plano, Texas: 1. Writ of Garnishment for Earnings: This type of garnishment allows for a portion of a debtor's wages to be withheld by their employer and paid directly to the creditor. In Plano, Texas, the maximum amount that can be garnished from earnings is limited by the federal Consumer Credit Protection Act (CCPA), which restricts the amount to be withheld to a certain percentage of the debtor's disposable earnings. 2. Writ of Garnishment for Bank Accounts: This type of garnishment allows creditors to freeze and seize funds in a debtor's bank account. The court issues an order to the debtor's bank, directing them to freeze the funds up to the amount owed by the debtor. Once the funds are frozen, the creditor can then proceed to collect the owed debt through the court-approved process. To initiate a Writ of Garnishment in Plano, Texas, the creditor is required to follow a specific process: 1. Obtain a Judgment: The creditor must first obtain a judgment from the court, proving that the debtor owes them money. This often involves filing a lawsuit, presenting evidence, and obtaining a favorable judgment. 2. File the Application and Writ of Garnishment: Once the judgment is obtained, the creditor must file an application for a Writ of Garnishment with the Plano court. This application includes the necessary details such as the debtor's name, address, and specific information about the debt owed. 3. Serve the Writ of Garnishment: After the court approves the application, the creditor must serve the Writ of Garnishment to the relevant parties involved, including the debtor's employer or bank. Serving the writ ensures that the garnishment process begins, allowing the creditor to start collecting the debt. It is important to note that Texas state law provides some exemptions and restrictions regarding the Writ of Garnishment process to protect debtors. Some examples of exemptions may include certain types of income like Social Security benefits, retirement funds, or child support payments. In summary, a Writ of Garnishment in Plano, Texas, is a legal tool used by creditors to collect debt owed by debtors. There are mainly two types of garnishment: one for earnings and another for bank accounts. The process involves obtaining a judgment, filing an application, serving the writ, and following Texas state laws to collect the debt.

Plano Texas Writ of Garnishment

Description

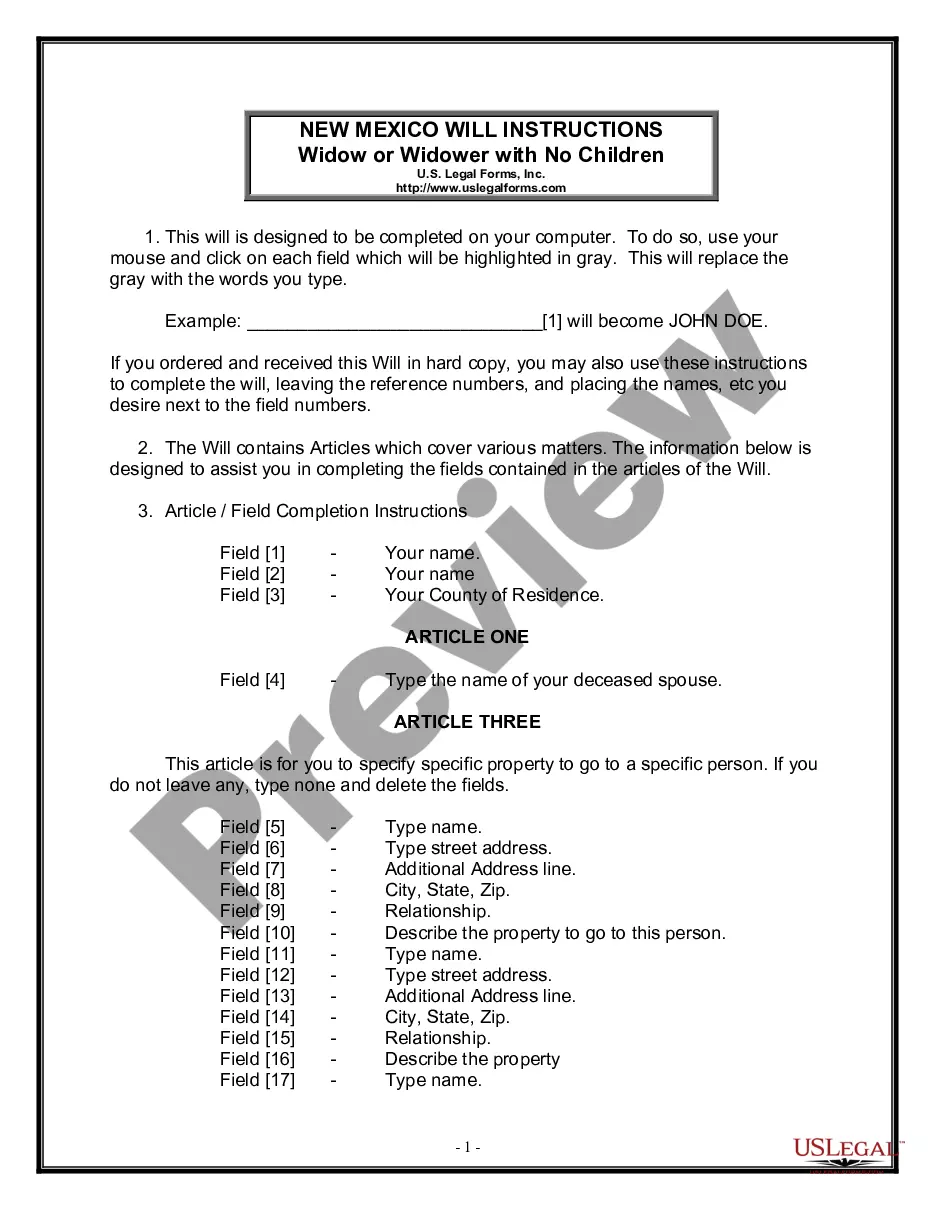

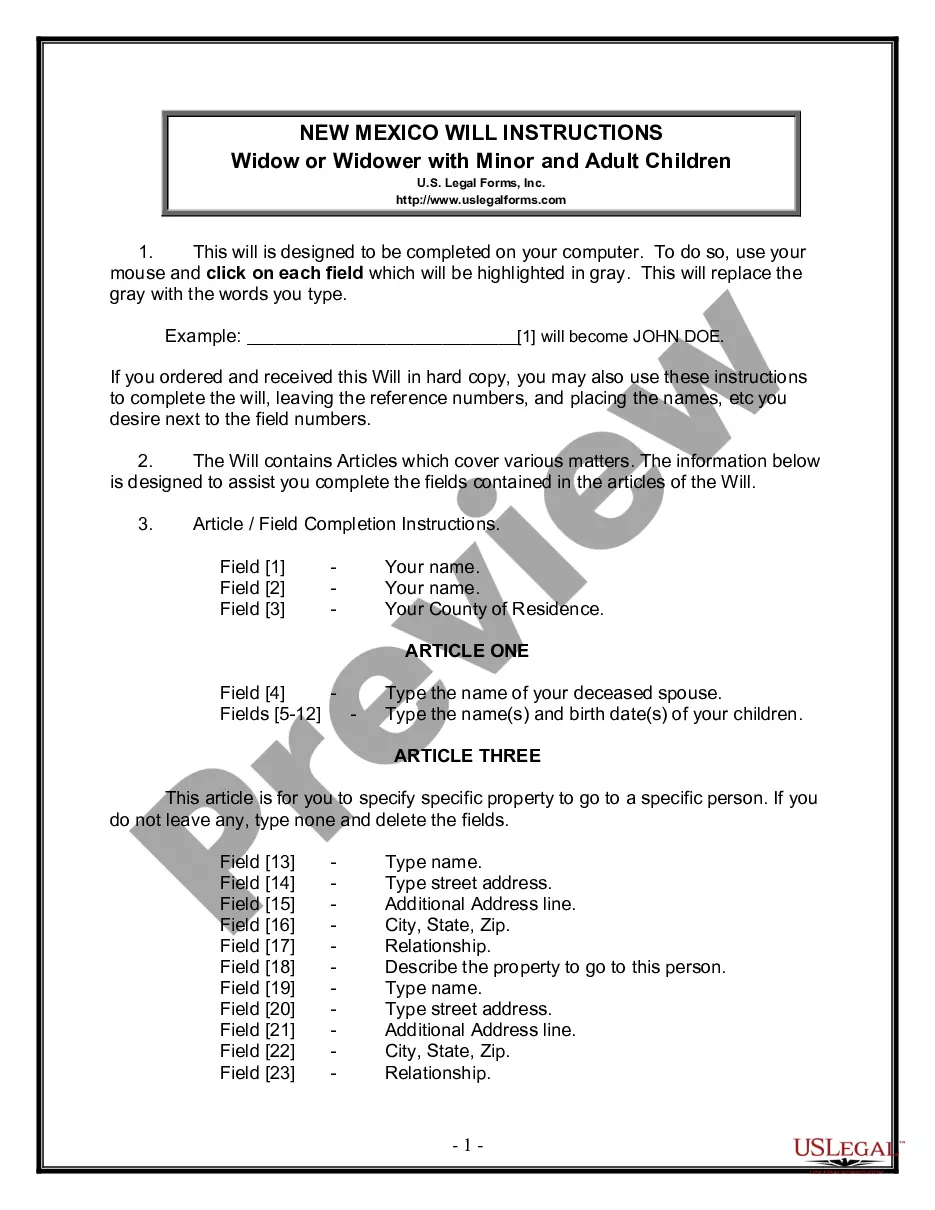

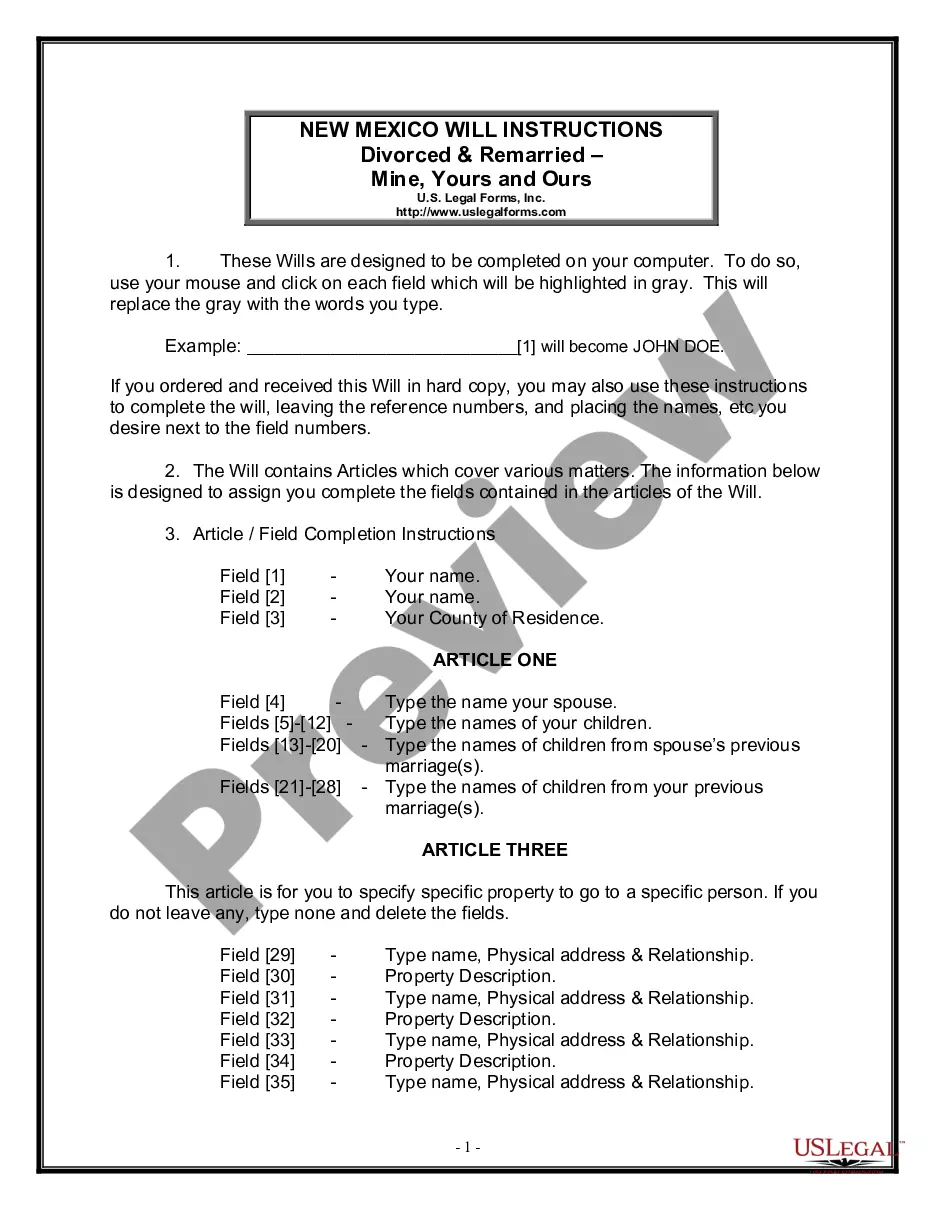

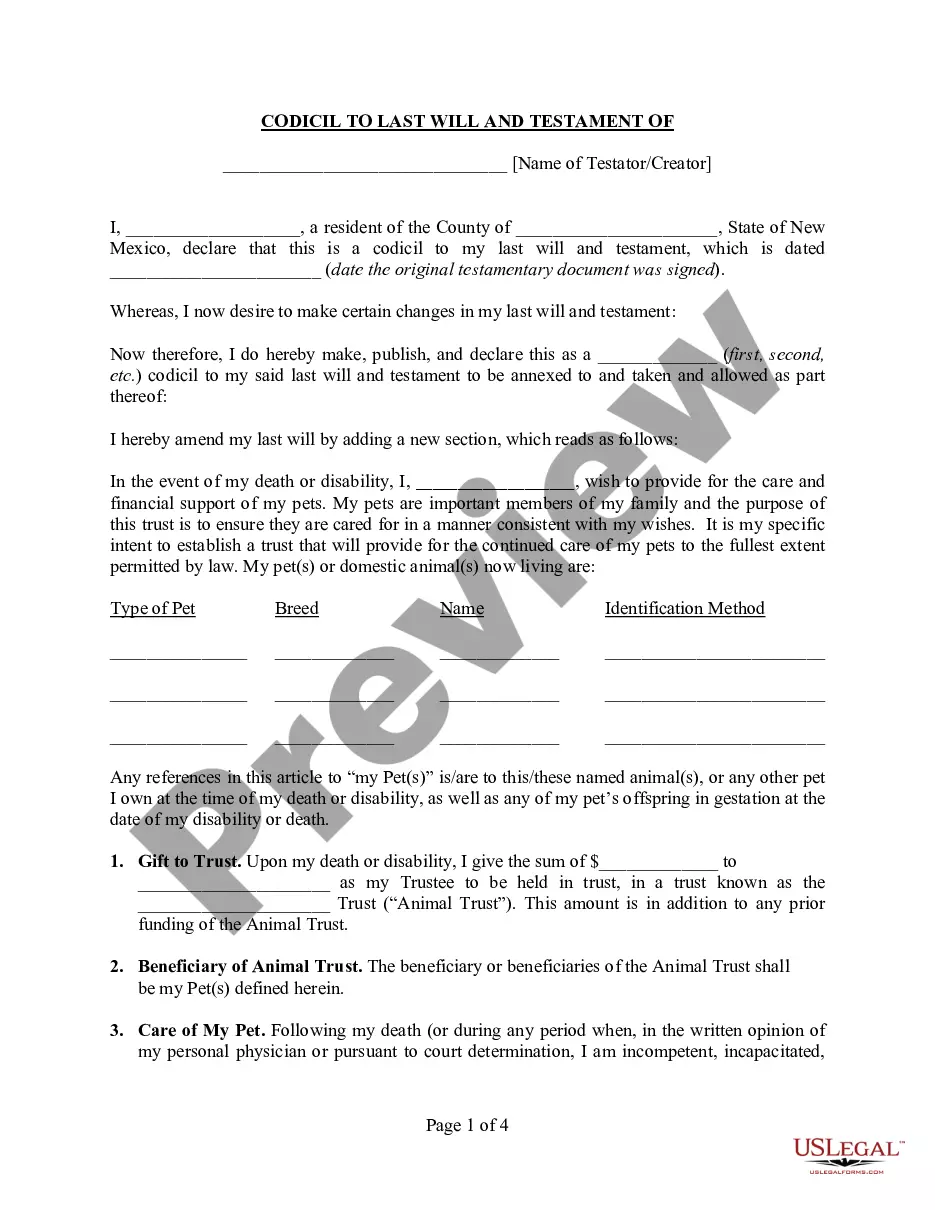

How to fill out Plano Texas Writ Of Garnishment?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Plano Texas Writ of Garnishment? US Legal Forms is your go-to solution.

Whether you need a basic arrangement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed in accordance with the requirements of separate state and area.

To download the form, you need to log in account, find the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Plano Texas Writ of Garnishment conforms to the laws of your state and local area.

- Read the form’s details (if available) to learn who and what the form is good for.

- Start the search over in case the template isn’t good for your legal scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Plano Texas Writ of Garnishment in any available file format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending hours researching legal paperwork online for good.