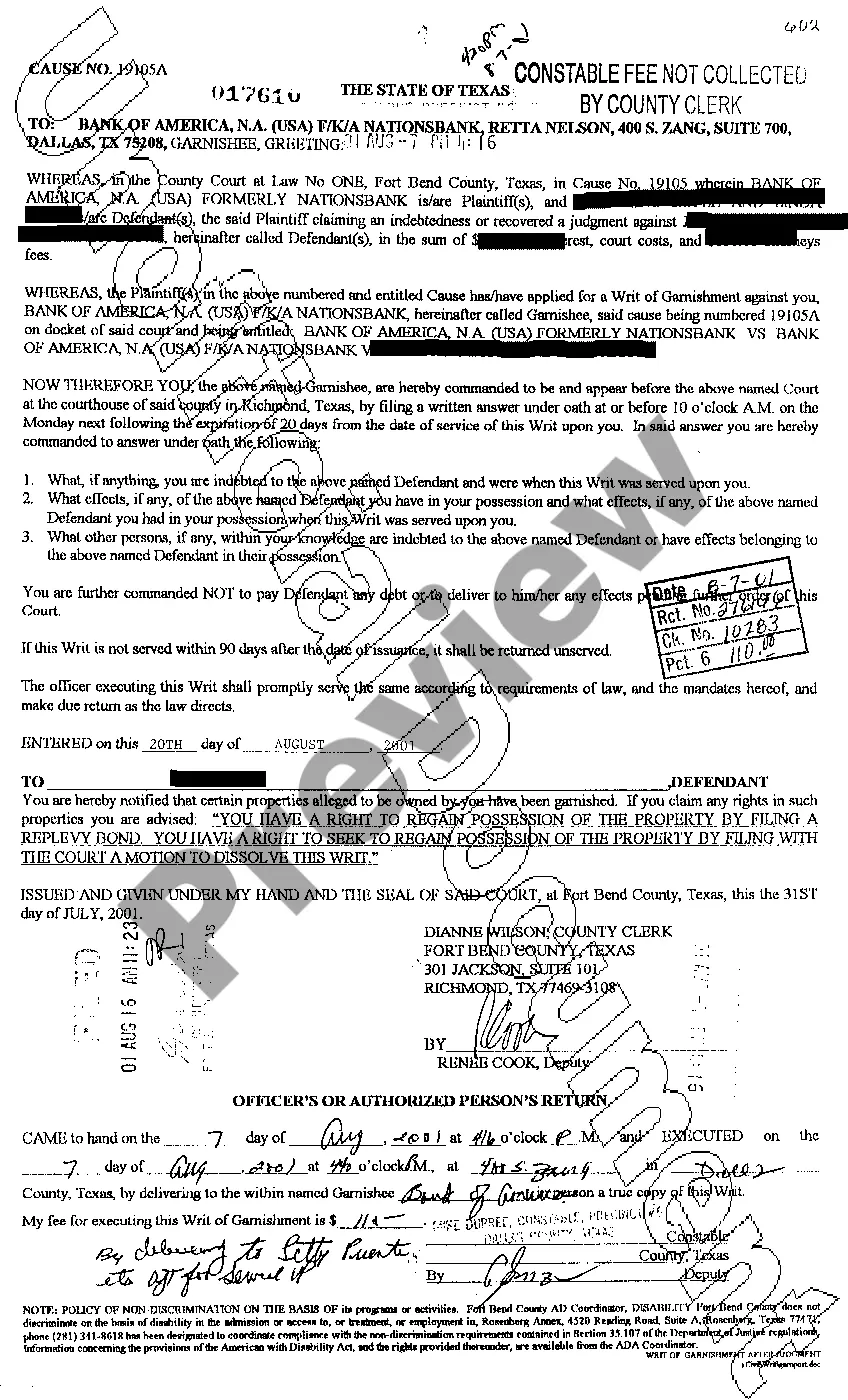

The Round Rock Texas Writ of Garnishment is a legal procedure used to collect outstanding debts from a debtor's wages, bank accounts, or other assets. It is a court order that allows a creditor to intercept a portion of the debtor's income or assets in order to satisfy a judgment. In Round Rock, Texas, there are three main types of Writs of Garnishment that can be issued by the court: 1. Writ of Garnishment of Earnings: This type of garnishment allows a creditor to collect debt directly from the debtor's wages or salary. The court orders the debtor's employer to withhold a portion of their income and send it to the creditor until the debt is satisfied. 2. Writ of Garnishment of Bank Accounts: With this type of garnishment, a creditor can freeze and seize funds from the debtor's bank accounts to repay the outstanding debt. The court directs the debtor's financial institution to turn over the specified amount to the creditor. 3. Writ of Garnishment of Property: In certain cases, a creditor can request a writ of garnishment on the debtor's personal property, such as real estate, vehicles, or valuable assets. The court can grant permission to sell these assets and use the proceeds to satisfy the debt. To initiate a Writ of Garnishment in Round Rock, Texas, the creditor must first obtain a judgment against the debtor. The judgment serves as a legal basis for seeking garnishment. Once the creditor has obtained the judgment, they can file a writ of garnishment petition with the appropriate court. It is important to note that Round Rock, Texas follows state and federal laws regarding garnishment procedures. There are limits on the amount that can be garnished from a debtor's wages, which vary depending on the debtor's income and other factors. Additionally, certain types of income, such as social security benefits or child support, may be exempt from garnishment. Overall, the Round Rock Texas Writ of Garnishment is a powerful tool that allows creditors to collect outstanding debts by intercepting the debtor's income, bank accounts, or even personal property. It is a legal process that should be followed according to the specific guidelines set forth by the state and federal laws to ensure fairness and protection for both parties involved.

Round Rock Texas Writ of Garnishment

Description

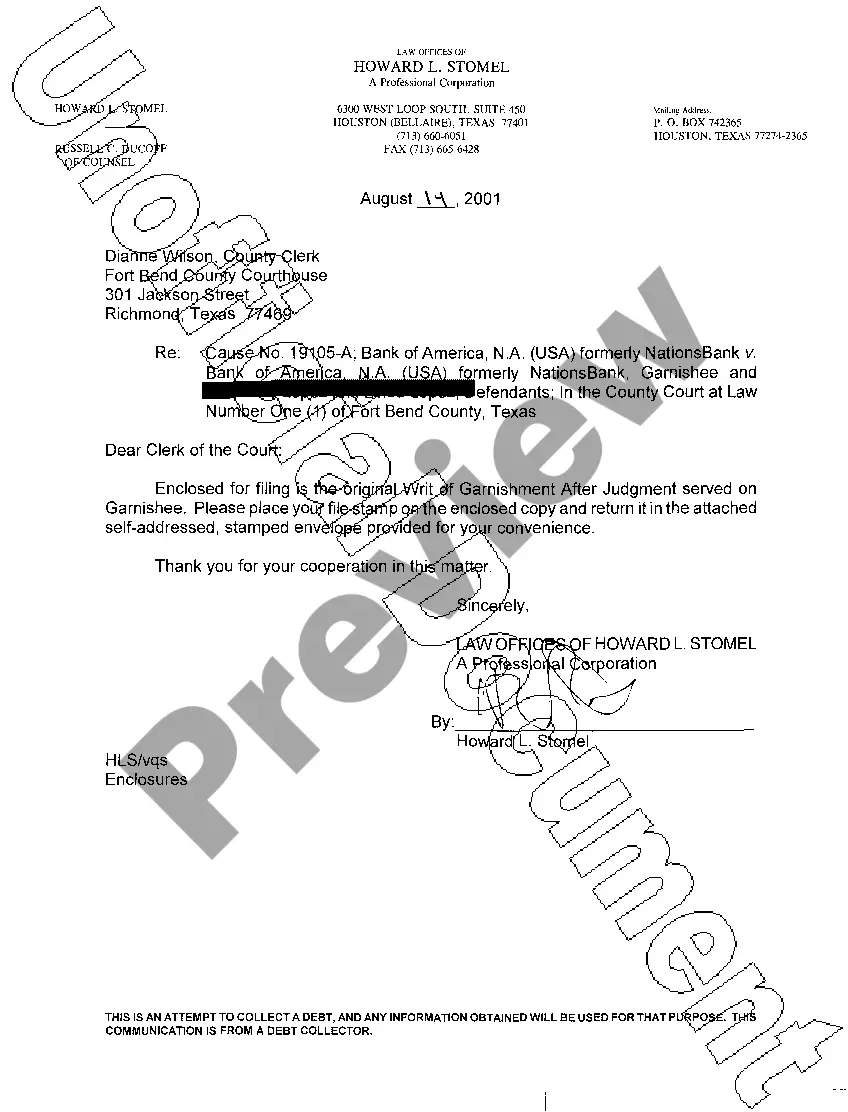

How to fill out Round Rock Texas Writ Of Garnishment?

If you are looking for a pertinent form template, it’s incredibly challenging to find a superior platform than the US Legal Forms website – arguably the most extensive collections on the web.

Through this collection, you can obtain a vast array of document samples for commercial and personal use categorized by types and areas, or keywords.

With our premium search functionality, locating the latest Round Rock Texas Writ of Garnishment is as simple as 1-2-3.

Complete the payment. Utilize your credit card or PayPal account to finalize the registration process.

Receive the form. Choose the file format and save it to your device. Edit. Complete, modify, print, and sign the procured Round Rock Texas Writ of Garnishment.

- Moreover, the significance of each document is validated by a team of experienced attorneys who routinely review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to acquire the Round Rock Texas Writ of Garnishment is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, just follow the instructions below.

- Ensure you have found the form you need. Read its description and use the Preview feature to examine its content. If it doesn’t satisfy your needs, use the Search field at the top of the display to locate the suitable document.

- Confirm your choice. Click the Buy now button. After that, select your preferred pricing option and provide the necessary information to create an account.

Form popularity

FAQ

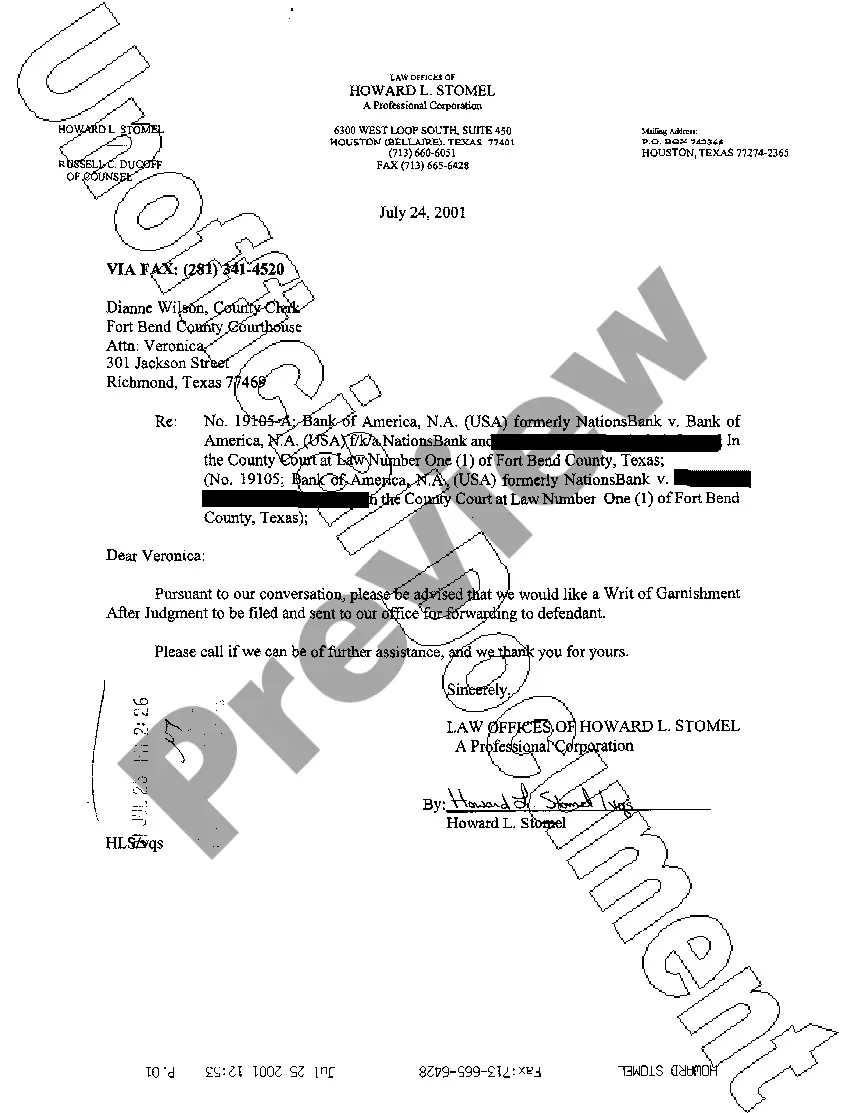

In order to file a Writ of Garnishment, the creditor must have an existing final judgment against the debtor and then must file for the writ in the court which rendered the original judgment against the debtor. It is the third party, the bank or financial institution, which receives the Writ of Garnishment.

How Long Is a Writ of Execution Good for? According to Texas Rule of Civil Procedure 34.001, a Writ of Execution for a money judgment can be applied for within 10 years of the entry of a judgment and is good for just as long. Within the 10 year period, the writ can be renewed at any time for an additional 10 years.

In Texas, wage garnishment is prohibited by the Texas Constitution except for a few kinds of debt: child support, spousal support, student loans, or unpaid taxes. A debt collector cannot garnish your wages for ordinary debts. However, Texas does allow for a bank account to be frozen.

If a defendant does not pay a judgment, the plaintiff can try to enforce the judgment by filing another lawsuit. For example, if the defendant owns several cars, the plaintiff can sue to have the car transferred to the plaintiff.

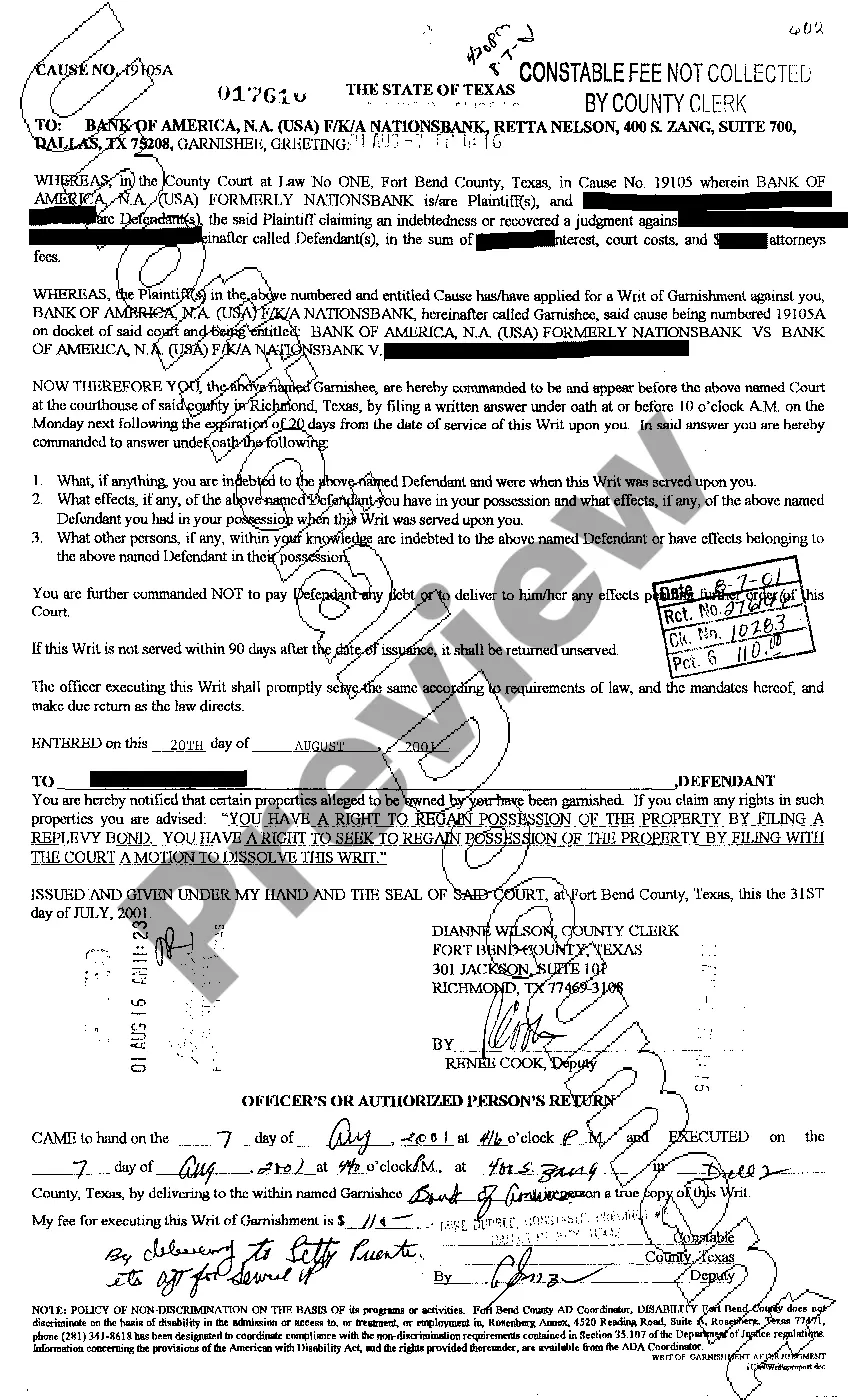

WHO MAY ISSUE. The clerk of a district or county court or a justice of the peace may issue a writ of garnishment returnable to his court. Acts 1985, 69th Leg., ch. 959, Sec.

Once issued, the writ of execution directs the sheriff to seize the non-exempt property and sell it. The proceeds of the sale are given to the creditor to satisfy all or part of the judgment.

The writ of garnishment orders the third party to surrender the defendant's assets to the court in order to satisfy a judgment against the defendant. With a writ of garnishment in place, creditors such as banks and credit cards can pull directly from defendants' bank accounts under Texas garnishment laws.

A judgment is valid for 10 years and can be enforced at any time during those that time. It is not uncommon for a creditor to seek to enforce a judgment that is close to ten years old. There are also ways to renew the judgment, so that it can be enforced for even longer than ten years.

A creditor can stop a writ of garnishment by essentially asking the court to dismiss it.