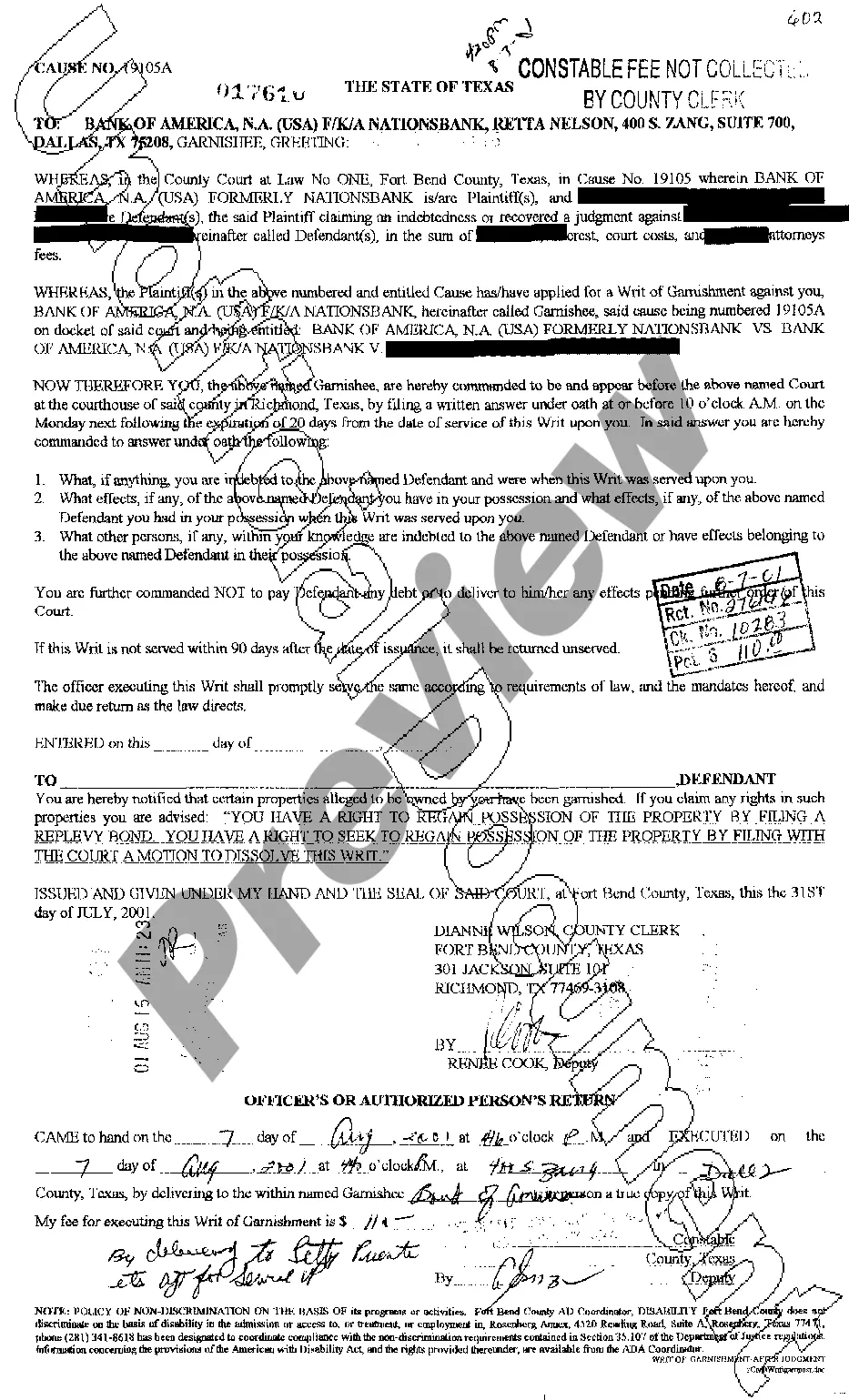

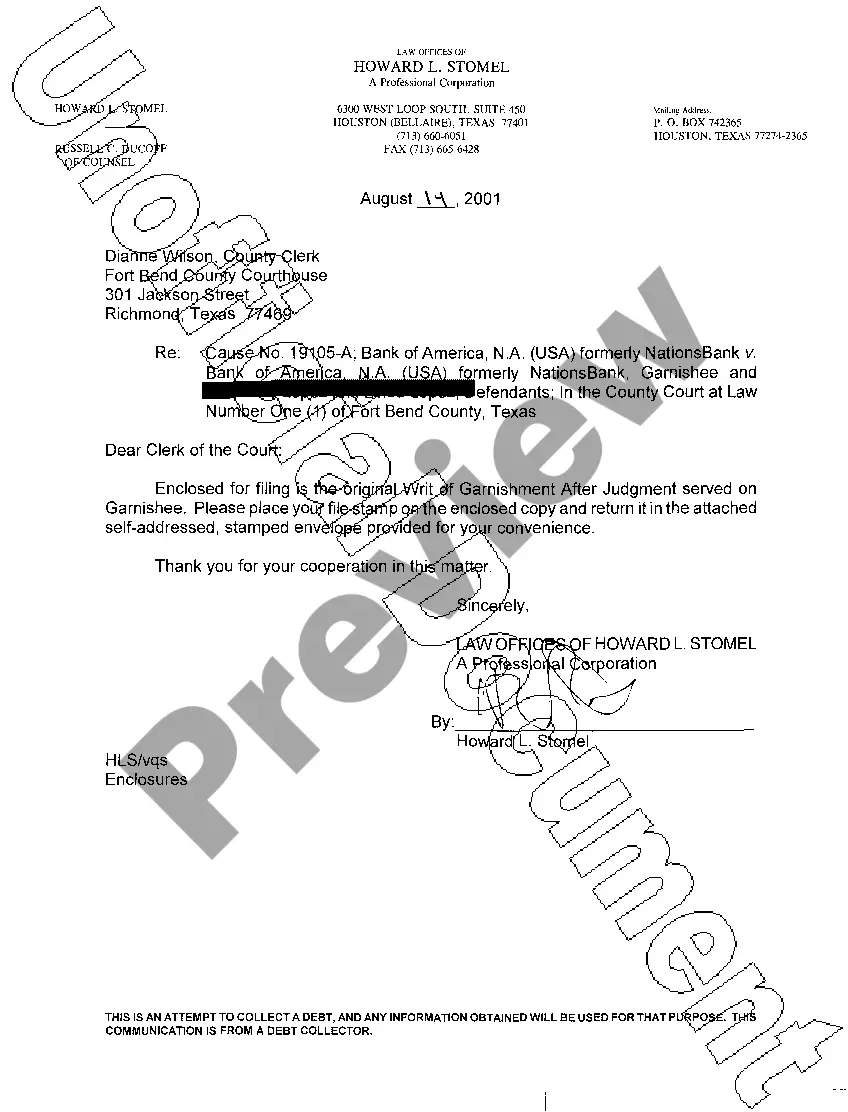

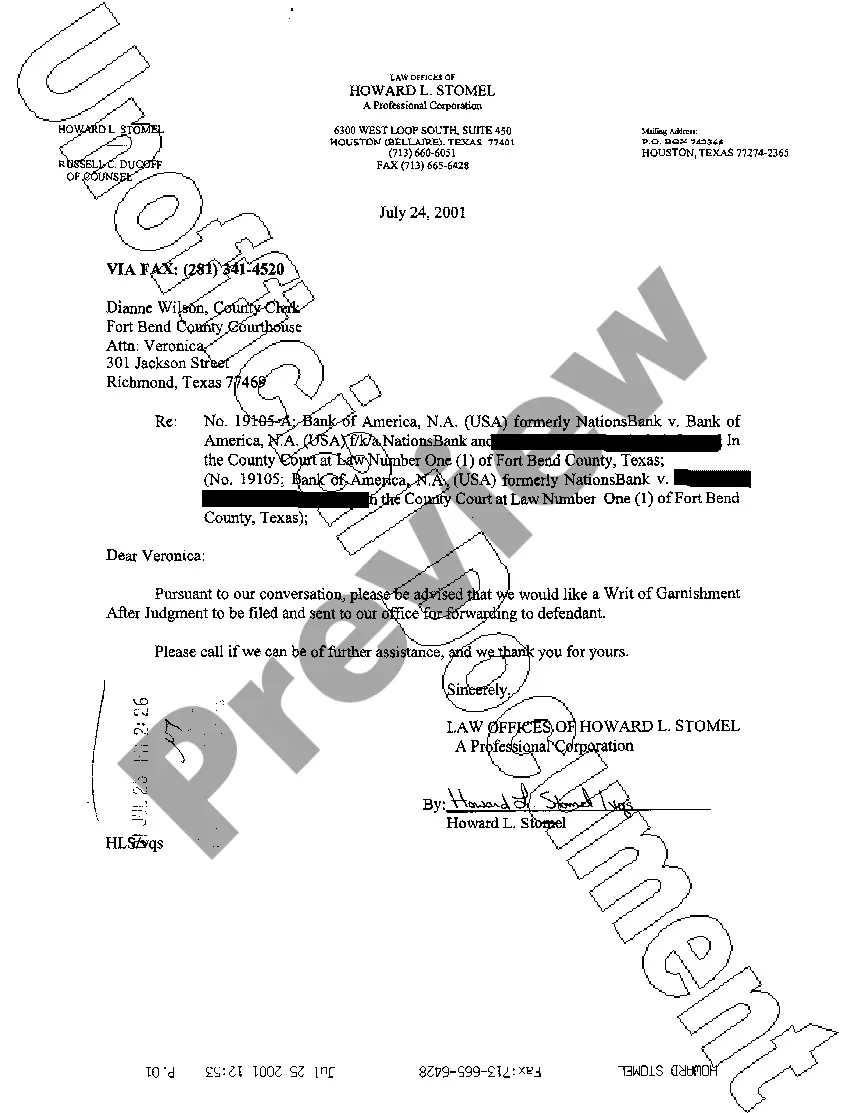

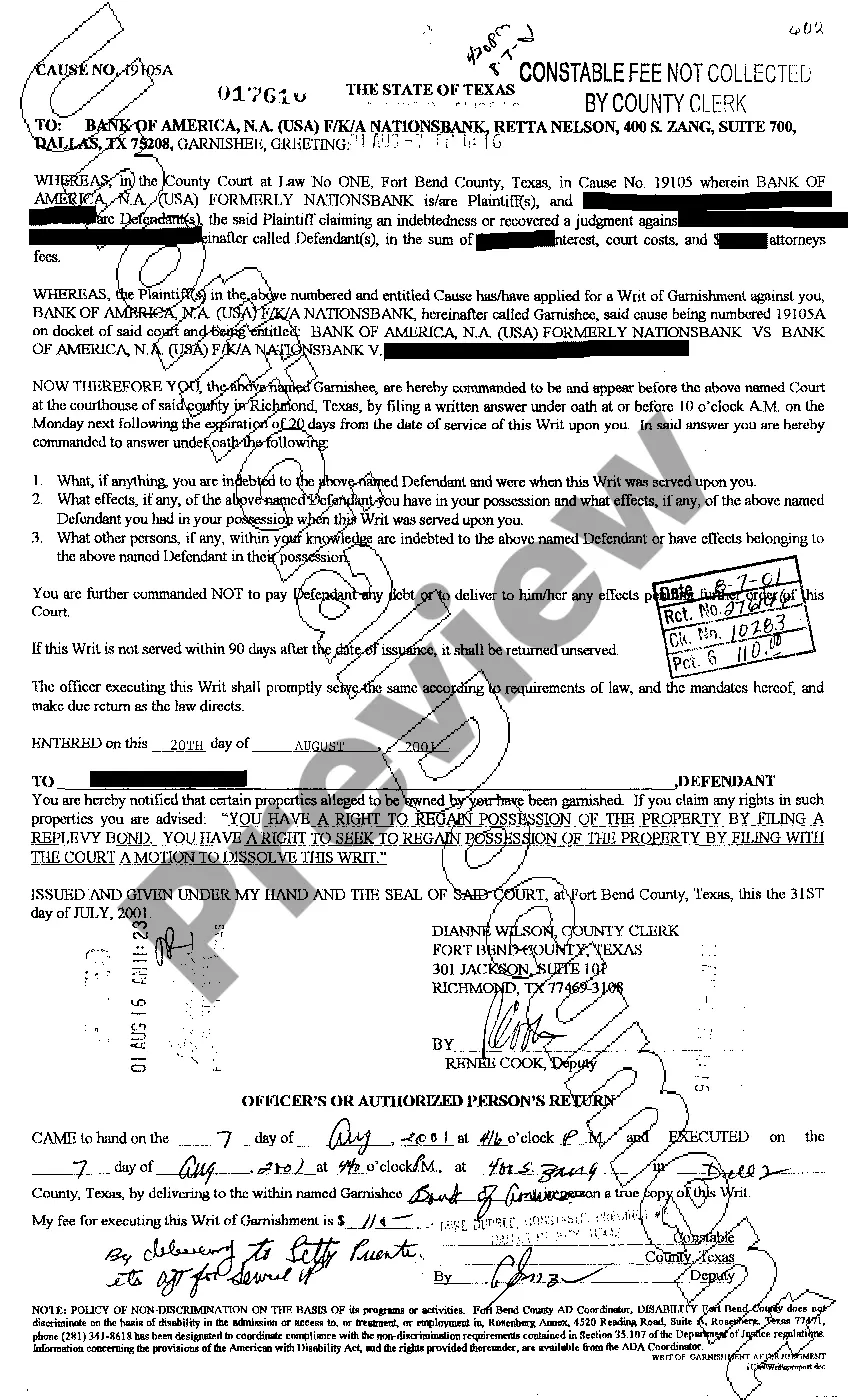

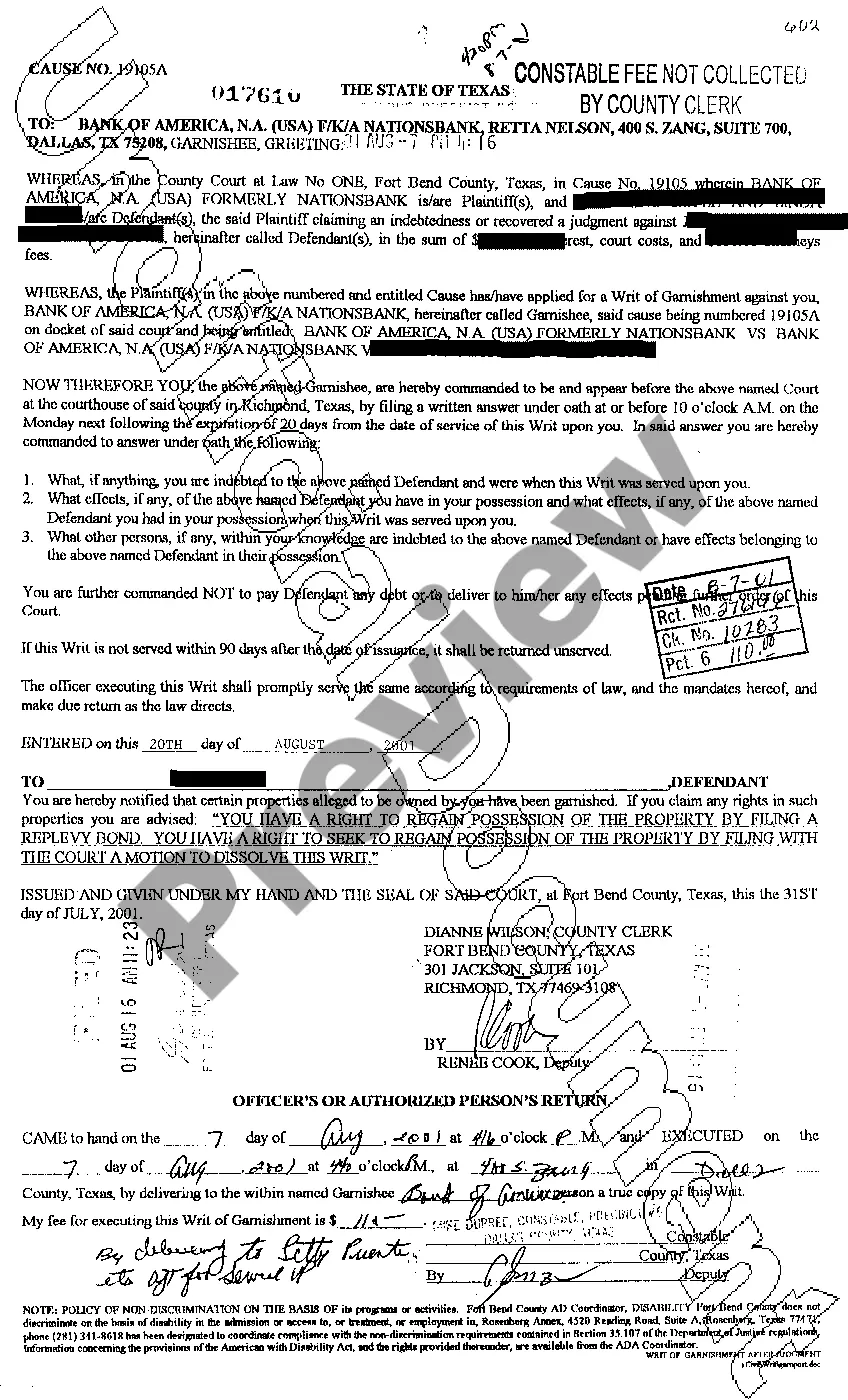

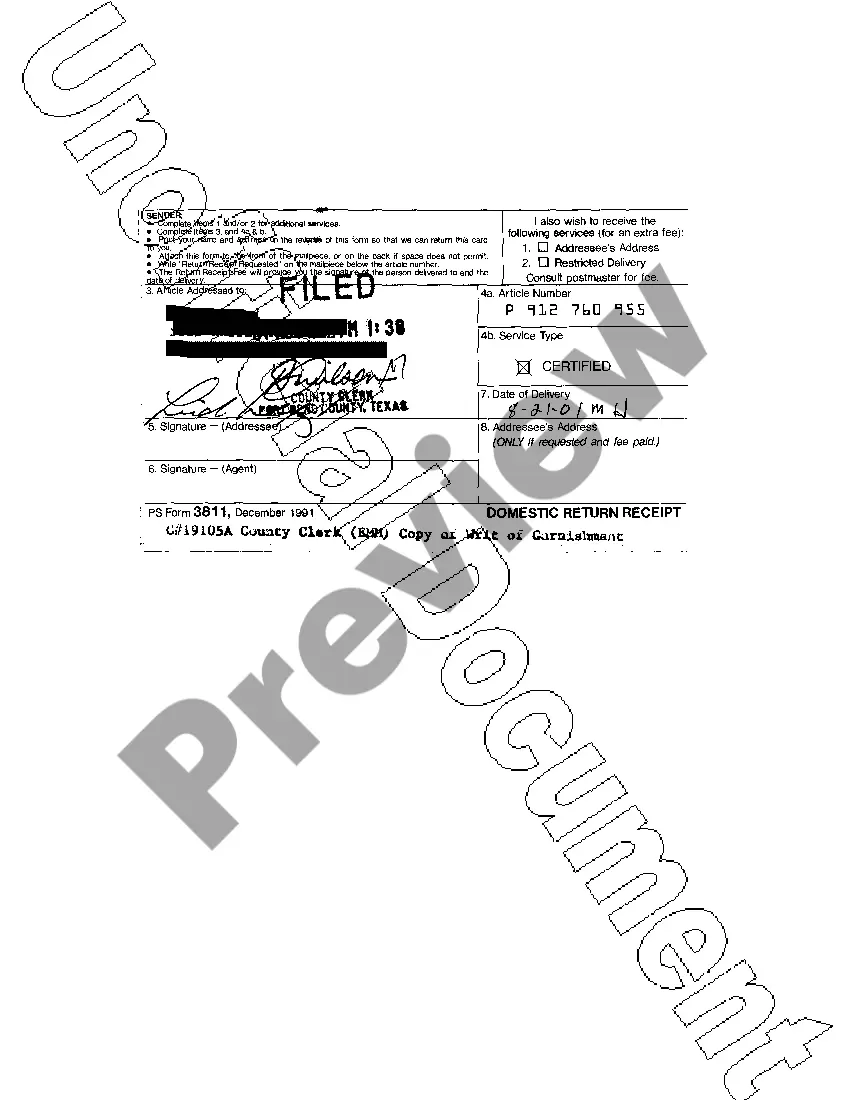

The Tarrant Texas Writ of Garnishment is a legal process used to collect debts owed by individuals or businesses in Tarrant County, Texas. It allows creditors to seize a portion of the debtor's wages or assets to satisfy the outstanding debt. This article will provide a detailed description of the Tarrant Texas Writ of Garnishment, outlining its purpose, procedure, and different types. In Tarrant County, Texas, a Writ of Garnishment is initiated by a creditor who has obtained a judgment against a debtor. This judgment may result from an unpaid debt, such as credit card bills or unpaid loans. The Writ of Garnishment is a valuable tool for creditors as it enables them to enforce the collection of the debt by legally seizing the debtor's wages, bank accounts, or other assets. To begin the process, the creditor must file an application for the Writ of Garnishment with the Tarrant County Clerk's Office. This application requires specific information about the debtor, such as their full name, address, and employer's details. Once filed, the clerk issues the Writ of Garnishment, which is then served to the debtor's employer or financial institution. When served with the Writ of Garnishment, the debtor's employer is obligated by law to withhold a portion of the debtor's wages and remit it to the creditor. This withholding generally continues until the debt is fully satisfied or until instructed otherwise by the court. In the case of a financial institution, the funds in the debtor's account may be frozen, allowing the creditor to claim the owed amount. It is important to note that there are different types of Tarrant Texas Writs of Garnishment, each applicable in specific circumstances. The most common types include: 1. Writ of Earnings Garnishment: This type of writ is used to garnish the wages or salary of a debtor. It allows the creditor to collect a portion of the debtor's income until the debt is fully paid off. 2. Writ of Bank Garnishment: This writ enables a creditor to garnish funds held in a debtor's bank account. It involves freezing the account and redirecting the funds to satisfy the debt owed. 3. Writ of Third-Party Garnishment: In some cases, a creditor may identify a third party who owes money to the debtor. This type of writ is used to garnish those funds owed by the third party, redirecting them to the creditor. 4. Writ of Property Garnishment: If a debtor owns valuable assets such as real estate or vehicles, a creditor can use this type of writ to seize and sell those assets in order to satisfy the debt. In conclusion, the Tarrant Texas Writ of Garnishment is a legal tool used by creditors to enforce the collection of outstanding debts in Tarrant County, Texas. It allows for the seizure of wages, bank accounts, or assets belonging to the debtor. Understanding the different types of Tarrant Texas Writs of Garnishment is essential for both creditors and debtors involved in the debt collection process.

Tarrant Texas Writ of Garnishment

Description

How to fill out Tarrant Texas Writ Of Garnishment?

Do you need a reliable and inexpensive legal forms provider to get the Tarrant Texas Writ of Garnishment? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set rules for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of particular state and county.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Tarrant Texas Writ of Garnishment conforms to the regulations of your state and local area.

- Read the form’s details (if available) to learn who and what the form is intended for.

- Start the search over in case the form isn’t suitable for your legal scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Tarrant Texas Writ of Garnishment in any available format. You can get back to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time learning about legal paperwork online for good.