Bexar Texas Writ Second to Financial Institution: A Comprehensive Explanation In Bexar County, Texas, the legal process of a writ second to financial institution plays a vital role in various financial matters. This detailed description aims to provide insights into what this writ entails, its significance, and its potential types. A Bexar Texas Writ Second to Financial Institution is a legal procedure initiated by a court order to authorize the enforcement of monetary claims against a financial institution. It serves as a means to collect outstanding debts or judgments owed by a defendant through the seizure of funds held by the financial institution. When a financial institution is served with a Bexar Texas Writ Second, it is legally required to freeze the defendant's assets, typically in the form of bank accounts or investment holdings. The frozen funds are then held securely until the court resolves the underlying dispute or grants permission to release the funds to the plaintiff. There are two primary types of Bexar Texas Writ Second to Financial Institution: 1. Writ of Garnishment: This type of writ allows a creditor, typically a plaintiff, to seize funds from a debtor's bank account. Upon receiving the writ, the financial institution freezes the specified amount owed by the debtor, preventing any withdrawals or transfers. The court then determines whether the funds should be released to the plaintiff or returned to the debtor. 2. Writ of Execution: This writ authorizes the creditor to seize not only bank accounts but also other assets held by the debtor. Besides targeting funds in the financial institution, a writ of execution enables the plaintiff to potentially seize real estate property, vehicles, or other valuable assets to satisfy the outstanding debt or judgment. Bexar Texas Writ Second to Financial Institution is an essential tool for creditors seeking to enforce their financial rights. It helps provide a legal framework through which a plaintiff can collect what they are owed by effectively freezing the defendant's financial resources. However, it is important to note that the process of obtaining and executing a Bexar Texas Writ Second can be complex and regulated by specific legal procedures. It is strongly advised for both creditors and debtors to seek legal advice and representation to ensure their rights and interests are protected throughout the process. In conclusion, a Bexar Texas Writ Second to Financial Institution enables the attachment of a debtor's funds held by a financial institution in order to pay off outstanding debts or judgments. Its two primary types, writ of garnishment and writ of execution, allow for varying degrees of asset seizure. Engaging legal professionals with experience in this area is crucial to navigate the process effectively.

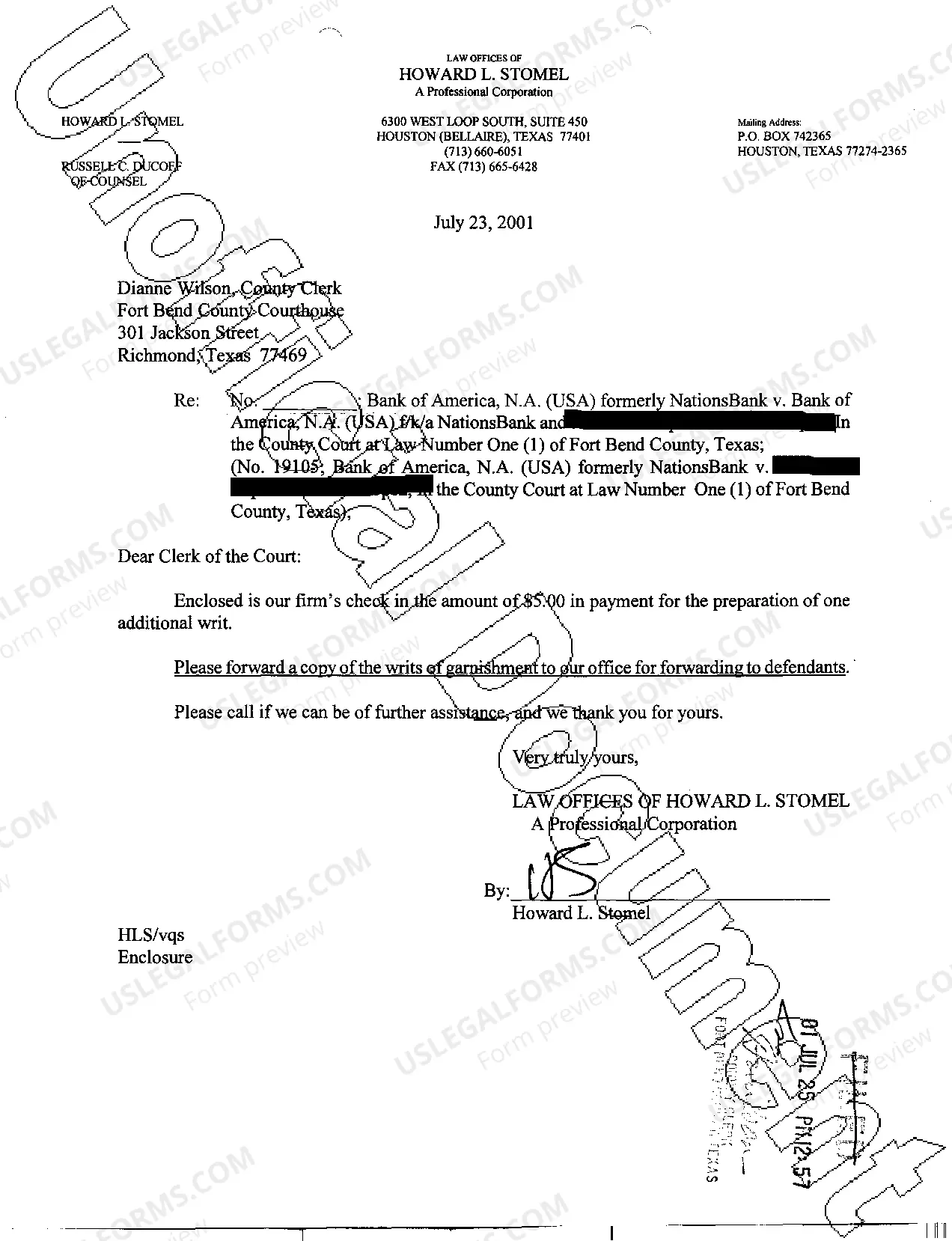

Bexar Texas Writ Second to Financial Institution

Description

How to fill out Bexar Texas Writ Second To Financial Institution?

We always want to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for legal solutions that, as a rule, are very costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to a lawyer. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Bexar Texas Writ Second to Financial Institution or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Bexar Texas Writ Second to Financial Institution adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Bexar Texas Writ Second to Financial Institution would work for you, you can select the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!