Frisco, Texas, located in Collin and Denton counties, is a rapidly growing city renowned for its thriving economy, excellent quality of life, and vast opportunities for financial institutions. In this article, we will delve into the various aspects of Frisco Texas Writ Second to Financial Institution, highlighting its significance and the different forms it takes. Frisco, Texas, also known as the "Sports City USA," is a hub for finance and business, offering a favorable environment for financial institutions to establish their presence. With a burgeoning population of over 200,000 residents and a median household income surpassing the national average, Frisco provides a fertile ground for financial institutions to grow and flourish. 1. Frisco Texas Writ Second to Financial Institution — Residential Mortgages: One area of focus for financial institutions in Frisco revolves around residential mortgages. Numerous individuals and families are seeking home financing options, thanks to the city's surging real estate market and highly desirable attributes. Financial institutions offer Frisco residents competitive mortgage rates, loan options, and personalized services, empowering them to realize their homeownership dreams. 2. Frisco Texas Writ Second to Financial Institution — Commercial Real Estate Loans: Frisco's thriving business sector presents a unique opportunity for financial institutions to cater to the needs of entrepreneurs and businesses in search of commercial real estate loans. As companies flock to Frisco to take advantage of its business-friendly climate, financial institutions play a vital role in supporting their growth by providing tailored loan solutions for office spaces, retail premises, industrial facilities, and more. 3. Frisco Texas Writ Second to Financial Institution — Personal Banking Services: In addition to mortgage and commercial loan offerings, financial institutions in Frisco also excel in providing excellent personal banking services. These services encompass checking and savings accounts, credit cards, personal loans, and investment opportunities. By tailoring their offerings to the needs and preferences of Frisco residents, financial institutions establish lasting relationships founded on trust and reliability. 4. Frisco Texas Writ Second to Financial Institution — Wealth Management and Financial Planning: As Frisco continues to attract professionals and high-net-worth individuals, financial institutions also specialize in wealth management and financial planning services. These services encompass retirement planning, investment portfolio management, estate planning, and more. By collaborating closely with their clients, financial institutions assist them in achieving their long-term financial goals and securing a stable future. In conclusion, Frisco Texas Writ Second to Financial Institution encompasses various facets of finance within the city. From residential mortgages to commercial real estate loans, personal banking services to wealth management and financial planning, financial institutions in Frisco play a crucial role in supporting the economic growth and prosperity of the city and its residents. By delivering tailored solutions, exceptional customer service, and strategic guidance, these institutions ensure a positive and prosperous financial landscape in Frisco.

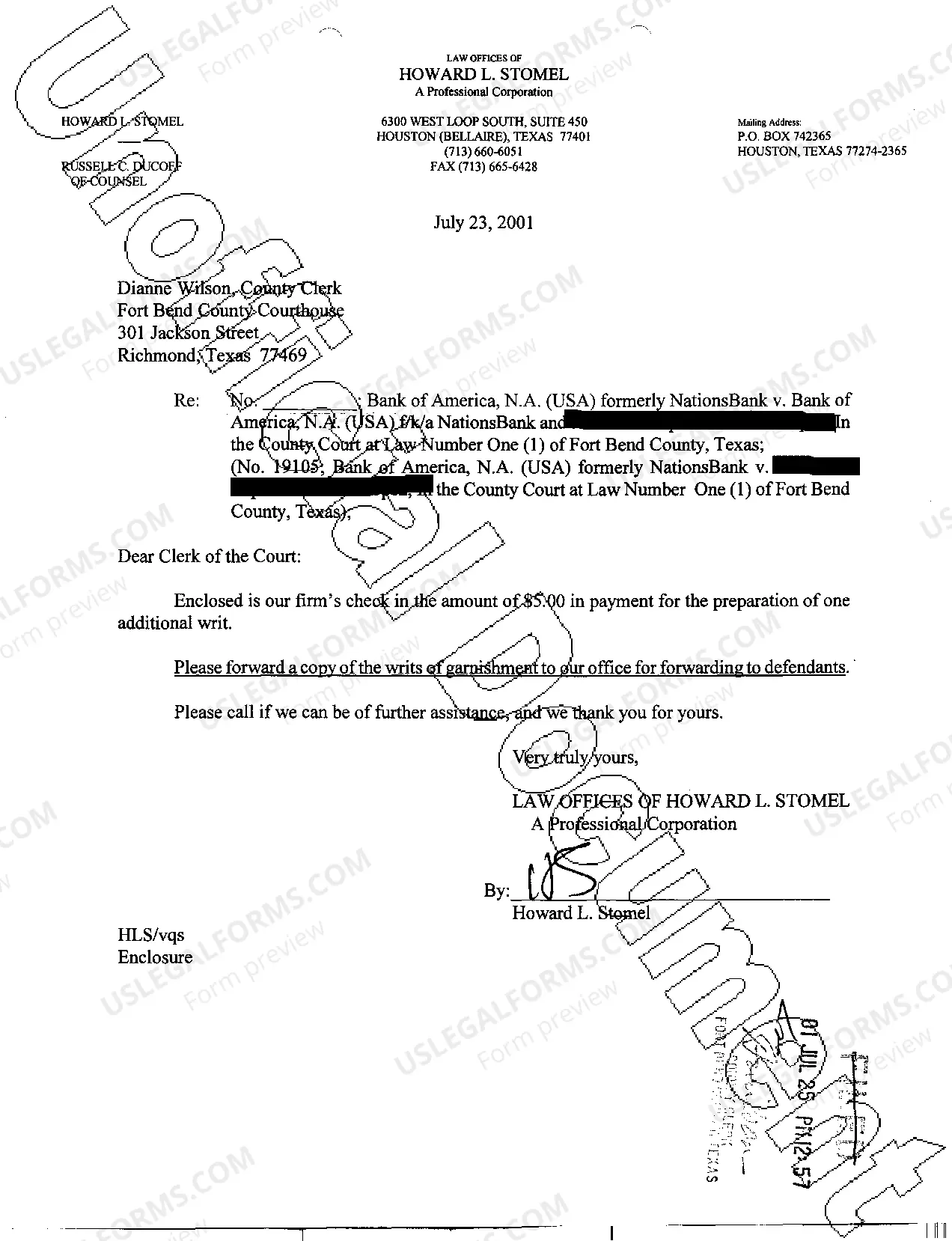

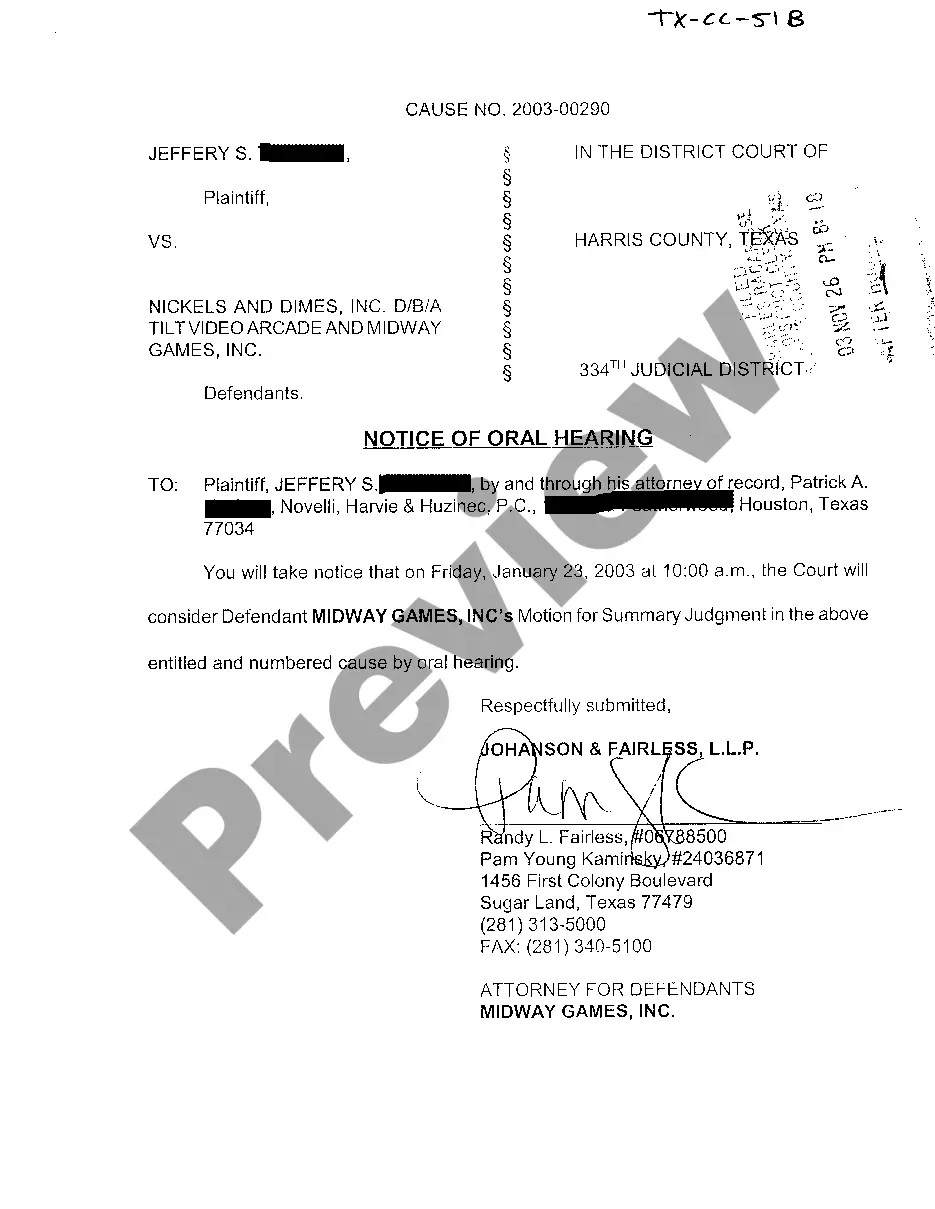

Frisco Texas Writ Second to Financial Institution

Description

How to fill out Frisco Texas Writ Second To Financial Institution?

Take advantage of the US Legal Forms and get immediate access to any form sample you need. Our beneficial website with a huge number of documents makes it simple to find and get virtually any document sample you want. You are able to download, complete, and sign the Frisco Texas Writ Second to Financial Institution in a few minutes instead of browsing the web for hours searching for the right template.

Utilizing our collection is a superb strategy to raise the safety of your form filing. Our professional attorneys on a regular basis check all the documents to make sure that the forms are appropriate for a particular state and compliant with new acts and regulations.

How can you obtain the Frisco Texas Writ Second to Financial Institution? If you have a profile, just log in to the account. The Download button will appear on all the documents you look at. Additionally, you can find all the previously saved records in the My Forms menu.

If you haven’t registered an account yet, follow the instructions below:

- Open the page with the template you require. Make sure that it is the template you were hoping to find: verify its title and description, and take take advantage of the Preview feature if it is available. Otherwise, use the Search field to look for the needed one.

- Start the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order with a credit card or PayPal.

- Save the document. Indicate the format to get the Frisco Texas Writ Second to Financial Institution and modify and complete, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable document libraries on the web. Our company is always happy to assist you in any legal case, even if it is just downloading the Frisco Texas Writ Second to Financial Institution.

Feel free to take advantage of our form catalog and make your document experience as efficient as possible!