Grand Prairie Texas Writ Second to Financial Institution is a legal process that allows a creditor to place a lien on a property owned by a debtor in order to secure a debt owed to a financial institution. This type of writ is commonly utilized in Grand Prairie, Texas, and serves as a legal mechanism for banks, credit unions, and other financial institutions to protect their interests and recover outstanding debts. In the context of Grand Prairie Texas Writ Second to Financial Institution, there are two main types that are commonly used: voluntary and involuntary. 1. Voluntary Writ Second to Financial Institution: A voluntary writ is initiated by the debtor in order to secure a loan or mortgage from a financial institution. This type of writ is commonly used when individuals or businesses seek financing options for real estate properties or any other collateral that requires a formal agreement. By offering the property as collateral, the debtor agrees to grant a lien to the financial institution, allowing them to claim ownership or sell the property in case of default on the loan or mortgage. 2. Involuntary Writ Second to Financial Institution: An involuntary writ, on the other hand, is initiated by the financial institution when a debtor fails to fulfill their financial obligations. This type of writ is typically pursued as a last resort when all other methods of collection have been exhausted. Through the involuntary writ process, the financial institution obtains a court order that grants them the right to place a lien on the debtor's property. The institution can then proceed with the foreclosure process if necessary, to recover the outstanding debt. Whether voluntary or involuntary, Grand Prairie Texas Writ Second to Financial Institution plays a crucial role in safeguarding the rights and interests of financial institutions while also enabling individuals and businesses to secure necessary financing. It serves as a crucial legal tool that helps maintain the stability and integrity of the lending industry in Grand Prairie, Texas, ensuring that both lenders and borrowers uphold their financial responsibilities.

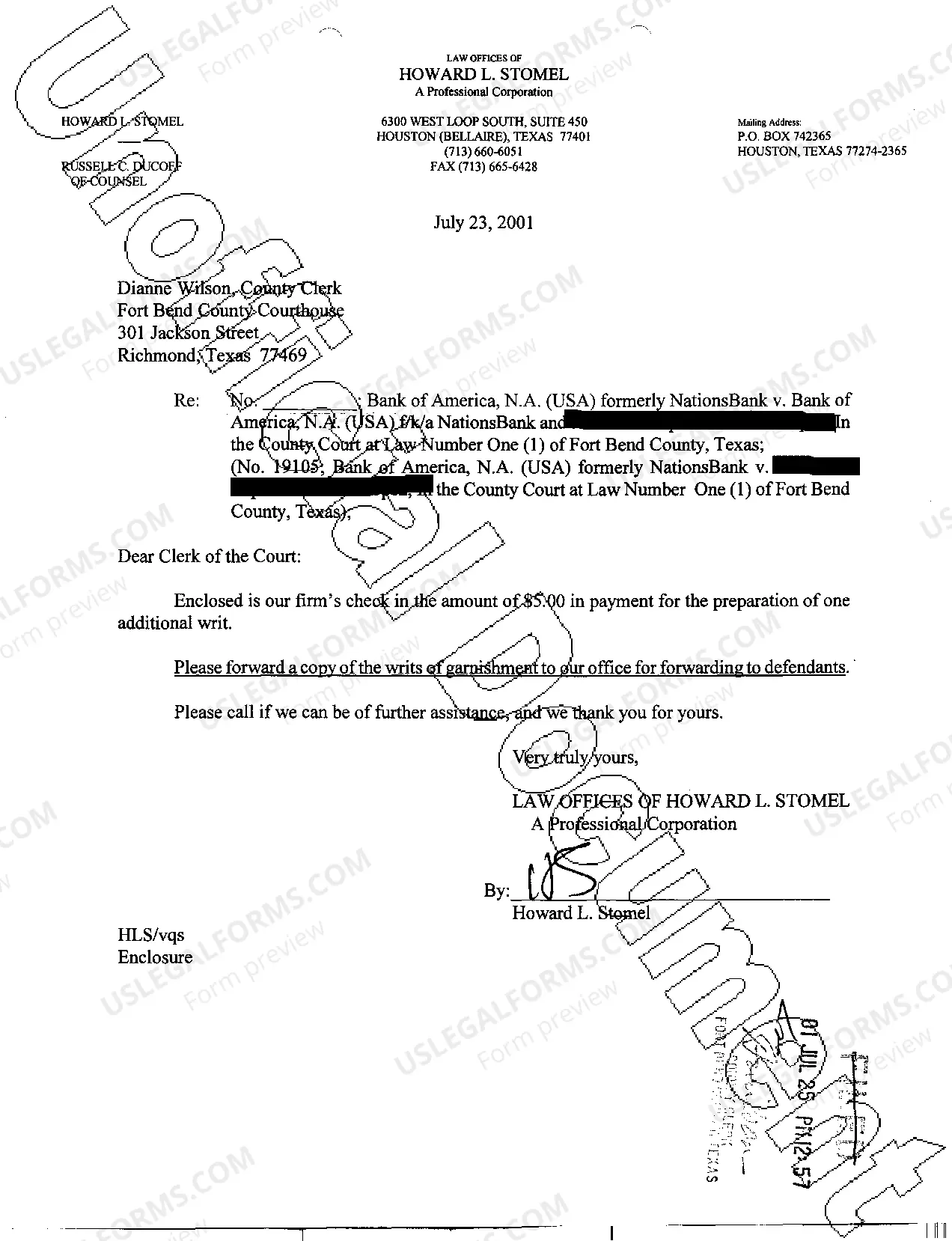

Grand Prairie Texas Writ Second to Financial Institution

Description

How to fill out Grand Prairie Texas Writ Second To Financial Institution?

Take advantage of the US Legal Forms and obtain instant access to any form template you need. Our useful platform with a large number of documents makes it simple to find and get almost any document sample you need. You can save, fill, and sign the Grand Prairie Texas Writ Second to Financial Institution in a few minutes instead of surfing the Net for several hours searching for an appropriate template.

Utilizing our catalog is a wonderful strategy to increase the safety of your record filing. Our professional legal professionals regularly check all the records to make sure that the forms are appropriate for a particular region and compliant with new acts and regulations.

How do you get the Grand Prairie Texas Writ Second to Financial Institution? If you have a subscription, just log in to the account. The Download option will appear on all the documents you look at. Furthermore, you can find all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instructions below:

- Find the template you need. Make certain that it is the form you were hoping to find: check its headline and description, and utilize the Preview function when it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Launch the saving process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Download the file. Pick the format to get the Grand Prairie Texas Writ Second to Financial Institution and revise and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy template libraries on the web. Our company is always ready to help you in any legal procedure, even if it is just downloading the Grand Prairie Texas Writ Second to Financial Institution.

Feel free to make the most of our platform and make your document experience as straightforward as possible!