League City, Texas, is home to several reputable financial institutions offering various services to its residents. One such service provided by these institutions is known as League City Texas Writ Second, which specifically caters to the needs of individuals and businesses seeking financial assistance or loans. In League City, Texas, Writ Second refers to a legal document issued by a financial institution, granting a borrower the ability to secure a loan using an existing asset as collateral. This enables individuals or businesses to access the necessary funds to meet their financial needs without having to sell their valuable assets. There are different types of League City Texas Writ Second programs available, each designed to address specific financial requirements. These programs include: 1. Personal Writ Second Loans: These loans are typically offered to individuals who require immediate cash for personal expenses such as home renovations, medical bills, or education expenses. By using their assets as collateral, borrowers can secure personal loans with favorable interest rates and repayment terms. 2. Business Writ Second Loans: Aimed at entrepreneurs and business owners, this type of loan allows borrowers to use their business assets like commercial property, equipment, or inventory as collateral. Business Writ Second loans can be used to fund expansions, purchase additional inventory, or cover operating expenses while ensuring the continuity and growth of the business. 3. Real Estate Writ Second Loans: Designed for individuals or businesses involved in the real estate industry, this type of loan allows borrowers to use their existing real estate holdings as collateral. Real Estate Writ Second loans can help investors acquire additional properties, finance property renovations, or fund real estate development projects. 4. Vehicle Writ Second Loans: For those who need quick cash but own a valuable vehicle, Vehicle Writ Second loans can be an ideal solution. Borrowers can use their cars, motorcycles, or other vehicles as collateral to secure a loan. These funds can be useful for situations such as emergency expenses, debt consolidation, or even starting a small business. In League City, Texas, financial institutions offering Writ Second programs ensure a transparent and efficient process for borrowers. Through extensive evaluation of the borrower's creditworthiness and the fair market value of the collateral, these institutions determine the loan amounts, interest rates, and repayment terms that align with the borrower's financial goals and capabilities. By leveraging the League City Texas Writ Second options provided by trustworthy financial institutions, individuals and businesses in League City can access the necessary financial resources to achieve their goals, overcome challenges, and secure a stable financial future.

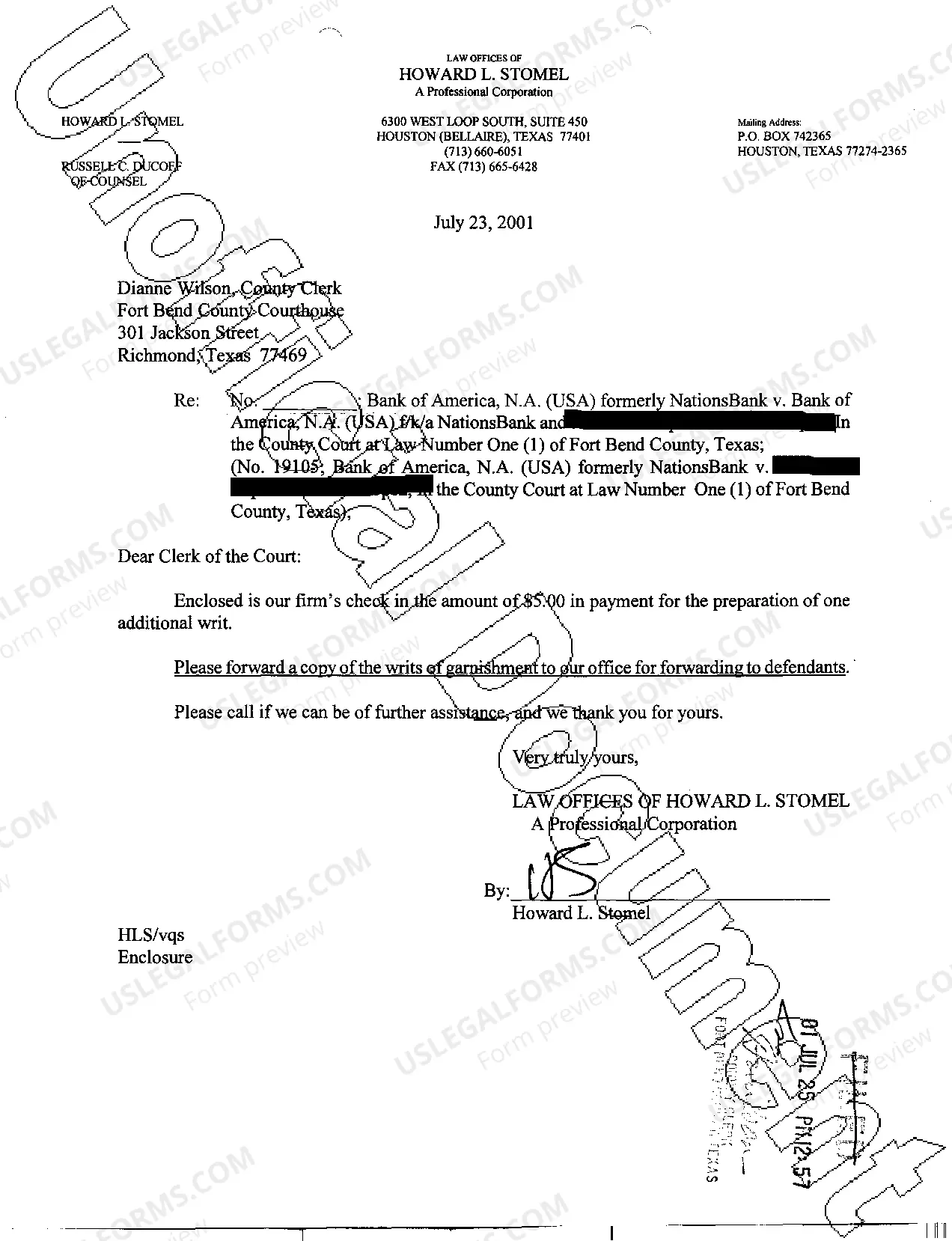

League City Texas Writ Second to Financial Institution

Description

How to fill out League City Texas Writ Second To Financial Institution?

We always want to minimize or prevent legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for legal services that, as a rule, are very expensive. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of an attorney. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the League City Texas Writ Second to Financial Institution or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the League City Texas Writ Second to Financial Institution adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the League City Texas Writ Second to Financial Institution is proper for your case, you can select the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!