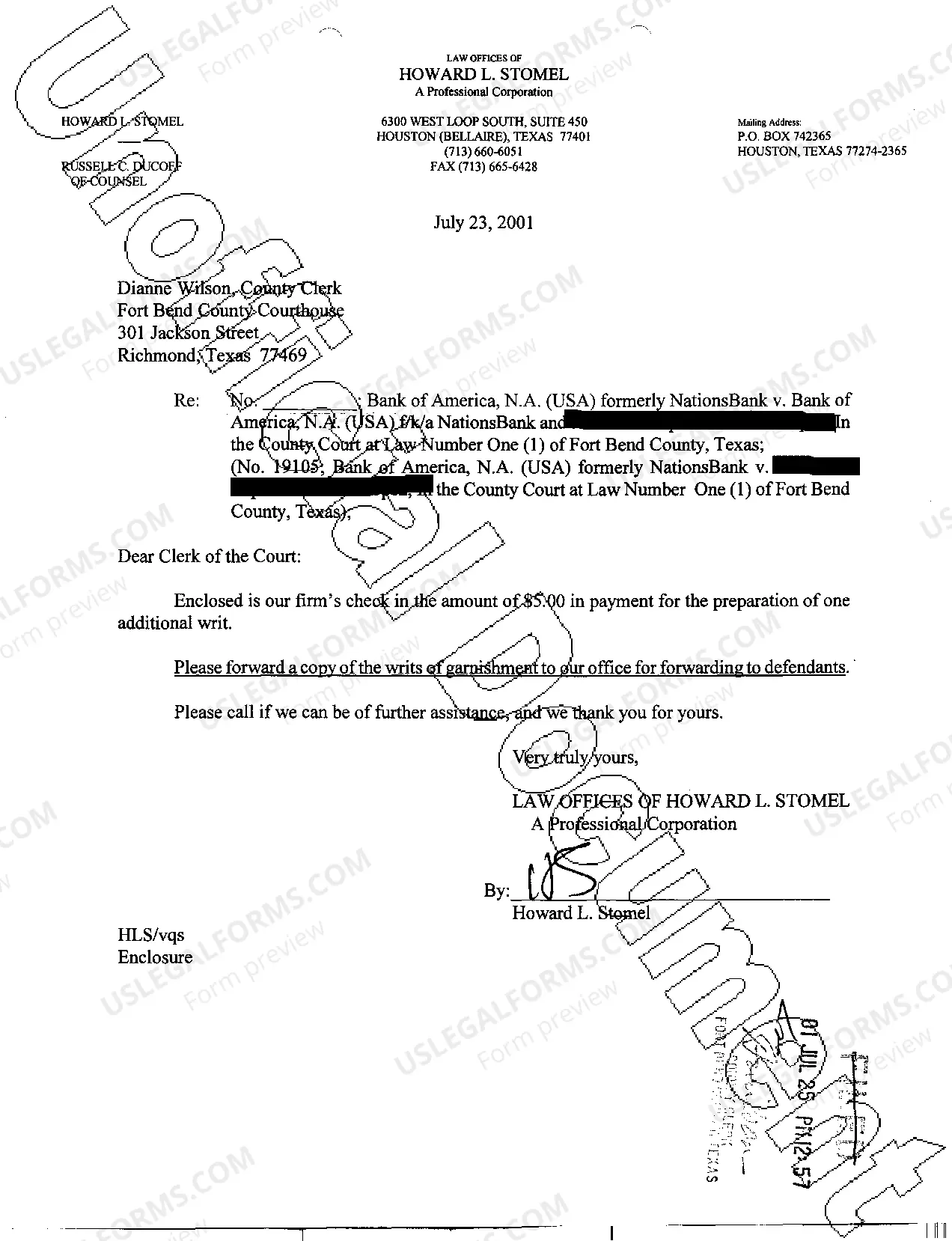

McAllen Texas Writ Second to Financial Institution: Understanding Its Types and Importance In McAllen, Texas, the term "Writ Second to Financial Institution" refers to a legal document that allows a financial institution, such as a bank, to place a lien on a debtor's property. This lien ensures that the institution retains priority over other creditors when it comes to collecting on a debt. This detailed description aims to explain the different types of McAllen Texas Writ Second to Financial Institution and highlight their significance. Types of McAllen Texas Writ Second to Financial Institution: 1. Mortgage Liens: This is the most common type of writ second to a financial institution. When a borrower obtains a mortgage loan to purchase a property, the lender places a lien on the property as collateral against the loan. In case of default, the lender can enforce the lien to foreclose on the property and recoup their investment. 2. HELOT Liens: A Home Equity Line of Credit (HELOT) allows homeowners to borrow against the equity in their property. When obtaining a HELOT, the financial institution places a writ second on the property, meaning that if the homeowner defaults on payments, the institution can use the writ to seize the property and recover the outstanding debt. 3. Judgment Liens: In the event that a debtor fails to fulfill a court-ordered judgment to pay a certain amount to a financial institution, the institution can obtain a writ second to that judgment. This allows the institution to place a lien on the debtor's property, ensuring that they have priority when it comes to collecting the debt. Importance of McAllen Texas Writ Second to Financial Institution: 1. Priority in Debt Collection: By having a writ second to financial institutions, these entities ensure that they have priority over other creditors. In cases of foreclosure or debt collection, the financial institution holding the writ second can be assured of receiving the proceeds from the sale of the property or the recovery of the debt before others. 2. Protection of Investments: Placing a writ second on assets, such as properties, serves as a safeguard for financial institutions. By having a lien on the debtor's property, they can reduce the risk of losing their investment in case of non-payment or default. 3. Enforceable Legal Protection: The McAllen Texas Writ Second to Financial Institution holds legal weight. It grants the holder the right to pursue legal action against the debtor and foreclose on the property to recover the outstanding debt, ensuring that the financial institution's interests are protected. In conclusion, McAllen Texas Writ Second to Financial Institution is crucial for financial institutions operating in the area, as it gives them priority in collecting on outstanding debts. Mortgage liens, HELOT liens, and judgment liens are some commonly encountered types of writ second. By understanding the different types and their importance, financial institutions can better protect their investments and ensure a smooth debt collection process.

McAllen Texas Writ Second to Financial Institution

Description

How to fill out McAllen Texas Writ Second To Financial Institution?

Do you require a trustworthy and cost-effective supplier of legal forms to obtain the McAllen Texas Writ Second to Financial Institution? US Legal Forms is your preferred selection.

Whether you are looking for a straightforward agreement to establish guidelines for living with your partner or a collection of forms to facilitate your divorce proceedings, we have you covered. Our platform provides over 85,000 current legal document templates for personal and business purposes. All templates that we offer access to are not generic but tailored based on the stipulations of particular states and counties.

To retrieve the form, you need to Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can create an account with great ease, but before doing that, ensure you take the following steps.

Now you can set up your account. Then choose the subscription plan and continue to payment. Once the payment is processed, download the McAllen Texas Writ Second to Financial Institution in any available file format. You can revisit the website at any time and re-download the form without incurring any additional costs.

Finding current legal forms has never been simpler. Give US Legal Forms a try today, and eliminate the hassle of wasting your precious time searching for legal documentation online for good.

- Verify if the McAllen Texas Writ Second to Financial Institution aligns with the regulations of your state and locality.

- Examine the form’s specifics (if available) to understand its suitability and intended use.

- Initiate the search again if the form does not meet your particular circumstances.

Form popularity

FAQ

Certain assets are exempt from a writ of execution in Texas. These generally include essential personal property, a portion of wages, and specific amounts in bank accounts. Understanding these exemptions can protect your essential assets under the McAllen Texas Writ Second to Financial Institution. If you're unsure about what may be exempt, USLegalForms can provide guidance tailored to your situation.

In Texas, you typically must file a writ of execution within 10 years after the judgment is rendered. The timeframe is crucial, especially concerning the McAllen Texas Writ Second to Financial Institution, as missing the deadline can result in losing the right to collect the debt. It's important to be aware of this limitation so you can act promptly. Utilizing the services of USLegalForms can simplify this process and help ensure you meet all necessary deadlines.

To effectively serve a writ of execution in Texas, you first need to ensure it is filed with the court. After that, enlist the help of a sheriff or constable, who will handle the formal service process. Utilizing services from platforms like uslegalforms can help you navigate the complexities of a McAllen Texas writ second to financial institution, ensuring you follow all necessary steps.

To serve a writ of execution, you must file the writ with the appropriate court and then present it to a law enforcement officer for enforcement. The officer will notify the debtor and can begin seizing property as specified in the writ. If you encounter challenges related to a McAllen Texas writ second to financial institution, having detailed knowledge of the serving process is essential.

Serving a writ of execution in Texas involves delivering the legal document to a sheriff or constable who can then enforce the order. The officer will execute the writ by seizing a debtor's property based on the judgment awarded. If you need assistance with this process or have concerns regarding a McAllen Texas writ second to financial institution, legal platforms like uslegalforms can provide resources to help you.

Yes, a debt collector can garnish your bank account in Texas, but they must first obtain a court judgment against you. Once they have this judgment, they can use a McAllen Texas writ second to financial institution to access funds from your bank account. It is important to know your rights and seek legal assistance if you find yourself in this situation.

In Texas, a writ of possession is typically served through a sheriff or constable. This legal order allows a landlord or property owner to regain possession of their property after a judgment in their favor. Keep in mind that if you face issues related to the McAllen Texas writ second to financial institution, knowing the process of obtaining a writ of possession can be crucial for securing your property rights.

A financial institution refers to any organization that deals with financial transactions, such as deposits, loans, and investments. This term covers a wide variety of entities, including banks, credit unions, and investment companies. For those in McAllen, Texas, understanding what constitutes a financial institution can be pivotal when dealing with legal tools like a writ second to financial institution.

In Texas, a financial institution includes banks, credit unions, savings associations, and other organizations that provide financial services to individuals and businesses. These institutions play an essential role in the Texas economy, offering products that help people manage their finances. When considering a writ second to financial institution in McAllen, you may need to engage with these organizations to resolve your financial obligations.

Section 59.006 of the Texas Finance Code outlines the rights of financial institutions regarding the collection of debts owed to them. This section is crucial for understanding how financial institutions operate within the legal framework in Texas. If you are dealing with a situation that involves a writ second to a financial institution, consulting this section can provide valuable insights.